As of September 30, 2023, our properties in the Querétaro Aerospace Park had an aggregate GLA of 2,337,248 square feet (217,137 square meters), of which 98.4% was leased under long-term leases. In the nine-month period ended September 30, 2023, the quarterly rent per square foot of the Querétaro Aerospace Park was equal to US$1.6 million.

As of December 31, 2022, our properties in the Querétaro Aerospace Park had an aggregate GLA of 2,256,090 square feet (209,598 square meters), of which 97.9% was leased under long-term term leases with their tenants. In 2021 and 2022, the annual rent per square foot of the Querétaro Aerospace Park was equal to US$6.9 million and US$6.2 million, respectively.

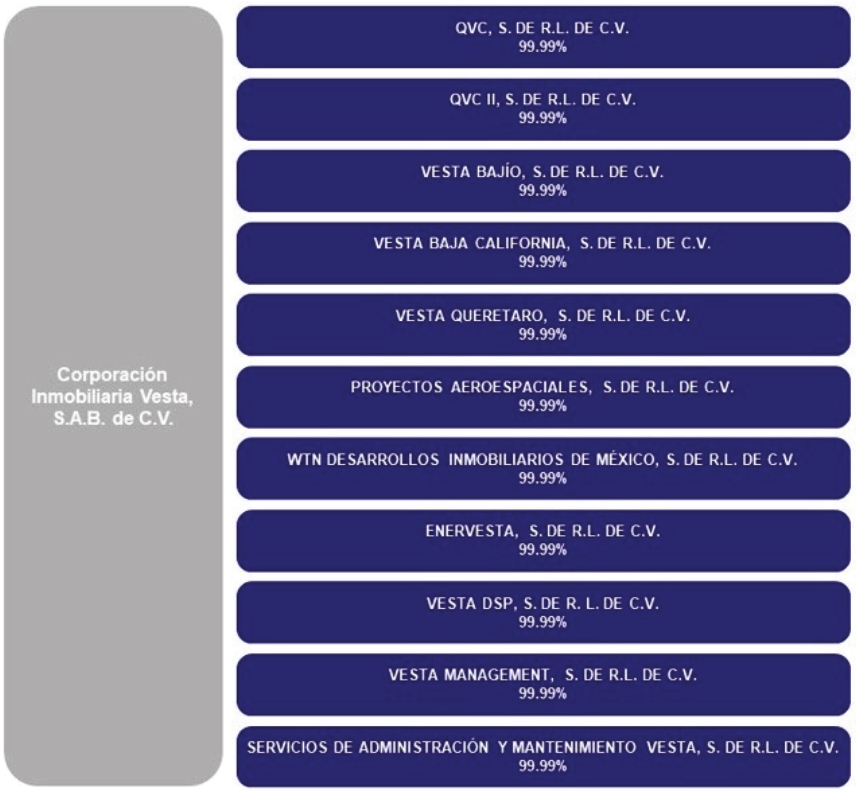

Proyectos Aeroespaciales is a joint venture established in 2007 between us and Neptuno Real Estate, S. de R.L. de C.V., an entity controlled by General Electric for purposes of the development of the Querétaro Aerospace Park. In December 2009, we acquired General Electric’s interest in Proyectos Aeroespaciales for a purchase price equal to 50.0% of the value of the enterprise. The financing for the acquisition was supplied by General Electric and secured through rental income flows generated by the leases in effect at the time. Concurrently with this acquisition, Proyectos Aeroespaciales assigned some of its collection rights to CIV Infraestructura, S. de R.L. de C.V. The General Electric loan has been repaid in full and CIV Infraestructura, S. de R.L. de C.V. was merged into Proyectos Aeroespaciales.

