Exhibit 4.3

LOAN AGREEMENT

BY AND BETWEEN

Vesta Bajío,

S. de R.L. de C.V.,

Vesta Baja California, S. de R.L. de C.V.,

QVC, S. de R.L. de C.V.

QVCII, S. de R.L. de C.V., and

WTN DESARROLLOS INMOBILIARIOS DE MÉXICO, S. DE R.L. DE C.V.

each, a Mexican Sociedad de Responsabilidad Limitada de Capital Variable,

individually and collectively, as the context may require, as Borrower

AND

METROPOLITAN LIFE INSURANCE COMPANY,

a New York corporation,

as Lender

July 27, 2016

EXECUTION COPY

TABLE OF CONTENTS

PAGE

Article I

LOAN TERMS AND SECURITY

| Section 1.01 | Amount of Loan | 9 |

| Section 1.02 | Term of Loan; Amounts In Us Dollars | 10 |

| Section 1.03 | Interest Rate and Payment Terms | 10 |

| Section 1.04 | Acceleration | 12 |

| Section 1.05 | Prepayment | 13 |

| Section 1.06 | Application of Payments | 14 |

| Section 1.07 | Increased Costs | 14 |

| Section 1.08 | Change in Law | 14 |

| Section 1.09 | Security | 15 |

Article II

CONDITIONS PRECEDENT TO DISBURSEMENT

| Section 2.01 | Initial Funding Disbursement | 15 |

| Section 2.02 | Second Funding Disbursement | 15 |

Article III

BORROWER REPRESENTATIONS, WARRANTIES AND COVENANTS

| Section 3.01 | Due Authorization, Execution, and Delivery | 17 |

| Section 3.02 | Performance by Borrower | 19 |

| Section 3.03 | Warranty of Title to Trust Property | 19 |

| Section 3.04 | Taxes, Liens and Other Charges | 19 |

| Section 3.05 | Escrow Deposits | 20 |

| Section 3.06 | Care And Use Of The Trust Property | 21 |

| Section 3.07 | Collateral Security Instruments | 23 |

| Section 3.08 | Suits and Other Acts to Protect the Trust Property | 23 |

| Section 3.09 | Liens and Encumbrances | 23 |

| Section 3.10 | No Change in Fact or Circumstance | 23 |

| Section 3.11 | Post-Closing Obligations | 24 |

Article IV

INSURANCE

| Section 4.01 | Required Insurance and Terms of Insurance Policies. | 24 |

| Section 4.02 | Adjustment of Claims | 27 |

| Section 4.03 | Assignment to Lender | 27 |

- i -

Article V

BOOKS, RECORDS AND ACCOUNTS

| Section 5.01 | Books and Records | 27 |

| Section 5.02 | Property Reports | 28 |

| Section 5.03 | Additional Matters | 29 |

Article VI

LEASES AND OTHER AGREEMENTS AFFECTING THE TRUST PROPERTY

| Section 6.01 | Borrower’s Representations and Warranties | 29 |

| Section 6.02 | Performance of Obligations | 31 |

| Section 6.03 | Recognition by Tenants | 32 |

| Section 6.04 | Leasing Commissions, Management Agreements | 32 |

| Section 6.05 | Assignment of Leases | 33 |

| Section 6.06 | Lease Payments | 34 |

Article VII

ENVIRONMENTAL HAZARDS

| Section 7.01 | Representations and Warranties | 34 |

| Section 7.02 | Remedial Work | 35 |

| Section 7.03 | Environmental Site Assessment | 35 |

| Section 7.04 | Unsecured Obligations | 35 |

| Section 7.05 | Hazardous Materials | 36 |

| Section 7.06 | Requirements of Environmental Laws | 36 |

| Section 7.07 | Official Mexican Norms | 36 |

Article VIII

CASUALTY, CONDEMNATION AND RESTORATION

| Section 8.01 | Borrower’s Representations | 37 |

| Section 8.02 | Restoration | 37 |

| Section 8.03 | Condemnation | 38 |

| Section 8.04 | Requirements for Restoration | 39 |

Article IX

REPRESENTATIONS OF BORROWER

| Section 9.01 | ERISA | 41 |

| Section 9.02 | Non-Relationship | 41 |

| Section 9.03 | No Adverse Change | 41 |

| Section 9.04 | Compliance with Laws, Including Anti-Terrorism, Bribery, KYC and Anti Money Laundering Laws | 42 |

- ii -

Article X

CHANGE IN OWNERSHIP, CONVEYANCE OF Trust PROPERTY

| Section 10.01 | Conveyance of Trust Property, Change in Ownership and Composition | 43 |

