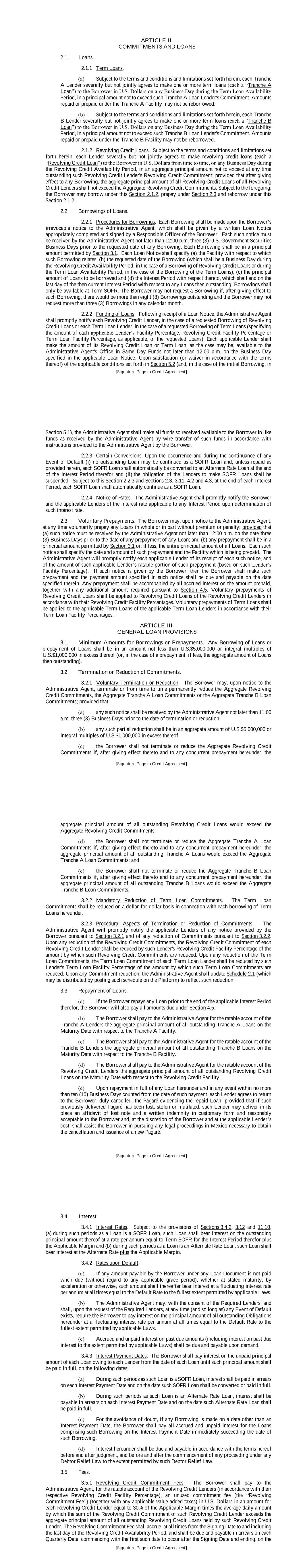

Exhibit 4.9 The redacted information (indicated with [***]) has been excluded because it is both (i) not material and (ii) of the type that the registrant customarily and actually treats as private or confidential Execution Version #99403003v4 CREDIT AGREEMENT dated as of December 17, 2024 among CORPORACIÓN INMOBILIARIA VESTA, S.A.B. DE C.V., as Borrower, VARIOUS FINANCIAL INSTITUTIONS AND OTHER PERSONS FROM TIME TO TIME PARTIES HERETO, as Lenders, BANCO SANTANDER MÉXICO, S.A., INSTITUCIÓN DE BANCA MÚLTIPLE, GRUPO FINANCIERO SANTANDER MÉXICO, as Administrative Agent, BBVA MÉXICO, S.A., INSTITUCIÓN DE BANCA MÚLTIPLE, GRUPO FINANCIERO BBVA MÉXICO, as Sustainability Agent, and BBVA MÉXICO, S.A., INSTITUCIÓN DE BANCA MÚLTIPLE, GRUPO FINANCIERO BBVA MÉXICO, CITIGROUP GLOBAL MARKETS INC, BANCO SANTANDER MÉXICO, S.A., INSTITUCIÓN DE BANCA MÚLTIPLE, GRUPO FINANCIERO SANTANDER MÉXICO, as Joint Lead Arrangers and Joint Bookrunners with INTERNATIONAL FINANCE CORPORATION, as Sustainability Coordinator and Parallel Lender #99403003v4 TABLE OF CONTENTS Page ARTICLE I. DEFINITIONS AND INTERPRETATION ............................................................................ 7 1.1 Defined Terms .................................................................................................................... 7 1.2 Other Interpretive Provisions ............................................................................................ 38 1.3 Accounting Terms ............................................................................................................. 38 1.4 Times of Day .................................................................................................................... 39 1.5 Rates ................................................................................................................................. 39 1.6 Term SOFR Conforming Changes.................................................................................... 39 ARTICLE II. COMMITMENTS AND LOANS ........................................................................................ 40 2.1 Loans ................................................................................................................................. 40 2.2 Borrowings of Loans ........................................................................................................ 40 2.3 Voluntary Prepayments ..................................................................................................... 41 ARTICLE III. GENERAL LOAN PROVISIONS...................................................................................... 41 3.1 Minimum Amounts for Borrowings or Prepayments ....................................................... 41 3.2 Termination or Reduction of Commitments ..................................................................... 41 3.3 Repayment of Loans ......................................................................................................... 42 3.4 Interest .............................................................................................................................. 43 3.5 Fees ................................................................................................................................... 43 3.6 Computation of Interest and Fees ..................................................................................... 44 3.7 Evidence of Debt .............................................................................................................. 44 3.8 Payments; Administrative Agent’s Clawback .................................................................. 45 3.9 Sharing of Payments ......................................................................................................... 46 3.10 Defaulting Lenders ........................................................................................................... 47 3.11 Benchmark Replacement Setting ...................................................................................... 47 3.12 Sustainability Adjustment ................................................................................................. 49 3.13 Role of the Sustainability Coordinator. ............................................................................ 51 3.14 Uncommitted Incremental Loans. ..................................................................................... 51 ARTICLE IV. TAXES, YIELD PROTECTION AND ILLEGALITY ...................................................... 52 4.1 Taxes ................................................................................................................................. 52 4.2 Illegality ............................................................................................................................ 55 4.3 Inability to Determine Rates ............................................................................................. 55 4.4 Increased Costs Generally................................................................................................. 56 4.5 Compensation for Losses .................................................................................................. 57 4.6 Mitigation Obligations; Replacement of Lenders ............................................................. 57 4.7 Survival ............................................................................................................................. 58 ARTICLE V. CONDITIONS PRECEDENT TO EFFECTIVENESS AND LOANS ............................... 58 5.1 Conditions to Closing Date ............................................................................................... 58 5.2 Additional Conditions Precedent to each Borrowing Date ............................................... 60 ARTICLE VI. REPRESENTATIONS AND WARRANTIES ................................................................... 61 6.1 Existence and Power; Compliance with Laws .................................................................. 61 #99403003v4 6.2 Authorization; No Contravention ..................................................................................... 61 6.3 Authorizations and Consents; Admissibility in Evidence ................................................. 61 6.4 Binding Effect ................................................................................................................... 61 6.5 Financial Statements ......................................................................................................... 62 6.6 Litigation ........................................................................................................................... 62 6.7 No Default......................................................................................................................... 62 6.8 Ownership of Property ...................................................................................................... 62 6.9 Environmental Compliance .............................................................................................. 62 6.10 Taxes ................................................................................................................................. 62 6.11 ERISA Matters .................................................................................................................. 62 6.12 Disclosure ......................................................................................................................... 63 6.13 Compliance with Anti-Corruption Laws, Anti-Money Laundering Laws and Sanctions ........................................................................................................................... 