Douki Seisan Park

In connection with a private bidding process held by Nissan Mexicana, S.A. de C.V., or “Nissan,” in July 2012, we were awarded exclusive developer and operator rights with respect to the Douki Seisan Park. This park, which is located adjacent to Nissan’s A2 assembly plant in the Mexican state of Aguascalientes, is intended to accommodate strategic Nissan suppliers who require of close proximity to that plant.

The development and operation of the Douki Seisan Park are governed by a trust agreement dated July 9, 2013, among Nissan, as grantor and beneficiary, our subsidiary Vesta DSP, also as grantor and beneficiary, and CI Banco, S.A., Institución de Banca Múltiple (which replaced Deutsche Bank Mexico, S.A., Institución de Banca Múltiple, División Fiduciaria), as trustee. We refer to this trust agreement, as amended on December 17, 2013 and October 3, 2016, as the “Nissan Trust.” Nissan contributed to the Nissan Trust, for our benefit, the right to use (but not its title to) the land for purposes of the development and construction of the Douki Seisan Park. As consideration therefor, we have the right to lease and collect rental payments in respect of all buildings at the Douki Seisan Park for a period of 40 years, which we expect will allow us to recover our investment, which amounted to approximately US$72.7 million. Upon expiration of the Nissan Trust, all rights and title to the Douki Seisan Park, including the land and any properties, renovations, expansions and improvements will revert to Nissan. Since Nissan holds the title to the land in which the Douki Seisan Park is constructed, Nissan pays the real estate taxes with respect to this land.

Under the Nissan Trust, space at the Douki Seisan Park may be leased only to Nissan suppliers approved by the board of trustees of the Nissan Trust, which is comprised of representatives of both Nissan and Vesta DSP. Nissan suppliers who currently lease space from us at the Douki Seisan Park include Posco (metal parts), Tachi-S (car seats), Sanoh (fuel systems), Voestalpine (steel and other metals for high-technology systems), Toyota-Tsusho (rim and tire assemblies) and Plastic Omnium (parts for interiors). We also serve Daimler, which began operations in the region in 2018.

As of September 30, 2023, our properties in the Douki Seisan Park had an aggregate GLA of 2,143,262 square feet (199,116 square meters), of which 98.5% was leased under long-term leases. In the nine-month period ended September 30, 2023, the quarterly rent per square foot of the Douki Seisan Park was equal to US$1.5 million.

As of December 31, 2022, our properties in the Douki Seisan Park had an aggregate GLA of 2,143,262 square feet (199,116 square meters), of which 98.5% was leased under long-term term leases. In 2021 and 2022, the annual rent per square foot of the Douki Seisan Park was equal to US$5.4 million and US$5.7 million, respectively.

