Corporación Inmobiliaria Vesta, S. A. B. de C. V. and Subsidiaries Consolidated Financial Statements for the Years Ended December 31, 2024, 2023 and 2022, and Independent Auditor’s Report Dated February 14, 2025

Corporación Inmobiliaria Vesta, S. A. B. de C. V. and Subsidiaries Independent Auditor’s Report and Consolidated Financial Statements for 2024, 2023 and 2022 Table of contents Page Independent Auditor’s Report 1 Consolidated Statements of Financial Position 5 Consolidated Statements of Profit and Other Comprehensive Income (Loss) 7 Consolidated Statements of Changes in Stockholders’ Equity 8 Consolidated Statements of Cash Flows 9 Notes to Consolidated Financial Statements 10

Independent Auditor’s Report to the Board of Directors and Stockholders of Corporación Inmobiliaria Vesta, S. A. B. de C. V. (in US dollars) Opinion We have audited the consolidated financial statements of Corporación Inmobiliaria Vesta, S. A. B. de C. V. and subsidiaries (the “Entity”), which comprise the consolidated statements of financial position as of December 31, 2024, 2023 and 2022, and the consolidated statements of profit and other comprehensive income (loss), consolidated statements of changes in stockholders’ equity and consolidated statements of cash flows for the years then ended, and notes to the consolidated financial statements, including material accounting policies. In our opinion, the accompanying consolidated financial statements present fairly, in all material respects, the consolidated financial position of the Entity as of December 31, 2024, 2023 and 2022 and its financial performance and its cash flows for the years then ended in accordance with IFRS Accounting Standards as issued by the International Accounting Standards Board (IASB). Basis for Opinion We conducted our audits in accordance with International Standards on Auditing (ISAs). Our responsibilities under those standards are further described in the Auditor’s Responsibilities for the Audit of the Consolidated Financial Statements section of our report. We are independent of the Entity in accordance with the International Ethics Standards Board for Accountants’ International Code of Ethics for Professional Accountants (“IESBA Code”) together with the Code of Ethics issued by the Mexican Institute of Public Accountants (“IMCP Code”), and we have fulfilled our other ethical responsibilities in accordance with the IESBA Code and with the IMCP Code. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our opinion. Other Matters The accompanying consolidated financial statements have been translated into English for the convenience of readers. Key Audit Matters Key audit matters are those matters that, in our professional judgment, were of most significance in our audit of the consolidated financial statements of the current period. These matters were addressed in the context of our audit of the consolidated financial statements as a whole, and in forming our opinion thereon, and we do not provide a separate opinion on these matters. Deloitte se refiere a Deloitte Touche Tohmatsu Limited, sociedad privada de responsabilidad limitada en el Reino Unido, y a su red de firmas miembro, cada una de ellas como una entidad legal única e independiente. Conozca en www.deloitte.com/mx/conozcanos la descripción detallada de la estructura legal de Deloitte Touche Tohmatsu Limited y sus firmas miembro. Galaz, Yamazaki, Ruiz Urquiza, S.C. Paseo de la Reforma 505, piso 28 Colonia Cuauhtémoc 06500 Ciudad de México México Tel: +52 (55) 5080 6000 www.deloitte.com/mx