| Section 10.02 | Prohibition on Subordinate Financing | 44 |

| Section 10.03 | Restrictions on Additional Obligations | 44 |

| Section 10.04 | Statements Regarding Ownership | 45 |

| Section 10.05 | Compliance with Laws | 45 |

| Section 10.06 | Partial Releases | 45 |

| Section 10.07 | Substitution of Properties | 47 |

| Section 10.08 | Deemed Approval for Easements | 51 |

| Section 10.09 | Casualty/Condemnation Release or Substitution | 51 |

Article XI

DEFAULTS AND REMEDIES

| Section 11.01 | Events of Default | 52 |

| Section 11.02 | Remedies upon Default | 54 |

| Section 11.03 | Application of Proceeds | 54 |

| Section 11.04 | Waiver of Jury Trial | 54 |

| Section 11.05 | Lender’s Right to Perform Borrower’s Obligations | 54 |

| Section 11.06 | Lender Reimbursement | 55 |

| Section 11.07 | Fees and Expenses | 55 |

| Section 11.08 | Waiver of Consequential Damages | 55 |

| Section 11.09 | Attorney-In-Fact | 55 |

Article XII

BORROWER AGREEMENTS AND FURTHER ASSURANCES

| Section 12.01 | Participation and Sale of Loan | 56 |

| Section 12.02 | Replacement of Pagaré | 57 |

| Section 12.03 | Borrower’s Estoppel | 57 |

| Section 12.04 | Further Assurances | 57 |

| Section 12.05 | UCC Financing Statements | 58 |

Article XIII

RECOURSE LIABILITIES

|

Section 13.01 |

Recourse Liabilities | 58 |

- iii -

Article XIV

DEBT SERVICE RESERVE

| Section 14.01 | Debt Service Reserve Requirement | 61 |

| Section 14.02 | Debt Service Reserve Account | 61 |

| Section 14.03 | Option to Provide Letter Of Credit | 61 |

| Section 14.04 | LC Draw Events | 61 |

| Section 14.05 | Renewal of Letters Of Credit | 62 |

| Section 14.06 | Assignment of Letter Of Credit | 62 |

Article XV

MISCELLANEOUS COVENANTS

| Section 15.01 | Prohibitions of Assignment | 62 |

| Section 15.02 | No Waiver | 62 |

| Section 15.03 | Notices | 62 |

| Section 15.04 | Broker | 62 |

| Section 15.05 | Heirs and Assigns; Terminology | 63 |

| Section 15.06 | Severability | 63 |

| Section 15.07 | Applicable Law | 63 |

| Section 15.08 | Consent to Jurisdiction and Service of Process | 63 |

| Section 15.09 | Waiver of Immunities | 64 |

| Section 15.10 | Judgment Currency | 64 |

| Section 15.11 | Captions | 64 |

| Section 15.12 | Time of the Essence | 64 |

| Section 15.13 | No Modifications | 64 |

| Section 15.14 | Entire Agreement | 64 |

| Section 15.15 | Counterparts | 65 |

| Section 15.16 | No Third Party Beneficiaries | 65 |

| Section 15.17 | Joint and Several Liability | 65 |

| Section 15.18 | Construction | 65 |

| Section 15.19 | Confidentiality | 65 |

| EXHIBITS | |

| EXHIBIT A: | REAL PROPERTY |

| Schedule 1: | TRUST PROPERTY |

| EXHIBIT B: | PERSONAL PROPERTY |

| EXHIBIT C: | ALLOCATED LOAN AMOUNTS |

| EXHIBIT D: | FORM OF PAGARÉ |

- iv -

| EXHIBIT E: | FORM OF LEASING GUIDELINES |

| EXHIBIT F: | FORM OF POWER OF ATTORNEY |

| EXHIBIT G: | RENT ROLL FOR EACH TRUST PROPERTY |

| EXHIBIT H: | FORM OF LEASE AGREEMENT |

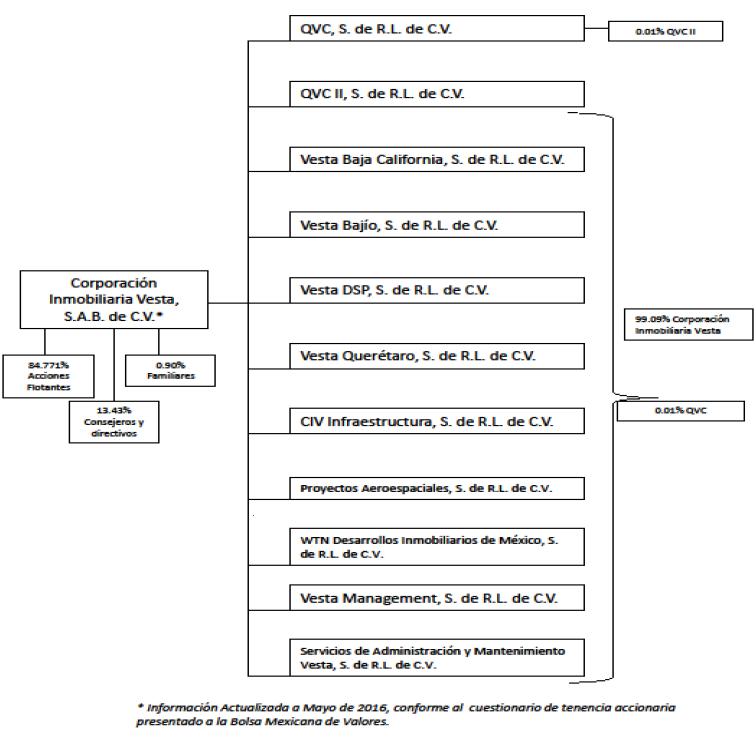

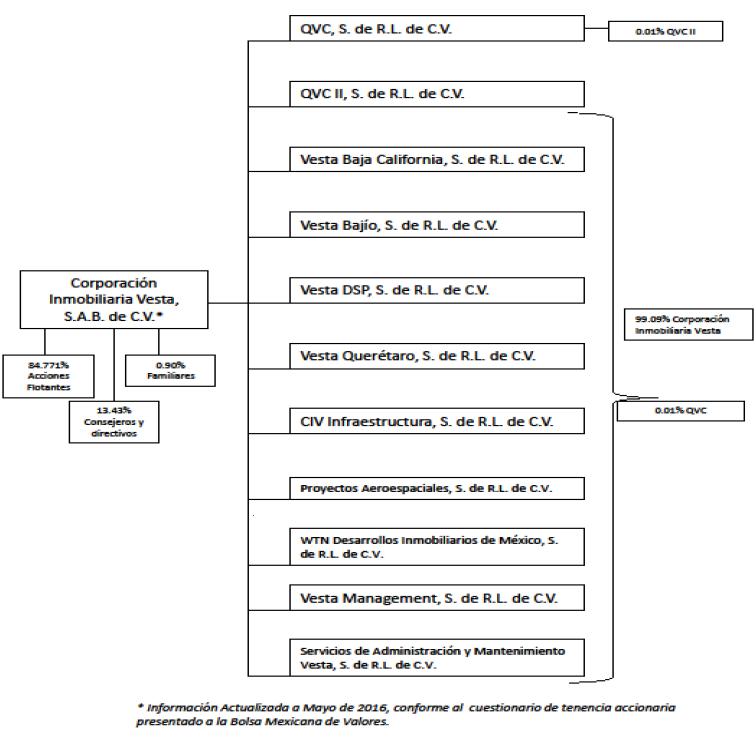

| EXHIBIT I: | ORGANIZATIONAL CHART |

| EXHIBIT J: | PERSONAL PROPERTY LOCATED AT REAL PROPERTY |

| EXHIBIT K: | FORM LOAN REQUEST |

| EXHIBIT L: | SECOND FUNDING TRUST PROPERTIES |

| SCHEDULE 3.11 | POST-CLOSING OBLIGATIONS |

- v -

EXECUTION COPY

LOAN

AGREEMENT

DEFINED TERMS

| Execution Date: As of July 27, 2016 | |

| Loan: A loan in an amount not to exceed US$150,000,000 (the “Total Loan Amount”) from Lender to the Borrower comprised of (i) an amount not to exceed US$119,927,000 (the “Initial Funding”), and (ii) an amount not to exceed US$30,073,000 which shall be disbursed in a single disbursement (the “Second Funding”). The disbursement of the Initial Funding pursuant to the terms hereof shall be referred to as the “Initial Funding Disbursement” and the disbursement of the Second Funding pursuant to the terms hereof shall be referred to as the “Second Funding Disbursement.” The Initial Funding and the Second Funding, once repaid pursuant to Section 1.06 or otherwise, are not available to be re-borrowed. | |

| Borrower: Vesta Bajío, S. de R.L. de C.V., Vesta Baja California, S. de R.L. de C.V., QVC, S. de R.L. de C.V., QVCII, S. de R.L. de C.V. and WTN Desarrollos Inmobiliarios de México, S. de R.L. de C.V., each a Mexican Sociedad de Responsabilidad Limitada de Capital Variable, individually and collectively, as the context may require | |

| Borrower’s Address: | Paseo de Tamarindos 90, Torre 2, 28th floor, Colonia Bosques de las Lomas, Mexico City, C.P. 05120. Attention: Lorenzo Berho and Juan Sottil |

| Borrower Taxpayer Registry Number: | ||

| Vesta Bajío, S. de R.L. de C.V.: | VBA050208J72 | |

| Vesta Baja California, S. de R.L. de C.V.: | VBC050208UU8 | |

| QVC, S. de R.L. de C.V.: | QVC940801V88 | |

| QVCII, S. de R.L. de C.V.: | QVC941103DK2 | |

| WTN Desarrollos Inmobiliarios de México, | WDI100731521 | |

| S. de R.L. de C.V. | ||

| Lender: Metropolitan Life Insurance Company, a New York corporation | |

| As used in this Agreement, the term “Lender” shall have the meaning set forth in Paragraph E of the Recitals. | |

Lender’s Address: |

Metropolitan Life Insurance Company Paseo de Tamarindos No. 90, Torre I, Piso 11, Oficina “B” Colonia Bosques de las Lomas, Cuajimalpa, C.P. 05120, México,

D.F. |

| and: | Metropolitan Life Insurance Company Real Estate Investments 10 Park Avenue, P.O. Box 1902 Morristown, New Jersey 07962 U.S.A. Tel: (973) 355-4000 Fax: (973) 355-4920 Attention: Associate General Counsel – REI |

| With a copy (which shall not

constitute notice) to: Hunton & Williams LLP 200 Park Avenue New York, New York 10166 Tel: (212) 309-1023 Fax: (917) 254-4639 Attention: Peter Mignone, Esq. |

| Location and Address of the Trust Property: See Exhibit A. |

| Use: Bulk warehouse, distribution facilities or light manufacturing facilities. |

| Address for Insurance Notification: | |

| Metropolitan Life Insurance Company and/or its successors and assigns Real Estate Investments 10 Park Avenue, P.O. Box 1902 Morristown, New Jersey 07962 U.S.A. Attn: Risk Management; |

| With a copy to: | Metropolitan Life Insurance Company |

| MetLife Real Estate Investors | |

| Paseo de Tamarindos No. 90, Torre I, Piso 11, Oficina “B” | |

| Colonia Bosques de las Lomas, Cuajimalpa, | |

| C.P. 05120, México, D.F. | |

| Tel: 52 55 5328 7054 | |

| Fax: 52 55 5540 2294 | |

| Attention: Regional Director |

| Security Trustee Name: | CIBanco, Institución de Banca Múltiple |

Affiliate: With respect to any specified Person, a Person that directly or indirectly, through one or more intermediaries, Controls, is Controlled by, or is under common Control with, the Person specified.

Agreements: Means the Lease Agreements and the Management Agreements as each of the foregoing may be amended, modified or replaced from time to time to the extent permitted under the Loan Documents.

Allocated Loan Amount: Means, with respect to each individual Trust Property, the amount set forth on Exhibit C hereto. Upon the occurrence of a Permitted Property Substitution effected in accordance with the terms hereof, the Allocated Loan Amount of the applicable Replacement Property shall be the same Allocated Loan Amount of the applicable individual Trust Property substituted in connection with said Permitted Property Substitution.

Annual Debt Service Payments: An amount equal to the sum of all projected monthly installments of principal and interest payable by Borrower to Lender for the 12 consecutive calendar month period |

- 2 -

immediately following any date of determination.

Applicable Prepayment Fee: Except to the extent otherwise provided in this Agreement, with respect to any prepayment of all or part of the Secured Obligations made during the Lockout Period, the Default Prepayment Fee, and with respect to any prepayment of all or part of the Secured Obligations made in any year after the expiration of the Lockout Period (and prior to the Open Period), the Prepayment Fee

|

Business Day: Any day except Saturday, Sunday and any other day in which the principal office of commercial banks located in New York City, United States of America or Mexico City, Mexico are authorized or required by law, regulation or decree to remain closed.

|

Business Income: The meaning given to such term in Section 4.01(b).

|

Control: The possession, directly or indirectly, of the power to direct or cause the direction of management, policies or activities of a Person, whether through ownership of voting securities, by contract or otherwise.