63 6.14 Solvency............................................................................................................................ 63 6.15 Regulation D ..................................................................................................................... 63 6.16 Material Adverse Change ................................................................................................. 64 6.17 Margin Regulations ........................................................................................................... 64 6.18 Investment Company Act ................................................................................................. 64 6.19 Sanctions ........................................................................................................................... 64 6.20 Commercial Activity; Absence of Immunity .................................................................... 64 6.21 Property Trust Agreements and Lease Agreements .......................................................... 64 6.22 Trust Properties Litigation or Suspension of Rights ......................................................... 64 6.23 Senior Debt Status ............................................................................................................ 65 6.24 Sustainability Information. ............................................................................................... 65 ARTICLE VII. ............................................................................................................................................ 65 AFFIRMATIVE COVENANTS................................................................................................................. 65 7.1 Financial Statements ......................................................................................................... 65 7.2 Certificates; Other Information ......................................................................................... 66 7.3 Notices .............................................................................................................................. 67 7.4 Payment of Obligations .................................................................................................... 68 7.5 Preservation of Existence, Etc .......................................................................................... 68 7.6 Maintenance of Unencumbered Properties ....................................................................... 68 7.7 Maintenance of Insurance ................................................................................................. 68 7.8 Compliance with Laws ..................................................................................................... 68 7.9 Books and Records ........................................................................................................... 68 7.10 Inspection Rights .............................................................................................................. 68 7.11 Use of Proceeds ................................................................................................................ 69 7.12 Pari Passu .......................................................................................................................... 69 7.13 Guaranties and Removal of Unencumbered Assets .......................................................... 69 7.14 Exchange Listing .............................................................................................................. 70 7.15 Certain Amendments to Debt Documents ........................................................................ 70 7.16 Interest Rate Hedging ....................................................................................................... 70 7.17 Transactions with Affiliates .............................................................................................. 70 7.18 Compliance with Property Trust Agreements ................................................................... 70 7.19 Compliance with Anti-Corruption Laws, Anti-Money Laundering Laws and Sanctions ........................................................................................................................... 70 7.20 SLLP. ................................................................................................................................ 71 7.21 Pricing Certificate and Verification Report. ..................................................................... 71 #99403003v4 7.22 Sustainability Information. ............................................................................................... 71 7.23 Second Party Opinion. ...................................................................................................... 72 ARTICLE VIII. NEGATIVE COVENANTS ............................................................................................ 72 8.1 Fundamental Changes ....................................................................................................... 72 8.2 Restricted Payments .......................................................................................................... 72 8.3 Investments ....................................................................................................................... 72 8.4 Payment Restrictions Affecting Certain Subsidiaries ....................................................... 73 8.5 Use of Proceeds ................................................................................................................ 73 8.6 Financial Covenants. ......................................................................................................... 73 8.7 Property Trust Agreements ............................................................................................... 74 8.8 Changes in Nature of Business ......................................................................................... 74 8.9 Amendments to Organizational Documents ..................................................................... 74 8.10 Anti-Corruption Laws; Anti-Money Laundering; Sanctions ............................................ 74 8.11 Disclosure of Confidential Information. ........................................................................... 75 ARTICLE IX. EVENTS OF DEFAULT AND REMEDIES ..................................................................... 75 9.1 Events of Default .............................................................................................................. 75 9.2 Remedies Upon Event of Default ..................................................................................... 76 9.3 Application of Funds ........................................................................................................ 77 ARTICLE X. ADMINISTRATIVE AGENT ............................................................................................. 77 10.1 Appointment and Authority .............................................................................................. 77 10.2 Rights as a Lender ............................................................................................................. 78 10.3 Exculpatory Provisions ..................................................................................................... 78 10.4 Reliance by Administrative Agent .................................................................................... 79 10.5 Delegation of Duties ......................................................................................................... 79 10.6 Resignation of Administrative Agent ............................................................................... 