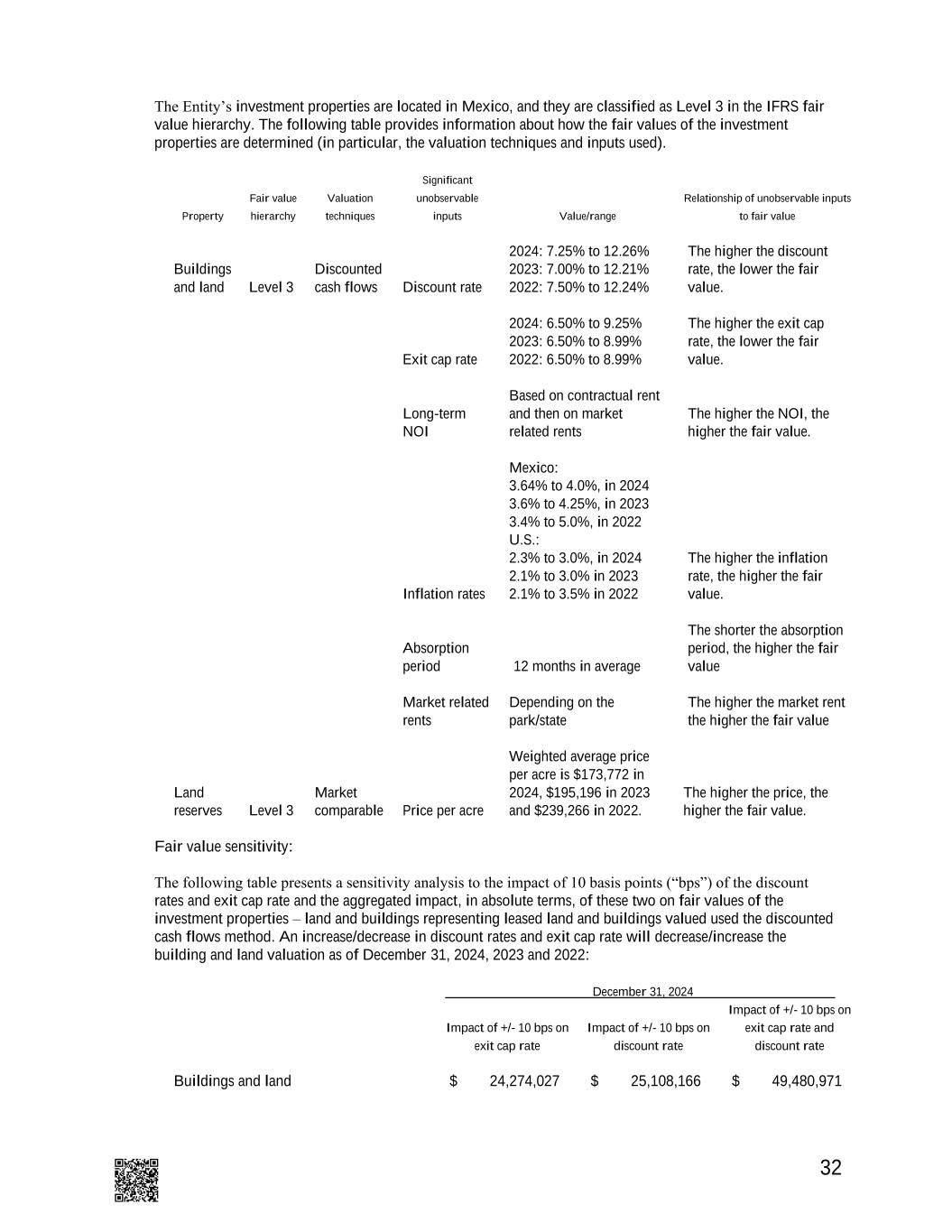

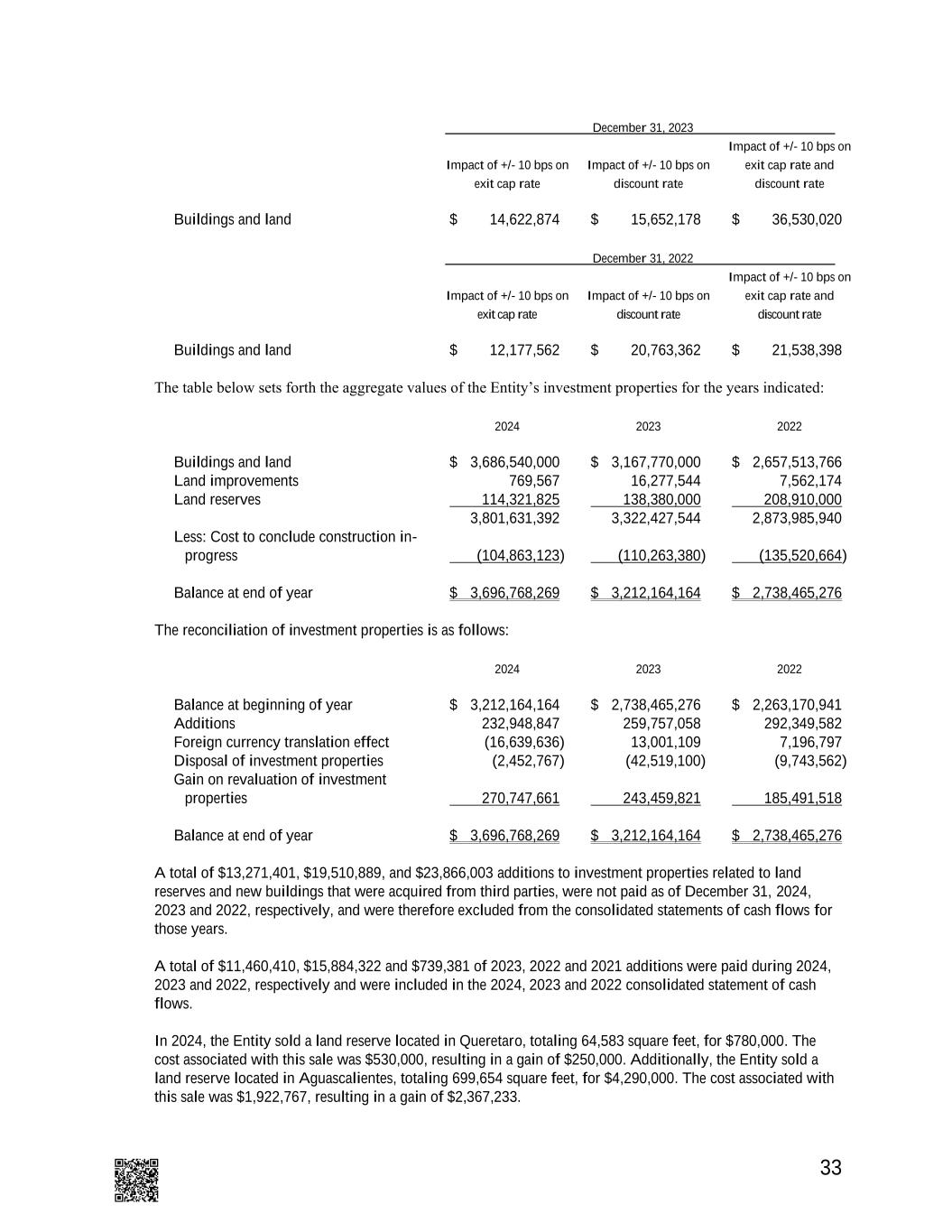

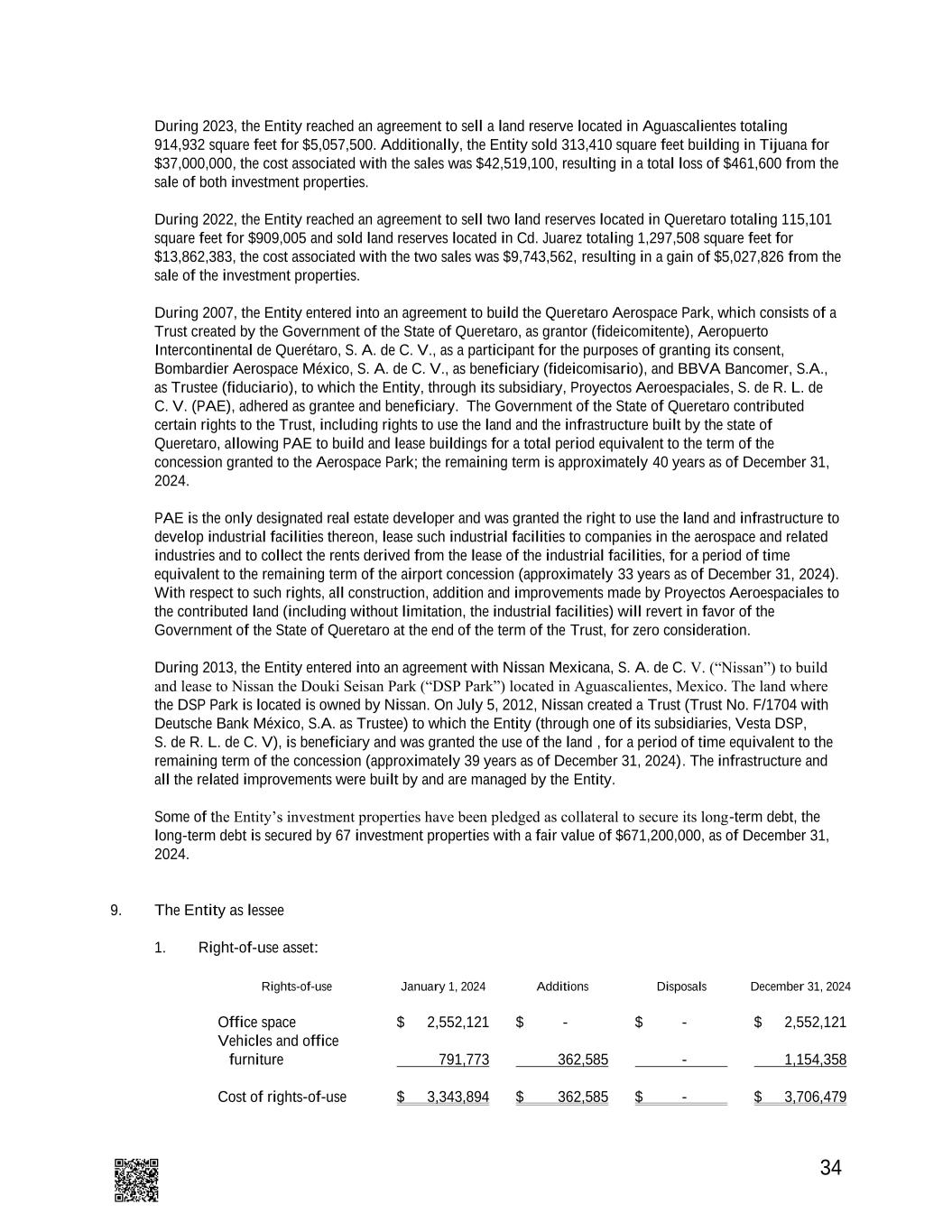

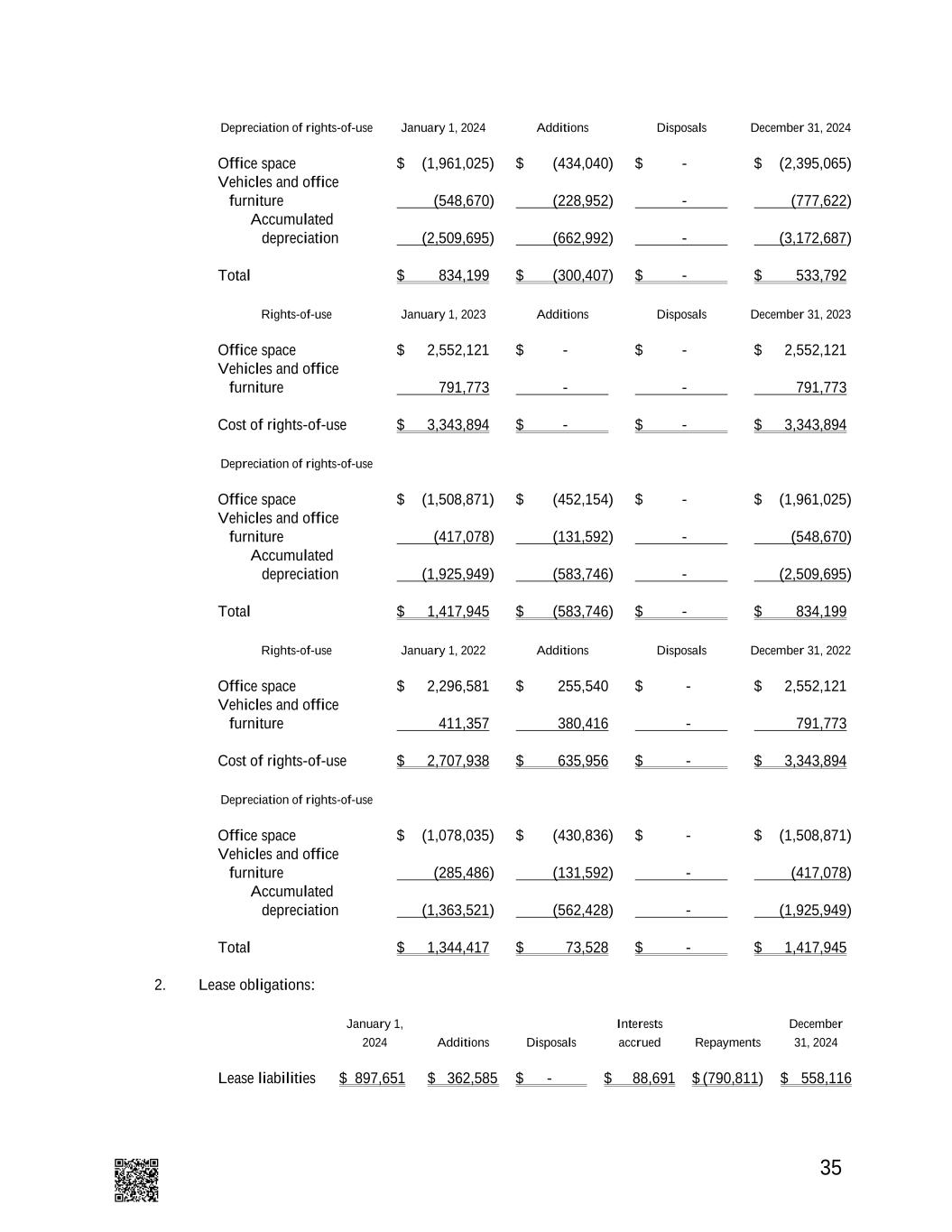

2 Fair value of investment properties The Entity engages external appraisers to assist with the determination of the fair value of the investment properties. The external appraisers use valuation techniques, including the discounted cash flows approach, replacement cost approach and income cap rate approach. In determining the fair value, the external appraisers also consider factors and assumptions such as discount rates, long-term net operating income, inflation rates, absorption periods and market rents. Any gains or losses resulting from changes in fair value, are recognized in profit or loss in the period in which they occur. We identified the fair value of investment properties as a key audit matter due to the significant judgments and estimates involved in the valuation process. Minor changes in the key assumptions used, could materially impact the reported fair value. Addressing this matter required a high degree of auditor judgement and significant audit effort, including the involvement of our internal fair value specialists. Our audit procedures for assessing the fair value of the Entity’s investment properties included the following, among others: We obtained an understanding of the Entity's methodology for determining the fair value of its investment properties, including an understanding and evaluation of the related internal controls. For a selected sample of investment properties, we perform detail procedures on the valuation, including, but not limited to, engaging internal fair value specialists to review the methodologies used by the external appraisers and the key factors and assumptions contained in the investment property appraisal, focusing on market rents, discount rates, and terminal capitalization rates. Based on this information, our specialists calculated independent fair value ranges and compared them to the values determined by the Entity’s external