Deemed Approval Requirements: With respect to any matter, that (i) no Event of Default shall have occurred and be continuing (either at the date of any notices specified below or as of the effective date of any deemed approval), (ii) Borrower shall have sent Lender a written request for approval with respect to such matter in accordance with the applicable terms and conditions hereof (the “Initial Notice”), which such Initial Notice shall have been (A) accompanied by any and all required information and documentation relating thereto as may be reasonably required in order to approve or disapprove such matter (the “Approval Information”) and (B) marked in bold lettering with the following language: “LENDER’S RESPONSE IS REQUIRED WITHIN TEN (10) BUSINESS DAYS OF RECEIPT OF THIS NOTICE PURSUANT TO THE TERMS OF A LOAN AGREEMENT BETWEEN THE UNDERSIGNED AND LENDER”; (iii) Lender shall have failed to respond to the Initial Notice within the aforesaid time-frame; (iv) Borrower shall have submitted a second request for approval with respect to such matter in accordance with the applicable terms and conditions hereof (the “Second Notice”), which such Second Notice shall have been (A) accompanied by the Approval Information and (B) marked in bold lettering with the following language: “LENDER’S RESPONSE IS REQUIRED WITHIN THREE (3) BUSINESS DAYS OF RECEIPT OF THIS NOTICE PURSUANT TO THE TERMS OF A LOAN AGREEMENT BETWEEN THE UNDERSIGNED AND LENDER”; and (v) Lender shall have failed to respond to the Second Notice within the aforesaid time-frame. For purposes of clarification, Lender requesting additional and/or clarified information, in addition to approving or denying any request (in whole or in part), shall be deemed a response by Lender for purposes of the foregoing.

Default: The occurrence of any event hereunder or under any other Loan Document or the Unsecured Indemnity Agreement which, but for the giving of notice or passage of time, or both, would be an Event of Default.

Default Interest Rate: The Default Interest Rate set forth in the Pagaré. For the avoidance of doubt, the Default Interest Rate shall in no case exceed the sum of (i) the Interest Rate plus (ii) 400 basis points (4.00%).

Default Prepayment Fee: An amount equal to the Prepayment Fee except that when calculating the Prepayment Fee, the determination of the applicable interest payments be calculated at the Default Interest Rate. Notwithstanding anything in this Agreement to the contrary, payment of the Default Prepayment Fee hereunder shall be in lieu of, and not in addition to, the payment of the Prepayment Fee. |

- 3 -

Dollars and US$: The legal currency of the United States of America.

|

DSCR: The ratio of Net Operating Income to Annual Debt Service Payments. For purposes of calculating the DSCR, the Annual Debt Service Payments for the applicable period shall be determined based on the Total Loan Amount then-outstanding at the time of such calculation and (A) assuming that the Loan had been in place for the entirety of said period and (B) disregarding the “interest only” period under the Loan and assuming that the constant principal and interest payments provided for hereunder were due for the entirety of said period.

Environmental Report: The meaning given to such term in the Unsecured Indemnity Agreement.

Event of Default: The meaning set forth in Section 11.01.

Existing Liens: The existing mortgages, security trusts, or any other Liens and Encumbrances over the Trust Property in favor of BRE Debt Mexico II, S.A. de C.V. (as successor of GE Real Estate Mexico, S. de R.L. de C.V.) or any other Person other than the Lender.

Fabricas de Calzado Andrea and Multitenant Norte Trust Property: shall mean the real estate property that comprise plots seventeen (17), nineteen (19), twenty one (21) twenty three (23), twenty five (25) and twenty seven (27) of block 2 (manzana 2) including any buildings and expansion constructed in such plots, located in Fraccionamiento Parque Industrial y de Negocios las Colinas, in Monte Coecillo, Silao, Guanjuato, Mexico pursuant to public deed 17,764 dated July16, 2008, granted before Ponciano López Juárez, notary public 222 of Mexico City.

Funding or Fundings: The meaning set forth in Section 1.01(a).

|

| Governmental Authority: Any national or federal government, any state, regional, local or other political subdivision thereof with jurisdiction and any individual or entity with jurisdiction exercising executive, legislative, judicial, regulatory or administrative functions of or pertaining to government or quasi-governmental issues (including any court). |

Gross Income: As of any date of determination, the annualized then current gross recurring monthly rent and other collections (including any amounts which may eventually be reimbursed by tenants in respect of operating expense or real estate tax adjustments) receivable from tenants that have accepted their respective premises under Lease Agreements demising space in the Trust Property.

Hazardous Materials: The meaning set forth in Section 7.05.

|

Imposition: The meaning set forth in Section 3.04(a).

|

Impairment of the Security: The meaning set forth in Section 8.02(c).

Initial Funding: has the meaning in the defined term for “Loan.”.

Initial Funding Disbursement: has the meaning in the defined term for “Loan.”

Initial Funding Disbursement Date: has the meaning in Section 2.01.

|

Insurance Proceeds: The meaning set forth in Section 4.02.

Late Charge: The Late Charge set forth in the Pagaré. For the avoidance of doubt, the Late Charge shall |

- 4 -

in no case exceed four percent (4%) on unpaid amounts after any applicable grace period as provided herein or in the other Loan Documents.

Lease Agreements: The meaning given to the term “Contratos de Arrendamiento” in the Security Trust Agreement.

Lease Payments: The meaning given to the term “Pagos de Arrendamiento” in the Security Trust Agreement.

|

Liens and Encumbrances: The meaning set forth in Section 3.09.

|

Loan Documents: The Pagaré, this Agreement, the Security Trust Agreement, and any other agreement, document or instrument related to the Pagaré, this Agreement, and/or the Security Trust Agreement together with all extensions, renewals, amendments, modifications and restatements thereof. The Unsecured Indemnity Agreement is not a Loan Document.

Loan Fee: With respect to the Initial Funding, an amount equal to US$599,635.00 and with respect to the Second Funding, an amount equal to US$150,365.00. The Loan Fee relating to the Initial Funding and the Second Funding (i.e., US$750,000.00) shall be paid by Borrower on Initial Funding Disbursement Date, subject to the terms of Section 1.02.

|

LTV Ratio: The fraction, described as a percentage, obtained by dividing the outstanding principal balance of the Loan by the total fair market value of the Trust Property, as determined by Lender in its sole discretion.

Management Agreement: means each one of the management agreements dated July 31, 2012, entered into by each Borrower, individually, with Manager.

Manager: Vesta Management, S. de R.L. de C.V. formerly known as Vesta Management, S.C.

Material Adverse Effect: means, with respect to any circumstance, act, condition or event of whatever nature (including any adverse determination in any litigation, arbitration, or governmental investigation or proceeding), whether singly or in conjunction with any other event, act, condition circumstances, whether or not related, a material adverse change in, or a materially adverse effect upon, (a) the ability of Borrower to perform its obligations under any Loan Document or the Unsecured Indemnity Agreement; (b) the value or physical condition of the Trust Property (taken as a whole); or (c) the validity, priority or enforceability of any Loan Document or the Unsecured Indemnity Agreement or the liens, rights (including, without limitation, recourse against the Trust Property) or remedies of Lender hereunder or thereunder (as applicable).

Net Operating Income: As of any date of determination (A) the Gross Income, less (B) all Operating Expenses payable by Borrower in respect of the Trust Property for the previous twelve (12) calendar month period.

|

Official Mexican Norms: The meaning set forth in Section 7.07.

Open Date: May 1, 2026.

|

| Operating Expenses: As of any date of determination, the expenses for operating the Trust Property in the ordinary course of business which are paid in cash by Borrower and which are directly associated with and allocable to the Trust Property including, without limitation, (a) Impositions, which shall be |

- 5 -

calculated by Borrower and, upon request by Lender, supplied to Lender with supporting documentation acceptable to Lender, (b) insurance premiums, (c) management fees (which shall not be greater than three percent (3%) of Gross Income for the purposes calculating the management fees), and (d) utility and maintenance expenses. Operating Expenses shall exclude (x) Annual Debt Service Payments, (y) any of the foregoing expenses described in clauses (a) through (d) above for which Borrower has been or will be reimbursed from insurance proceeds or by a tenant or any third party and (z) any non-cash charges such as depreciation and amortization.

|

Pagaré: Pagaré dated as of the Execution Date, written in both English and Spanish and executed and delivered by Borrower in favor of Lender evidencing the Loan, together with all extensions, renewals, amendments, modifications, restatements and replacements thereof (including, without limitation, any replacement pagaré delivered in connection with the Second Funding and/or any Property Release).

|

Parent: Corporación Immobiliaria Vesta, S.A.B. de C.V.

|

Permitted Exceptions: (a) the Liens and Encumbrances created by this Agreement and the other Loan Documents, (b) all Liens and Encumbrances for any Trust Property that are disclosed to Lender in writing prior to the Execution Date, (c) Agreements and Lease Agreements expressly permitted pursuant to the Loan Documents, (d) Liens, if any, for Impositions imposed by any Governmental Authority being contested in accordance with the terms hereof, (e) Liens, if any, relating to contractor claims that can result in a Lien that are contested in accordance with Section 8.04(c) hereto and (f) such other title and survey exceptions as Lender has approved or may approve in writing in Lender’s sole discretion.

|

Person: any individual, corporation, partnership, limited liability company, joint venture, estate, trust, unincorporated association, any other person or entity, and any federal, state, county or municipal government or any bureau, department or agency thereof and any fiduciary acting in such capacity on behalf of any of the foregoing.

|

Pesos: The legal currency of the United Mexican States.

|

Prepayment Fee: An amount equal to the greater of (i) the Prepayment Ratio multiplied by the difference between (x) and (y) where (x) is the present value of all remaining payments of principal (if applicable) and interest relating to the Loan, including the outstanding principal relating to the Loan due on the Maturity Date, discounted at the rate which, when compounded monthly, is equivalent to the Treasury Rate (as defined below) plus 25 basis points (0.25%) compounded semi-annually and (y) is the principal amount of the Loan then outstanding, and (ii) one percent (1%) of the amount of the Loan being prepaid.