79 10.7 Non-Reliance on Administrative Agent and Other Lenders ............................................. 80 10.8 No Other Duties, Etc ......................................................................................................... 80 10.9 Administrative Agent May File Proofs of Claim .............................................................. 81 10.10 Erroneous Payment ........................................................................................................... 81 ARTICLE XI. MISCELLANEOUS ........................................................................................................... 84 11.1 Amendments, Etc .............................................................................................................. 84 11.2 Sustainability Amendments. ............................................................................................. 85 11.3 Notices; Effectiveness; Electronic Communication ......................................................... 86 11.4 No Waiver; Cumulative Remedies ................................................................................... 87 11.5 Expenses; Indemnity; Damage Waiver ............................................................................. 87 11.6 Payments Set Aside .......................................................................................................... 89 11.7 Successors and Assigns .................................................................................................... 90 11.8 Treatment of Certain Information; Confidentiality ........................................................... 93 11.9 Right of Setoff .................................................................................................................. 93 11.10 Interest Rate Limitation .................................................................................................... 94 11.11 Counterparts; Integration; Effectiveness; Electronic Execution of Documents ............... 94 11.12 Severability ....................................................................................................................... 94 11.13 Replacement of Lenders ................................................................................................... 95 11.14 Acknowledgment and Consent to Bail-In of Affected Financial Institutions ................... 95 11.15 [Governing Law; Jurisdiction; Etc .................................................................................... 96

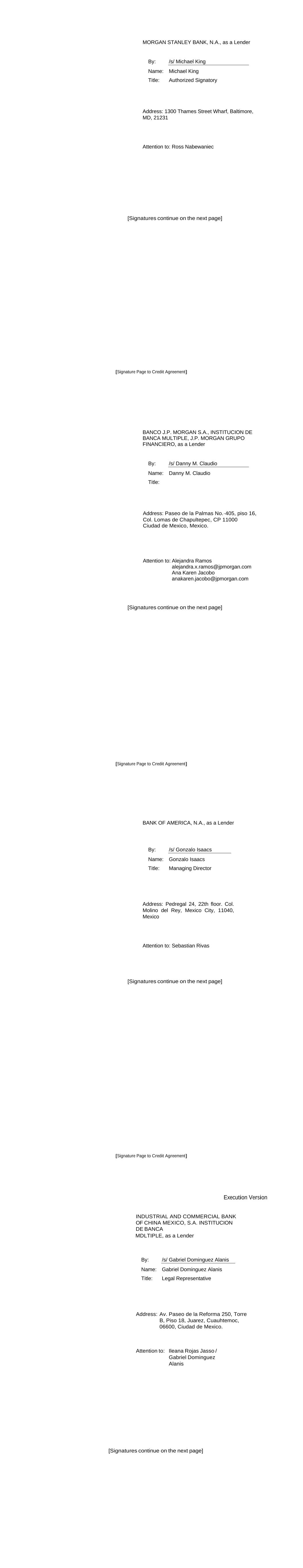

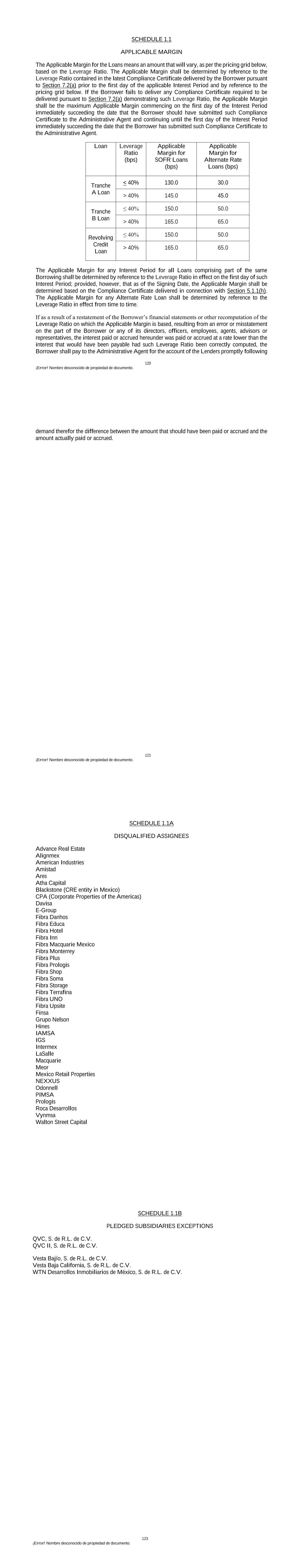

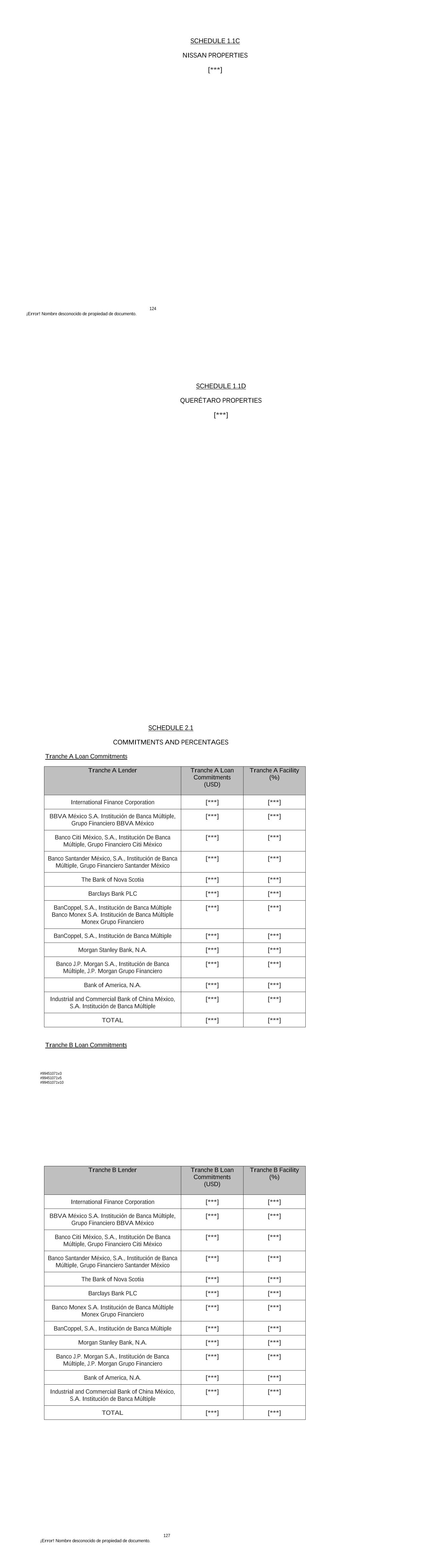

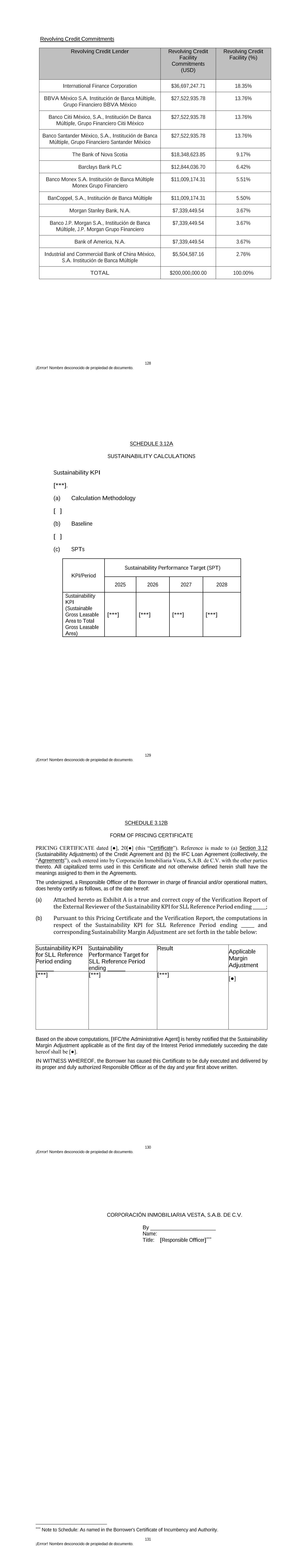

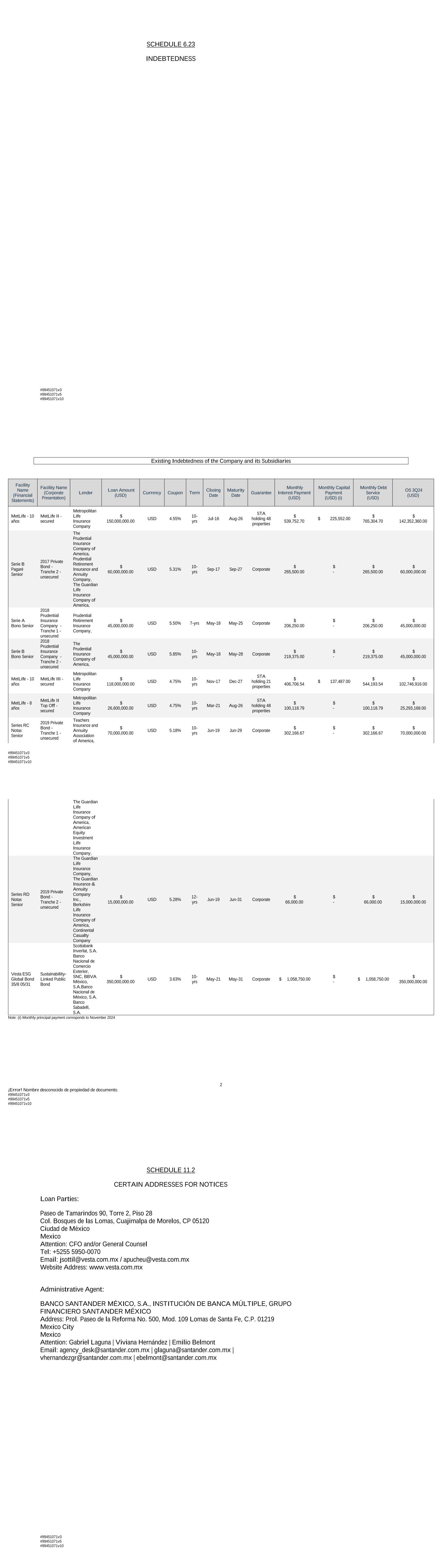

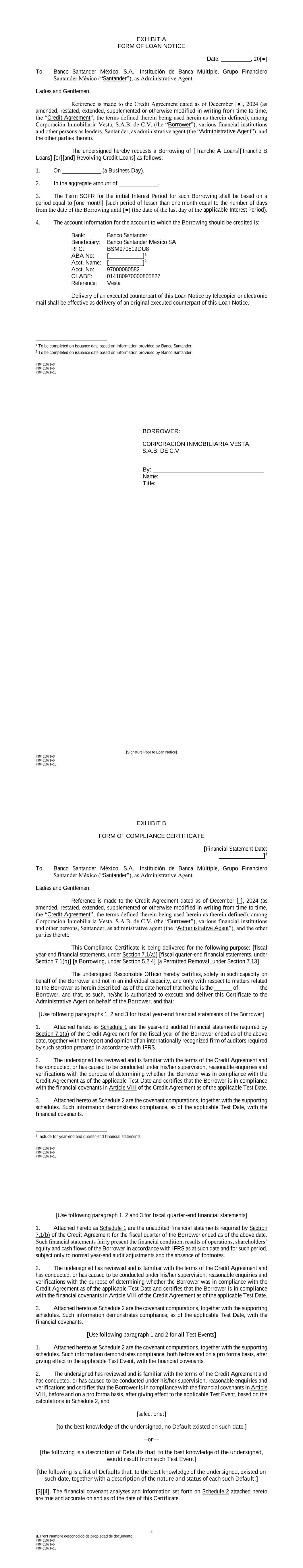

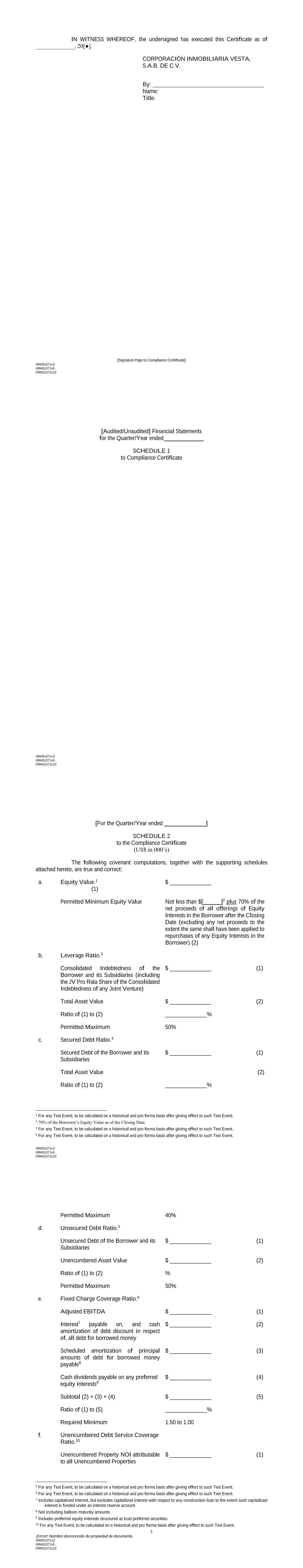

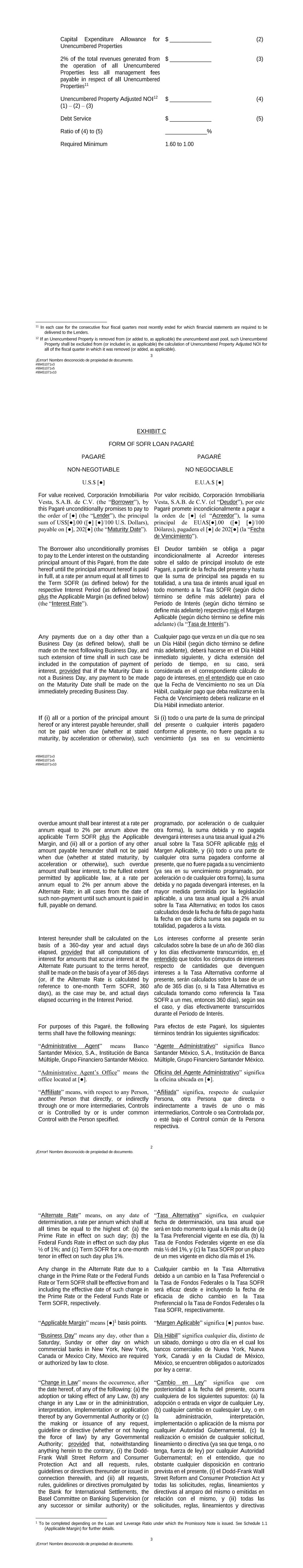

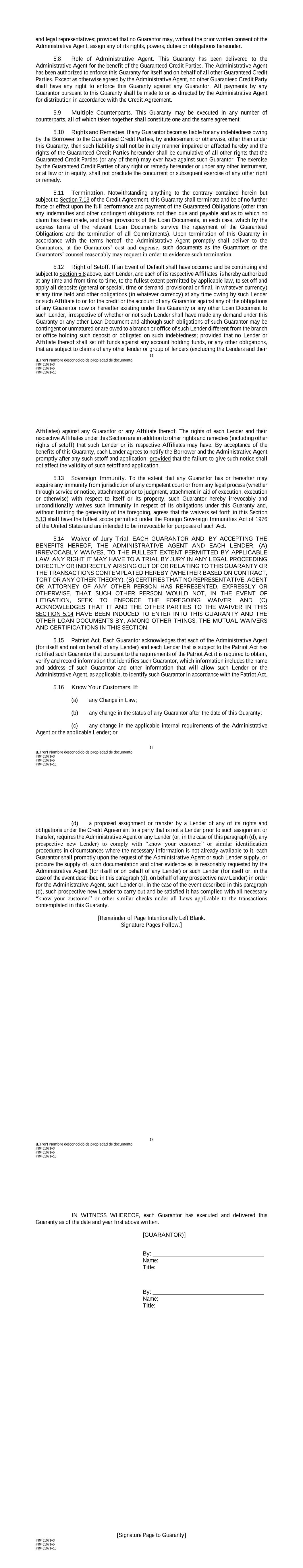

#99403003v4 11.16 Waiver of Jury Trial .......................................................................................................... 97 11.17 Patriot Act ......................................................................................................................... 98 11.18 Know Your Customers ..................................................................................................... 98 11.19 Time of the Essence .......................................................................................................... 98 11.20 Judgment Currency ........................................................................................................... 98 11.21 Entire Agreement .............................................................................................................. 99 11.22 No Fiduciary Duty ............................................................................................................ 99 11.23 Certain ERISA Matters ................................................................................................... 100 11.24 Original Issue Discount .................................................................................................. 101 #99403003v4 SCHEDULES 1.1 Applicable Margin 1.1A Disqualified Assignees 1.1B Pledged Subsidiaries Exceptions 1.1C Nissan Properties 1.1D Querétaro Properties 2.1 Commitments and Percentages 3.12A Sustainability Calculations 3.12B Form of Pricing Certificate 3.12C Sustainability-Linked Financing Framework 6.9 Environmental Matters 6.11 ERISA Matters 6.23 Indebtedness 11.2 Certain Addresses for Notices #99403003v4 EXHIBITS Form of A Loan Notice B Compliance Certificate C SOFR Loan Pagaré D Assignment and Assumption E Beneficial Ownership Certification F Guaranty G Special Power of Attorney H Property Report I Guarantor Corporate Opinion J Incremental Amendment [Signature Page to Credit Agreement] CREDIT AGREEMENT This CREDIT AGREEMENT dated as of December 17, 2024 (this “Agreement”) is entered into among CORPORACIÓN INMOBILIARIA VESTA, S.A.B. DE C.V. (the “Borrower”), various financial institutions and other Persons party hereto, BANCO SANTANDER MÉXICO, S.A., INSTITUCIÓN DE BANCA MÚLTIPLE, GRUPO FINANCIERO SANTANDER MÉXICO, as administrative agent (in such capacity, the “Administrative Agent”), BBVA MÉXICO, S.A., INSTITUCIÓN DE BANCA MÚLTIPLE, GRUPO FINANCIERO BBVA MÉXICO (“BBVA México”) as sustainability agent (in such capacity, the “Sustainability Agent”) and BBVA México, CITIGROUP GLOBAL MARKETS INC (“Citi”), BANCO SANTANDER MÉXICO, S.A., INSTITUCIÓN DE BANCA MÚLTIPLE, GRUPO FINANCIERO SANTANDER MÉXICO (“Santander México”), as joint lead arrangers and joint bookrunners (in such capacities, the “Joint Lead Arrangers and Joint Bookrunners”), and INTERNATIONAL FINANCE CORPORATION, as Sustainability Coordinator and as the Parallel Lender (as defined below). In consideration of the mutual covenants and agreements herein contained, the parties hereto covenant and agree as follows: ARTICLE I. DEFINITIONS AND INTERPRETATION 1.1 Defined Terms. As used in this Agreement, the following terms shall have the meanings set forth below: “Adjusted EBITDA” means, for any period, (a) EBITDA for such period less (b) the Capital Expenditure Allowance for all Properties for such period. “Administrative Agent” has the meaning specified in the preamble. “Administrative Agent’s Office” means the Administrative Agent’s address and, as appropriate, account as set forth on Schedule 11.2, such other address or account as the Administrative Agent may from time to time notify to the Borrower and the Lenders. “Administrative Agent’s Spot Rate of Exchange” means, in relation to any amount denominated in any currency, and unless expressly provided otherwise, the exchange rate published by the Mexican Central Bank (Banco de México) in the Official Gazette of the Federation (Diario Oficial de la Federación) for the payment of obligations in a foreign currency in Mexican territory (tipo de cambio para solventar obligaciones denominadas en moneda extranjera pagaderas en la República Mexicana), provided that if such rate ceases to be available, the Administrative Agent shall use such other service or page quoting cross currency rates as the Administrative Agent determines in its reasonable discretion. “Administrative Questionnaire” means an administrative questionnaire in a form supplied by the Administrative Agent. “Affected Financial Institution” means (a) any EEA Financial Institution or (b) any UK Financial Institution. “Affiliate” means, with respect to any Person, another Person that directly, or indirectly through one or more intermediaries, Controls or is Controlled by or is under common Control with the Person specified. “Agent Parties” has the meaning specified in Section 11.3.3. “Aggregate Commitments” means, at any time, the Commitments of all Lenders.