appraisers. Finally, we conduct site visits to prove the existence of the investment properties. The results of our procedures indicate that the investment properties' valuations are reasonable within the context of the consolidated financial statements as a whole. Information other than the Consolidated Financial Statements and Auditor’s Report Management is responsible for the other information. The other information comprises the information that will be incorporated in the Annual Report which the Entity is required to prepare in accordance with article 33, Section I, numeral b) of Title Fourth, Chapter First of the General Provisions Applicable to Issuers and other Stock Market Participants in Mexico and the Guidelines accompanying these provisions (the “Provisions”). The Annual Report is expected to be made available to us after the date of this auditors’ report. Our opinion on the consolidated financial statements does not cover the other information and we will not express any form of assurance conclusion thereon. In connection with our audit of the consolidated financial statements, our responsibility is to read the other information identified above when it becomes available and, in doing so, consider whether the other information is materially inconsistent with the consolidated financial statements or our knowledge obtained in the audit, or otherwise appears to be materially misstated. When reading the Annual Report, we will issue a declaration on this regard, as required by Article 33 Section I, paragraph b) numeral 1.2. of the Provisions. Responsibilities of Management and Those Charged with Governance for the Consolidated Financial Statements Management is responsible for the preparation and fair presentation of the consolidated financial statements in accordance with IFRS Accounting Standards as issued by the IASB, and for such internal control as management determines is necessary to enable the preparation of consolidated financial statements that are free from material misstatement, whether due to fraud or error. Deloitte.