Prepayment Ratio: A fraction, the numerator of which shall be the amount of principal being prepaid and the denominator of which shall be the principal of the Loan then outstanding.

Qualified Management Agreement: The meaning set forth in Section 6.04(c).

Rating Agency: The meaning set forth in Section 5.03(a).

Remedial Work: The meaning set forth in Section 7.02.

|

| Requirements: All laws, ordinances, orders, covenants, conditions and restrictions and other requirements relating to land and building design and construction, use and maintenance, that may now or hereafter pertain to or affect the Trust Property or any part of the Trust Property or the Use, including, without limitation, planning, zoning, subdivision, environmental, air quality, flood hazard, fire safety, |

- 6 -

handicapped facilities, building, health, fire, traffic, safety, wetlands, coastal and other governmental or regulatory rules (including all material applicable Official Mexican Norms issued by the Mexican Ministry of Economy or other competent authority), laws, ordinances, statutes, codes and requirements applicable to the Trust Property, including permits, licenses, certificates of occupancy and/or other certificates that may be necessary from time to time to comply with any of the these requirements.

Requirements of Environmental Laws: The meaning set forth in Section 7.06.

Second Funding: has the meaning in the defined term for “Loan.”

Second Funding Disbursement: has the meaning in the defined term for “Loan.”

Second Funding Disbursement Conditions: has the meaning set forth in Section 2.02(b).

Second Funding Disbursement Date: has the meaning set forth in Section 1.01(b).

Second Funding End Date: has the meaning set forth in Section 1.01(a)(ii).

Second Funding Trust Properties: the properties described on Exhibit L.

Secured Obligations: The meaning set forth in Section 1.09.

|

Security Trust Agreement: Fideicomiso Irrevocable Traslativo de Dominio, de Garantía y Medio de Pago con Derechos de Reversión número CIB/2574, dated the Execution Date and executed by Borrower, as trustor, CIBANCO, S.A., INSTITUCIÓN DE BANCA MÚLTIPLE, DIVISIÓN FIDUCIARIA, as trustee (the “Security Trustee”), and Lender, as first beneficiary, and given to secure, among other things, the repayment of the Loan, together with all extensions, renewals, amendments, modifications and restatements thereof.

SMR Trust Property: shall mean the real estate property that comprise plots thirteen (13), fourteen (14), fifteen (15) and sixteen (16) of block II (manzana II) located in Circuito Exportación del Parque Industrial Tres Naciones, in San Luis Potosí, Mexico pursuant to public deed 11,918 dated November 27, 2006, granted before Leopoldo de la Garza Marroquín, notary public 33 of San Luis Potosí, recorded in the Public Registry of San Luis Potosí under number 244,182, pages 245-252, volume 4690 on April 24, 2007.

Total Loan Amount: has the meaning in the defined term for “Loan.”

Treasury Rate: The annualized yield on securities issued by the United States Treasury having a maturity equal to the remaining stated term of the Loan, as quoted in the Federal Reserve Statistical Release H. 15 (519) under the heading “U.S. Government Securities - Treasury Constant Maturities” for the date on which prepayment is being made. If this rate is not available as of the date of prepayment, the Treasury Rate shall be determined by interpolating between the yield on securities of the next longer and next shorter maturity. If the Treasury Rate is no longer published, Lender shall select a comparable rate. Lender will, upon request, provide an estimate of the amount of the Prepayment Fee two weeks before the date of the scheduled prepayment.

Trust Property: Has the meaning set forth in Recital D. For the avoidance of doubt, Trust Property includes forty eight (48) Real Properties as more particularly described in the Security Trust Agreement, as well as the Rights under the Lease Agreements (as defined in the Security Trust Agreement), the Insurance Policies and the Insurance Proceeds of the Insurance Policies. In the event of any Property |

- 7 -

Release of any individual Trust Property effected in accordance with the terms of the Loan Documents, the term Trust Property shall thereafter exclude the applicable released property from and after the date of the applicable Property Release.

|

Unsecured Indemnity Agreement: Unsecured Indemnity Agreement dated as of the Execution Date and executed by Borrower in favor of Lender, together with all amendments, modifications and restatements thereof.

Vishay Trust Property: shall mean the real estate property located in Avenida de las Torres 2150, Lote Bravo in Ciudad Juarez, Chihuahua, Mexico pursuant to public deed 13,526 dated November 20, 2007, granted before Aureliano González Baz, notary public 1 of Judicial District Bravos, Chihuahua.

Wilson Trust Property: shall mean the real estate property comprising plot 21 and any building constructed in such plot located in Second Section (Sección Segunda) of Fraccionamiento Industrial el Trebol Tepoztlán in Tepoztlán, Cuautitlán Estado de México, Mexico pursuant to public deed 64,970 dated June 3, 1998, granted before Heriberto Román Talavera, notary public 62 of Mexico City, recorded in the Public Registry of Cuautitlán Izcalli, Estado de México under number 118, Volume 428, Libro Primero, Sección Primera on November 11, 1999.

3M Trust Property: shall mean the real estate property located in 133 Circuito Exportación del Parque Industrial Tres Naciones in San Luis Potosí, Mexico pursuant to public deed 30,319 dated December 1, 2014, granted before Ponciano López Juárez, notary public 222 of Mexico City, recorded in the Public Registry of San Luis Potosí under folio number 51,1156. |

- 8 -

THIS LOAN AGREEMENT (this “Agreement”) is made as of the Execution Date by and between Borrower and Lender. All capitalized terms which are not defined in this Agreement shall have the respective meanings set forth in the Exhibits attached to this Agreement and the Pagaré or, if not defined therein, the respective meanings set forth in the Security Trust Agreement.

R E C I T A L S

A. Lender has agreed to advance to Borrower the Loan in accordance with the terms and conditions set forth in this Agreement.

B. The Loan is evidenced by the Pagaré.

C. Immediately prior to the Execution Date, each Borrower held good, marketable and insurable title to the Real Property described and defined in Exhibit A attached to this Agreement owned by each such Borrower and good, sufficient legal title to all the items of Personal Property described and defined in Exhibit B attached to this Agreement owned by it.

D. Pursuant to the Security Trust Agreement, each Borrower has transferred, or is simultaneously with the execution and delivery of this Agreement transferring, all of its right, title and interest in and to the Real Property and the Personal Property owned by each such Borrower to the Security Trustee as security for the Loan. The Real Property and Personal Property conveyed from time to time to the Security Trustee pursuant to the Security Trust Agreement, whether in connection with the disbursement of the Initial Funding or the Second Funding, a Substitution or otherwise, shall be referred to herein as the “Trust Property”.

E. Each Borrower makes the following covenants and agreements for the benefit of Lender or any party designated by Lender, including any prospective purchaser of the Loan Documents or participant in the Loan (all of which are collectively referred to as “Lender”).

NOW, THEREFORE, IN CONSIDERATION of the Recitals and for other good and valuable consideration, the receipt and sufficiency of which are acknowledged, the parties hereto agree as follows:

Article

I

LOAN TERMS AND SECURITY

Section 1.01 Amount of Loan.

(a) Lender has agreed to make a loan to Borrower in an amount equivalent to the Total Loan Amount. The Loan will be comprised of two separate fundings: the Initial Funding and the Second Funding (each of the foregoing, a “Funding” and collectively, the “Fundings”). Disbursements of the Loan with respect to each Funding shall be made as follows:

(i) The Initial Funding shall be funded in full in accordance with Section 2.01. There shall only be one Initial Funding Disbursement; and

(ii) The Second Funding shall be funded in full on the date determined as provided in Section 2.02 provided that the conditions set forth in Section 2.02 are satisfied. If the Second Funding has not been funded by Lender on or prior the date that is thirty (30) days following the Initial Funding Disbursement Date (the “Second Funding End Date”), Lender shall thereafter have no obligation to make the Second

- 9 -

Funding Disbursement. The Second Funding Disbursement shall be considered an advance of the Loan, shall be added to the unpaid principal balance of the Loan as of the day such Second Funding Disbursement is made and shall be secured by the Security Trust Agreement. Borrower shall make a request for the Second Funding Disbursement no later than the tenth (10th) day before the Second Funding End Date. It shall be an Event of Default hereunder if the Second Funding is not made on or prior to the Second Funding End Date due to reasons within the control of Borrower (including, without limitation, any failure of any Second Funding Disbursement Condition if such failed Second Funding Disbursement Condition was within Borrower’s control to satisfy). For the avoidance of doubt, it shall not be an Event of Default hereunder if the Second Funding is not made on or prior to the Second Funding End Date due to reasons within the control of Lender provided all Second Funding Disbursement Conditions within the control of Borrower have been satisfied on or before the Second Funding End Date.