[Signature Page to Credit Agreement] “Aggregate Revolving Credit Commitments” means, at any time, the Revolving Credit Commitments of all Revolving Credit Lenders. “Aggregate Term Loan Commitments” means the Aggregate Tranche A Loan Commitments and the Aggregate Tranche B Commitments. “Aggregate Tranche A Loan Commitments” means, at any time, the Tranche A Loan Commitments of all Tranche A Lenders. “Aggregate Tranche B Loan Commitments” means, at any time, the Tranche B Loan Commitments of all Tranche B Lenders. “Agreement” has the meaning specified in the preamble. “Agreement Currency” has the meaning specified in Section 11.20. “Alternate Rate” means, on any date of determination, a rate per annum which shall at all times be equal to the highest of: (a) the Prime Rate in effect on such day; (b) the Federal Funds Rate in effect on such day plus ½ of 1%; and (c) Term SOFR for a one-month tenor in effect on such day plus 1%. Any change in the Alternate Rate due to a change in the Prime Rate or the Federal Funds Rate or Term SOFR shall be effective from and including the effective date of such change in the Prime Rate or the Federal Funds Rate or Term SOFR, respectively. “Alternate Rate Loans” means a Loan that bears interest at a rate based on the Alternate Rate. “Alternate Rate Term SOFR Determination Day” is defined in the definition of “Term SOFR”. “Anti-Corruption Laws” shall mean all laws, rules, and regulations of any jurisdiction applicable to the Borrower or its Subsidiaries from time to time concerning or relating to bribery, corruption or money laundering including, without limitation, (i) the United Kingdom Bribery Act of 2010, (ii) the U.S. Foreign Corrupt Practices Act of 1977, as amended, (iii) the Canada Corruption of Foreign Officials Act, the Special Economic Measures Act, the United Nations Act, the Freezing Assets of Corrupt Foreign Officials Act, Section II of the Canada’s Criminal Code and the Export and Import Permits Act, (iv) any applicable Mexican anti-bribery and anti-corruption laws, including all Mexican laws that are comprised in the National Anti-Corruption System (Sistema Nacional Anticorrupción), including the General Law for the National Anticorruption System (Ley General del Sistema Nacional Anticorrupción) of Mexico, the General Law of Administrative Responsibilities (Ley General de Responsabilidades Administrativas) of Mexico and the regulations, rules and executive orders promulgated thereunder, as amended, renewed, extended, or replaced, and (v) any other anti-bribery and anti-corruption conventions such as the OECD Convention on Combating Bribery of Foreign Public Officials in International Business Transactions and the United Nations Convention Against Corruption. “Anti-Money Laundering Laws” means all laws concerning or relating to money laundering or terrorism financing, including, without limitation, (a) the U.S. Currency and Financial Transactions Reporting Act of 1970, as amended by the Patriot Act, the U.S. Money Laundering Control Act of 1986 and other legislation, which legislative framework is commonly referred to as the “Bank Secrecy Act,” to the extent applicable, (b) the Mexican Ley Federal para la Prevención e Identificación de Operaciones con Recursos de Procedencia Ilícita, (c) articles 139, 139 Bis, 139 Ter, 139 Quater, 139 Quinqui, 148 Bis, 148 Ter, 148 Quater, 400 bis and 400 bis 1 of the Mexican Federal Penal Code (Código Penal Federal); (d) Proceeds of Crime (Money Laundering) and Terrorist Financing Act (Canada), to the extent applicable, and (e) the corresponding laws of the jurisdictions in which any Loan Party or any of its Subsidiaries [Signature Page to Credit Agreement] operates or in which the proceeds of the Loans will be used and all rules and regulations implementing such laws, as any of the foregoing may be amended from time to time. “Applicable Margin” means a rate per annum determined in accordance with Schedule 1.1; subject to any adjustment to the Applicable Margin pursuant to Section 3.12. “Appraisal” means an appraisal prepared by an Approved Appraiser and complying with the standards applied by the Uniform Standards of Professional Appraisal Practice (USPAP) to the Properties as of the Signing Date, together with such revisions to such standards as are implemented by the applicable appraiser after the Signing Date (i) that are not materially adverse to the Lenders or (ii) that are materially adverse to the Lenders, but only in the case of this clause (ii) if such revisions and the applicable appraiser (whether or not such appraiser is an Approved Appraiser) have been reasonably approved by the Required Lenders). “Appraised Value” means, for any Property, the fair market value of such Property, determined pursuant to an Appraisal of such Property. “Approved Appraiser” means CBRE Group, Inc., Cushman & Wakefield Inc. or Jones Lang Lasalle and any other appraiser reasonably approved by the Administrative Agent upon written request from the Borrower, from time to time. “Approved Auditor” means Galaz, Yamazaki, Ruiz Urquiza, S.C. (Member of Deloitte Touche Tohmatsu Limited) or another internationally recognized “Big 4” firm of auditors (including their member companies). “Assignment and Assumption” means an assignment and assumption entered into by a Lender and an assignee (with the consent of any party whose consent is required by Section 11.7.2), and acknowledged by the Administrative Agent, in substantially the form of Exhibit D. “Audited Financial Statements” means the audited Consolidated balance sheet of the Borrower for the fiscal year ended December 31, 2023, and the related Consolidated statements of income or operations, shareholders’ equity and cash flows for such fiscal year of the Borrower, including the notes thereto. “Availability Period” means (a) with respect to the Term Loan Facilities, the Term Loan Availability Period, (b) with respect to the Revolving Credit Facility, the Revolving Credit Availability Period and (c) with respect to any Incremental Loan, the Incremental Availability Period. “Available Tenor” means, as of any date of determination and with respect to the then-current Benchmark, as applicable, (x) if such Benchmark is a term rate, any tenor for such Benchmark (or component thereof) that is or may be used for determining the length of an interest period pursuant to this Agreement or (y) otherwise, any payment period for interest calculated with reference to such Benchmark (or component thereof) that is or may be used for determining any frequency of making payments of interest calculated with reference to such Benchmark pursuant to this Agreement, in each case, as of such date and not including, for the avoidance of doubt, any tenor for such Benchmark that is then-removed from the definition of “Interest Period” pursuant to Section 3.11(d). “Bail-In Action” means the exercise of any Write-Down and Conversion Powers by the applicable Resolution Authority in respect of any liability of an Affected Financial Institution. “Bail-In Legislation” means, (a) with respect to any EEA Member Country implementing Article 55 of Directive 2014/59/EU of the European Parliament and of the Council of the European Union, the implementing law, regulation rule or requirement for such EEA Member Country from time to time which is described in the EU Bail-In Legislation Schedule and (b) with respect to the United Kingdom, Part I of the United Kingdom Banking Act 2009 (as amended from time to time) and any other law, regulation or rule applicable in the United Kingdom relating to the resolution of unsound or failing banks, investment [Signature Page to Credit Agreement] firms