As confidentially submitted to the U.S. Securities and Exchange Commission on March 27, 2023. This draft registration statement has not been filed, publicly or otherwise, with the U.S. Securities and Exchange Commission and all information contained herein remains strictly confidential.

Registration No. 333-___________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form F-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Corporación Inmobiliaria Vesta, S.A.B. de C.V.

(Exact name of Registrant as specified in its charter)

Vesta Real Estate Corporation

(Translation of Registrant’s name into English)

| United Mexican States (State or other jurisdiction of incorporation or organization) |

6500 (Primary Standard Industrial Classification Code Number) |

None (I.R.S. Employer Identification No.) |

Paseo de Tamarindos No. 90, Torre II, Piso 28, Col. Bosques de las Lomas Cuajimalpa, C.P. 05210 Mexico City United Mexican States +52 (55) 5950-0070 |

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Cogency Global Inc.

122 East 42nd Street, 18th Floor

New York, New York 10168

+1 (212) 947-7200

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies of all communications, including communications sent to agent for service, should be sent to:

| Maurice Blanco Drew Glover Davis Polk & Wardwell LLP 450 Lexington Avenue New York, New York 10017 +1 (212) 450-4000 |

Juan Francisco Mendez Simpson Thacher & Bartlett LLP 425 Lexington Avenue New York, New York 10017 +1 (212) 455-2000 |

Approximate date of commencement of proposed sale of the securities to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box: ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company ☒

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant will file a further amendment which specifically states that this registration statement will thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement will become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the U.S. Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED , 2023

PRELIMINARY PROSPECTUS

Common Shares

represented by American Depositary Shares

Corporación

Inmobiliaria Vesta, S.A.B. de C.V.

(incorporated in the United Mexican States)

We are offering common shares represented by American depositary shares, or “ADSs,” in the United States of America, or the “United States,” and other countries outside of the United Mexican States, or “Mexico.” Each ADS represents common shares.

Our common shares are listed on the Mexican Stock Exchange (Bolsa Mexicana de Valores, S.A.B. de C.V.), or the “BMV,” under the symbol “VESTA.” On , 2023, the last reported sales price of our common shares on the BMV was Ps. per common share (equivalent to approximately US$ per common share or US$ per ADS, based on the exchange rate of Ps. per US$1.00 announced publicly by the Mexican Central Bank (Banco de México) on such date). Prior to this offering, no public market existed for the ADSs. After the pricing of this offering, we expect the ADSs to trade on the , or the “ ,” under the symbol “ .”

Neither the U.S. Securities and Exchange Commission, or the “Commission” or the “SEC” nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The ADSs have not been and will not be registered with the Mexican National Securities Registry (Registro Nacional de Valores) or the “RNV,” maintained by the Mexican National Banking and Securities Commission (Comisión Nacional Bancaria y de Valores), or the “CNBV, and may not be offered or sold publicly in Mexico. The ADSs may be offered or sold in Mexico, on a private placement basis, to investors that qualify as institutional or accredited investors pursuant to Article 8 of the Mexican Securities Market Law and regulations thereunder. The common shares underlying the ADSs have been registered with the RNV; registration of the common shares with the RNV does not imply any certification as to the investment quality of the common shares underlying the ADSs offered pursuant to this prospectus or our solvency or the accuracy or completeness of the information contained herein, and does not ratify or validate any actions or omissions, if any, undertaken in contravention of applicable law.

The information set forth in this prospectus or in any other related materials, is the sole responsibility of Corporación Inmobiliaria Vesta, S.A.B. de C.V. and has not been reviewed or authorized by the CNBV.

We have granted to the underwriters an option, exercisable for 30 days from the date of this prospectus, to purchase up to an aggregate of additional common shares represented by ADSs, at the public offering prices listed below, less the underwriting discounts and commissions. The underwriters may exercise this option solely for the purpose of covering over-allotments, if any, made in connection with the offering.

We are an “emerging growth company” as defined in Section 2(a)(19) of the U.S. Securities Act of 1933, as amended, or the “Securities Act” and, as such, are allowed to provide in this prospectus more limited disclosures than an issuer that would not so qualify. In addition, for as long as we remain an emerging growth company, we will qualify for certain limited exceptions from the U.S. Sarbanes-Oxley Act of 2002, as amended, or the “Sarbanes-Oxley Act.” See “Risk Factors—Risks Related to our ADSs—As a foreign private issuer and an “emerging growth company” (as defined in the JOBS Act), we will have different disclosure and other requirements than U.S. registrants and non-emerging growth companies.”

Investing in our common shares and ADSs involves risks. See “Risk Factors” beginning on page of this prospectus.

|

Per ADS |

Total |

Per Common Share |

Total | |

| Public offering price | US$ | US$ | US$ | US$ |

| Underwriting discounts and commissions(1)(2) | US$ | US$ | US$ | US$ |

| Proceeds, before expenses, to us(2) | US$ | US$ | US$ | US$ |

| (1) | See “Underwriting” for a description of the compensation payable to the underwriters. |

| (2) | Assumes no exercise of the underwriters’ over-allotment option. |

The underwriters expect to deliver the ADSs to purchasers on or about , 2023 through the book-entry facilities of the Depository Trust Company, or “DTC.”

Joint Global Coordinators

| Citigroup | BofA Securities | Barclays |

The date of this prospectus is ,

2023.

Page

This prospectus has been prepared by us solely for use in connection with the proposed offering of ADSs having common shares as underlying securities in the United States and, to the extent described below, elsewhere. We have not authorized anyone to provide you with any information or to make any representations other than as contained in this prospectus or in any free writing prospectuses we have prepared. We neither take any responsibility for nor can provide any assurance about the reliability of, any information that others may give you. You should not assume that the information contained in this prospectus is accurate as of any date other than the date on the cover of this prospectus. Our business, financial condition, results of operations, future growth prospects and other information in this prospectus may have changed since that date.

This prospectus is not an offer to sell and it is not a solicitation of an offer to buy securities in any jurisdiction in which the offer, sale or exchange is not permitted. The distribution of this prospectus and the offer or sale of the securities offered hereby in certain jurisdictions is restricted by law. This prospectus may not be used for, or in connection with, and does not constitute, any offer to, or solicitation by, anyone in any jurisdiction or under any circumstance in which such offer or solicitation is not authorized or is unlawful. Recipients must not distribute this prospectus into jurisdictions where such distribution would be unlawful.

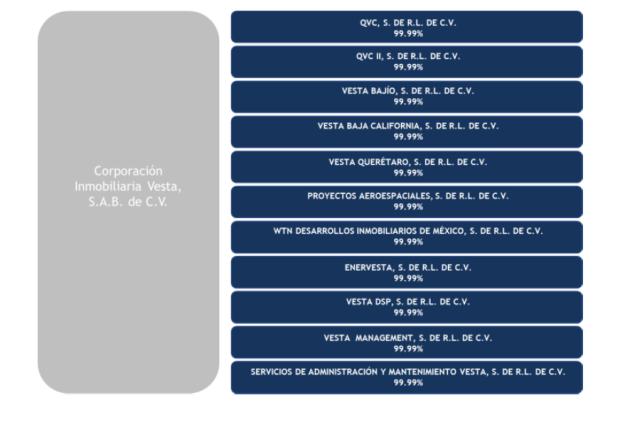

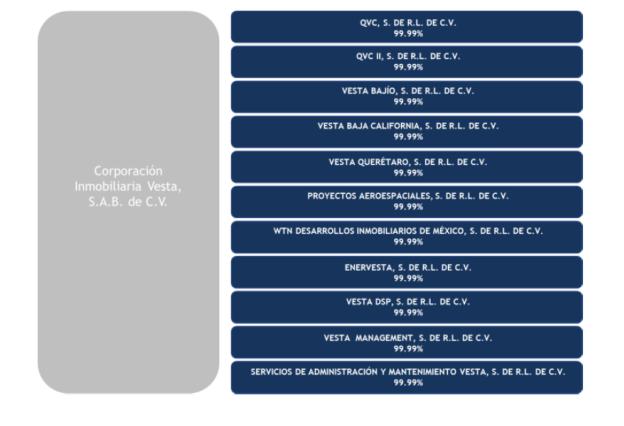

In this prospectus, we use the terms “Vesta” and “Company” to refer to Corporación Inmobiliaria Vesta, S.A.B. de C.V. Unless otherwise indicated or the context otherwise requires, the terms “we,” “our,” “ours,” “us” or similar terms refer to Vesta and its subsidiaries.

We own or have rights to trademarks, service marks and trade names that we use in connection with the operation of our business, including our corporate name, logos and website names. Solely for convenience, some of the trademarks, service marks and trade names referred to in this prospectus are listed without the ® and ™ symbols, but we will assert, to the fullest extent under applicable law, our rights to our trademarks, service marks and trade names. Other trademarks, service marks and trade names appearing in this prospectus are the property of their respective owners.

i

Glossary of Certain Terms and Definitions

Set forth below is a glossary of certain industry and other terms used in this prospectus:

“Adjusted EBITDA” means the sum of profit for the year adjusted by (a) total income tax expense, (b) interest income, (c) other income-net, (d) finance costs, (e) exchange gain (loss) - net, (f) gain on sale of investment property, (g) gain on revaluation of investment property, (h) depreciation and (i) long-term incentive plan and equity plus during the relevant period.

“Adjusted NOI” means the sum of NOI plus property operating costs related to properties that did not generate rental income during the relevant period.

“AMVO” means the Asociación Mexicana de Venta Online (Mexican Association of Online Sales).

“BMV” means the Bolsa Mexicana de Valores, S.A.B. de C.V. (Mexican Stock Exchange).

“BTS Building” means a build-to-suit building that is designed and constructed in a tailor-made manner in order to meet client-specific needs.

“CETES” means the Mexican Certificados de la Tesorería de la Federación (Federal Treasury Certificates).

“Class A Buildings” are industrial properties that typically possess most of the following characteristics: (i) 15 years old or newer; (ii) concrete tilt-up construction; (iii) clear height in excess of 26 feet, (iv) a ratio of dock doors to floor area that is more than one door per 10,000 square feet; and (v) energy efficient design characteristics suitable for current and future tenants.