3 In preparing the consolidated financial statements, management is responsible for assessing the Entity’s ability to continue as a going concern, disclosing, as applicable, matters related to going concern and using the going concern basis of accounting unless management either intends to liquidate the Entity or to cease operations, or has no realistic alternative but to do so. Those charged with governance are responsible for overseeing the Entity’s financial reporting process. Auditor’s Responsibilities for the Audit of the Consolidated Financial Statements Our objectives are to obtain reasonable assurance about whether the consolidated financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditor’s report that includes our opinion. Reasonable assurance is a high level of assurance, but is not a guarantee that an audit conducted in accordance with ISAs will always detect a material misstatement when it exists. Misstatements can arise from fraud or error and are considered material if, individually or in the aggregate, they could reasonably be expected to influence the economic decisions of users taken on the basis of these consolidated financial statements. As part of an audit in accordance with ISAs, we exercise professional judgment and maintain professional skepticism throughout the audit. We also: Identify and assess the risks of material misstatement of the consolidated financial statements, whether due to fraud or error, design and perform audit procedures responsive to those risks, and obtain audit evidence that is sufficient and appropriate to provide a basis for our opinion. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control. Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Entity’s internal control. Evaluate the appropriateness of accounting policies used and the reasonableness of accounting estimates and related disclosures made by management. Conclude on the appropriateness of management’s use of the going concern basis of accounting and, based on the audit evidence obtained, whether a material uncertainty exists related to events or conditions that may cast significant doubt on the Entity’s ability to continue as a going concern. If we conclude that a material uncertainty exists, we are required to draw attention in our auditor’s report to the related disclosures in the consolidated financial statements or, if such disclosures are inadequate, to modify our opinion. Our conclusions are based on the audit evidence obtained up to the date of our auditor’s report. However, future events or conditions may cause the Entity to cease to continue as a going concern. Evaluate the overall presentation, structure and content of the consolidated financial statements, including the disclosures, and whether the consolidated financial statements represent the underlying transactions and events in a manner that achieves fair presentation. Obtain sufficient and appropriate audit evidence regarding the financial information of the entities or business activities within the Entity as a basis for forming an opinion on the consolidated financial statements. We are responsible for the direction, supervision and review of the audit work performed for purposes of the group audit. We remain solely responsible for our audit opinion. Deloitte.

4 We communicate with those charged with governance regarding, among other matters, the planned scope and timing of the audit and significant audit findings, including any significant deficiencies in internal control that we identify during our audit. We also provide those charged with governance with a statement that we have complied with relevant ethical requirements regarding independence, and to communicate with them all relationships and other matters that may reasonably be thought to bear on our independence, and where applicable, actions taken to eliminate threats or safeguards applied. From the matters communicated with those charged with governance, we determine those matters that were of most significance in the audit of the consolidated financial statements of the current period and are therefore the key audit matters. We describe these matters in our auditor’s report unless law or regulation precludes public disclosure about the matter or when, in extremely rare circumstances, we determine that a matter should not be communicated in our report because the adverse consequences of doing so would reasonably be expected to outweigh the public interest benefits of such communication. Galaz, Yamazaki, Ruiz Urquiza, S. C. Affiliate of a Member of Deloitte Touche Tohmatsu Limited C. P. C. Alexis Hernández Almanza Mexico City, Mexico February 14, 2025 Deloitte.