or other financial institutions or their affiliates (other than through liquidation, administration or other insolvency proceedings). “Baseline” means, in relation to any Sustainability KPI, the baseline performance of the Borrower set out in Schedule 3.12A. “Benchmark” means, initially, the Term SOFR Reference Rate; provided that if a Benchmark Transition Event has occurred with respect to the Term SOFR Reference Rate or the then-current Benchmark, then “Benchmark” means the applicable Benchmark Replacement to the extent that such Benchmark Replacement has replaced such prior benchmark rate pursuant to Section 3.11(a) “Benchmark Replacement” means, with respect to any Benchmark Transition Event, the first alternative set forth in the order below that can be determined by the Administrative Agent for the applicable Benchmark Replacement Date: (a) Daily Simple SOFR; or (b) the sum of: (i) the alternate benchmark rate that has been selected by the Administrative Agent and the Borrower giving due consideration to (A) any selection or recommendation of a replacement benchmark rate or the mechanism for determining such a rate by the Relevant Governmental Body or (B) any evolving or then-prevailing market convention for determining a benchmark rate as a replacement to the then-current Benchmark for Dollar-denominated syndicated credit facilities and (ii) the related Benchmark Replacement Adjustment. If the Benchmark Replacement as determined pursuant to clause (a) or (b) above would be less than the Floor, the Benchmark Replacement will be deemed to be the Floor for the purposes of this Agreement and the other Loan Documents. “Benchmark Replacement Adjustment” means, with respect to any replacement of the then- current Benchmark with an Unadjusted Benchmark Replacement, the spread adjustment, or method for calculating or determining such spread adjustment, (which may be a positive or negative value or zero) that has been selected by the Administrative Agent and the Borrower giving due consideration to (a) any selection or recommendation of a spread adjustment, or method for calculating or determining such spread adjustment, for the replacement of such Benchmark with the applicable Unadjusted Benchmark Replacement by the Relevant Governmental Body or (b) any evolving or then-prevailing market convention for determining a spread adjustment, or method for calculating or determining such spread adjustment, for the replacement of such Benchmark with the applicable Unadjusted Benchmark Replacement for Dollar-denominated syndicated credit facilities at such time. “Benchmark Replacement Date” means the earliest to occur of the following events with respect to the then-current Benchmark: (a) in the case of clause (a) or (b) of the definition of “Benchmark Transition Event,” the later of (i) the date of the public statement or publication of information referenced therein and (ii) the date on which the administrator of such Benchmark (or the published component used in the calculation thereof) permanently or indefinitely ceases to provide all Available Tenors of such Benchmark (or such component thereof); or (b) in the case of clause (c) of the definition of “Benchmark Transition Event,” the first date on which all Available Tenors of such Benchmark (or the published component used in the calculation thereof) have been determined and announced by the regulatory supervisor for the administrator of such Benchmark (or such component thereof) to be non-representative; provided that such non- representativeness will be determined by reference to the most recent statement or publication referenced in such clause (c) and even if any Available Tenor of such Benchmark (or such component thereof) continues to be provided on such date. [Signature Page to Credit Agreement] For the avoidance of doubt, the “Benchmark Replacement Date” will be deemed to have occurred in the case of clause (a) or (b) with respect to any Benchmark upon the occurrence of the applicable event or events set forth therein with respect to all then-current Available Tenors of such Benchmark (or the published component used in the calculation thereof). “Benchmark Transition Event” means the occurrence of one or more of the following events with respect to the then-current Benchmark: (a) a public statement or publication of information by or on behalf of the administrator of such Benchmark (or the published component used in the calculation thereof) announcing that such administrator has ceased or will cease to provide all Available Tenors of such Benchmark (or such component thereof), permanently or indefinitely; provided that, at the time of such statement or publication, there is no successor administrator that will continue to provide any Available Tenor of such Benchmark (or such component thereof); (b) a public statement or publication of information by the regulatory supervisor for the administrator of such Benchmark (or the published component used in the calculation thereof), the FRB, the Federal Reserve Bank of New York, an insolvency official with jurisdiction over the administrator for such Benchmark (or such component), a resolution authority with jurisdiction over the administrator for such Benchmark (or such component) or a court or an entity with similar insolvency or resolution authority over the administrator for such Benchmark (or such component), which states that the administrator of such Benchmark (or such component) has ceased or will cease to provide all Available Tenors of such Benchmark (or such component thereof) permanently or indefinitely; provided that, at the time of such statement or publication, there is no successor administrator that will continue to provide any Available Tenor of such Benchmark (or such component thereof); or (c) a public statement or publication of information by the regulatory supervisor for the administrator of such Benchmark (or the published component used in the calculation thereof) announcing that all Available Tenors of such Benchmark (or such component thereof) are not, or as of a specified future date will not be, representative. For the avoidance of doubt, a “Benchmark Transition Event” will be deemed to have occurred with respect to any Benchmark if a public statement or publication of information set forth above has occurred with respect to each then-current Available Tenor of such Benchmark (or the published component used in the calculation thereof). “Benchmark Unavailability Period” means, the period (if any) (a) beginning at the time that a Benchmark Replacement Date has occurred if, at such time, no Benchmark Replacement has replaced the then-current Benchmark for all purposes hereunder and under any Loan Document in accordance with Section 3.11 and (b) ending at the time that a Benchmark Replacement has replaced the then-current Benchmark for all purposes hereunder and under any Loan Document in accordance with Section 3.11. “Beneficial Ownership Certification” means a certification regarding beneficial ownership as required by the Beneficial Ownership Regulation in substantially the form of Exhibit E. “Beneficial Ownership Regulation” means 31 C.F.R. § 1010.230. “Benefit Plan” means any of (a) an “employee benefit plan” (as defined in ERISA) that is subject to Title I of ERISA, (b) a “plan” as defined in and subject to Section 4975 of the Code or (c) any Person whose assets include (for purposes of ERISA Section 3(42) or otherwise for purposes of Title I of ERISA or Section 4975 of the Code) the assets of any such “employee benefit plan” or “plan”. “BOMA BEST” means Canada’s environmental assessment and certification program for existing buildings. “Borrower” has the meaning specified in the preamble.