“CNBV” means the Mexican Comisión Nacional Bancaria y de Valores (Mexican National Banking and Securities Commission).

“CPA” means Corporate Properties of the Americas.

“CPI” means the U.S. Consumer Price Index.

“CPW” means CPW México, S. de R.L. de C.V.

“Exchange Act” means the Securities Exchange Act of 1934, as amended.

“Federal Government” means the Federal Government of Mexico.

“FFO” means profit for the year, excluding: (i) gain on sale of investment property and (ii) gain on revaluation of investment property.

“General Electric” means G.E. Real Estate de México, S. de R.L. de C.V.

“GLA” means gross leasable area.

“IASB” means the International Accounting Standards Board.

“IFRS” means International Financial Reporting Standards, as issued by the IASB.

“Indeval” means S.D. Indeval Institución para el Depósito de Valores, S. A. de C.V.

“INEGI” means the Mexican Instituto Nacional de Estadística y Geografía (Mexican National Institute of Statistics and Geography).

“INPC” means the Mexican Índice Nacional de Precios al Consumidor (Mexican National Consumer Price Index).

ii

“Inventory Buildings” are buildings that are built without a lease signed with a specific customer, and designed in accordance with standard industry specifications, for the purpose of having readily-available space for clients that do not have the time or interest to build a specialized BTS Building.

“LEED Certification” means a certification granted by the Leadership in Energy and Environmental Design, which certifies a building’s compliance with certain environmental standards.

“Mexican Central Bank” means the Banco de México (Bank of Mexico).

“Multi-Tenant Buildings” means buildings designed and built pursuant to general specifications and which may be adapted for two or more tenants, each with its specific GLA and separate entrances and utilities.

“NAV” means the sum of investment property, plus cash, cash equivalents and restricted cash, plus recoverable taxes, plus guarantee deposits made, restricted cash and others, minus the current portion of long-term debt, minus long-term debt.

“Net Debt to Adjusted EBITDA” means (i) our gross debt (defined as current portion of long-term debt plus long-term debt plus amortization of debt issuance costs) less cash and cash equivalents divided by (ii) Adjusted EBITDA.

“Net Debt to Total Assets” means (i) our gross debt (defined as current portion of long-term debt plus long-term debt plus amortization of debt issuance costs) less cash and cash equivalents divided by (ii) total assets.

“Nissan” means Nissan Mexicana, S.A. de C.V.

“Nissan Trust” means the trust agreement dated July 5, 2013, between Nissan, as trustor and beneficiary, and Vesta DSP, as trustor and beneficiary, and formerly by Deutsche Bank Mexico, S.A., Multiple Banking Institution, (currently, CIBanco, S.A., Institución de Banca Múltiple, as successor), as trustee, as such has been or is amended from time to time, pursuant to which the terms and conditions for the development of Vesta DSP (as defined below) were established.

“NOI” means the sum of Adjusted EBITDA plus general and administrative expenses, minus long-term incentive plan and equity plus during the relevant period.

“Paris Agreement” means the international agreement on climate change that is legally binding in the United Nations Framework Convention on Climate Change (UNFCCC) on climate change mitigation, adaptation, and finance.

“PCAOB” means the U.S. Public Company Accounting Oversight Board.

“PROFEPA” means the Mexican Procuraduría Federal de Protección al Ambiente (Federal Environmental Protection Agency).

“Proyectos Aeroespaciales” means Proyectos Aeroespaciales, S. de R.L. de C.V., a subsidiary of Vesta.

“PTS Park” means an industrial park-to-suit that is designed and constructed in a tailor-made manner in order to meet specific needs of an industry or cluster.

“REIT” means real estate investment trust.

“Securities Act” means the U.S. Securities Act of 1933, as amended.

“QAP” means the Querétaro Aerospace Park.

“QVC” means QVC, S. de R.L. de C.V.

iii

“QVC II” means QVC II, S. de R.L. de C.V.

“QVC III” means QVC III, S. de R.L. de C.V.

“RNV” means the Mexican Registro Nacional de Valores (Mexican National Securities Registry).

“Same-Store Sales” means the change in rental income of stabilized properties in the relevant period (excluding rental income of non-stabilized properties) compared to the rental income of such properties from the prior period.

“SEDI” means the Sistema Electrónico de Envío y Difusión de Información (automated electronic information transfer system).

“USMCA” means the United States-Mexico-Canada Agreement which entered into force on July 1, 2020.

“VBC” means Vesta Baja California, S. de R.L. de C.V.

“Vesta DSP” means Vesta DSP, S. de R.L. de C.V., a subsidiary of Vesta.

“Vesta FFO” means the sum of FFO, as adjusted for the impact of exchange gain (loss) - net, other income – net, interest income, total income tax expense, depreciation and long-term incentive plan and equity plus.

“Vesta Management” means Vesta Management, S. de R.L. de C.V., a subsidiary of Vesta.

“WTN” means WTN Desarrollos Inmobiliarios de México, S. de R.L. de C.V., a subsidiary of Vesta.

“Yield on Cost” means rental income for the first year of operation of a property, divided by the total investment in such property (including land acquisition costs, development and construction costs, and closing costs).

iv

Presentation of Financial and Other Information

Financial Statements

This prospectus includes our audited consolidated financial statements as of and for the year ended December 31, 2021, together with the notes thereto, or our “audited consolidated financial statements.” These audited consolidated financial statements are not presented in accordance with International Accounting Standard 1 (Presentation of Financial Statements) (“IAS 1”), as they do not include comparative information as of and for the year ended December 31, 2020, which constitutes a departure from IFRS as issued by the IASB. The financial information in this prospectus has been prepared in accordance with IFRS, as issued by the IASB, which differ in certain significant respects from accounting principles generally accepted in the United States, or “U.S. GAAP.” The financial information in this prospectus for the year ended December 31, 2022 has not been audited in accordance with PCAOB or any other standards and is solely presented herein for informational purposes and to comply with Item 8.A.5 of Form 20-F. This prospectus does not include a reconciliation from IFRS to U.S. GAAP. You should consult your own professional advisors for an understanding of the differences between IFRS and U.S. GAAP, and how those differences might affect the financial information included in this prospectus. Per share amounts are presented based on the weighted average number of ordinary shares outstanding. For more information, see note 12.5 to our audited consolidated financial statements.

Appraisals

We use independent external appraisers to determine the fair value of our investment properties. Such appraisers use different valuation methodologies (including discounted cash flow analysis, replacement cost and income capitalization analysis) that include assumptions that are not directly observable in the market (such as discount and terminal rates, inflation rates, absorption periods, market rents and leasing commissions) to determine a projected NOI and the market value of our investment assets. This property-by-property valuation is carried out on a quarterly basis. The main valuation method used by the external appraisers is the discounted cash flow analysis for properties and market value to determine the value of our land reserves.

Our audited consolidated financial statements included in this prospectus contain a detailed description of the valuation of our properties.

Our management believes that the independent appraisal process and the chosen valuation methodologies as well as the assumptions used under such methodologies are appropriate for determining the fair value of the type of investment properties we own.

Special Note Regarding Non-IFRS Financial Measures and Other Measures

Non-IFRS financial measures do not follow generally accepted accounting principles and, as such, do not follow IFRS. In this prospectus, we report our Adjusted EBITDA, NOI, Adjusted NOI, FFO, Vesta FFO, Net Debt to Adjusted EBITDA and Net Debt to Total Assets. These non-IFRS measures, however, do not have standardized meanings and may not be directly comparable to similarly-titled measures adopted by other companies. Potential investors should not rely on information not recognized under IFRS as a substitute for the IFRS measures of earnings or liquidity in making an investment decision. We also present NAV and NAV per share, which we consider to be useful supplemental measures of our operating performance.

We calculate Adjusted EBITDA as the sum of profit for the year adjusted by (a) total income tax expense (b) interest income, (c) other income-net, (d) finance costs, (e) exchange gain (loss) - net, (f) gain on sale of investment property, (g) gain on revaluation of investment property, (h) depreciation and (i) long-term incentive plan and equity plus during the relevant period. We calculate NOI as the sum of Adjusted EBITDA plus general and administrative expenses, minus long-term incentive plan and equity plus during the relevant period. We calculate Adjusted NOI as the sum of NOI plus property operating costs related to properties that did not generate rental income during the relevant period.

Adjusted EBITDA is not a financial measure recognized under IFRS and does not purport to be an alternative to profit or total comprehensive income for the period as a measure of operating performance or to cash flows from operating activities as a measure of liquidity. Additionally, Adjusted EBITDA is not intended to be a measure of free cash flow available for management’s discretionary use, as it does not consider certain cash requirements such as interest payments and tax payments. Our presentation of Adjusted EBITDA has limitations as an analytical tool,

v

and you should not consider it in isolation or as a substitute for analysis of our results as reported under IFRS. Management uses Adjusted EBITDA to measure and evaluate the operating performance of our principal business (which consists of developing, leasing and managing industrial properties) before our cost of capital and income tax expense. Adjusted EBITDA is a measure commonly used in our industry, and we present Adjusted EBITDA to supplement investor understanding of our operating performance. We believe that Adjusted EBITDA provides investors and analysts with a measure of operating results unaffected by differences in capital structures, capital investment cycles and fair value adjustments of related assets among otherwise comparable companies.

NOI or Adjusted NOI are not financial measures recognized under IFRS and do not purport to be alternatives to profit for the period or total comprehensive income as measures of operating performance. NOI and Adjusted NOI are supplemental industry reporting measures used to evaluate the performance of our investments in real estate assets and our operating results. In addition, Adjusted NOI is a leading indicator of the trends related to NOI as we typically have a strong development portfolio of “speculative buildings.” Under IAS 40, we have adopted the fair value model to measure our investment property and, for that reason, our financial statements do not reflect depreciation nor amortization of our investment properties, and therefore such items are not part of the calculations of NOI or Adjusted NOI. We believe that NOI is useful to investors as a performance measure and that it provides useful information regarding our results of operations and financial condition because, when compared across periods, it reflects the impact on operations from trends in occupancy rates, rental rates, operating costs and acquisition and development activity on an unleveraged basis, providing perspective not immediately apparent from profit for the year. For example, interest expense is not necessarily linked to the operating performance of a real estate asset and is often incurred at the corporate level as opposed to the property level. Similarly, interest expense may be incurred at the property level even though the financing proceeds may be used at the corporate level (e.g., used for other investment activity). As so defined, NOI and Adjusted NOI may not be comparable to net operating income or similar measures reported by other real estate companies that define NOI or Adjusted NOI differently.