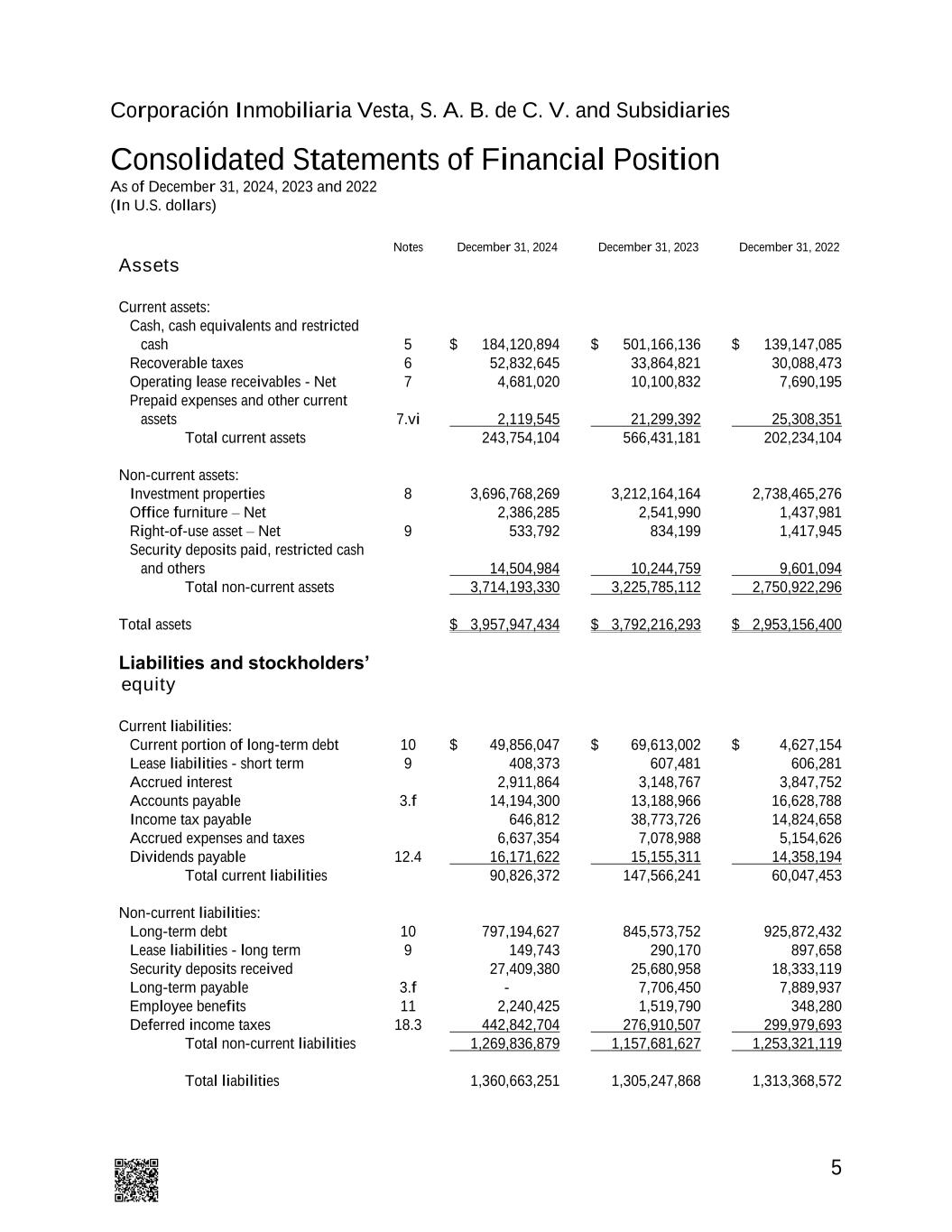

5 Corporación Inmobiliaria Vesta, S. A. B. de C. V. and Subsidiaries Consolidated Statements of Financial Position As of December 31, 2024, 2023 and 2022 (In U.S. dollars) Notes December 31, 2024 December 31, 2023 December 31, 2022 Assets Current assets: Cash, cash equivalents and restricted cash 5 $ 184,120,894 $ 501,166,136 $ 139,147,085 Recoverable taxes 6 52,832,645 33,864,821 30,088,473 Operating lease receivables - Net 7 4,681,020 10,100,832 7,690,195 Prepaid expenses and other current assets 7.vi 2,119,545 21,299,392 25,308,351 Total current assets 243,754,104 566,431,181 202,234,104 Non-current assets: Investment properties 8 3,696,768,269 3,212,164,164 2,738,465,276 Office furniture – Net 2,386,285 2,541,990 1,437,981 Right-of-use asset – Net 9 533,792 834,199 1,417,945 Security deposits paid, restricted cash and others 14,504,984 10,244,759 9,601,094 Total non-current assets 3,714,193,330 3,225,785,112 2,750,922,296 Total assets $ 3,957,947,434 $ 3,792,216,293 $ 2,953,156,400 Liabilities and stockholders’ equity Current liabilities: Current portion of long-term debt 10 $ 49,856,047 $ 69,613,002 $ 4,627,154 Lease liabilities - short term 9 408,373 607,481 606,281 Accrued interest 2,911,864 3,148,767 3,847,752 Accounts payable 3.f 14,194,300 13,188,966 16,628,788 Income tax payable 646,812 38,773,726 14,824,658 Accrued expenses and taxes 6,637,354 7,078,988 5,154,626 Dividends payable 12.4 16,171,622 15,155,311 14,358,194 Total current liabilities 90,826,372 147,566,241 60,047,453 Non-current liabilities: Long-term debt 10 797,194,627 845,573,752 925,872,432 Lease liabilities - long term 9 149,743 290,170 897,658 Security deposits received 27,409,380 25,680,958 18,333,119 Long-term payable 3.f - 7,706,450 7,889,937 Employee benefits 11 2,240,425 1,519,790 348,280 Deferred income taxes 18.3 442,842,704 276,910,507 299,979,693 Total non-current liabilities 1,269,836,879 1,157,681,627 1,253,321,119 Total liabilities 1,360,663,251 1,305,247,868 1,313,368,572

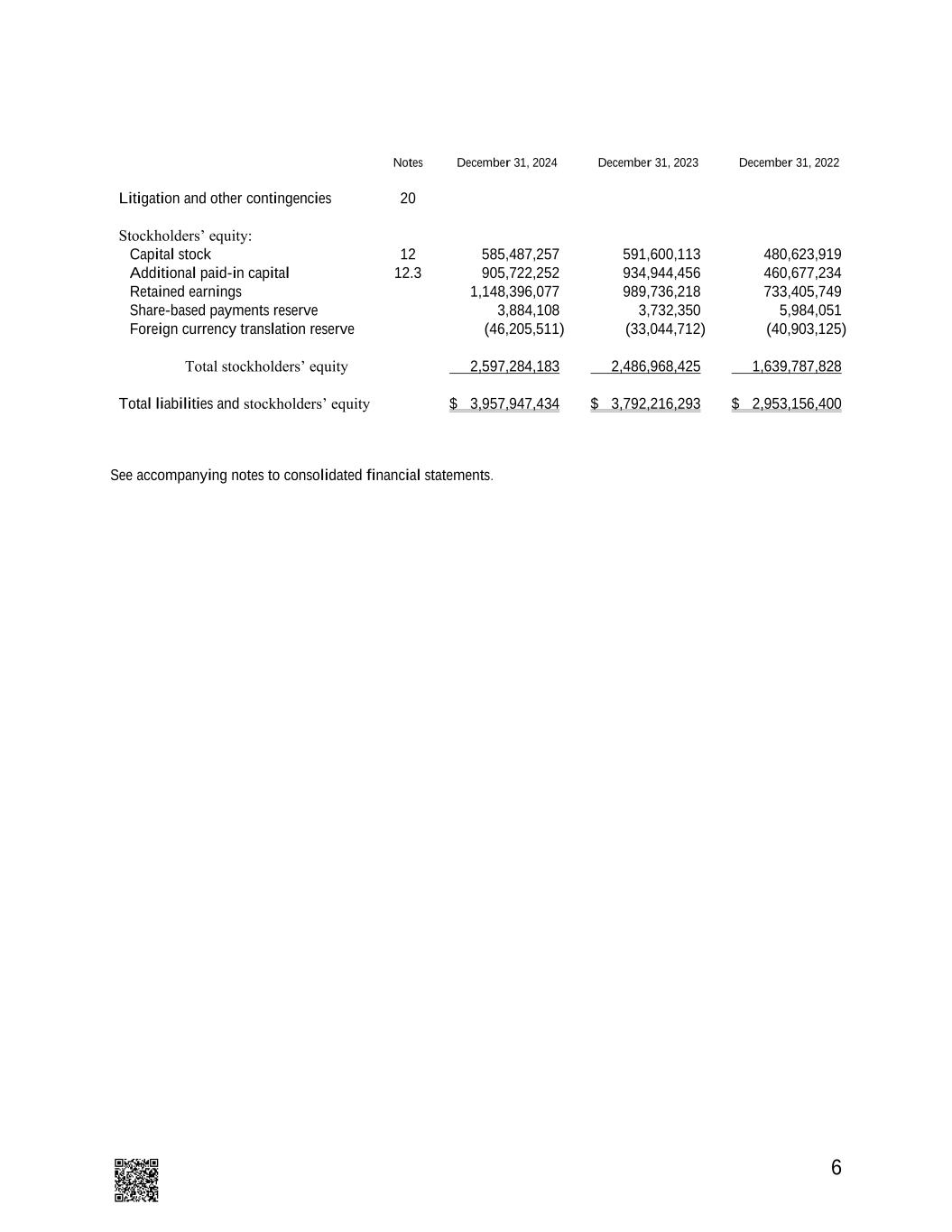

6 Notes December 31, 2024 December 31, 2023 December 31, 2022 Litigation and other contingencies 20 Stockholders’ equity: Capital stock 12 585,487,257 591,600,113 480,623,919 Additional paid-in capital 12.3 905,722,252 934,944,456 460,677,234 Retained earnings 1,148,396,077 989,736,218 733,405,749 Share-based payments reserve 3,884,108 3,732,350 5,984,051 Foreign currency translation reserve (46,205,511) (33,044,712) (40,903,125) Total stockholders’ equity 2,597,284,183 2,486,968,425 1,639,787,828 Total liabilities and stockholders’ equity $ 3,957,947,434 $ 3,792,216,293 $ 2,953,156,400 See accompanying notes to consolidated financial statements.