Any amount borrowed and repaid hereunder in respect of the Loan may not be re-borrowed. Lender’s obligations to make any Disbursement in accordance with the terms and provisions of this Agreement are an independent contract made by Lender to Borrower separate and apart from any other obligation of Lender to Borrower under the other provisions of the Loan Documents and the Unsecured Indemnity Agreement. The obligations of Borrower under the Loan Documents and the Unsecured Indemnity Agreement shall not be reduced, discharged or released because or by reason of any existing or future offset, claim or defense of Borrower, or any other party, against Lender by reason of Lender’s failure to make the Second Disbursement.

(b) Lender shall disburse (i) the Initial Funding Disbursement on the Initial Funding Disbursement Date and (ii) the Second Funding Disbursement upon satisfaction of the conditions set forth in Section 2.02. At least ten (10) days prior to the date of the Second Funding Disbursement and in no event later than the tenth (10th) day before the Second Funding End Date (the date of such disbursement, the “Second Funding Disbursement Date”), Borrower shall deliver to Lender a completed Loan Request executed by Borrower in the form of Exhibit K (“Loan Request”) which shall identify the proposed Second Funding Disbursement Date (which shall be a Business Day).

Section 1.02 Term of Loan; Amounts In Us Dollars. The Loan shall be for a term commencing on the Execution Date and ending on August 1, 2026 (the “Maturity Date”), at which time all amounts owing under the Loan Documents shall be due and payable in full. All payments due to Lender under the Loan Documents and the Unsecured Indemnity Agreement, whether at the Maturity Date or otherwise, shall be paid in immediately available Dollars. On the Execution Date, Borrower shall pay to Lender the Loan Fee applicable to the Initial Funding and the Second Funding (i.e., in the amount of US$750,000.00); provided, however, in the event that Lender has not made the Second Funding as of the Second Funding End Date, Lender shall promptly refund to Borrower after the Second Funding End Date a portion of the Loan Fee in the amount of US$150,365.00.

Section 1.03 Interest Rate and Payment Terms.

(a) The interest rate applicable to the Loan is four and fifty-five hundredths percent (4.55%) (the “Interest Rate”). Payments of interest and principal on the Loan shall be made by Borrower in accordance with the terms and conditions set forth in this Agreement, the Pagaré and the Security Trust Agreement. All monthly installments shall be applied first to the payment of interest and, to the extent applicable, second to the reduction of principal. Interest shall be calculated on a daily basis of the actual number of days elapsed over a 360-day year. On and prior to August 1, 2023, Borrower shall be required to make monthly payments of interest only on each monthly payment date, in accordance with the terms set forth in the Pagaré. After August 1, 2023, Borrower shall be required to make monthly payments of

- 10 -

interest and principal on each monthly payment date in accordance with the terms set forth in the Pagaré. The principal component of the monthly installments of principal and interest due on the Loan shall be paid in accordance with the thirty (30) year amortization schedule set forth in the Pagaré. The entire outstanding principal balance of the Loan, together with all accrued interest and all other sums due under the Loan Documents and the Unsecured Indemnity Agreement, shall be paid on the Maturity Date.

(b) All payments to Lender pursuant to the Loan Documents and the Unsecured Indemnity Agreement will be made free and clear of, and without deduction or withholding for or on account of, any present or future income, stamp or other taxes, levies, imposts, duties, charges, fees, deductions or withholdings, levied, collected, withheld or assessed by any Mexican Governmental Authority (“Taxes”), other than withholding taxes at a rate of four and nine-tenths percent (4.9%) (or such other rate as may be applicable pursuant to, in the case of Lender, the United States-Mexico Income Tax Convention signed at Washington on September 18, 1992, along with a Protocol and an Additional Protocol that modified the Convention signed at Mexico City on September 8, 1994, as amended by the Protocol signed at Mexico City on November 26, 2002, as the same may be further amended, renegotiated, modified, replaced, supplemented or restated from time to time (the “US-Mexico Tax Treaty”), or, in the case of an assignee or transferee of Lender, the applicable income tax treaty, if any, and the Mexican Income Tax Law (Ley del Impuesto Sobre la Renta)) on interest, fees and other such payments (as applicable) made by Borrower to Lender (“Excluded Taxes”). Lender shall, to the extent permitted by applicable law at the time and following written request of Borrower, provide Borrower with a copy of U.S. Internal Revenue Service Form 6166 (Certification of U.S. Tax Residency) for each calendar year during which the Loan is outstanding (a “Tax Certification”). In the event that, to Lender’s actual knowledge, the Tax Certification most recently delivered to Borrower becomes inaccurate in any material respect as a result of any factual change with respect to Lender, where the result of such factual change is a change in the applicable withholding rate, then, promptly after becoming aware of such factual inaccuracy, Lender agrees to deliver an updated Tax Certification to Borrower or notify Borrower of such inaccuracy.

(c) If Borrower is required to deduct or withhold any Taxes other than Excluded Taxes, then Borrower will pay to Lender such additional amount as is necessary to ensure that the net amount actually received by Lender (free and clear of such Taxes, whether assessed against Borrower or Lender) will equal the full amount Lender would have received had no such deduction or withholding been required or made. As soon as possible, but in any event no later than fifteen (15) days following the date on which Borrower pays any Taxes to the Mexican tax authority, Borrower shall deliver to Lender the original or certified copy of a receipt or stamped tax return issued by such tax authority evidencing such payment and all other additional information and documents that Lender shall reasonably request relating to such payment.

(d) Borrower shall timely pay the full amount of Excluded Taxes deducted or withheld to the relevant Mexican tax authority in accordance with applicable law. As soon as possible, but in any event not later than fifteen (15) Business Days following the date on which Borrower pays any Excluded Taxes to the Mexican tax authority, Borrower shall deliver to Lender the original or a certified copy of a receipt or stamped tax return issued by such tax authority, or other documentation reasonably acceptable to Lender, evidencing such payment and all other additional information and documents that Lender shall reasonably request relating to such payment.

(e) In the event that Lender is unable to obtain a full tax credit on its United States tax return for any Excluded Taxes withheld by Borrower as provided herein and in the Loan Documents as a result of (i) the failure of any Borrower to furnish Lender with any of (A) a copy of the tax return filed with the relevant Governmental Authority, (B) the written evidence of payment of such Excluded Taxes to the Mexican tax authority or, (C) if reasonably required by Lender, a certificate of income tax

- 11 -

withholding or (ii) any other action or inaction of any Borrower that would reasonably be expected to cause the inability to obtain a full tax credit and which, in the case of inaction, follows a reasonable request of Lender of an action by Borrower, then Borrower will pay to Lender, within ten (10) Business Days after written demand therefor (which demand shall specify the reason for which Lender was unable to obtain the tax credit and confirm (1) that Lender was unable to claim such tax credit as a result of action or inaction of Borrower (and specifying such action or inaction) and (2) the amount of any such Excluded Taxes not fully credited on the United States tax return of Lender), such additional amount as is necessary, without duplication of any additional amounts paid pursuant to Section 1.03(c), to ensure that the net amount actually received by Lender (free and clear of Taxes, including Excluded Taxes for which Lender is unable to obtain a United States tax credit as described above) will equal the full amount Lender would have received had no such deduction or withholding for such Excluded Taxes been required or made. A certificate as to the reason for which Lender was unable to obtain the tax credit and confirming (1) that Lender was unable to claim such tax credit as a result of action or inaction of Borrower and (2) the amount of any such Excluded Taxes not fully credited on the United States tax return of Lender, delivered to Borrower by Lender in good faith, shall be conclusive and binding absent manifest error.

(f) Borrower shall indemnify Lender, within ten (10) Business Days after written demand therefor for (i) the full amount of any Taxes (other than Excluded Taxes) paid by Lender with respect to any payment by or obligation of Borrower hereunder or under the Loan Documents (including such Taxes imposed on, asserted against or attributable to amounts payable as contemplated herein or in the Loan Documents) and any liability, including penalties, interest and reasonable expenses arising therefrom or with respect thereto, whether or not such Taxes were correctly or legally imposed or asserted; and (ii) the full amount of any Excluded Taxes not duly and timely paid by Borrower as required under Section 1.03(d) and any liability, including penalties, interest and reasonable expenses arising therefrom or with respect thereto, whether or not such Excluded Taxes were correctly or legally imposed or asserted, except to the extent the Excluded Taxes are paid by Lender and Lender is able to obtain a tax credit on its United States tax return with respect to such Excluded Taxes. A certificate as to the amount, of any Excluded Taxes not fully credited on the United States tax return of Lender, delivered to Borrower, and prepared by Lender, shall be conclusive and binding absent manifest error.

(g) Notwithstanding anything to the contrary contained in this Section 1.03, if Lender assigns or transfers all or part of its interests in the Loan Documents or the Unsecured Indemnity Agreement, Borrower shall not be required to make any greater payment in respect of such interests pursuant to this Section 1.03 than Borrower would have been required to make in respect of the assigning Lender at the time of such assignment or transfer; provided, however, for the avoidance of doubt, nothing in this clause (g) shall limit (i) the rights of Lender to sell, transfer or assign all or a portion of its interest in the Loan to any assignee, participant or other transferee pursuant to Section 12.01 and (ii) the rights of such assignee, participant or other transferee under this Section 1.03 as a result in a change of law occurring after the date of such assignment or transfer.

Section 1.04 Acceleration.