FFO is calculated as profit for the year, excluding: (i) gain on sale of investment property and (ii) gain on revaluation of investment property. We calculate Vesta FFO as the sum of FFO, as adjusted for the impact of exchange gain (loss) - net, other income – net, interest income, total income tax expense, depreciation and long-term incentive plan and equity plus.

The Company believes that Vesta FFO is useful to investors as a supplemental performance measure because it excludes the effects of certain items which can create significant earnings volatility, but which do not directly relate to our business operations. We believe Vesta FFO can facilitate comparisons of operating performance between periods, while also providing a more meaningful predictor of future earnings potential. Additionally, since Vesta FFO does not capture the level of capital expenditures per maintenance and improvements to maintain the operating performance of properties, which has a material economic impact on operating results, we believe Vesta FFO’s usefulness as a measure of performance may be limited.

Our computation of FFO and Vesta FFO may not be comparable to FFO measures reported by other REITs or real estate companies that define or interpret the FFO definition differently. FFO and Vesta FFO should not be considered as a substitute for net profit for the year attributable to our common shareholders.

We compute FFO and Vesta FFO per share amounts using the weighted average number of ordinary shares outstanding during the relevant period. For more information, see note 12.5 to our audited consolidated financial statements.

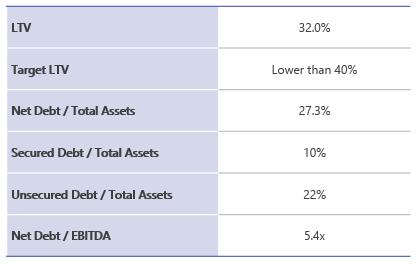

Net Debt to Adjusted EBITDA represents (i) our gross debt (defined as current portion of long-term debt plus long-term debt plus amortization of debt issuance costs) less cash and cash equivalents divided by (ii) Adjusted EBITDA. Our management believes that this ratio is useful because it provides investors with information on our ability to repay debt, compared to our performance as measured using Adjusted EBITDA.

Net Debt to Total Assets represents (i) our gross debt (defined as current portion of long-term debt plus long-term debt plus amortization of debt issuance costs) less cash and cash equivalents divided by (ii) total assets. Our management believes that this ratio is useful because it shows the degree in which net debt has been used to finance our assets and using this measure investors and analysts can compare the leverage shown by this ratio with that of other companies in the same industry.

vi

We calculate NAV as the sum of investment property, plus cash, cash equivalents and restricted cash, plus recoverable taxes, plus guarantee deposits made, restricted cash and others, minus the current portion of long-term debt, minus long-term debt. We calculate NAV per share as the sum of NAV, divided by weighted average number of ordinary shares outstanding during the relevant period.

We consider NAV to be a useful supplemental measure of our operating performance because it enables both management and investors to estimate the fair value of our business. The assessment of the fair value of a particular line of our business is subjective in that it involves estimates and can be calculated using various methods. Therefore, we have presented the financial results and investments related to our business that we believe are important in calculating our NAV, but we have not presented any specific methodology nor provided any guidance on the assumptions or estimates that should be used in the calculation. As so defined, NAV may not be comparable to similar measures reported by other real estate companies that define net asset value differently.

The components of NAV do not consider the potential changes in rental and fee income streams or the value associated with our property portfolio, strategic capital platform or development platform.

For reconciliations of Adjusted EBITDA, NOI and Adjusted NOI to profit for the year, FFO and Vesta FFO to profit for the year, Net Debt to total debt, NAV to investment property and total stockholders’ equity, and NAV per share to investment property, see “Summary Consolidated Financial Information and Operating Data¾Non-IFRS Financial Measures and Other Measures and Reconciliations.”

We calculate our Yield on Cost as the result from dividing rental income of stabilized properties for a period (properties that have reached 80% occupancy or that have been completed for more than one year), by the total investment in such properties in the corresponding period (including land acquisition costs, development and construction costs, and closing costs). We consider Yield on Cost to provide a profitability measure at a point in time on our investment properties by comparing the income generated by our stabilized properties to the costs and expenses incurred to develop such properties. Yield on Cost may not be comparable from period to period as it may be impacted by the evolution of our portfolio of stabilized properties. Yield on Cost is not a metric under IFRS and is derived from management financial records. Our presentation of Yield on Cost may not be comparable to similarly titled measures presented by other companies.

We present Same-Store Sales, which we measure as the change in rental income of stabilized properties in the relevant period (excluding rental income of non-stabilized properties) compared to the rental income of such properties from the prior period. We believe Same-Store Sales is a useful measure for understanding the evolution of income generated by our portfolio of stabilized properties. Same-Store Sales is not a measure under IFRS and is derived from management financial records. Our Same-Store Sales may not be comparable to similarly titles measures presented by other companies.

Currency and Other Information

Unless otherwise stated, the financial information appearing in this prospectus is presented in U.S. dollars. In this prospectus references to “peso,” “pesos” or “Ps.” are to Mexican pesos, and references to “U.S. dollar,” “U.S. dollars,” “dollar,” “dollars” or “US$” are to United States dollars.

The U.S. dollar is the functional currency of Vesta and all of its subsidiaries except for WTN, which considers the peso to be its functional currency, for which reason WTN is considered to be a “foreign operation” under IFRS. A “foreign operation” is an entity that is a subsidiary, associate, joint arrangement or branch of a reporting entity, the activities of which are based or conducted in a country or currency other than those of the reporting entity.

For purposes of presenting consolidated financial statements, the assets and liabilities of WTN are translated into U.S. dollars using the exchange rates in effect on the last business day of each reporting period. Income and expense items are translated at the average exchange rates for the period, unless exchange rates fluctuate significantly during that period, in which case the exchange rates in effect on the dates of the transactions are used. Exchange differences arising, if any, are recorded in “other comprehensive income.”

Totals in some tables in this prospectus may differ from the sum of individual amounts in those tables due to rounding. In this prospectus, where information is presented in thousands, millions or billions of pesos or thousands, millions or billions of U.S. dollars, amounts of less than one thousand, one million, or one billion, as the case may be, have been truncated unless otherwise specified. All percentages have been rounded to the nearest percent, one-

vii

tenth of one percent or one-hundredth of one percent, as the case may be. In some cases, amounts and percentages presented in tables in this prospectus may not add up due to such rounding adjustments or truncating.

Industry and Market Data

Market data and other statistical information (other than with respect to our financial results and performance) used throughout this prospectus are based on independent industry publications, government publications, reports by market research firms or other published independent sources, including but not limited to INEGI, World Bank, U.S. Bureau of Economic Analysis (BEA), U.S. Economic Census Bureau, CBRE, CBRE Research, Bloomberg, Federal Reserve Bank of Dallas, Americas Market Intelligence, JLL, JLL Mexico, JLL Research, AMVO, Kearney, The Boston Consulting Group, the Mexican Ministry of Economy, the Mexican Central Bank, the Global Trade and Innovation Policy Alliance, Deloitte, International Organization of Motor Vehicle Manufacturers, Euromonitor, Organization for Economic Cooperation and Development, United Nations, Mexican Automotive Industry Association, National Association of Manufacturers, International Trade Administration, Optoro, Office of the U.S. Trade Representative, PGIM, Shipa Freight, Freight Qoute, Peterson Institute for International Economics, GBM, LENS, Cushman & Wakefield, International Monetary Fund, Interamerican Development Bank, and Statista.

Some data are also based on our estimates, which are derived from our review of internal surveys and analyses, as well as from independent sources. Although we believe these sources are reliable, neither we nor the underwriters have independently verified the information and cannot guarantee their accuracy or completeness. In addition, these sources may use different definitions of the relevant markets than those we present. Data regarding our industry are intended to provide general guidance but are inherently imprecise. Though we believe these estimates were reasonably derived, you should not place undue reliance on estimates, as they are inherently uncertain. Nothing in this prospectus should be interpreted as a market forecast.

The standard measures of area in the real estate market in Mexico are the square meter (m2) and the hectare (ha), while in the U.S. they are the square foot (ft2) and the acre (ac), respectively. This prospectus contains information in both (i) square meters and square feet applying a conversion factor of 1 square meter = 10.8 square feet, and (ii) hectares and acres, applying a conversion factor of 1 hectare = 2.5 acres.

Occupancy Rate

When we refer to our occupancy rate generally,

we refer to the rate of all our occupied properties. When we refer to our stabilized occupancy rate, we refer to the rate of occupied

stabilized properties only. We deem a property to be stabilized once it has reached 80% occupancy or has been completed for more than

one year, whichever occurs first. The occupancy rate is calculated as the ratio of rented GLA to the total amount of available GLA. We

consider the occupancy rate to be an important measure of the anticipated cash flow of the portfolio, and as an indicator of management

leasing performance and the markets demand for the portfolio. We consider the stabilized occupancy rate to be an important measure of

the anticipated cash flow of the stabilized portfolio and an indicator of management leasing performance and the market’s demand

for the stabilized portfolio. Incorporating newly developed properties into the portfolio does not impact our stabilized occupancy rate.

Our stabilized occupancy rate, however, does not have a standardized meaning and may not be directly comparable to similarly-titled measures

adopted by other companies.

viii

Special Note Regarding Forward-Looking Statements

This prospectus contains forward-looking statements. Examples of such forward-looking statements include, but are not limited to: (i) statements regarding our results of operations and financial position; (ii) statements of plans, objectives or goals, including those related to our operations and to our pipeline of potential developments and acquisitions; and (iii) statements of assumptions underlying such statements. Words such as “aim,” “anticipate,” “believe,” “could,” “estimate,” “expect,” “forecast,” “guidance,” “intend,” “may,” “plan,” “potential,” “predict,” “seek,” “should,” “will” and similar expressions are intended to identify forward-looking statements but are not the exclusive means of identifying such statements.