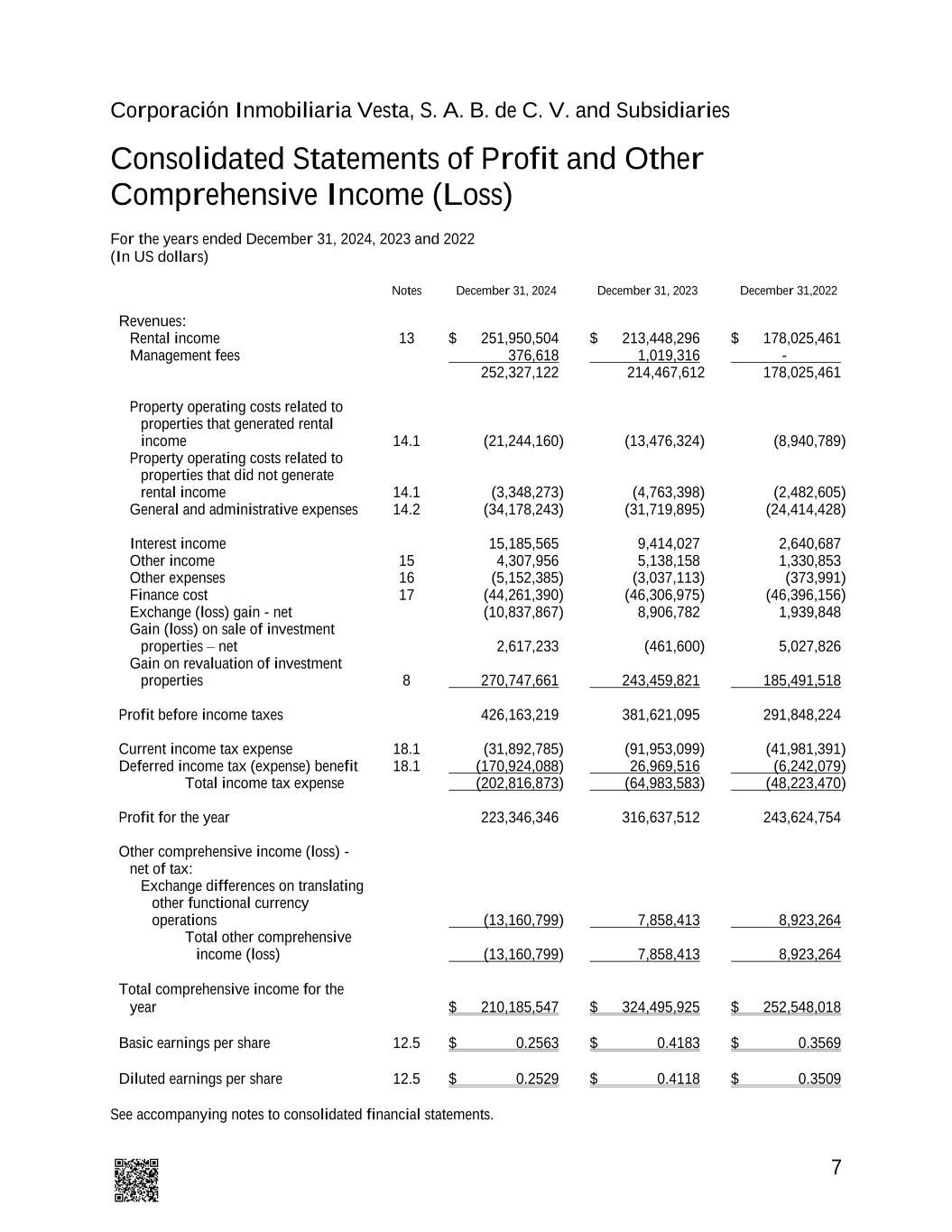

7 Corporación Inmobiliaria Vesta, S. A. B. de C. V. and Subsidiaries Consolidated Statements of Profit and Other Comprehensive Income (Loss) For the years ended December 31, 2024, 2023 and 2022 (In US dollars) Notes December 31, 2024 December 31, 2023 December 31,2022 Revenues: Rental income 13 $ 251,950,504 $ 213,448,296 $ 178,025,461 Management fees 376,618 1,019,316 - 252,327,122 214,467,612 178,025,461 Property operating costs related to properties that generated rental income 14.1 (21,244,160) (13,476,324) (8,940,789) Property operating costs related to properties that did not generate rental income 14.1 (3,348,273) (4,763,398) (2,482,605) General and administrative expenses 14.2 (34,178,243) (31,719,895) (24,414,428) Interest income 15,185,565 9,414,027 2,640,687 Other income 15 4,307,956 5,138,158 1,330,853 Other expenses 16 (5,152,385) (3,037,113) (373,991) Finance cost 17 (44,261,390) (46,306,975) (46,396,156) Exchange (loss) gain - net (10,837,867) 8,906,782 1,939,848 Gain (loss) on sale of investment properties – net 2,617,233 (461,600) 5,027,826 Gain on revaluation of investment properties 8 270,747,661 243,459,821 185,491,518 Profit before income taxes 426,163,219 381,621,095 291,848,224 Current income tax expense 18.1 (31,892,785) (91,953,099) (41,981,391) Deferred income tax (expense) benefit 18.1 (170,924,088) 26,969,516 (6,242,079) Total income tax expense (202,816,873) (64,983,583) (48,223,470) Profit for the year 223,346,346 316,637,512 243,624,754 Other comprehensive income (loss) - net of tax: Exchange differences on translating other functional currency operations (13,160,799) 7,858,413 8,923,264 Total other comprehensive income (loss) (13,160,799) 7,858,413 8,923,264 Total comprehensive income for the year $ 210,185,547 $ 324,495,925 $ 252,548,018 Basic earnings per share 12.5 $ 0.2563 $ 0.4183 $ 0.3569 Diluted earnings per share 12.5 $ 0.2529 $ 0.4118 $ 0.3509 See accompanying notes to consolidated financial statements.