[Signature Page to Credit Agreement] “Borrower Materials” has the meaning specified in Section 7.2. “Borrowing” means a borrowing consisting of simultaneous Loans of the same Class, bearing the same rate of interest, having the same Interest Period, and made by each of the Lenders pursuant to Section 2.1. “Borrowing Date” means, with respect to each Loan, any Business Day during the Availability Period designated by the Borrower in the applicable Loan Notice on which such Loan is disbursed by the Lenders. “Business Day” means any day, other than a Saturday, Sunday or other day on which commercial banks in New York, New York, Canada or Mexico City, Mexico are required or authorized by law to close. “Calculation Methodology” means, in relation to a Sustainability KPI, the calculation methodology applicable to such Sustainability KPI as set out in Schedule 3.12A hereto. “Capital Expenditure Allowance” means, with respect to any Property at any date of determination, U.S.$0.15 per annum times the total number of rentable square feet of such Property. “Capital Lease” means any capital lease or sublease that has been (or under IFRS should be) capitalized on a balance sheet of the lessee. “Change in Law” means the occurrence, after the date of this Agreement, of any of the following: (a) the adoption or taking effect of any Law, (b) any change in any Law or in the administration, interpretation, implementation or application thereof by any Governmental Authority or (c) the making or issuance of any request, guideline or directive (whether or not having the force of law) by any Governmental Authority; provided that, notwithstanding anything herein to the contrary, (i) the Dodd- Frank Wall Street Reform and Consumer Protection Act and all requests, rules, guidelines or directives thereunder or issued in connection therewith and (ii) all requests, rules, guidelines or directives promulgated by the Bank for International Settlements, the Basel Committee on Banking Supervision (or any successor or similar authority) or the United States or foreign regulatory authorities, in each case pursuant to Basel III, in each case shall be deemed to be a “Change in Law,” regardless of the date enacted, adopted, promulgated or issued (so long as such date occurs after the date of this Agreement). “Change of Control” means the occurrence of any of the following: (a) any Person or two or more Persons acting in concert (other than one or more Permitted Holders) shall have acquired and shall continue to have following the date hereof beneficial ownership, directly or indirectly, of Equity Interests of the Borrower representing more than 50% of the combined voting power of all Equity Interests of the Borrower; or (b) there is a change in the composition of the Borrower’s Board of Directors over a period of 24 consecutive months (or less) such that a majority of Board members ceases to be comprised of individuals who have been Board members continuously since the beginning of such period. “Class” (a) when used with respect to any Lender, refers to whether such Lender has a Loan or Commitment with respect to a particular Class of Loans or Commitments, (b) when used with respect to Commitments, refers to whether such Commitments are Revolving Credit Commitments or Term Loan Commitments, and (c) when used with respect to Loans, refers to whether such Loans are Revolving Credit Loans or Term Loans. “Closing Date” means the date on which all the conditions precedent in Section 5.1 are satisfied or waived in accordance with Section 11.1. “Code” means the Internal Revenue Code of 1986, as amended. “Commitment” means a Revolving Credit Commitment or a Term Loan Commitment, as the context requires. [Signature Page to Credit Agreement] “Compensation Amount” has the meaning specified in Section 4.6.2. “Compliance Certificate” means a certificate substantially in the form of Exhibit B. “Conforming Changes” means, with respect to either the use or administration of Term SOFR or the use, administration, adoption or implementation of any Benchmark Replacement, any technical, administrative or operational changes (including changes to the definition of “Alternate Rate,” the definition of “Business Day,” the definition of “U.S. Government Securities Business Day,” the definition of “Interest Period” or any similar or analogous definition (or the addition of a concept of “interest period”), timing and frequency of determining rates and making payments of interest, timing of borrowing requests or prepayment, conversion or continuation notices, the applicability and length of lookback periods, the applicability of Section 4.5 and other technical, administrative or operational matters) that the Administrative Agent reasonably determines in consultation with the Borrower may be appropriate to reflect the adoption and implementation of any such rate or to permit the use and administration thereof by the Administrative Agent in a manner substantially consistent with market practice (or, if the Administrative Agent determines that the adoption of any portion of such market practice is not administratively feasible or if the Administrative Agent determines that no market practice for the administration of any such rate exists, in such other manner of administration as the Administrative Agent reasonably determines in consultation with the Borrower is reasonably necessary in connection with the administration of this Agreement and the other Loan Documents); it being understood that the Administrative Agent may request instructions from the Required Lenders with respect to any determination or decision to be made in connection with any Conforming Changes. “Connection Income Taxes” means Other Connection Taxes that are imposed on or measured by net income (however denominated) or that are franchise Taxes or branch profits Taxes. “Consolidated Indebtedness” means at any time the aggregate Indebtedness of the Borrower and its Subsidiaries calculated on a Consolidated basis as of such time. “Consolidated” refers to the consolidation of accounts in accordance with IFRS. “Contractual Obligation” means, as to any Person, any provision of any security issued by such Person or of any agreement, instrument or other undertaking to which such Person is a party or by which it or any of its property is bound. “Control” means the possession, directly or indirectly, of the power to direct or cause the direction of the management or policies of a Person, whether through the ability to exercise voting power, by contract or otherwise. The term “Controlled” has the meaning correlative thereto. “Credit Parties” means, collectively, the Administrative Agent and each Lender; and “Credit Party” means any one of the Credit Parties. “Customary Recourse Exceptions” means, with respect to any Non-Recourse Debt, exclusions from the exculpation provisions with respect to such Non-Recourse Debt for fraud, material misrepresentation, material breach of warranty, physical waste, misapplication of cash, environmental claims and other circumstances customarily excluded by institutional lenders from exculpation provisions and/or included in separate indemnification agreements in non-recourse financings of real estate. “Customary Recourse Exceptions Guaranty” means a Guarantee by any Person of Liability of another Person solely with respect to Customary Recourse Exceptions. “Daily Simple SOFR” means, for any day, SOFR, with the conventions for this rate (which will include a lookback) being established by the Administrative Agent in accordance with the conventions for this rate selected or recommended by the Relevant Governmental Body for determining “Daily Simple SOFR” for syndicated business loans; provided that if the Administrative Agent decides that any such [Signature Page to Credit Agreement] convention is not administratively feasible for the Administrative Agent, then the Administrative Agent may establish another convention in its reasonable discretion. “Debt Rating” means the rating of the Borrower’s long-term senior unsecured debt by Moody’s, S&P or Fitch or to the extent more than one rating type or category exists, the rating type or category that would include the Loans hereunder. “Debt Service” means, for any date of determination, the annual debt service payments that would have been required to be made for a four fiscal quarter period ending immediately prior to such date on an assumed debt in an aggregate principal amount equal to the Facility Exposure as of such date, applying a 25-year amortization schedule with a coupon equal to the greater of (i) the rate per annum on 5 year United States Treasury Securities plus 2.10% per annum or (ii) 4.0% per annum. “Debtor Relief Laws” means, with respect to any Person, any statute, law, code or regulation applicable to such Person relating to bankruptcy, insolvency, concurso mercantil, quiebra, receivership, suspension of payment, reorganization, rearrangement, winding-up, composition, liquidation, special liquidation, corporate restructuring, adjustment of debts or other relief for debtors, including Title 11, U.S. Code, the Mexican Ley de Concursos Mercantiles, any applicable law governing a proceeding of the type referred to in Section 9.1.6 and any similar foreign, federal or state law for the relief of debtors. “Default” means any event or condition that constitutes an Event of Default or that, with the giving of any notice, the passage of time, or both, would be an Event of Default. “Default Rate” means, with respect to principal or interest relating to any Loan, an interest rate equal to the interest rate (including any Applicable Margin) otherwise applicable to such Loan plus 2% per annum, and with respect to any other amount payable under any Loan Document, the Alternate Rate plus 2% per annum. “Defaulting Lender” means at any time, subject to Section 3.10.2, any Lender that (a) has failed to (i) fund all or any portion of its Loans within two Business Days of the date such Loans were required to be funded hereunder unless such Lender notifies the Administrative Agent and the Borrower in writing that such failure is the result of such Lender’s determination that one or more conditions precedent to funding (each of which conditions precedent, together with any applicable default, shall be specifically identified in such writing) has not been satisfied, or (ii) pay to the Administrative Agent or any other Lender any other amount required to be paid by it hereunder within two Business Days of the date when due, (b) has notified the Borrower or the Administrative Agent in writing that it does not intend to comply with its funding obligations hereunder, or has made a public statement to that effect (unless such writing or public statement relates to such Lender’s obligation to fund a Loan hereunder and states that such position is based on such Lender’s determination that a condition precedent to funding (which condition precedent, together with any applicable default, shall be specifically identified in such writing or public statement) cannot be satisfied), (c) has failed, within three (3) Business Days after written request by the Administrative Agent or the Borrower, to confirm in writing to the Administrative Agent and the Borrower that it will comply with its prospective funding obligations hereunder (provided that such Lender shall cease to be a Defaulting Lender pursuant to this clause (c) upon receipt of such written confirmation by the Administrative Agent and the