By their very nature, forward-looking statements involve inherent risks and uncertainties, both general and specific, and risks exist that the predictions, forecasts, projections and other forward-looking statements will not be achieved. We caution investors that a number of important factors could cause actual results to differ materially from the plans, objectives, expectations, estimates and intentions expressed or implied in such forward-looking statements, including the following factors:

| · | our business and strategy of investing in industrial facilities, which may subject us to risks of the sector in which we operate but uncommon to other companies that invest primarily in a broader range of real estate assets; |

| · | our ability to maintain or increase our rental rates and occupancy rates; |

| · | the performance and financial condition of our tenants; |

| · | our expectations regarding income, expenses, sales, operations and profitability; |

| · | our ability to obtain returns from our projects similar or comparable to those obtained in the past; |

| · | our ability to successfully expand into new markets in Mexico; |

| · | our ability to successfully engage in property development; |

| · | our ability to lease or sell any of our properties; |

| · | our ability to successfully acquire land or properties to be able to execute on our accelerated growth strategy; |

| · | the competition within our industry and markets in which we operate; |

| · | economic trends in the industries or the markets in which our customers operate; |

| · | the continuing impact of the coronavirus pandemic identified as SARS-CoV-2 (“COVID-19”) and the impact of any other pandemics, epidemics or outbreaks of infectious diseases on the Mexican economy and on our business, results of operations, financial condition, cash flows and prospects, as well as our ability to implement any necessary measures in response to such impact; |

| · | higher interest rates, increased leasing costs, increased construction costs, distressed supply chains for construction materials, increased maintenance costs, all of which could increase our costs and limit our ability to acquire or develop additional real estate assets; |

| · | the terms of laws and government regulations that affect us, and interpretations of those laws and regulations, including changes in tax laws and regulations and changes in environmental, real estate and zoning laws; |

| · | supply of utilities, principally electricity and water, and general availability of public services, to support operations in our properties and industrial parks; |

| · | economic, political and social developments in Mexico, including political instability, currency devaluation, inflation, and unemployment; |

ix

| · | the performance of the Mexican economy and the global economy; |

| · | the competitiveness of Mexico as an exporter of manufactured and other products to the United States and other key markets; |

| · | limitations on our access to sources of financing on competitive terms; |

| · | changes in capital markets that might affect the investment policies or attitude in Mexico or regarding securities issued by Mexican companies; |

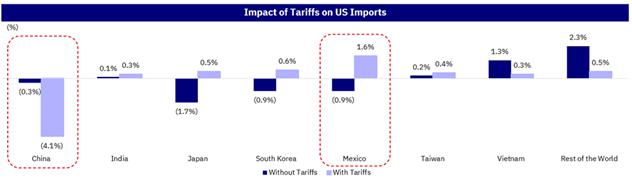

| · | obstacles to commerce, including tariffs or import taxes and changes to the existing commercial policies, and change or withdrawal from free trade agreements, including the USMCA, of which Mexico is a member that might negatively affect our current or potential clients or Mexico in general; |

| · | increase of trade flows and the formation of trade corridors connecting certain geographic areas of Mexico and the U.S., which results in a vigorous economic activity within those areas in Mexico and a source of demand for industrial buildings; |

| · | our ability to execute our corporate strategies; |

| · | the growth of e-commerce markets; |

| · | a negative change in our public image; |

| · | epidemics, catastrophes, insecurity and other events that might affect the regional or national consumption; |

| · | the loss of key executives or personnel; |

| · | restrictions on foreign currency convertibility and remittance outside Mexico; |

| · | changes in exchange rates, market interest rates or the rate of inflation; |

| · | possible disruptions to commercial activities due to natural and human-induced disasters that could affect our properties in Mexico, including criminal activity relating to drug trafficking, terrorist activities, and armed conflicts; |

| · | deterioration of labor relations with third-party contractors, changes in labor costs and labor difficulties, including subcontracting reforms in Mexico comprising changes to labor and social laws; |

| · | the prices of our common shares or ADSs may be volatile or may decline regardless of our operational performance; |

| · | the increased costs and disruptions to our business arising from our transformation into a public company in the United States; and |

| · | other risk factors included under “Risk Factors” in this prospectus. |

Should one or more of these factors or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described herein as anticipated, believed, estimated, expected, forecast or intended.

You should read the sections of this prospectus entitled “Summary,” “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Industry and Regulatory Overview” and “Business” for a more complete discussion of the factors that could affect our future performance and the markets and industry sectors in which we operate.

In light of these risks, uncertainties and assumptions, the forward-looking statements described in this prospectus may not occur. These forward-looking statements speak only as to the date of this prospectus and we undertake no obligation to update or revise any forward-looking statement, whether as a result of new information or

x

future events or developments. Additional factors affecting our business emerge from time to time and it is not possible for us to predict all of these factors, nor can we assess the impact of all such factors on our business or the extent to which any factor, or the combination of factors, may cause actual results to differ materially from those contained in any forward-looking statement. Although we believe the plans, intentions and expectations reflected in or suggested by such forward-looking statements are reasonable, we cannot assure you that those plans, intentions or expectations will be achieved. In addition, you should not interpret statements regarding past trends or activities as assurances that those trends or activities will continue in the future. All written, oral and electronic forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by this cautionary statement. For these reasons, we caution you to avoid relying on the forward-looking statements described in this prospectus.

xi

This summary highlights information contained elsewhere in this prospectus. This summary may not contain all the information that may be important to you, and we urge you to read this entire prospectus carefully, including the “Risk Factors,” “Business” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections, and our consolidated financial statements and notes to those statements, included elsewhere in this prospectus, before deciding to invest in our common shares and ADSs.

Overview

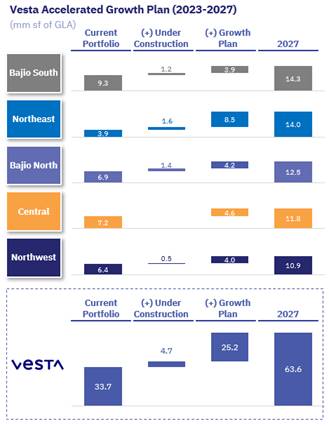

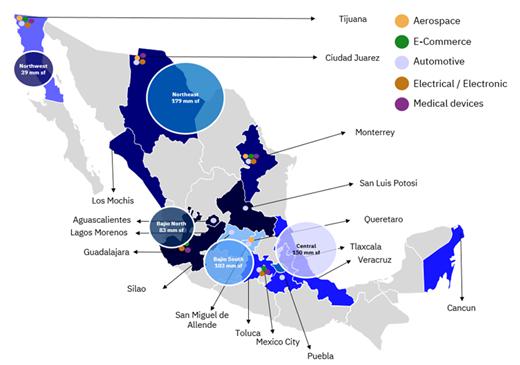

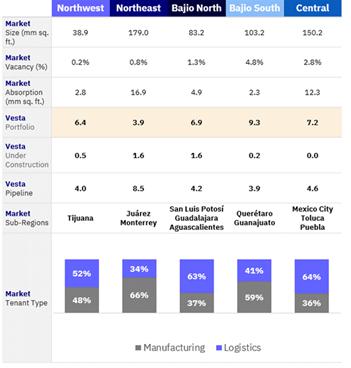

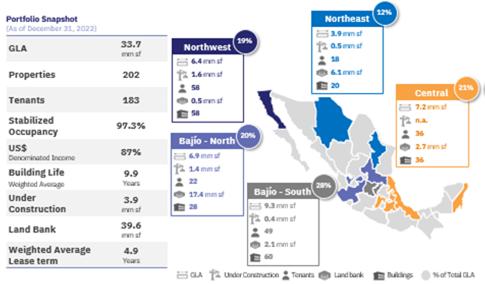

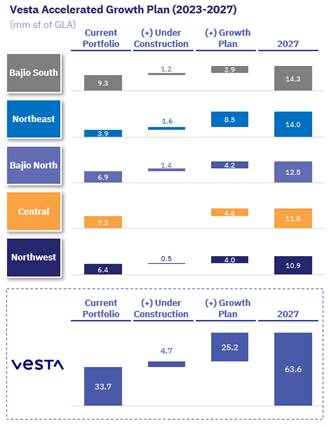

We are a fully-integrated, internally managed real estate company that owns, manages, develops and leases industrial properties in Mexico. We have significant development experience and capabilities, focused on a single real estate segment comprised of industrial parks and industrial buildings in Mexico. With an experienced management team, we strive to achieve excellence in the development of industrial real estate, to generate efficient and sustainable investments. We offer our world-class clients strategic locations across fifteen Mexican states located in the most developed industrial areas, with a growing portfolio of our developments built according to eco-efficient standards. As of December 31, 2022, our portfolio was comprised of 202 buildings with a total gross leasable area, or “GLA,” of 33.7 million square feet (3.1 million square meters), and a stabilized occupancy rate of 97.3%. Our GLA has grown 56x since we began operations in 1998, representing a compound annual growth rate, or “CAGR,” of 10.8% since our initial public offering in 2012. Our facilities are located in strategic areas for light-manufacturing and logistics in the Northwest, Northeast, Bajío-North, Bajío-South and Central regions of Mexico. The quality and geographic location of our properties are key to optimizing our clients’ operations, and constitute a crucial link in the regional supply chain.

Since our inception in 1998, we have grown from a private to a public company and evolved from a high-growth real estate developer into a leading Mexican real estate company, with a high-quality portfolio and an extensive development pipeline. As we continue to evolve, we seek to become a world-class fully integrated industrial real estate company, striving to adhere to the highest standards available worldwide.

We believe that over the last five years, we have created value for our shareholders by implementing our “Vision 2020” strategic plan for 2014 to 2019, and since 2019, our “Level 3 Strategy”. We are aiming to maximize growth in Vesta FFO and NAV per share by implementing this strategy, which establishes our expansion and growth strategy for 2019 to 2024, based on five strategic pillars: (i) manage, maintain and broaden our current portfolio, (ii) invest in and/or divest properties for ongoing value creation, (iii) strengthen our balance sheet and expand funding sources and maturities, (iv) strengthen our organization to successfully execute our strategy, and (v) become a category leader in ESG, embedding our sustainability practices throughout our business model. For more information, see “Business—Our Level 3 Strategy.”