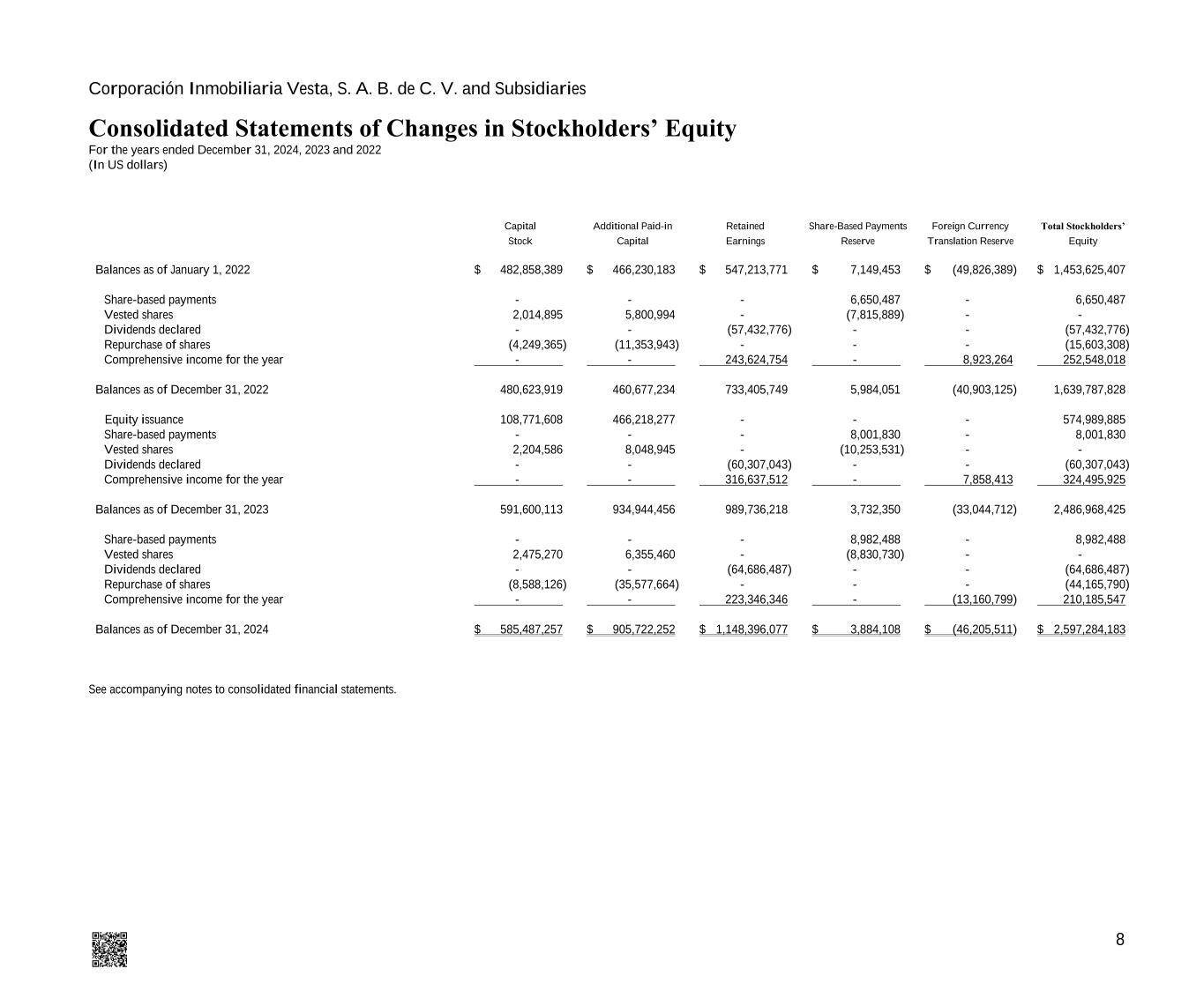

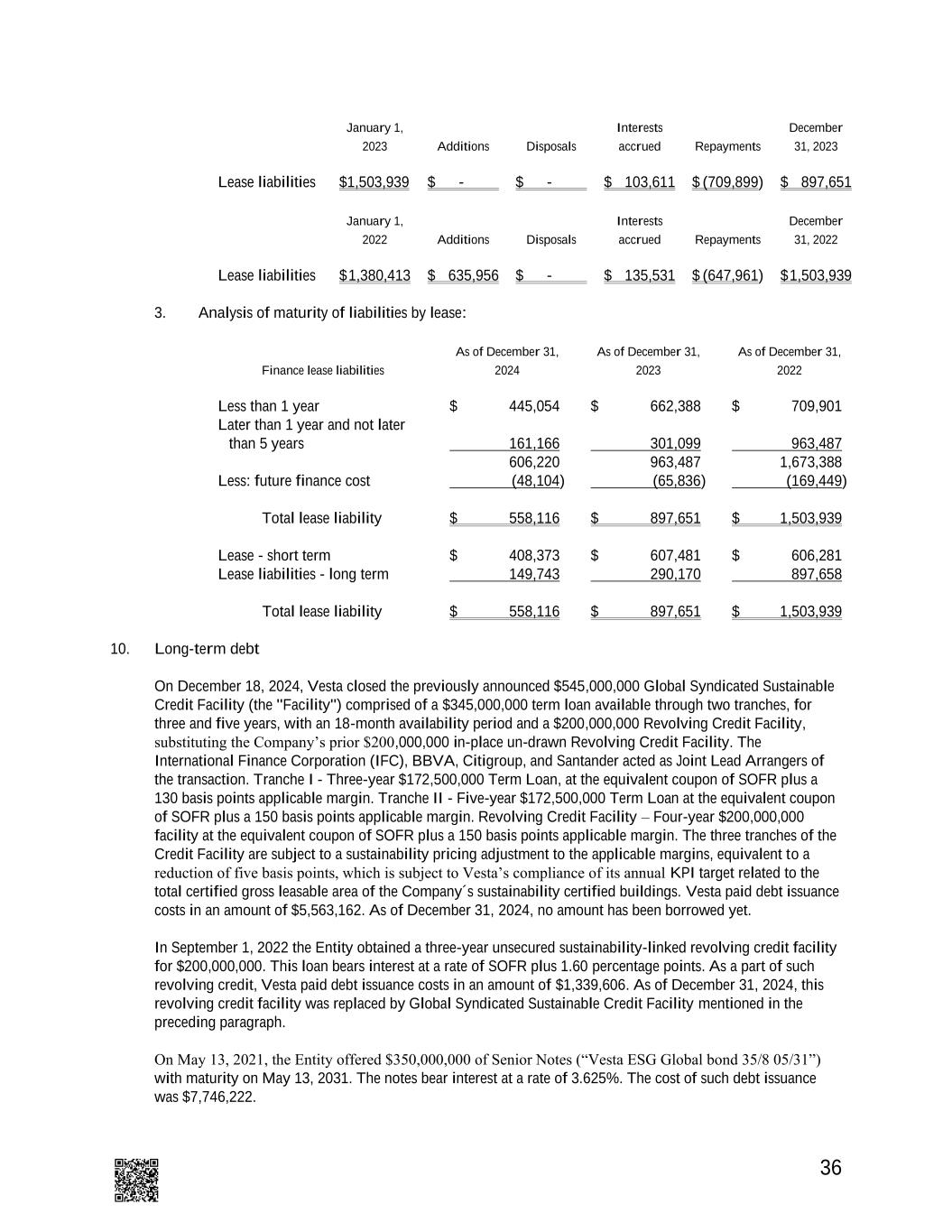