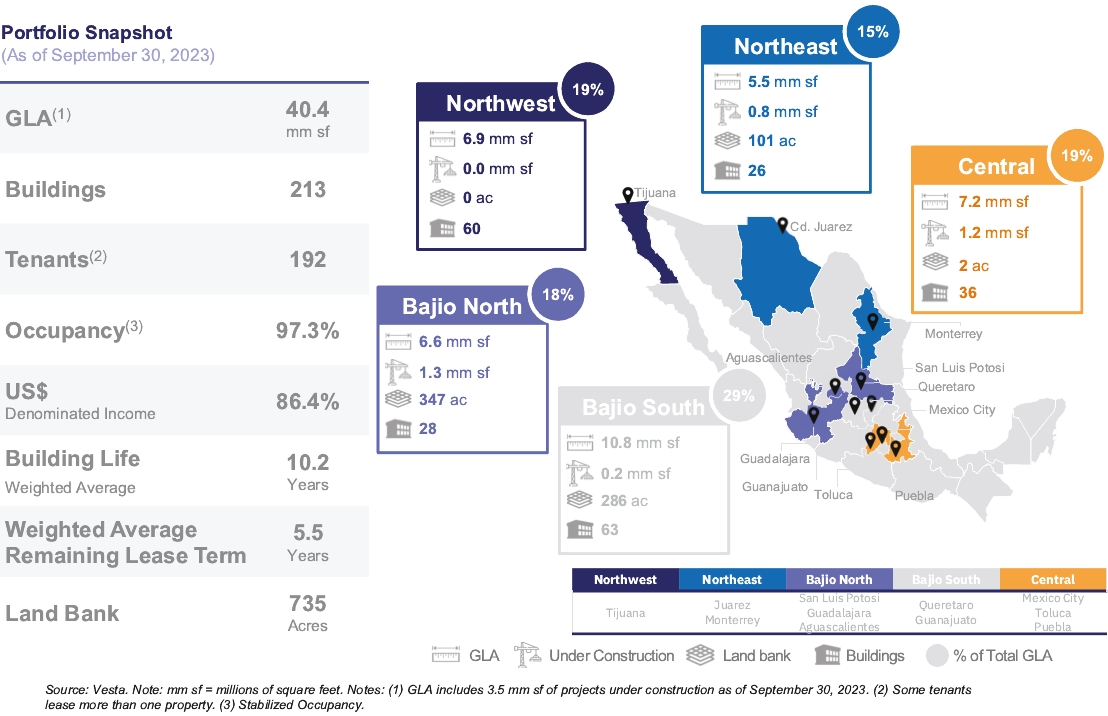

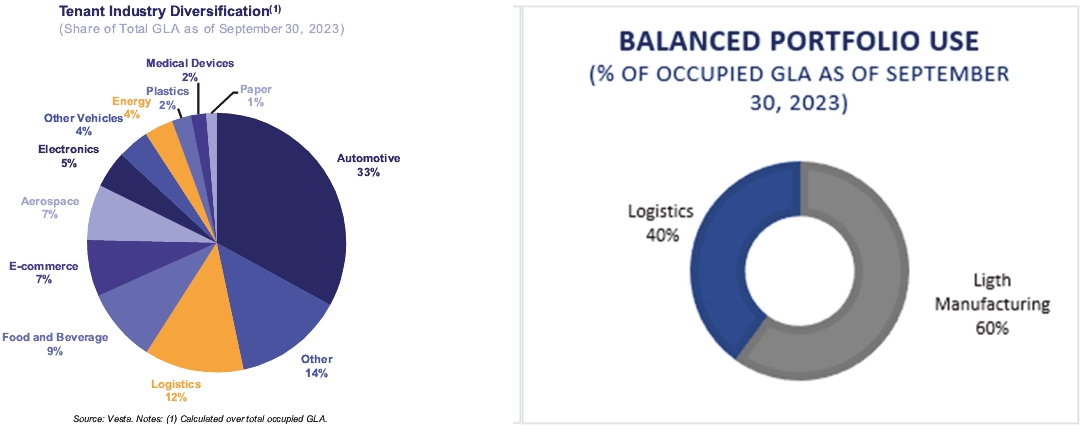

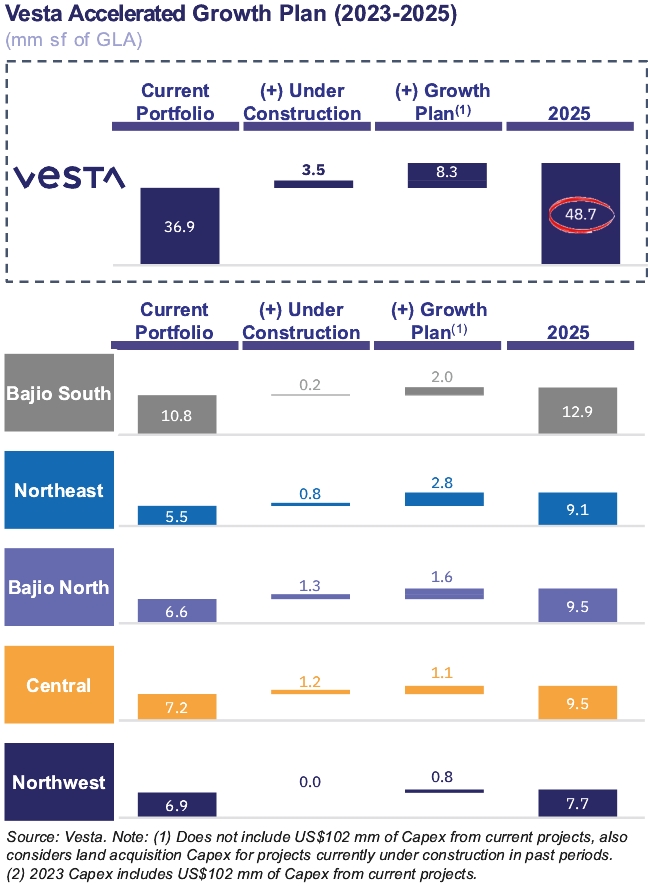

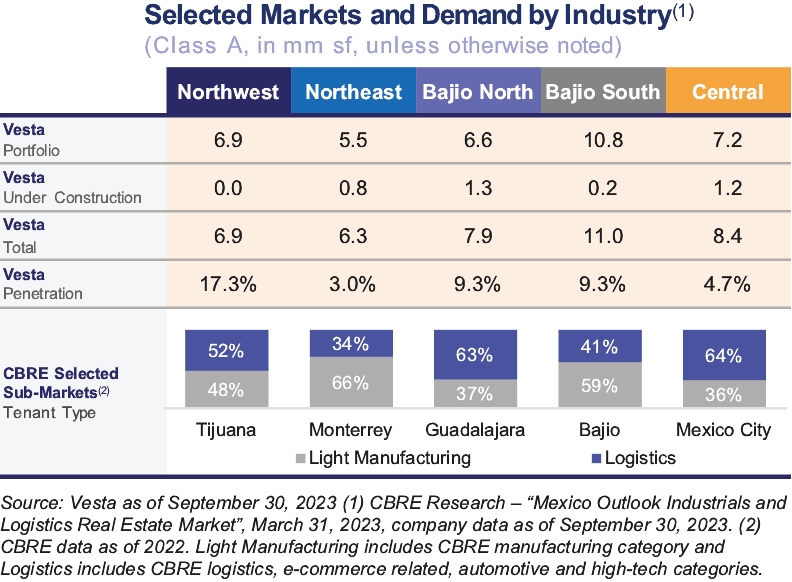

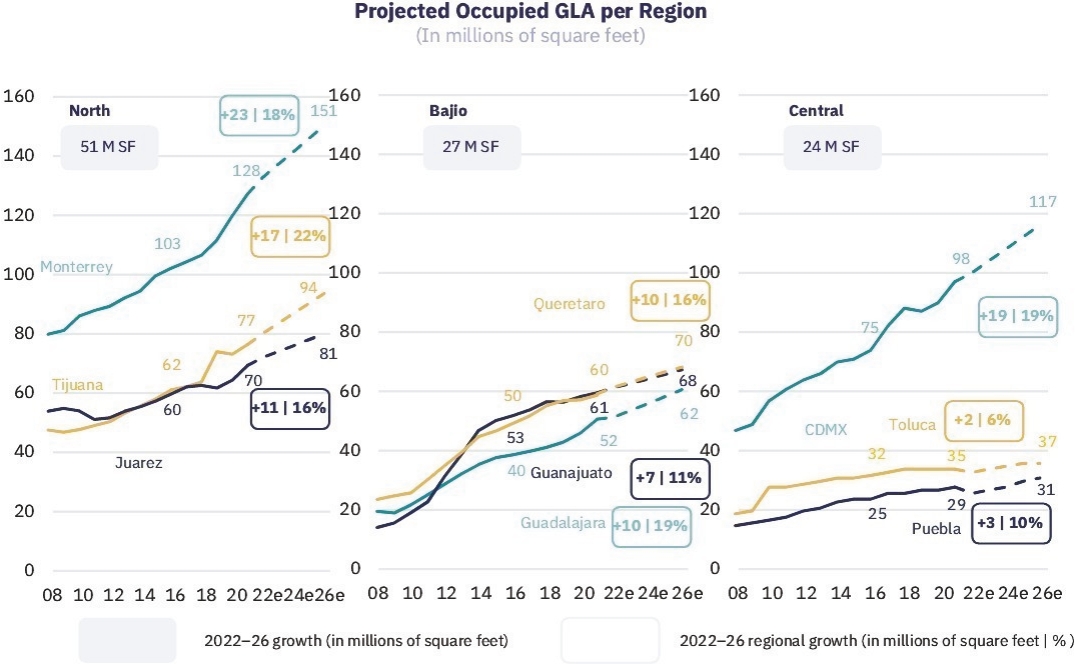