Our profit for each of the years ended December 31, 2022 and 2021 was and US$173.9, respectively. Our profit for the year has increased 6.2x since 2012, growing at a CAGR of 20.0% from 2012 to 2022 and 46.5% from 2021 to 2022. Our basic earnings per share has increased 2.55x since 2012 growing at a CAGR of 9.8% from 2012 to 2022 and 33.0% from 2021 to 2022. Vesta FFO per share has increased 36.3x since 2012 growing at a CAGR of 55.7% from 2012 to 2022 and 22.8% from 2021 to 2022. Our total GLA has grown 2.8x since 2012 growing at a CAGR of 10.8% from 2012 to 2022 and 8.4% from 2021 to 2022. Likewise, our NAV per share has grown at a CAGR of 6.9% from 2012 to 2022 and 10.4% from 2021 to 2022. In addition, Adjusted NOI has grown at a CAGR of 13.3% from 2012 to 2022 and 11.0% from 2021 to 2022. For a reconciliation of Vesta FFO, NAV and Adjusted NOI to the nearest IFRS measure, see “Summary Consolidated Financial Information and Operating Data—Non-IFRS Financial Measures and Other Measures and Reconciliations.”

Our properties provide innovative and customer-tailored real estate solutions to respond to our clients’ specific needs, as well as to adapt to industry trends that we identify in our markets. We selectively develop light-manufacturing and distribution centers through built-to-suit, or “BTS Buildings”, which are tailored to address the specific needs of clients or a particular industry. Our properties allow for modular reconfiguration to address specific client needs, ensuring that a facility can be continuously transformed. Working closely with our clients on the design of these bespoke properties, also allows us to stay abreast of and anticipate industry trends. In addition to tailormade

1

solutions in proven industrial areas, we also develop “Inventory Buildings,” which are built without a lease signed with a specific customer and are designed in accordance with standard industry specifications. Inventory Buildings provide sufficient space for clients that do not have the time or interest to build BTS Buildings. We adjust our building mix to cater to real estate demands of current and prospective clients by monitoring our clients’ and their sectors’ needs.

We believe that we are one of the only fully vertically-integrated and internally managed Mexican industrial real estate companies that owns, manages, develops and leases industrial properties, on a large scale, in Mexico, which we believe differentiates us from our competitors. Our business is focused on developing our industrial properties, seeking to incorporate global quality standards to develop high-specification assets that are comparable with properties in other jurisdictions, with internal processes that minimize delivery times and costs. We focus on the development and management of our properties by outsourcing all construction, design, engineering and project management services and related works to third parties that are both experienced as well as known to us. By using high-quality contractors and service providers with long track-records and awarding contracts through bidding processes, we seek to mitigate contractor risk and foster competition, lowering our costs, increasing the quality of our buildings and providing competitive alternatives for our current and future clients. Our bidding processes are conducted in accordance with procedures that comply with the International Standard ISO 9001-2008, a certification we obtained in 2011 and renewed in 2015. We also obtained the ISO 9001-2015 Standard certification that focuses on risk mitigation.

The following table presents a summary of our real estate portfolio as of December 31, 2022, 2021 and 2020:

| 2022 | 2021 | 2020 | ||||||||||

| Number of real estate properties | 199 | 189 | 188 | |||||||||

| GLA (sq. feet)(1) | 33,714,370 | 31,081,746 | 31,221,035 | |||||||||

| Leased area (sq. feet)(2) | 32,054,026 | 29,257,404 | 28,317,125 | |||||||||

| Number of clients | 183 | 175 | 177 | |||||||||

| Average rent per square foot (US$ per year)(3) | 5.59 | 5.45 | 5.07 | |||||||||

| Weighted average remaining lease term (years) | 4.9 | 4.3 | 4.5 | |||||||||

| Collected rental revenues per square foot (US$ per year)(4) | 5.26 | 5.21 | 5.27 | |||||||||

| Stabilized Occupancy rate (% of GLA)(5) | 97.3 | 94.3 | 91.1 | |||||||||

| (1) | Refers to the total GLA across all of our real estate properties. |

| (2) | Refers to the GLA that was actually leased to tenants as of the dates indicated. |

| (3) | Calculated as the annual base rent as of the end of the relevant period divided by the GLA. For rents denominated in pesos, annual rent is converted to US$ at the average exchange rate for each quarter. |

| (4) | Calculated as the annual income collected from rental revenues during the relevant period divided by the square feet leased. For income collected denominated in pesos, income collected is converted to US$ at the average exchange rate for each quarter. |

| (5) | We calculate stabilized occupancy rate as leased area divided by total GLA. We deem a property to be stabilized once it has reached 80% occupancy or has been completed for more than one year, whichever occurs first. |

Our Industrial Parks and Industrial Properties

The table below sets forth our real estate portfolio, classified by industrial park and other properties outside of industrial parks, as of December 31, 2022, and includes, for each property, the location, the GLA, the percentage each property represents of our total GLA, the rental income for the year ended December 31, 2022 and the percentage each property represents of our rental income for the year. The first year of operations, the number of buildings, and the appraisal value. We value our portfolio on a quarterly basis through an independent appraisal process conducted by CBRE, JLL and Cushman & Wakefield.

2

| Location | Total GLA | Total GLA | Percentage of Portfolio GLA | Rental Income for the Year Ended December 31, 2022 | Percentage of Rental Income for the Year Ended December 31, 2022 | Operations Start Year | Number of Buildings | Appraisal Value as of December 31, 2022(1) | ||||||||||||||||||||||||||

| (in square feet) | (in square meters) | (%) | (US$) | (%) | (US$) | |||||||||||||||||||||||||||||

| Industrial Park | ||||||||||||||||||||||||||||||||||

| DSP | Aguascalientes | 2,143,262 | 199,116 | 6.4 | 12,134,168 | 6.8 | 2013 | 8 | 141,100,000 | |||||||||||||||||||||||||

| Vesta Park Aguascalientes | Aguascalientes | 306,804 | 28,503 | 0.9 | 324,213 | 0.2 | 2019 | 2 | 17,500,000 | |||||||||||||||||||||||||

| Los Bravos Vesta Park | Cd Juárez | 460,477 | 42,780 | 1.4 | 2,212,805 | 1.2 | 2007 | 4 | 29,540,000 | |||||||||||||||||||||||||

| Vesta Park Juárez Sur I | Cd Juárez | 1,514,249 | 140,678 | 4.5 | 7,989,586 | 4.5 | 2015 | 8 | 109,760,000 | |||||||||||||||||||||||||

| Vesta Park Guadalajara | Guadalajara | 1,836,990 | 170,662 | 5.4 | 7,503,974 | 4.2 | 2020 | 4 | 156,500,000 | |||||||||||||||||||||||||

| Vesta Park Guadalupe | Monterrey | 497,929 | 46,259 | 1.5 | 2,048,525 | 1.2 | 2021 | 2 | 32,210,000 | |||||||||||||||||||||||||

| Vesta Puebla I | Puebla | 1,028,564 | 95,557 | 3.1 | 6,043,996 | 3.4 | 2016 | 5 | 75,000,000 | |||||||||||||||||||||||||

| Bernardo Quintana | Querétaro | 772,025 | 71,723 | 2.3 | 2,861,340 | 1.6 | 1998 | 9 | 37,930,000 | |||||||||||||||||||||||||

| PIQ | Querétaro | 1,998,727 | 185,688 | 5.9 | 10,482,912 | 5.9 | 2006 | 13 | 127,180,000 | |||||||||||||||||||||||||

| VP Querétaro | Querétaro | 923,238 | 85,772 | 2.7 | 2,582,314 | 1.5 | 2018 | 4 | 51,200,000 | |||||||||||||||||||||||||

| Querétaro Aerospace Park | Querétaro Aero | 2,256,090 | 209,598 | 6.7 | 13,995,093 | 7.9 | 2007 | 13 | 160,750,000 | |||||||||||||||||||||||||

| SMA | San Miguel de Allende | 1,361,878 | 126,523 | 4.0 | 6,093,710 | 3.4 | 2015 | 8 | 86,400,000 | |||||||||||||||||||||||||

| Las Colinas | Silao | 903,487 | 83,937 | 2.7 | 4,432,256 | 2.5 | 2008 | 7 | 54,750,000 | |||||||||||||||||||||||||

| Vesta Park Puento Interior | Silao | 1,080,795 | 100,409 | 3.2 | 4,316,942 | 2.4 | 2018 | 6 | 64,600,000 | |||||||||||||||||||||||||

| Tres Naciones | San Luis Potosí | 960,964 | 89,276 | 2.9 | 4,663,343 | 2.6 | 1999 | 9 | 59,200,000 | |||||||||||||||||||||||||

| Vesta Park SLP | San Luis Potosí | 603,594 | 56,076 | 1.8 | 1,043,112 | 0.6 | 2018 | 3 | 33,600,000 | |||||||||||||||||||||||||

| La Mesa Vesta Park | Tijuana | 810,013 | 75,253 | 2.4 | 4,494,235 | 2.5 | 2005 | 16 | 61,970,000 | |||||||||||||||||||||||||

| Nordika | Tijuana | 469,228 | 43,593 | 1.4 | 2,436,449 | 1.4 | 2007 | 2 | 49,350,000 | |||||||||||||||||||||||||

| El potrero | Tijuana | 282,768 | 26,270 | 0.8 | 1,497,262 | 0.8 | 2012 | 2 | 26,350,000 | |||||||||||||||||||||||||

| Vesta Park Tijuana III | Tijuana | 620,547 | 57,651 | 1.8 | 3,821,912 | 2.1 | 2014 | 3 | 53,050,000 | |||||||||||||||||||||||||

| Vesta Park Pacifico | Tijuana | 379,882 | 35,292 | 1.1 | 2,288,144 | 1.3 | 2017 | 2 | 30,400,000 | |||||||||||||||||||||||||

| VP Lago Este | Tijuana | 552,452 | 51,324 | 1.6 | 3,509,637 | 2.0 | 2018 | 2 | 60,500,000 | |||||||||||||||||||||||||

| Vesta Park Megaregion | Tijuana | 724,153 | 67,276 | 2.1 | - | 0.0 | 2022 | 4 | 58,510,000 | |||||||||||||||||||||||||