Borrower), or (d) any Lender with respect to which a Lender Insolvency Event has occurred and is continuing with respect to such Lender or its Parent Company. Any determination by the Administrative Agent that a Lender is a Defaulting Lender under any of clauses (a) through (d) above will be conclusive and binding absent manifest error, and such Lender will be deemed to be a Defaulting Lender (subject to Section 3.10.2) upon notification of such determination by the Administrative Agent to the Borrower and the Lenders. “Development Property” means any land or other real property acquired for development into one or more Industrial Properties until substantial completion of construction thereon has occurred; provided, however, that for the avoidance of doubt, neither Raw Land nor any Renovation Property shall constitute a Development Property. [Signature Page to Credit Agreement] “Disqualified Assignee” means, as of the Signing Date, any Person listed on Schedule 1.1A hereto, and after the Signing Date, (a) any other Person that at the time of determination has been designated by the Borrower as a competitor of any Loan Party and/or any of its Subsidiaries by written notice to the Administrative Agent attaching an updated Schedule 1.1A hereto which is approved by the Administrative Agent (if required, with the consent of the Required Lenders) (such approval or consent not to be unreasonably withheld or delayed) and (b) any Mexican real estate investment trust (“fideicomisos de inversión en bienes raices” or FIBRAs), any Mexican trust issuer of certificados bursátiles fiduciarios de proyectos de inversion or certificados bursátiles fiduciarios de desarrollo or any other similar vehicle organized or existing in Mexico, the principal purpose of which is the investment in real estate; provided that “Disqualified Assignee” shall in no event include any national or international financial institution or insurance company or pension fund; provided, however, that if a Person is designated as a competitor in an updated Schedule 1.1A and such update is delivered on or after the date that is two (2) Business Days prior to a proposed Trade Date for an assignment to such Person, then such assignment shall nonetheless be permitted, and the updated Schedule 1.1A shall be disregarded for purposes of that assignment. “EBITDA” means, for any period of determination (calculated, with respect to any period consisting of less than four consecutive fiscal quarters, on an annualized basis), the sum of the following items: (a) the sum of (i) comprehensive income (or loss) (excluding (w) gains (or losses) from extraordinary items, (x) fair value adjustments, (y) amortization of debt premiums, and (z) translation effects from foreign currencies, (ii) interest expense, (iii) income tax expense, (iv) to the extent directly deducted to determine such comprehensive income (or loss), tenant improvements, (v) leasing commissions, (vi) capital expenditures and (vii) to the extent deducted in computing comprehensive income, non-recurring items, in each case of the Borrower and its Subsidiaries determined on a Consolidated basis and in accordance with IFRS for such period, plus (b) with respect to each Joint Venture, the JV Pro Rata Share of the sum of (i) comprehensive income (or loss) (excluding (x) gains (or losses) from extraordinary items, (y) fair value adjustments (including the amortization of debt premiums) and (z) translation effects from foreign currencies), (ii) interest expense, (iii) income tax expense, (iv) to the extent directly deducted to determine such comprehensive income (or loss), tenant improvements, (v) leasing commissions, (vi) capital expenditures and (vii) to the extent deducted in computing comprehensive income of such Joint Venture, non-recurring items, in each case of such Joint Venture determined on a Consolidated basis. “EEA Financial Institution” means (a) any credit institution or investment firm established in any EEA Member Country which is subject to the supervision of an EEA Resolution Authority, (b) any entity established in an EEA Member Country which is a parent of an institution described in clause (a) of this definition, or (c) any financial institution established in an EEA Member Country which is a subsidiary of an institution described in clauses (a) or (b) of this definition and is subject to consolidated supervision with its parent. “EEA Member Country” means any of the member states of the European Union, Iceland, Liechtenstein, and Norway. “EEA Resolution Authority” means any public administrative authority or any person entrusted with public administrative authority of any EEA Member Country (including any delegee) having responsibility for the resolution of any EEA Financial Institution. “Eligible Certifications” means (i) LEED BD+C, (ii) LEED O+M, (iii) BOMA BEST, (iv) EDGE, and (v) any successor to any of the foregoing. “Environmental Laws” means all applicable Laws relating to pollution and the protection of the environment or the release of any materials into the environment, including those related to hazardous substances or wastes, air emissions and discharges to waste or public systems, including the Mexican General Law of Ecological Balance and Environmental Protection (Ley General del Equilibrio Ecológico

[Signature Page to Credit Agreement] y la Protección al Ambiente), Mexico’s Federal Law of Environmental Responsibility (Ley Federal de Responsabilidad Ambiental), Mexico’s National Waters Law (Ley de Aguas Nacionales), Mexico’s General Law on Integral Waste Prevention and Management (Ley General para la Prevención y Gestión Integral de los Residuos), and any other applicable Mexican local laws, rules, regulations and official norms (Normas Oficiales Mexicanas) related to environmental matters. “Environmental Liability” means any liability, contingent or otherwise (including any liability for damages, costs of environmental remediation, fines, penalties or indemnities), of the Borrower or any of its Subsidiaries directly or indirectly resulting from or based upon (a) violation of any Environmental Law, (b) the generation, use, handling, transportation, storage, treatment or disposal of any Hazardous Materials, (c) exposure to any Hazardous Materials, or (d) the release or threatened release of any Hazardous Materials into the environment. “Equity Interests” means, with respect to any Person, (i) shares of capital stock or partnership interests of (or other ownership or profit interests in) such Person, (ii) beneficiary rights, derechos fideicomisarios that attribute equity or similar ownership rights or certificados de participación ordinarios or certificados bursátiles fiduciarios inmobiliarios, certificados bursátiles fiduciarios de proyectos de inversion or certificados bursátiles fiduciarios de desarrollo issued under a trust or fideicomiso, (iii) warrants, options or other rights for the purchase or other acquisition from such Person of shares of capital stock of (or other ownership or profit interests in) such Person, (iv) securities convertible into or exchangeable for shares of capital stock of (or other ownership or profit interests in) such Person or warrants, rights or options for the purchase or other acquisition from such Person of such shares (or such other interests), and (v) other ownership or profit interests in such Person (including partnership, member or trust interests therein), in each case whether voting or nonvoting and to the extent then outstanding. “Equity Value” means, as of any date of determination for the Borrower and its Subsidiaries on a Consolidated basis and determined in accordance with IFRS, the amount of “Total Stockholders’ Equity” set forth in the Borrower’s Consolidated financial statements for the most recently ended calendar quarter, provided that such amount shall be adjusted to eliminate the impact (whether positive or negative) of any gain or loss from any revaluation of investment property during the period since the date of the most recent audited balance sheet of the Borrower delivered to the Administrative Agent pursuant to Section 7.1(a). “Equivalent” (a) in U.S. Dollars of any currency other than U.S. Dollars on any date means the equivalent in U.S. Dollars of such other currency determined at the Administrative Agent’s Spot Rate of Exchange on the date falling two Business Days prior to the date of determination and (b) in any currency other than U.S. Dollars of any other currency (including U.S. Dollars) means the equivalent in such other currency determined at the Administrative Agent’s Spot Rate of Exchange on the date falling two Business Days prior to the date of conversion or notional conversion, as the case may be. “ERISA” means the Employee Retirement Income Security Act of 1974, as amended, and the regulations promulgated and rulings issued thereunder. “ERISA Affiliate” means any Person that together with any Loan Party is treated as a single employer under Section 414 of the Code. “ERISA Event” means (a) the occurrence of a reportable event, within the meaning of Section 4043 of ERISA, with respect to any Plan unless the 30-day notice requirement with respect to such event has been waived by the PBGC; (b) the application for a minimum funding waiver with respect to a Plan; (c) the provision by the administrator of any Plan of a notice of intent to terminate such Plan pursuant to Section 4041(a)(2) of ERISA (including any such notice with respect to a plan amendment referred to in Section 4041(e) of ERISA); (d) the cessation of operations at a facility of any Loan Party or any ERISA Affiliate in the circumstances described in Section 4062(e) of ERISA; (e) the withdrawal by any Loan Party or any ERISA Affiliate from a Multiple Employer Plan during a plan year for which it was a substantial employer, as defined in Section 4001(a)(2) of ERISA; (f) the conditions for imposition of a lien under Section 303(k) of ERISA shall have been met with respect to any Plan; or (g) the institution [Signature Page to Credit Agreement] by the PBGC of proceedings to terminate a Plan pursuant to Section 4042 of ERISA, or the occurrence of any event or condition described in Section 4042 of ERISA that constitutes grounds for the termination of, or the appointment of a trustee to administer, such Plan. “Erroneous Payment” has the meaning assigned to it in Section 10.10(a). “Erroneous Payment Deficiency Assignment” has the meaning assigned to it in Section 10.10(d)(i). “Erroneous Payment Impacted Class” has the meaning assigned to it in Section 10.10(d)(i). “Erroneous Payment Return Deficiency” has the meaning assigned to it in Section 10.10(d)(i). “Erroneous Payment Subrogation Rights” has the meaning assigned to it in Section 10.10(e). “EU Bail-In Legislation Schedule” means the EU Bail-In Legislation Schedule published by the Loan Market Association (or any successor person), as in effect from time to time. “Event of Default” has the meaning specified in Section 9.1. “Excluded Taxes” means, with respect to the Administrative Agent, any Lender, or any other recipient of any payment to be made by or on account of any obligation of the Borrower hereunder, (a) Taxes imposed on or measured by its overall net income (however denominated), branch profits Taxes imposed by the United States or any similar Tax and franchise Taxes imposed on it (in lieu of net income Taxes), in each case (i) imposed by the jurisdiction (or any political subdivision thereof) under the Laws of which such recipient is