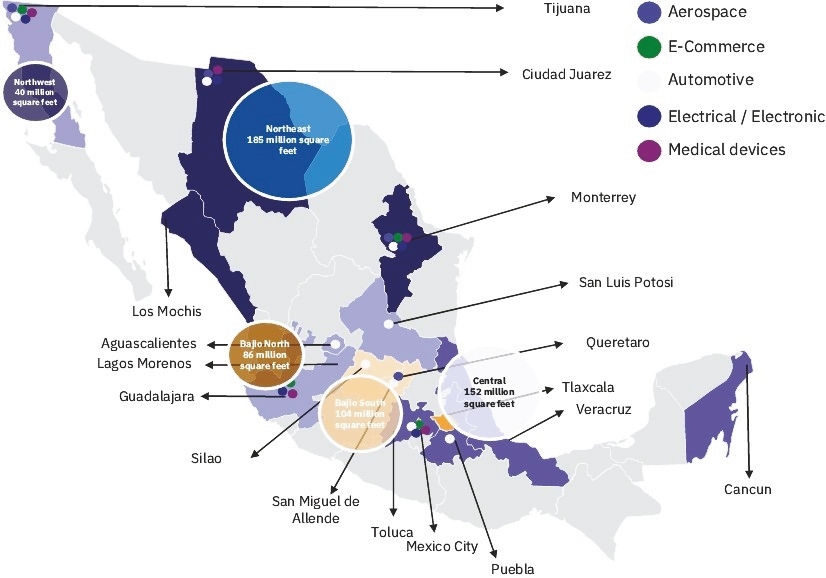

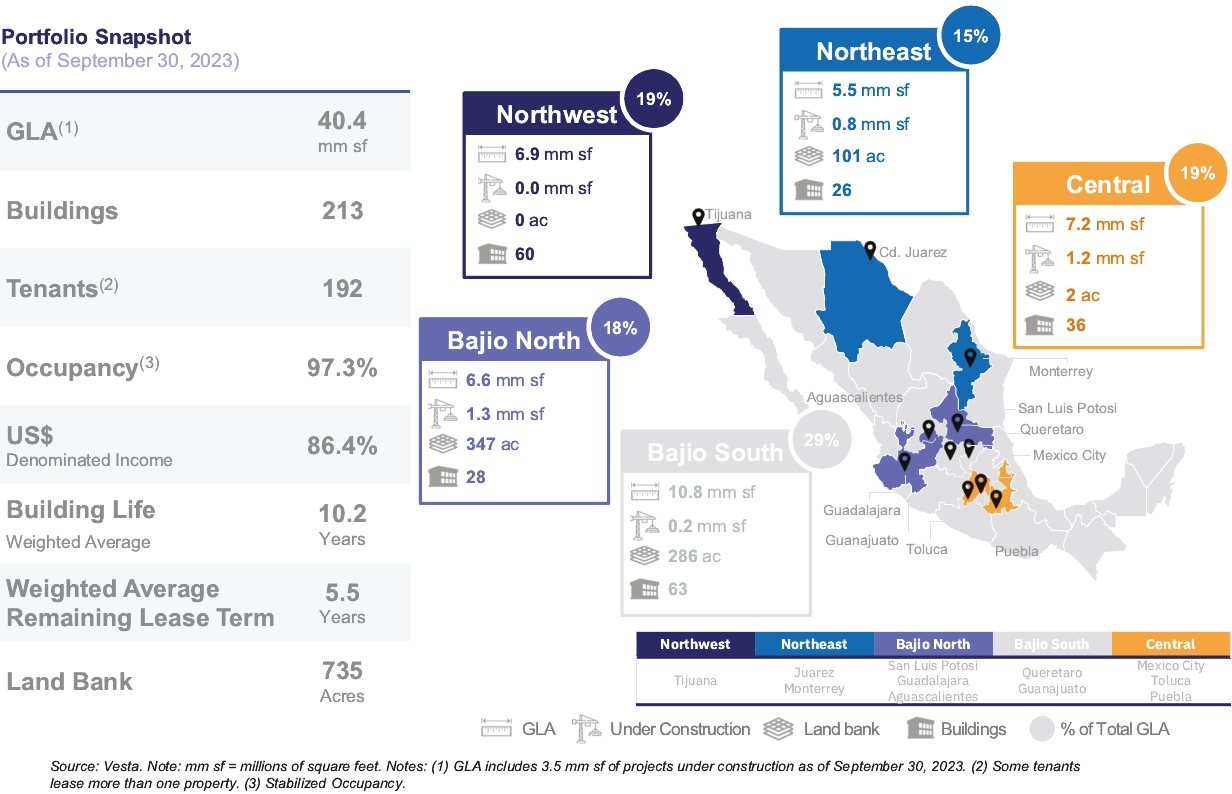

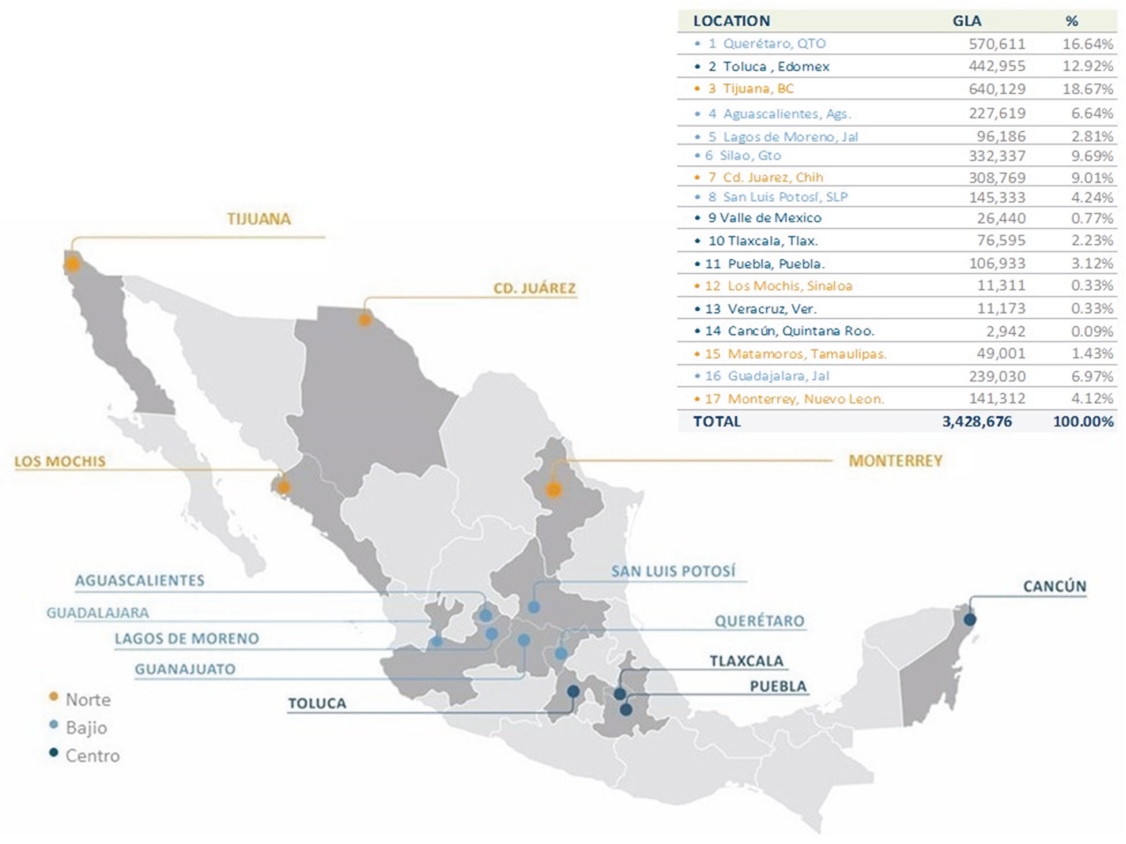

Geographic and Industry Diversification