| VPT I | Tlaxcala | 680,616 | 63,231 | 2.0 | 3,802,319 | 2.1 | 2015 | 4 | 43,000,000 | |||||||||||||||||||||||||

| Exportec | Toluca | 220,122 | 20,450 | 0.7 | 1,057,637 | 0.6 | 1998 | 3 | 14,200,000 | |||||||||||||||||||||||||

| T 2000 | Toluca | 1,070,180 | 99,423 | 3.2 | 5,674,286 | 3.2 | 1998 | 3 | 79,310,000 | |||||||||||||||||||||||||

| El Coecillo Vesta Park | Toluca | 816,056 | 75,814 | 2.4 | 4,248,317 | 2.4 | 2007 | 1 | 51,530,000 | |||||||||||||||||||||||||

| Vesta Park Toluca I | Toluca | 1,000,161 | 92,918 | 3.0 | 5,113,137 | 2.9 | 2006 | 5 | 73,690,000 | |||||||||||||||||||||||||

| Vesta Park Toluca II | Toluca | 1,473,199 | 136,865 | 4.4 | 8,522,707 | 4.8 | 2014 | 6 | 115,500,000 | |||||||||||||||||||||||||

| Other | 5,965,921 | 554,252 | 17.7 | 33,512,766 | 18.8 | na | 44 | 449,570,000 | ||||||||||||||||||||||||||

| Total | 33,714,370 | 3,132,168 | 100.0 | 168,707,094 | 94.8 | 202 | 2,404,650,000 | |||||||||||||||||||||||||||

| Other income (reimbursements)(2) | 9,318,367 | 5.2 | ||||||||||||||||||||||||||||||||

| Total | 178,025,461 | 100.0 | Vesta Offices at the DSP Park(3) | 300,000 | ||||||||||||||||||||||||||||||

| Under construction | 237,660,000 | |||||||||||||||||||||||||||||||||

| Total | 2,657,513,766 | |||||||||||||||||||||||||||||||||

| Land improvements | 7,562,174 | |||||||||||||||||||||||||||||||||

| Land Reserves | 208,910,000 | |||||||||||||||||||||||||||||||||

| Costs to Complete Construction in Process | (135,520,664 | ) | ||||||||||||||||||||||||||||||||

| Appraisal Total | 2,738,465,276 | |||||||||||||||||||||||||||||||||

| (1) | The appraisal value of our industrial properties is calculated exclusive of infrastructure expenses of US$24.5 million, down payments in respect of new land reserves with a market value of US$191.3 million for future development, and costs to complete construction in progress of US$135.5 million, in each case as of December 31, 2022. We obtain independent appraisals on a quarterly basis. |

| (2) | Other income (reimbursements) includes: (i) the reimbursement of payments made by us on behalf of some of our tenants to cover maintenance fees and other services, which we incur under the respective lease contracts; and (ii) management fees arising from the real estate portfolio we sold in May 2019. |

| (3) | Refers to the appraisal value of our corporate offices located at the Douki Seisan Park. |

3

Construction Projects

The table below summarizes our real estate projects under construction at our existing land reserves as of December 31, 2022.

Total

Expected Investment | Investment

to Date (Thousand US$) | |||||||||||||||||||||||||||||||||||||

| Project | Project GLA | Land + Infra | Shell(2) | Total | Land + Infra | Shell(2) | Total | Leased | Expected Completion Date | Type | ||||||||||||||||||||||||||||

| (in square feet) | (US$) | (US$) | (US$) | (US$) | (US$) | (US$) | (%) | |||||||||||||||||||||||||||||||

| North Region | ||||||||||||||||||||||||||||||||||||||

| Tijuana | Mega Región 05 | 359,660 | 7,885 | 17,387 | 25,272 | 6,702 | 6,955 | 13,657 | 0.0 | Jul-23 | Inventory | |||||||||||||||||||||||||||

| Tijuana | Mega Región 06 | 114,725 | 2,739 | 6,643 | 9,382 | 2,328 | 2,657 | 4,986 | 0.0 | Jul-23 | Inventory | |||||||||||||||||||||||||||

| Monterrey | Apodaca 01 | 297,418 | 5,201 | 9,496 | 14,697 | 4,681 | 6,647 | 11,328 | 0.0 | Apr-23 | Inventory | |||||||||||||||||||||||||||

| Monterrey | Apodaca 02 | 279,001 | 4,329 | 10,175 | 14,504 | 3,896 | 6,105 | 10,001 | 0.0 | May-23 | Inventory | |||||||||||||||||||||||||||

| Monterrey | Apodaca 03 | 222,942 | 5,521 | 8,758 | 14,279 | 4,969 | 2,628 | 7,596 | 0.0 | Jul-23 | Inventory | |||||||||||||||||||||||||||

| Monterrey | Apodaca 04 | 222,942 | 5,544 | 8,817 | 14,361 | 4,990 | 2,645 | 7,635 | 0.0 | Aug-23 | Inventory | |||||||||||||||||||||||||||

| Juárez | Juárez Oriente 1 | 279,117 | 6,539 | 11,703 | 18,241 | 5,100 | 4,681 | 9,781 | 0.0 | Jul-23 | Inventory | |||||||||||||||||||||||||||

| Juárez | Juárez Oriente 2 | 250,272 | 5,492 | 10,844 | 16,335 | 4,283 | 4,337 | 8,621 | 0.0 | Jul-23 | Inventory | |||||||||||||||||||||||||||

| 2,026,078 | 43,249 | 83,824 | 127,072 | 36,949 | 36,656 | 73,605 | 0.0 | |||||||||||||||||||||||||||||||

| Bajío Region | ||||||||||||||||||||||||||||||||||||||

| Guadalajara | GDL 06 | 341,969 | 7,278 | 14,511 | 21,790 | 5,823 | 7,256 | 13,078 | 0.0 | Jun-23 | Inventory | |||||||||||||||||||||||||||

| Guadalajara | GDL 07 | 393,938 | 8,509 | 16,335 | 24,843 | 6,807 | 9,801 | 16,608 | 100.0 | Jul-23 | Inventory | |||||||||||||||||||||||||||

| Guadalajara | GDL 08 | 680,333 | 15,387 | 27,911 | 43,297 | 12,309 | 8,373 | 20,683 | 0.0 | Oct-23 | Inventory | |||||||||||||||||||||||||||

| Silao | Puerto Interior 3 | 231,252 | 3,445 | 9,326 | 12,770 | 3,445 | 2,798 | 6,242 | 0.0 | Aug-23 | Inventory | |||||||||||||||||||||||||||

| Querétaro | Safran Exp | 81,158 | 0 | 4,446 | 4,446 | 0 | 2,667 | 2,667 | 100.0 | May-23 | BTS | |||||||||||||||||||||||||||

| Oxxo Exp | 110,764 | 1,970 | 5,494 | 7,465 | 1,970 | 2,747 | 4,718 | 100.0 | Apr-23 | BTS | ||||||||||||||||||||||||||||

| 1,839,413 | 36,589 | 78,023 | 114,612 | 30,354 | 33,642 | 63,996 | 31.9 | |||||||||||||||||||||||||||||||

| Total | 3,865,491 | 79,838 | 161,846 | 241,684 | 67,303 | 70,298 | 137,601 | 15.2 | ||||||||||||||||||||||||||||||

| (1) | Total Expected Investment comprises our material cash requirements, including commitments for capital expenditures. |

| (2) | A shell is typically comprised by the primary structure, the building envelope (roof and façade), mechanical and supply systems (electricity, water and drainage) up to a single point of contact. |

We continuously explore new development projects and acquisitions of industrial real estate portfolios, including individual buildings, land reserves in strategic locations and sale and lease-back transactions that meet our development and acquisition criteria. For the year ended December 31, 2022, we completed twelve buildings with a GLA of 2,406,526 square feet (223,574 square meters). Of these buildings, one was a BTS Building with a GLA of 78,286 square feet (7,273 square meters), and eleven were Inventory Buildings with a total GLA of 2,328,240 square feet (216,301 square meters).

Land reserves

As of December 31, 2022, we had 906.8 acres (39,681,673 square feet) of land reserves located in Monterrey, Guadalajara, Querétaro, Tijuana, San Miguel de Allende, San Luis Potosí, Ciudad Juárez, Guanajuato, Aguascalientes and Puebla, which are within active industrial corridors in Mexico, on which we plan to develop approximately 17.8 million square feet (1.5 million square meters) of industrial buildings.

As of December 31, 2022, the estimated development potential of the land reserves is:

4

| Location | Total Land Reserves | Total Land Reserves | Percentage of Total Land Reserves | Appraisal Value as of December 31, 2022(1) | Estimated GLA to be Developed | Estimated GLA to be Developed | ||||||||||||||||||

| (Hectares) | (Acres) | (%) | (thousands of US$) | (square meters) | (square feet) | |||||||||||||||||||

| Aguascalientes | 120 | 297 | 32.7 | 28,165 | 541,304 | 5,826,547 | ||||||||||||||||||

| Querétaro | 52 | 128 | 14.1 | 25,177 | 232,908 | 2,506,997 | ||||||||||||||||||

| Monterrey | 41 | 101 | 11.1 | 29,765 | 183,626 | 1,976,530 | ||||||||||||||||||

| San Miguel Allende | 36 | 89 | 9.8 | 10,798 | 161,801 | 1,741,607 | ||||||||||||||||||

| San Luis Potosí | 35 | 87 | 9.6 | 12,042 | 159,335 | 1,715,072 | ||||||||||||||||||

| Guanajuato | 32 | 78 | 8.6 | 18,250 | 142,350 | 1,532,242 | ||||||||||||||||||

| México | 24 | 60 | 6.6 | 49,621 | 109,899 | 1,182,947 | ||||||||||||||||||

| Ciudad Juárez | 16 | 40 | 4.4 | 12,755 | 73,587 | 792,082 | ||||||||||||||||||

| Guadalajara | 6 | 14 | 1.5 | 2,463 | 25,504 | 274,521 | ||||||||||||||||||

| Tijuana | 5 | 12 | 1.4 | 1,738 | 22,571 | 242,949 | ||||||||||||||||||

| Puebla | 1 | 2 | 0.2 | 508 | 3,869 | 41,647 | ||||||||||||||||||

| Total | 368 | 910 | 100.0 | 191,282 | 1,546,854 | 17,833,139 | ||||||||||||||||||

| (1) | Land value is appraised at cost. For more information, see “Presentation of Financial and Certain Other Information—Appraisals.” |

Our Competitive Strengths

We believe the following are our competitive strengths:

Vertically-Integrated and Internally Managed Industrial Real Estate Developer with a High-Quality Modern Portfolio of Scale

Our portfolio consists of what we believe to be one of the largest and modern industrial group of assets in Mexico, with 183 clients occupying 202 Class A Buildings, across industrial corridors and principal industrial sites of the country, with a total owned GLA of 33.7 million square feet and an average building life of 9.9 years, as of December 31, 2022. We manage our owned GLA and do not manage any GLA of third parties. Our portfolio of stabilized industrial properties has an average stabilized occupancy rate of 97.3%. Our profit for the year has increased 6.2x since 2012, growing at a CAGR of 20.0% from 2012 to 2022 and 46.5% from 2021 to 2022. Vesta FFO growth of 22.8% from 2021 to 2022, and an average historical Yield on Cost from 2020 to 2022 above 10.0%.