organized or considered a resident for tax purposes, in which its principal office is located and subject to such Taxes or, in the case of any Lender, in which its applicable Lending Office is located or (ii) that are Other Connection Taxes, (b) in the case of a Foreign Lender (other than an assignee or transferee that becomes an assignee or transferee pursuant to a request by the Borrower under Section 11.12), any withholding Tax (other than Mexican withholding Taxes, but solely to the maximum extent not excluded under paragraph (e) below) that is imposed on amounts payable to such Foreign Lender with respect to an applicable interest in a Loan or Commitment pursuant to a law in effect at the time such Foreign Lender acquires such interest in the Loan or Commitment (or designates a new Lending Office), except to the extent that such Foreign Lender (in relation to any designation of a new Lending Office) or its assignor or transferor (in the case of such Foreign Lender becoming a Party) was entitled, at the time of designation of a new Lending Office or assignment or transfer, to receive from the Borrower such amounts (which shall be treated as additional interest under Mexican law) with respect to such withholding Tax, (c) Taxes attributable to such recipient’s failure or inability (other than as a result of a Change in Law) to comply with Section 4.1.4 (to the extent not excluded under sub-clause (e) below), (d) any withholding Taxes imposed under FATCA, and (e) in the case of any Lender (including, for the avoidance of doubt, an Affiliate of a Lender), any Mexican withholding Taxes in excess of the withholding Taxes applicable to payments of interest or amounts deemed as interest made hereunder to a Qualified Lender. “Existing Credit Agreement” means the credit agreement dated August 31, 2022, entered into by and among the Borrower, various financial institutions as lenders, Banco Nacional de México, S.A., Integrante del Grupo Financiero Banamex, División Fiduciaria, as administrative agent, Banco Nacional de Comercio Exterior, S.N.C., I.B.D., BBVA México, S.A., Institución De Banca Múltiple, Grupo Financiero BBVA México, Banco Nacional de México, S.A., Integrante del Grupo Financiero Banamex, Scotiabank Inverlat, S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, as joint lead arrangers and joint book running managers, Banco Sabadell, S.A., Institución de Banca Múltiple, as mandated lead arranger and BBVA México, S.A., Institución de Banca Múltiple, Grupo Financiero BBVA México and The Bank of Nova Scotia, as sustainability agents. [Signature Page to Credit Agreement] “External Reviewer” means Valora Consultores, Responsables and E3 Consultoría Ambiental, or any replacement external and independent reviewer appointed from time to time by the Borrower, qualified and experienced in the relevant assurance or attestation services and acceptable to the Lending Parties (acting reasonably); appointed on an annual basis to perform the limited assurance of all Sustainability KPIs, with the results attached to the relevant Pricing Certificate; “Facilities” means the Revolving Credit Facility, the Tranche A Facility and the Tranche B Facility. “Facility Exposure” means, at any date of determination, the aggregate principal amount of all outstanding Loans. “Facility Percentage” means, as the context may require: (a) subject to clause (b) below, with respect to any Lender at any time and the Facilities, the percentage (carried out to the ninth decimal place) that (i) the sum of (A) such Lender’s unused Commitments at such time plus (B) such Lender’s outstanding Loans at such time is of (ii) the sum of (A) the unused Commitments of all Lenders at such time plus (B) the outstanding Loans of all Lenders at such time; or (b) with respect to clauses (b) and (c) of the defined term “Required Lenders” herein, with respect to any Lender or the Parallel Lender at any time and the Facilities and the loans provided for under the Parallel Loan Agreement, the percentage (carried out to the ninth decimal place) that (i) the sum of (A) such Lender’s unused Commitments or the Parallel Lender’s unused commitment under the Parallel Loan Agreement, as the case may be, at such time plus (B) such Lender’s outstanding Loans or the Parallel Lender’s outstanding loans under the Parallel Loan Agreement, as the case may be, at such time is of (ii) the sum of (A) the unused Commitments of all Lenders at such time plus (B) the outstanding Loans of all Lenders at such time plus (C) the unused commitment of the Parallel Lender under the Parallel Loan Agreement at such time plus (D) the outstanding loans of the Parallel Lender under the Parallel Loan Agreement at such time. “FATCA” means Sections 1471 through 1474 of the Code, as of the date of this Agreement (or any amended or successor version of such Sections that is substantively comparable and not materially more onerous to comply with), any current or future regulations or official interpretations thereof, any agreements entered into pursuant to Section 1471(b)(1) of the Code, any intergovernmental agreement entered into in connection with any of the foregoing and any fiscal or regulatory legislation, rules or practices adopted pursuant to any intergovernmental agreement, treaty or convention among Governmental Authorities and implementing such Sections of the Code. “Federal Funds Rate” means, for any period, a fluctuating interest rate per annum equal for each day during such period to the weighted average of the rates on overnight Federal funds transactions with members of the Federal Reserve System, as published for such day (or, if such day is not a Business Day, for the next preceding Business Day) by the Federal Reserve Bank of New York, or, if such rate is not so published for any day that is a Business Day, the average of the quotations for such day for such transactions received by the Administrative Agent from three Federal funds brokers of recognized standing selected by it. For the avoidance of doubt, in no event shall the Federal Funds Rate be less than zero. “Fee Letter” means each fee letter executed by any or all of the Joint Lead Arrangers and Joint Bookrunners and the Administrative Agent and acknowledged and agreed to by the Borrower. “Fitch” means Fitch IBCA, Duff & Phelps, a division of Fitch, Inc. (or any successor thereof) or, if Fitch no longer publishes ratings, then another ratings agency selected by the Borrower and reasonably acceptable to the Administrative Agent (as reasonably and timely instructed by the Required Lenders). “Fixed Charge Coverage Ratio” means, as of the last day of any fiscal quarter, the ratio of (a) Adjusted EBITDA to (b) the sum of (i) interest (including capitalized interest, but excluding capitalized interest with respect to any construction loan to the extent such capitalized interest is funded under an interest reserve account) payable on, and cash amortization of debt discount in respect of, all debt for [Signature Page to Credit Agreement] borrowed money plus (ii) scheduled amortization of principal amounts of all debt for borrowed money payable (not including balloon maturity amounts) plus (iii) all cash dividends payable on any preferred equity interests, if any (which, for the avoidance of doubt, shall include preferred equity interests structured as trust preferred securities), in each case of the Borrower and its Subsidiaries (including the JV Pro Rata Share of the foregoing clauses (i)-(ii)) (other than dividends payable to the Borrower or a Subsidiary of the Borrower) calculated as of the end of each fiscal quarter for the four fiscal quarters then ended and Consolidated in accordance with IFRS. “Floor” means a rate of interest equal to 0.00% per annum. “Foreign Lender” means any Lender that is organized under the Laws of a jurisdiction other than that in which the Borrower is a resident for tax purposes. For purposes of this definition, the United States, each State thereof and the District of Columbia shall be deemed to constitute a single jurisdiction. “Foreign Official” means an officer or employee of a Governmental Authority, or of a public international organization, or any person acting in an official capacity for or on behalf of any such Governmental Authority, or for or on behalf of any such public international organization, or any political party, party official, or candidate thereof. “Foreign Official” also includes officers, employees, representatives, or agents of any entity owned or controlled directly or indirectly by a Governmental Authority, including through ownership by a sovereign wealth fund. “FRB” means the Board of Governors of the Federal Reserve System of the United States. “Governmental Approval” means any order, authorization, consent, approval, license, ruling, permit, certification, exemption, filing or registration from, by or with any Governmental Authority. “Governmental Authority” means the government of the United States of America, Canada, Mexico or any other nation, or of any political subdivision thereof, whether state or local, and any agency, authority, instrumentality, regulatory body, court, central bank or other entity exercising executive, legislative, judicial, taxing, regulatory or administrative powers or functions of or pertaining to government (including any supra-national bodies such as the European Union or the European Central Bank). “Guarantee” means, as to any Person, (a) any obligation, contingent or otherwise, of such Person guaranteeing or having the economic effect of guaranteeing any Indebtedness or other obligation payable or performable by another Person (the “primary obligor”) in any manner, whether directly or indirectly, and including any obligation of such Person, direct or indirect, (i) to purchase or pay (or advance or supply funds for the purchase or payment of) such Indebtedness or other obligation, (ii) to purchase or lease property, securities or services for the purpose of assuring the obligee in respect of such Indebtedness or other obligation of the payment or performance of such Indebtedness or other obligation, (iii) to maintain working capital, equity capital or any other financial statement condition or liquidity or level of income or cash flow of the primary obligor so as to enable the primary obligor to pay such Indebtedness or other obligation, or (iv) entered into for the purpose of assuring in any other manner the obligee in respect of such Indebtedness or other obligation of the payment or performance thereof or to protect such obligee against loss in respect thereof (in whole or in part), or (b) any Lien on any asset of such Person securing any Indebtedness or other obligation of any other Person, whether or not such Indebtedness or other obligation is assumed by such Person (or any right, contingent or otherwise, of any holder of such Indebtedness to obtain any such Lien). The amount of any Guarantee shall be deemed to be an amount equal to the stated or determinable amount of the related primary obligation, or portion thereof, in respect of which such Guarantee is made or, if not stated or determinable, the maximum reasonably anticipated liability in respect thereof as determined by the guaranteeing Person in good faith. “Guarantor” means each Subsidiary of the Borrower that enters into a guaranty to guarantee the Obligations of the Borrower hereunder pursuant to Section 7.13, but excluding any Person released from its obligations as a Guarantor pursuant to Section 7.13 or Section 11.1.