(a) The Loan may be accelerated, at the option of Lender, following an Event of Default hereunder or under the other Loan Documents. Upon such acceleration, the Accelerated Loan Amount (as defined below) shall be immediately due and payable, together with interest accrued pursuant to the terms of the Loan Documents and any other amounts then payable under the terms of the Loan Documents. The Default Interest Rate shall commence to accrue upon the occurrence of an Event of Default and shall continue so long as the Event of Default is continuing or, if the Loan has been accelerated, until the Accelerated Loan Amount is indefeasibly paid in full.

- 12 -

(b) The Accelerated Loan Amount shall bear interest at the Default Interest Rate which shall never exceed the maximum rate of interest permitted to be contracted for under applicable law.

(c) “Accelerated Loan Amount” shall mean the entire amount of the Secured Obligations and all other sums evidenced by and/or secured under the Loan Documents and the Unsecured Indemnity Agreement, including without limitation any Applicable Prepayment Fee and/or Late Charges.

Section 1.05 Prepayment. The Secured Obligations may not be prepaid in whole or in part at any time prior to the Maturity Date except as follows:

(a) The Secured Obligations may not be prepaid in whole or in part at any time prior to August 1, 2021 (the “Lockout Date”).

(b) The Secured Obligations may not be prepaid in whole or in part at any time prior to the Maturity Date except as follows: commencing on the Lockout Date (the period through but excluding the Lockout Date sometimes referred to herein as the “Lockout Period”), Borrower may prepay the Secured Obligations, in whole (but not in part except in connection with a Partial Release), upon payment of the Applicable Prepayment Fee, on not less than sixty (60) days’ prior written notice to Lender. Any tender of payment by Borrower (or any of them) or any other person or entity of the Secured Obligations, except as expressly provided in this Section 1.05, shall constitute a prohibited prepayment and the Applicable Prepayment Fee shall be payable thereon. Without limitation of the foregoing, if a prepayment of all or any part of the Secured Obligations is made (i) during the Lockout Period, (ii) following an Event of Default and an acceleration of the Maturity Date, or (iii) in connection with a purchase of any individual Trust Property, or a repayment of the Secured Obligations at any time before, during or after, a judicial or non-judicial foreclosure or sale of any individual Trust Property, then to compensate Lender for the loss of the investment, Borrower shall pay an amount equal to the Applicable Prepayment Fee.

(c) Notwithstanding anything to the contrary contained herein, from and after the Open Date (such period, the “Open Period”), Borrower may prepay the Loan in full (but not in part) upon thirty (30) days’ prior written notice to Lender without the payment of the Applicable Prepayment Fee, provided Borrower shall pay to Lender all accrued interest through the date of such prepayment.

(d) Borrower acknowledges that Lender has relied upon the anticipated investment return under the Pagaré in entering into transactions with, and in making commitments to, third parties, and that the tender of any prohibited prepayment shall, to the extent permitted by law, include the Applicable Prepayment Fee. Borrower agrees that the Applicable Prepayment Fee represents the reasonable estimate of Lender and Borrower of fair average compensation for the loss that may be sustained by Lender as a result of a prohibited prepayment of the Pagaré and it shall be paid without prejudice to the right of Lender to collect any other amounts provided to be paid under the Loan Documents. Notwithstanding the foregoing, the parties recognize and acknowledge that the Applicable Prepayment Fee constitutes for all purposes the payment of a fee and not a penalty.

(e) EXCEPT AS EXPRESSLY PROVIDED HEREIN, BORROWER EXPRESSLY (1) WAIVES ANY RIGHTS IT MAY HAVE UNDER APPLICABLE LAW TO PREPAY THE PAGARÉ, IN WHOLE OR IN PART, WITHOUT FEE OR PENALTY, UPON ACCELERATION OF THE MATURITY DATE OF THE PAGARÉ, AND (2) AGREES THAT IF, FOR ANY REASON, A PREPAYMENT OF THE PAGARÉ IS MADE, UPON OR FOLLOWING ANY ACCELERATION OF THE MATURITY DATE OF THE PAGARÉ BY LENDER ON ACCOUNT OF ANY DEFAULT BY

- 13 -

BORROWER UNDER ANY LOAN DOCUMENT, INCLUDING BUT NOT LIMITED TO ANY TRANSFER, FURTHER ENCUMBRANCE OR DISPOSITION WHICH IS PROHIBITED OR RESTRICTED BY THIS AGREEMENT, THEN BORROWER SHALL BE OBLIGATED TO PAY CONCURRENTLY THE APPLICABLE PREPAYMENT FEE SPECIFIED IN THIS SECTION 1.05. BY EXECUTING THIS AGREEMENT, BORROWER AGREES THAT LENDER’S AGREEMENT TO MAKE THE LOAN AT THE INTEREST RATE AND FOR THE TERM SET FORTH IN THE PAGARÉ CONSTITUTES ADEQUATE CONSIDERATION FOR THIS WAIVER AND AGREEMENT.

(f) Simultaneously with any Partial Release made in accordance with this Agreement, Borrower shall execute and deliver to Lender, subject to the simultaneous receipt of the Pagaré being replaced and cancelled a new Pagaré in form of Exhibit D hereto reflecting the revised outstanding principal amount and a revised repayment schedule for the Loan (which shall, for the avoidance of doubt, be prepared by Lender based on an amortization term equal to 360 months less the number of full interest accrual periods that have elapsed since the Execution Date and an assumed Interest Rate equal to the Interest Rate) after giving effect to such prepayment.

Section 1.06 Application of Payments. At the election of Lender, and to the extent permitted by applicable law, all payments made pursuant to the Loan Documents shall be applied in the order selected by Lender to any expenses, prepayment fees, the Applicable Prepayment Fee, Late Charges (as defined in the Pagaré), Escrow Deposits (as hereinafter defined), and other sums due and payable under the Loan Documents, and to unpaid interest at the Interest Rate or the Default Interest Rate, as applicable. The balance of any payments shall be applied to reduce the then unpaid outstanding principal balance of the Loan.

Section 1.07 Increased Costs. If, due to either (a) the introduction after the date hereof of or any change after the date hereof in or in the interpretation of any law or regulation or (b) the compliance with any guideline or request after the date hereof from any Governmental Authority (whether or not having the force of law), there shall be any increase in the cost to Lender of agreeing to make or of making, funding or maintaining the Loan (including any increase in taxes other than net income taxes, franchise taxes or withholding taxes), then Borrower shall from time to time, upon demand by Lender pay to Lender additional amounts sufficient to compensate Lender for such increased cost (which demand shall specify such additional amount). A certificate as to the amount of such increased cost, submitted to Borrower by Lender shall be conclusive and binding for all purposes, absent manifest error. Failure or delay on the part of Lender to demand compensation pursuant to this Section 1.07 shall not constitute a waiver of Lender’s right to demand such compensation; provided that Borrower shall not be required to compensate Lender pursuant to this Section 1.07 for any increased costs incurred or reductions suffered more than six (6) months prior to the date that Lender notifies Borrower of the event giving rise to such increased costs or reductions, and of Lender’s intention to claim compensation therefor (except that, if the applicable event giving rise to such increased costs or reductions is retroactive, then the six (6) month period referred to above shall be extended to include the period of retroactive effect thereof).

Section 1.08 Change in Law. Notwithstanding any other provision of the Loan Documents, if the introduction of or any change in or in the interpretation of any law or regulation shall make it unlawful, or any Governmental Authority shall assert that it is unlawful, for Lender to make any disbursements or to continue to maintain the Loan at the applicable Interest Rate (as defined in the Pagaré) in accordance with the terms of the Loan Documents, then (absent the mutual written agreement of Borrower and Lender on an alternative interest rate), on notice thereof and demand therefor by Lender to Borrower, (1) the Loan shall at the option of Lender be due and payable one hundred twenty (120) days after written notice to Borrower or such earlier date upon which it shall become unlawful for Lender to

- 14 -

make any disbursements or to continue to maintain the Loan at the applicable Interest Rate in accordance with the terms of the Loan Documents, provided that, anything in this Agreement to the contrary notwithstanding, no Prepayment Fee or Default Prepayment Fee will be due in connection therewith and (2) Borrower agrees in writing to pay or reimburse Lender (and shall pay or reimburse Lender) in accordance with Section 11.06 hereof for the payment of any costs, expenses, penalties, fines or other sums incurred by Lender as a result of such unlawfulness which becomes payable at any time when the Loan is outstanding in accordance with the terms of Section 1.04.

Section 1.09 Security. To secure the payment of all amounts owed to Lender pursuant to the Pagaré and any other amounts required to be paid by Borrower under this Agreement and any of the other Loan Documents with interest at the rates set forth therein and the full performance by Borrower of all of the other terms, covenants and obligations set forth in the Loan Documents (collectively, the “Secured Obligations”), Borrower has contemporaneously herewith executed and delivered the Security Trust Agreement, pursuant to which Borrower has assigned, conveyed, granted, transferred and warranted all of its right, title and interest in and to the Trust Property to the Security Trustee, in trust, for the benefit of Lender.