Our portfolio is strategically located and diversified throughout Mexico’s key trade, logistics corridors with the U.S., manufacturing centers and urban areas, in a manner designed to maximize client demand. We also have a strategic land bank, with 909.75 acres of land reserves with the potential to develop over 17.8 million square feet of incremental GLA, as of December 31, 2022.

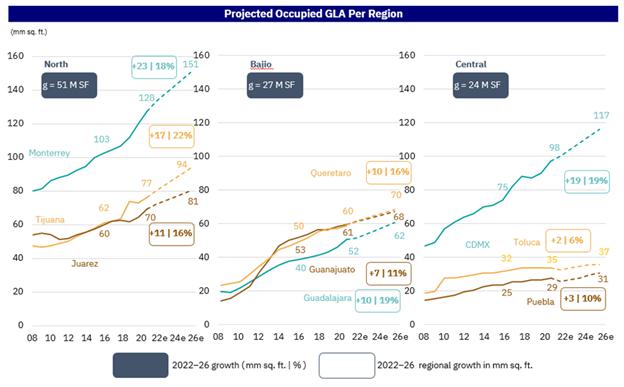

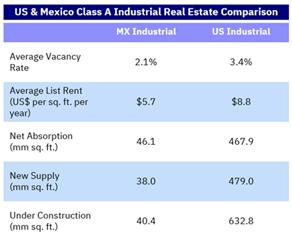

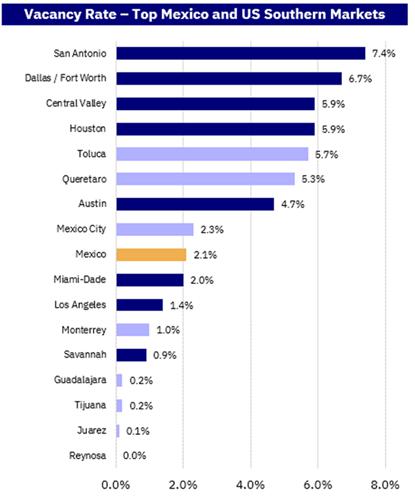

We operate in what we consider to be Mexico’s most dynamic industrial markets with the lowest vacancy rates in the country: Ciudad Juárez (0.1%), Guadalajara (0.2%), Tijuana (0.2%), Monterrey (1.0%), Mexico City (2.3%), and Bajío (4.2%), according to CBRE 4Q2022 market report. We develop, own and manage two types of industrial

5

real estate products: (i) Inventory Buildings and (ii) BTS Buildings. We believe that our client base is well diversified among logistics and light-manufacturing clients, and covers a variety of industries such as automotive, aerospace, high-tech, pharmaceuticals, electronics, food and beverage and packaging.

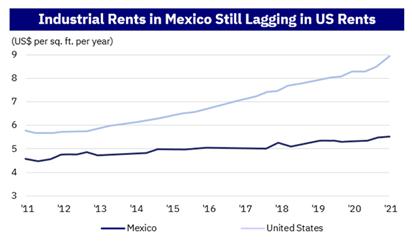

We have built what we believe to be a scaled, high quality and modern industrial portfolio. Our average building age is lower than the average of the Mexican industrial REITs. Also, we own a land bank of properties located in strategic regions. 87.5% of our rental income is denominated in U.S. dollars as we serve global clients in the manufacturing and logistics sectors.

Well Positioned to Take Advantage of Favorable Market Fundamentals and Industry Tailwinds

Nearshoring

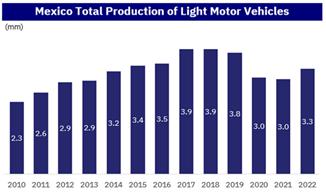

Global events have led companies to rethink their supply chains and explore ways to expand or relocate production facilities to closer regions. Nearshoring trends have recently accelerated due to global and geopolitical drivers such as:

| · | geopolitical tensions between the U.S. and China leading to relocation of Asia-based operations to North America; |

| · | pandemic-disrupted supply chains, including shortages of raw materials and manufacturing components; |

| · | a challenging labor and logistics environment in the U.S.; and |

| · | the Russia-Ukraine conflict. |

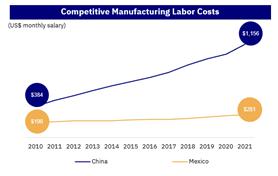

Moving manufacturing closer to end-users provides supply chain security for many sectors and companies, as it reduces long shipping routes while minimizing sensitivities to global disruptions. Supply times from Mexico to the U.S. and Canada can significantly improve delivery schedules, allowing goods to reach final consumers faster.

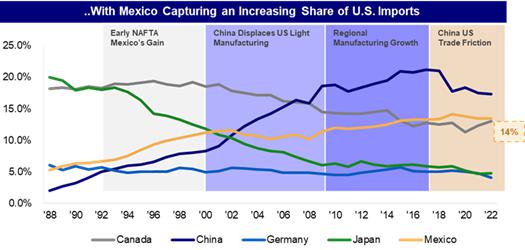

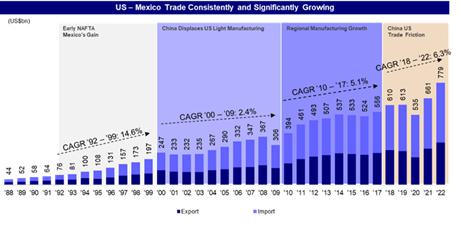

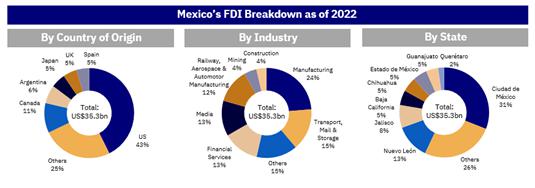

Mexico is well positioned to benefit from nearshoring given its geographic proximity to the U.S. and Canada, as well as the USMCA trade agreement, its manufacturing base, qualified labor force and competitive wages. According to a recent report by the Inter-American Development Bank, Mexico is likely to be the country to receive the most investment in Latin America, with an estimate of US$35.0 billion, driven by nearshoring dynamics.

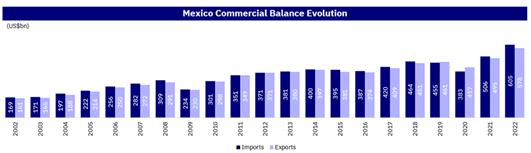

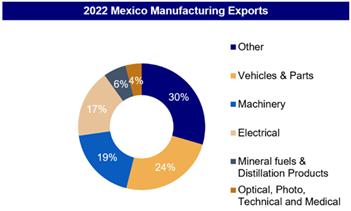

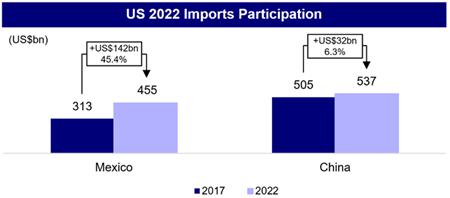

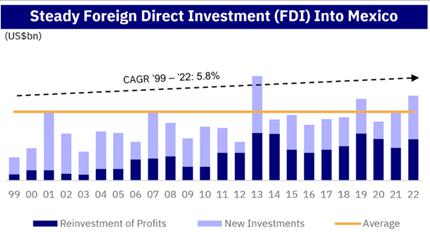

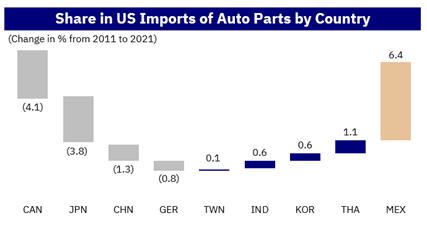

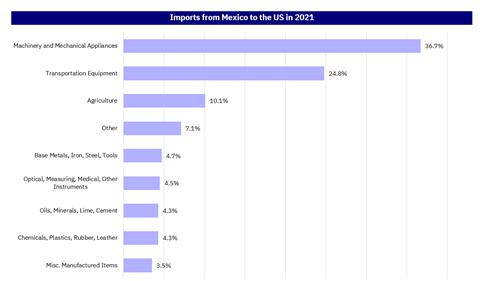

Mexico has become an essential part of North America’s trade and manufacturing platform with nearly 90% of Mexico’s exports deriving from manufacturing according to Bloomberg, and has continued to experience a steady influx of foreign direct investment, averaging US$8.7 billion of new investments per quarter since 2015, according to the Dallas Federal Reserve. The United States continues to be the world’s largest importer of goods, with more than US$3.3 trillion of import value per year during 2022, according to Statista. We believe that Mexico is well-positioned to capture more export market share from other economies into the U.S., especially companies aiming to relocate manufacturing from Asia and China.