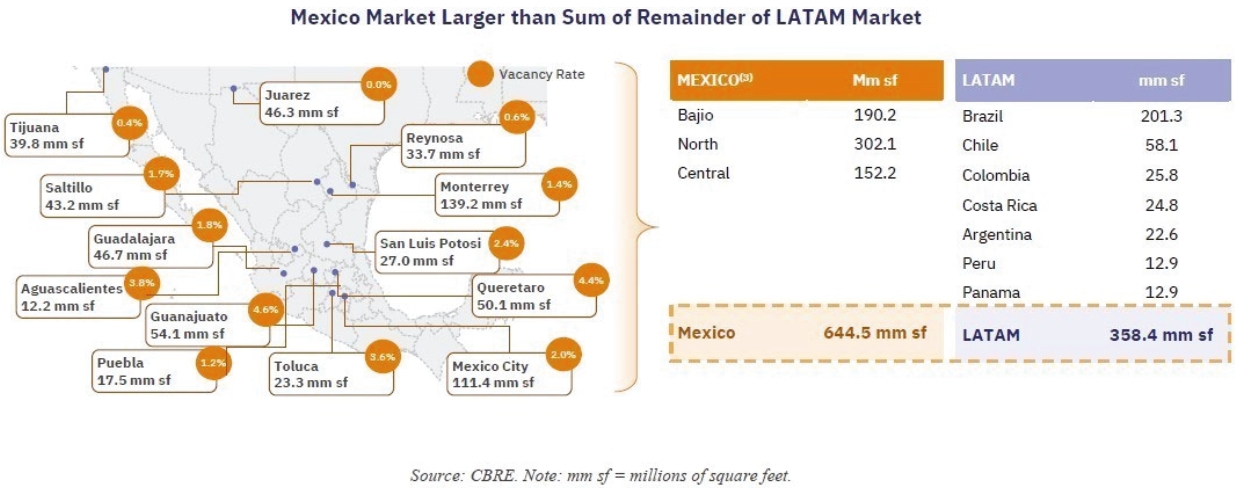

We believe that we have assembled a portfolio of high-quality industrial properties that is well diversified in terms of types of assets, geographic markets and tenant base, and which provides our shareholders with exposure to a broad range of properties throughout Mexico. Our properties are located in strategic areas for light manufacturing and logistics in 15 Mexican states, namely: Aguascalientes, Baja California, Chihuahua, Guanajuato, Jalisco, México, Nuevo León, Puebla, Querétaro, Quintana Roo, San Luis Potosí, Sinaloa, Tamaulipas, Tlaxcala and Veracruz.