Article

II

CONDITIONS PRECEDENT TO DISBURSEMENT

Section 2.01 Initial Funding Disbursement. Borrower hereby agrees that Lender’s obligation to make the Initial Funding Disbursement shall be conditioned upon Borrowers’ satisfaction of any and all conditions required by Lender to be satisfied, including, without limitation, the following (the date of funding of the Initial Funding, the “Initial Funding Disbursement Date”):

(a) Conditions set forth in that certain Letter from Lender to Borrower dated April 14, 2016 and accepted and agreed to by Borrower April 21, 2016, which have been satisfied on or before the Execution Date (excluding those applicable to the Second Funding Trust Property).

(b) Lender shall have received a Pagaré in the form of Exhibit D executed by Borrower in favor of Lender in the amount of the Initial Funding.

(c) Lender shall have received an original of a letter executed by the notary public under which the Security Trust Agreement will be granted, in which such notary public certifies that all preventive notices (avisos preventivos) with respect to the assignment of the Trust Property (excluding the Second Funding Trust Property) in favor of the Trustee are in effect.

(d) The Initial Funding Disbursement Date Shall occur no later than July 28, 2016.

(e) In the event that the Initial Funding Disbursement Date is not the Execution Date, all representations and warranties made by Borrower in any Loan Document, the Unsecured Indemnity Agreement and in any certificate or other document delivered to Lender on the Execution Date shall be true and correct as of the Initial Funding Disbursement Date, and Borrower shall be deemed to remake each such representation and warranty upon Lender’s making of the Initial Funding.

Section 2.02 Second Funding Disbursement.

(a) The Second Funding shall be funded in one advance on the Second Funding Disbursement Date in accordance with the terms of this Section 2.02.

- 15 -

(b) Borrower hereby agrees that Lender’s obligation to make the Second Funding Disbursement shall be conditioned upon Borrowers’ satisfaction of any and all conditions required by Lender to be satisfied (the “Second Funding Disbursement Conditions”), including, without limitation, the following:

(i) Lender shall have received an original of a letter executed by the notary public under which the Security Trust Agreement will be granted, in which such notary public certifies that all preventive notices (avisos preventivos) with respect to the assignment of the Second Funding Trust Property in favor of the Trustee are in effect.

(ii) Borrower shall submit to Lender a Loan Request at least ten (10) days prior to the proposed Second Funding Disbursement Date (and no later than ten (10) days prior to the Second Funding End Date) and simultaneously with the Loan Request specify the anticipated Second Funding Disbursement Date;

(iii) The proposed Disbursement Date for the Second Funding Disbursement does not occur after the Second Funding End Date;

(iv) No default or Event of Default shall then exist under the Loan Documents or the Unsecured Indemnity Agreement;

(v) Lender shall have received payment of, in the event that the Second Funding Disbursement Date occurs on a day other than the first day of a calendar month, interest accruing on the Second Funding from the Second Funding Disbursement Date through the end of the month in which the Second Funding Disbursement Date occurs (which amounts shall be deducted and retained by Lender from the Second Funding Disbursement);

(vi) Borrower shall deliver to Lender a certification that all the representations and warranties set forth in in the Loan Documents and the Unsecured Indemnity Agreement are true and correct in all material respects as of the date of the making of the Second Funding Disbursement;

(vii) Borrower shall have complied with the requirements set forth in Section 14.01 or Section 14.03 hereof;

(viii) Lender shall have received replacement Pagaré in the form of Exhibit D hereto executed by Borrower in favor of Lender reflecting the Total Loan Amount and a revised repayment schedule for the Loan (which shall, for the avoidance of doubt, be prepared by Lender based on an amortization term equal to 360 months less the number of full interest accrual periods that have elapsed since the Execution Date and an assumed Interest Rate equal to the Interest Rate), together with evidence that Borrower has duly authorized and executed such replacement Pagaré. Except for the Total Loan Amount and the revised repayment schedule, the terms of the replacement Pagaré shall be same as the Pagaré delivered to Lender on the Execution Date;

(ix) The Second Funding Trust Properties shall be transferred to the Security Trustee pursuant to the Security Trust Agreement (and thereafter become part of the Trust Property) free and clear of all liens and encumbrances and otherwise in a manner acceptable to Lender;

- 16 -

(x) Borrower shall execute such amendments, ratifications and assumptions to the Loan Documents and Unsecured Indemnity Agreement reasonably requested by Lender in connection with the Second Funding Disbursement (including, without limitation, to cause the representations, covenants, indemnifications and other provisions of such agreements to apply to the Second Funding Trust Properties and to reflect that the Allocated Loan Amount for the Second Funding Trust Properties as determined by Lender in its sole discretion);

(xi) Borrower shall deliver to Lender such opinions of counsel related to the Second Funding Disbursement reasonably required by Lender;

(xii) Lender shall have received, at Borrower’s sole cost and expense, (1) title insurance policies for each of the Second Funding Trust Properties in form and substance satisfactory to Lender in all respects and (2) any endorsements to the title policies relating to the Trust Properties existing as of the Initial Funding Disbursement Date required by Lender relating to the addition of the Second Funding Trust Properties to the Security Trust, which endorsements shall be in form and substance satisfactory to Lender in all respects;

(xiii) Borrower shall have delivered an Officer’s Certificate certifying that the requirements of this Section 2.02 have been satisfied;

(xiv) Borrower shall have paid to Lender all out-of-pocket costs and expenses incurred by Lender in connection with the applicable Second Funding Disbursement, including, without limitation, title insurance premiums and the reasonable fees and expenses of Lender’s attorneys; and

(xv) Since the Execution Date, there has been no material adverse change to (a) any of the Second Funding Trust Properties or (b) in the business, assets or financial condition of Borrower that is likely to have a material adverse impact on Borrower’s ability to perform its obligations under the Loan Documents or the Unsecured Indemnity Agreement.

(c) Lender shall have no obligation to make the Second Funding Disbursement at any time during which a default or Event of Default is continuing. The making of the Second Funding Disbursement by Lender at the time when a default or Event of Default has occurred and is then continuing shall not be deemed a waiver or cure of that default or Event of Default, nor shall Lender’s rights and remedies be prejudiced in any manner thereby.

Article

III

BORROWER REPRESENTATIONS, WARRANTIES AND COVENANTS

Section 3.01 Due Authorization, Execution, and Delivery.

(a) Each Borrower represents and warrants that it is a sociedad de responsabilidad limitada de capital variable duly organized and validly existing under the laws of the United Mexican States (“Mexico”), that it has all necessary licenses, authorizations, registrations, permits and/or approvals to own its properties and to carry on its business as presently conducted.

- 17 -

(b) Each Borrower represents and warrants that the execution of the Loan Documents and the Unsecured Indemnity Agreement by such Borrower have been duly authorized and there is no provision in the organizational documents, or any other agreement, document or instrument of Borrower or under applicable law, requiring further consent for such action by any other person or entity.

(c) Each Borrower represents and warrants that the execution, delivery and performance of the Loan Documents and the Unsecured Indemnity Agreement by such Borrower will not result in such Borrower’s being in default under any provision of its organizational documents. Each Borrower represents and warrants that the execution, delivery and performance of the Loan Documents and the Unsecured Indemnity Agreement by such Borrower will not result in such Borrower’s being in default under any provision of any encumbrance, trust agreement, lease, credit or other agreement to which it is a party or which affects it or the Trust Property or any portion thereof, except where such default does not, or is not reasonably likely to, result in a Material Adverse Effect.

(d) Each Borrower represents and warrants that its legal representative has all the necessary powers and authorizations (organizational and otherwise) to execute and deliver the Loan Documents and the Unsecured Indemnity Agreement on its behalf, and that such powers and authorizations (organizational and otherwise) have not been revoked or limited in any way whatsoever.

(e) Each Borrower represents and warrants that the Loan Documents and the Unsecured Indemnity Agreement have been duly authorized, executed and delivered by Borrower and constitutes legal, valid, and binding obligations of Borrower which are enforceable in accordance with their respective terms except as may be limited by applicable Bankruptcy Law and general principles of equity (regardless of whether enforcement is sought in a proceeding in equity or at law).

(f) Borrower represents and warrants that there are no Liens (other than the Permitted Exceptions) filed against any Borrower or its properties that would be shown on a certificate of no Liens (constancia de folio mercantil y constancia de folio real sin anotaciones de gravamenes vigentes) issued by the public registry of commerce of the jurisdiction of each Borrower’s corporate domicile.

(g) Each Borrower represents that the execution and delivery of the Loan Documents do not, and the performance by such Borrower of its obligations thereunder will not, (a) result in a violation of the laws of Mexico, or, to the best of each Borrower’s knowledge, the United States of America, and the State of New York (including the rules or regulations promulgated thereunder or pursuant thereto), or any order, writ, judgment, injunction, decree, determination or award binding on any Borrower or (b) result in a breach of, a default under, or the acceleration of (or entitle any party to accelerate) the maturity of any obligation of any Borrower under, or result in or require the creation any Lien upon or security interest in any property of Borrower pursuant to the terms of, any agreement to which it is a party.

(h) Except as previously disclosed to Lender in writing prior to the closing of the Loan (the “Disclosed Litigations”), each Borrower represents that there is no action, suit, investigation, litigation, or proceeding against such Borrower pending or, to the best of such Borrower’s knowledge, threatened before any court, governmental agency or arbitrator that challenges the legality, validity or enforceability of any Loan Document or the Unsecured Indemnity Agreement. Each Borrower represents that the Disclosed Litigations do not, and are not reasonably likely to, have a Material Adverse Effect.