6

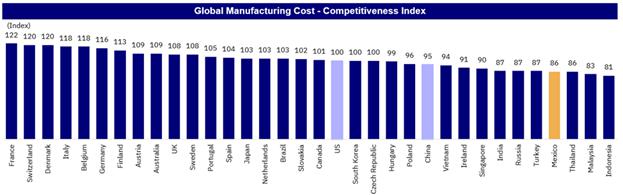

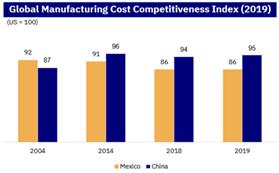

(1)(2)

(1)(2)

| (1) | Kearney – Mexico: a serious resilience play for North America. |

| (2) | Mexican Ministry of Economy Nearshoring Presentation from 2022. |

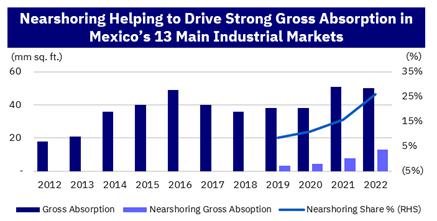

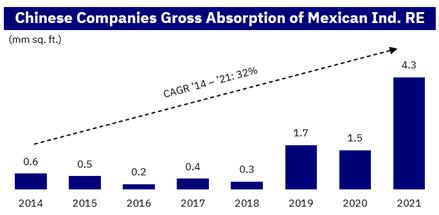

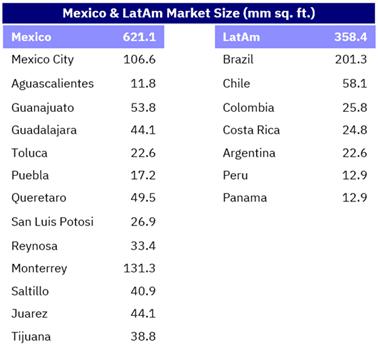

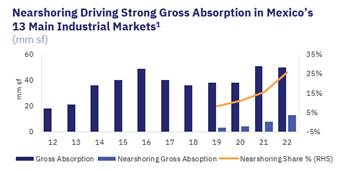

The relocation of global supply chains into North America is already benefiting Mexico’s industrial real estate market, as evidenced by an acceleration of nearshoring gross absorption since 2019. With Mexico’s industrial real estate market being the largest in Latin America according to CBRE, and due to its strategic location in the North America cluster, we expect this nearshoring trend to continue, with a favorable impact over the real estate industry.

| (1) | Based on CBRE figures on nearshoring absorption in Mexico’s main industrial markets. |

CBRE calculation on total GLA demand for nearshoring-related activities.

| (1) | Based on CBRE figures on nearshoring absorption in Mexico’s main industrial markets. |

7

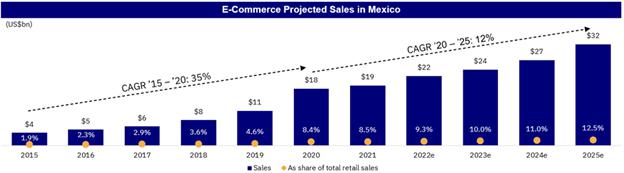

e-Commerce

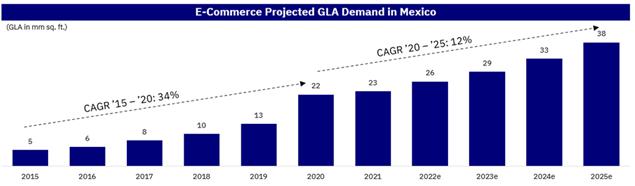

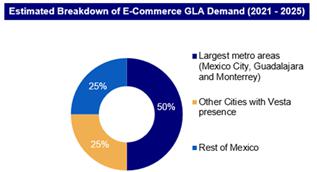

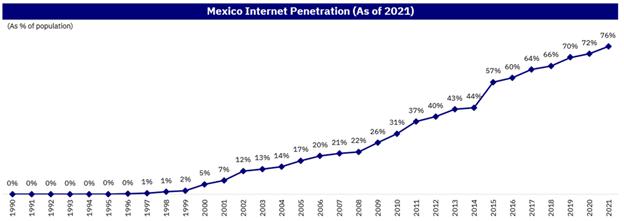

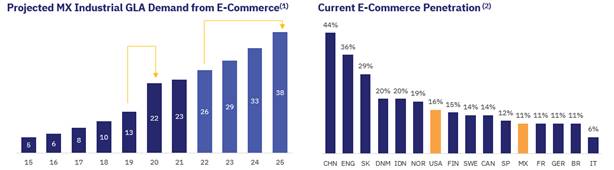

Our logistics focused properties are state-of-the art and well positioned to capture key e-commerce functions. According to Statista, the size of the e-commerce market in Mexico is expected to reach US$42.2 billion by the end of 2023, with an expected growth in e-commerce sales revenue of 85% between 2021-2025, creating new opportunities in logistics, warehousing and delivery services. Retailers are increasingly shifting to shipping parcels versus pallets, maintaining high inventory levels, expanding product portfolio and investing in reverse logistics to handle returns. E-commerce sales reached 11% of all Mexican retail sales in 2022 according to Statista, which could be considered a low penetration when compared to other economies such as the United States (16%) and China (44%). We believe industrial GLA demand from e-commerce will grow over the next few years, with the largest metro areas (Mexico City, Guadalajara and Monterrey) benefitting the most.

| (1) | Data from LENS analysis with information from AMVO, AMAI, and INEGI. Assumes 1.2 M SF demanded per each US$1Bn of e-commerce sales. |

| (2) | Asociación Mexicana de Ventas Online (Mexican Association of Online Sales). |

Best-in-class development platform allows Vesta to accelerate earnings and portfolio growth via owned land bank

We are a fully-integrated real estate company, actively engaging throughout the development process, from the search and acquisition of land, obtaining any necessary licenses, and conceptual design and development of our properties. Our 25+ years of proven track record as what we believe to be a “best-in-class” development platform, together with our disciplined approach towards design and construction and rigorous cost controls translate into robust value creation, increase in demand for our properties and increase in earnings metrics.

Historically, we have developed properties at an average Yield on Cost from 2020 to 2022 above 10.0%. In addition, we analyze the NOI of our entire portfolio of properties (including stabilized properties, construction in progress and vacant properties) in relation to their appraised value and believe that we generate strong value creation for our shareholders based on this analysis in relation to our Yield on Cost.

Our strategic land reserves are well diversified across Mexico’s most dynamic industrial markets, and located within the same regions where we currently have our industrial properties, which are locations that we consider to be well-positioned to benefit from nearshoring and logistics trends in the near future, such as Monterrey, Tijuana, Guadalajara, Juarez, San Luis Potosí, Querétaro, San Miguel de Allende, Guanajuato and Mexico City.

Our best-in-class development platform has allowed us to grow our basic earnings per share at a CAGR of 9.8% since 2012 and our NAV per share at a CAGR of 6.9% since 2012. Our total stockholder’s equity has increased 3.17x since 2012 growing at a CAGR of 12.2% from 2012 to 2022 and 12.8% from 2021 to 2022. In 2022 alone, we increased our NAV by US$178 million and increased our Adjusted NOI by US$17 million compared to December 31, 2021, which represents an Adjusted NOI growth of 11.1%.

8

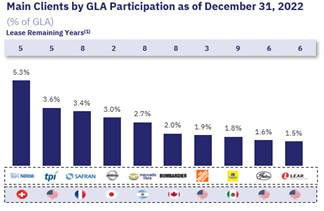

High quality and diversified tenant base of predominantly U.S. and global clients paying U.S. dollar-denominated leases

We have a well-diversified tenant base and portfolio of leading Mexican companies and multinational, world-class, tenants under long-term contracts, including Nestlé, TPI, Safran, Nissan, MercadoLibre, Bombardier, The Home Depot, Coppel, Gates, Lear Corporation, among others. Our client portfolio is well-balanced between light-manufacturing (60% of GLA) and logistics (40% of GLA) and we maintain exposure to key light-manufacturing and productive industries in Mexico such as automotive, aerospace, food & beverage, energy, among others.

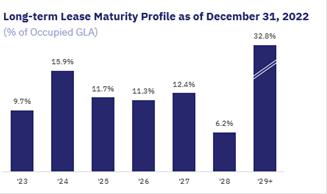

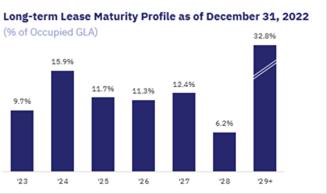

As of December 31, 2022, we had 183 tenants and 87.0% of our rental income in U.S. dollars with an average contract life of 4.9 years. No tenant occupies more than 6.0% of our total GLA, with the top 10 tenants maintaining an average remaining lease term of 6.9 years. Our long-dated lease terms are key to securing stable cash flows and allow us to foster long-term partnerships with our tenants. The table below indicates the breakdown of our top 10 tenants by GLA as of December 31, 2022:

Seasoned management team focused on shareholder return and best-in-class corporate governance

We believe we are one of the only publicly listed pure-play industrial platforms, with a fully internalized management in Mexico. Our internal flat management structure and the equity participation of our management team aligns internal incentives with the interests of our stakeholders, resulting in long-term value creation. Our executive chairman and other executive officers’ position in our equity, which represents approximately 6.3% of our outstanding capital stock as of December 31, 2022 ( % on an as adjusted basis after giving effect to this offering), represents a significant stakehold, while at the same time allows for significant liquidity of our shares (not in the possession of a control group).

9

Our management is comprised of a team with significant expertise in the Mexican industrial real estate market and a long tenure in the Company with an average of 11.1 years of experience with the Company. We have a highly professional and experienced team across all key areas of industrial real estate development and operations, including land selection, land and property acquisitions, design and engineering, development, government licensing and government relations, project management, marketing, sales and negotiation of contracts. This team possesses significant know-how in investing and operating industrial real estate companies and has a multidisciplinary track record of successfully deploying capital investments through development and acquisition of land for both single properties and portfolios.

Our Board of Directors currently consists of 10 members and their alternates, eight of whom are independent directors, well above the requirements of Mexican law, which supports our goal of improved governance and transparency to implement best practices. All board members are selected through a process that evaluates their expertise, experience and moral integrity. The experience gained from our partnership with institutional investors has also been a competitive advantage, attracting capital to create value.

Longstanding commitment to environmental, social and governance best practices