(i) All the representations and warranties made by Borrower in the Security Trust Agreement herein and in the Unsecured Indemnity Agreement are true, correct and accurate as of the date hereof.

- 18 -

Section 3.02 Performance by Borrower. Borrower shall pay the amounts owed under the Loan Documents and the Unsecured Indemnity Agreement to Lender and shall keep and perform each and every other obligation, covenant and agreement of the Loan Documents and the Unsecured Indemnity Agreement.

Section 3.03 Warranty of Title to Trust Property.

(a) Each Borrower warrants that in accordance with the Security Trust Agreement and subject to the existing Lease Agreements and the Permitted Exceptions, it has lawfully transferred and conveyed to the Security Trustee or that on or before the Execution Date will have lawfully transferred and conveyed to the Security Trustee (A) good, marketable, indefeasible and insurable fee simple absolute title to that portion of the Trust Property comprised of Real Property, and (B) good, sufficient and legal title to that portion of the Trust Property comprised of Personal Property. Borrower further represents and warrants that all of the information on Exhibit G attached to this Agreement is true, accurate and complete in all material respects.

(b) Each Borrower warrants that each individual Trust Property owned by it is (x) free from any conditions, limitations or restrictions on ownership except for the Permitted Exceptions, (y) not subject to any options or preemptive rights to purchase (including, without limitation, rights of first refusal or rights of first offer other than pursuant to the Lease Agreements or under applicable law) (and if subject to any such options or preemptive rights to purchase, all such options and preemptive rights to purchase have been duly waived to the extent described in the tenant estoppel certificates delivered to Lender in connection with the closing of the Loan with respect to existing Lease Agreements), and (z) current in the payment of all applicable Impositions (as defined below).

(c) Borrower further covenants to warrant and forever defend and indemnify Lender and the Security Trustee from and against all persons or entities claiming any interest in the Trust Property (other than pursuant to the Permitted Exceptions) or any portion thereof.

Section 3.04 Taxes, Liens and Other Charges.

(a) Borrower shall pay or cause to be paid all real estate, predial and other taxes, assessments, water charges, license or permit fees, Liens, fines, penalties, interest, contributions or other fiscal responsibilities, and other similar public and private claims which may be payable, assessed, levied, imposed upon or become a Lien on or against any portion of the Trust Property (all of the foregoing items are collectively referred to as the “Impositions”). Each Imposition shall be paid no later than the date on which such Imposition would become delinquent and Borrower shall produce to Lender receipts of the imposing authority, or other evidence reasonably satisfactory to Lender, evidencing the payment of the Imposition in full.

(b) If Borrower elects by appropriate legal action to contest any Imposition, Borrower shall (1) (i) provide to Lender evidence of payment of the Imposition in full, or (ii) provide to Lender evidence of (A) payment of a bond or (B) any other guaranty permitted by applicable law, in order to secure in favor of the relevant Governmental Authority the full payment of the Imposition in an amount sufficient to pay the contested Imposition plus all fines, interest, penalties and costs which may become due pending the determination of the contest which such guaranty or bond shall remain in full force and effect for the duration of the contest proceeding, and if Borrower fails to comply with the foregoing, then (2) Borrower shall deposit cash with Lender as a reserve in an amount which Lender determines is sufficient to pay the Imposition plus all fines, interest, penalties and costs which may become due pending the determination of the contest. Upon Borrower’s deposits of this reserve with Lender or pursuant to the requirements of the legal action, as applicable, Borrower shall not be required to pay the Imposition

- 19 -

provided that the contest operates to prevent enforcement or collection of the Imposition, and the sale or forfeiture of, the Trust Property or any portion thereof, and is prosecuted with due diligence and continuity. Upon termination of any such proceeding or contest, Borrower shall pay the amount of the Imposition as finally determined in the proceeding or contest. Provided that there is not then an Event of Default, the monies which have been deposited with Lender pursuant to this Section 3.04 shall be applied toward such payment and the excess, if any, shall be returned to Borrower.

(c) In the event of the passage, after the Execution Date, of any law which deducts from the value of any individual Trust Property, for the purposes of taxation, any lien or security interest encumbering such Trust Property, or changes in any way the existing laws regarding the taxation of security trust agreements, and/or security agreements or debts secured by these instruments, or changes the manner for the collection of any such taxes, and the law has the effect of imposing payment of any Imposition upon Lender, at Lender’s option, the Secured Obligations shall immediately become due and payable. Notwithstanding the preceding sentence, Lender’s election to accelerate the Loan shall not be effective if (i) Borrower is permitted by law (including, without limitation, applicable interest rate laws) to, and actually does, pay the Imposition or the increased portion of the Imposition and (ii) Borrower agrees in writing to pay or reimburse Lender in accordance with Section 11.06 hereof for the payment of any such Imposition which becomes payable at any time when the Loan is outstanding. Notwithstanding the foregoing or anything in this Agreement to the contrary, in the event that Borrower is not permitted by law to pay the Imposition or the increased portion of the Imposition, no Prepayment Fee or Default Prepayment Fee shall be payable by Borrower in connection with any prepayment or repayment of the Loan made pursuant to this Section 3.04(c).

(d) Borrower represents and warrants that each Borrower is current in the payment of any and all Impositions which are due and payable as of the date hereof.

Section 3.05 Escrow Deposits.

(a) Subject to Section 3.05(c) below, Borrower shall deposit with Lender, in an account to be designated by Lender, on the first day of each month an amount equal to one twelfth (1/12) of the amounts Lender has notified Borrower in writing are the amounts which Lender has reasonably determined are necessary to pay, on an annualized basis, (i) all Impositions, (ii) all premiums required to maintain the insurance policies more fully described in Article 4 (together with the Impositions, the “Payments”) until such time as Borrower has deposited an amount equal to the annual charges for the Payments (the “Escrow Deposits”) and on demand, Borrower shall pay to Lender from time to time any shortfall in the amounts required to pay the Payments. Borrower will furnish bills for all Payments to Lender on the earlier of thirty (30) days before any Payment shall become due or receipt of such bill. No payments shall be deemed to be trust funds and these funds may be commingled with the general funds of Lender. Lender shall have no obligation to pay interest to Borrower with respect to the Escrow Deposits. If no Event of Default shall exist, all Escrow Deposits shall be applied to the Payments prior to their becoming delinquent and the excess, if any, shall continue to be held as Escrow Deposits to be used as provided herein. If an Event of Default shall exist the Escrow Deposits shall be applied, at Lender’s option, to curing of such Event of Default or the payment of the Secured Obligations.

(b) If any Escrow Deposit is not deposited in the account designated therefor by Lender within seven (7) days after the date on which such deposit is due, Lender shall have the option to charge Borrower a late fee equal to four percent (4%) of the amount of the deficiency.

(c) Notwithstanding anything contained in this Agreement or the Security Trust Agreement to the contrary, Lender shall not require the Escrow Deposits unless and until any one of the following shall have occurred: (i) a Default or an Event of Default exists under the Loan Documents or

- 20 -

the Unsecured Indemnity Agreement; (ii) there shall be a Transfer (as hereinafter defined) in violation of the terms of the Loan Documents; or (iii) at any time any Borrower fails to furnish to Lender and the Security Trustee, not later than ten (10) days before the dates on which any insurance premiums would become delinquent, receipts for the payment of such insurance premiums or appropriate proof of issuance of a new policy which continues in force the insurance coverage of the existing policy. If any of the foregoing events shall occur, Lender reserves the right to require Escrow Deposits from Borrower at any time in its absolute discretion notwithstanding the fact that the Event of Default shall have been cured, or that the Transfer shall later have been approved in writing or otherwise by Lender.

Section 3.06 Care And Use Of The Trust Property.

(a) Borrower represents and warrants to Lender as follows:

(i) All authorizations, approvals, licenses, and permits required for the occupancy of the “Improvements” (as defined in Exhibit A) for the Use have been obtained, paid for and are in full force and effect, and Borrower shall enforce the terms of the Lease Agreements (provided that it is understood that such enforcement shall be conducted in a manner consistent with Borrower’s standard management practices) to cause the tenants of the Trust Property to obtain and maintain in full force and effect all authorizations, approvals, licenses, and permits required for the operation and occupancy of the Improvements for the Use.

(ii) The Improvements, all plazas, parking facilities and landscaping upon the described “Land” (as defined in Exhibit A) and their Use comply with (and no notices of violation have been received in connection with) all Requirements (other than with respect to de minimis violations that do not have, and are not reasonably likely to have, a Material Adverse Effect) and Borrower shall at all times comply with all present or future Requirements affecting or relating to the ownership, operation, construction, occupancy or Use of the Trust Property (other than with respect to de minimis violations that do not, and are not reasonably likely to have, have a Material Adverse Effect). Borrower shall furnish Lender, on request, proof of compliance with the Requirements (other than with respect to de minimis violations that do not have, and are not reasonably likely to have, a Material Adverse Effect). No Borrower shall use or permit the use of any individual Trust Property, or any part thereof, for any illegal purpose.