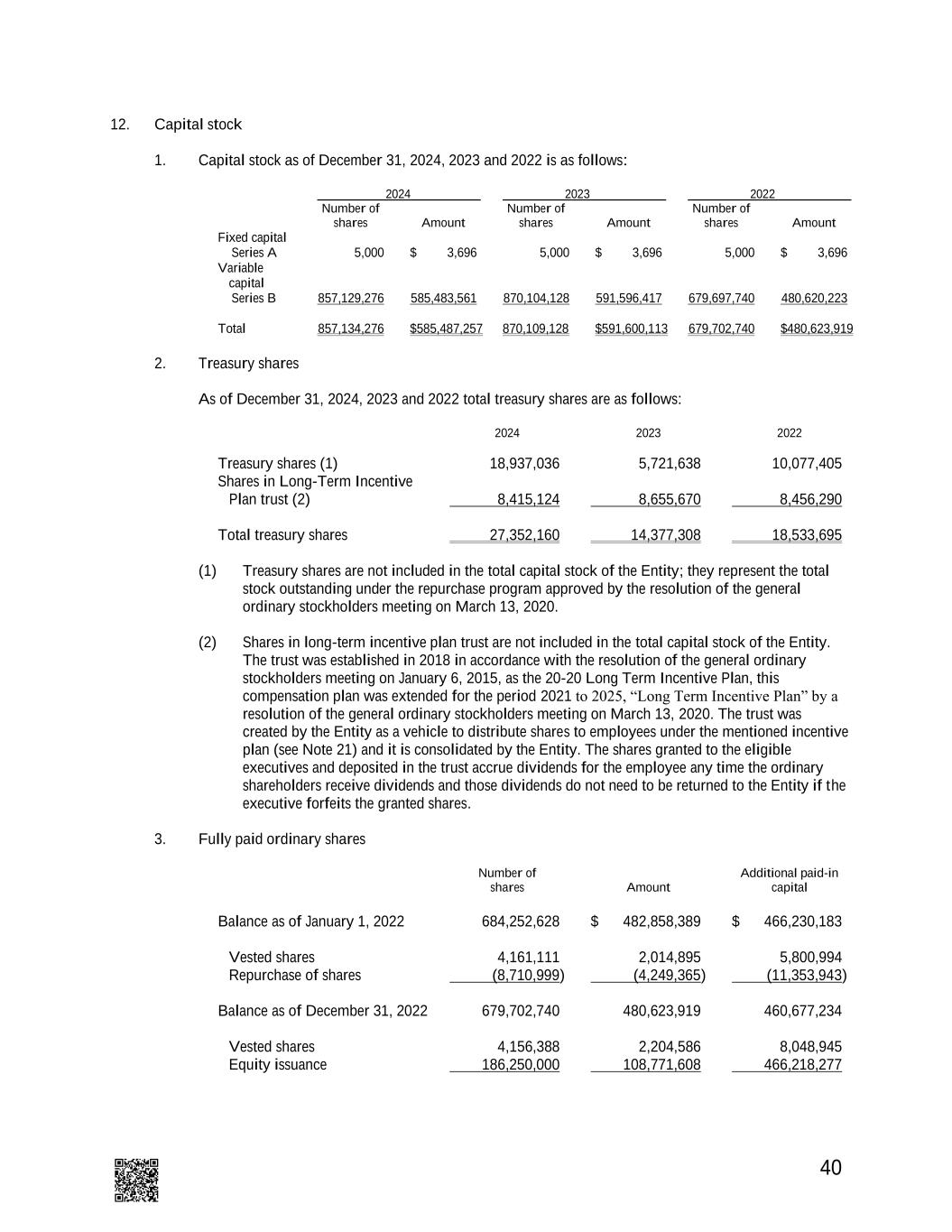

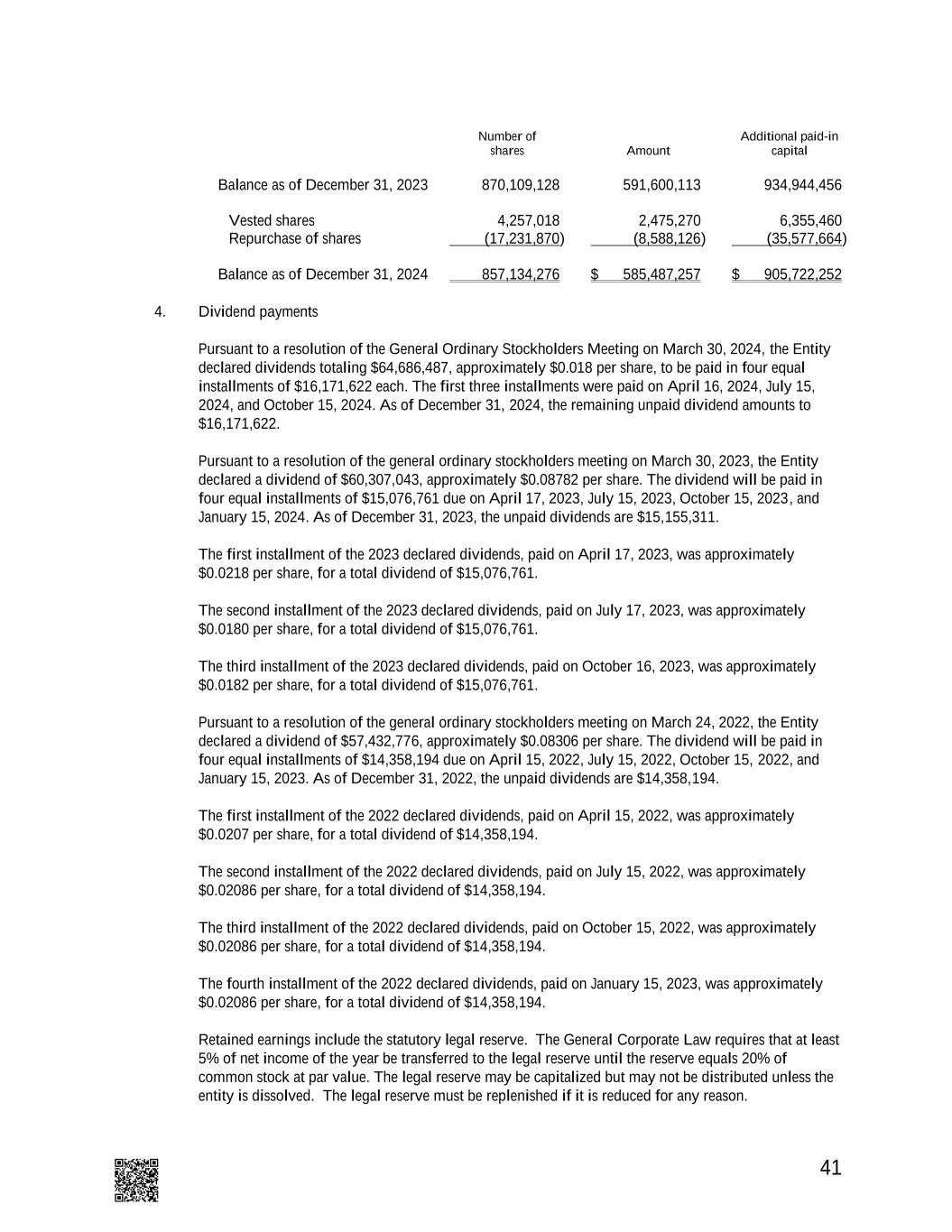

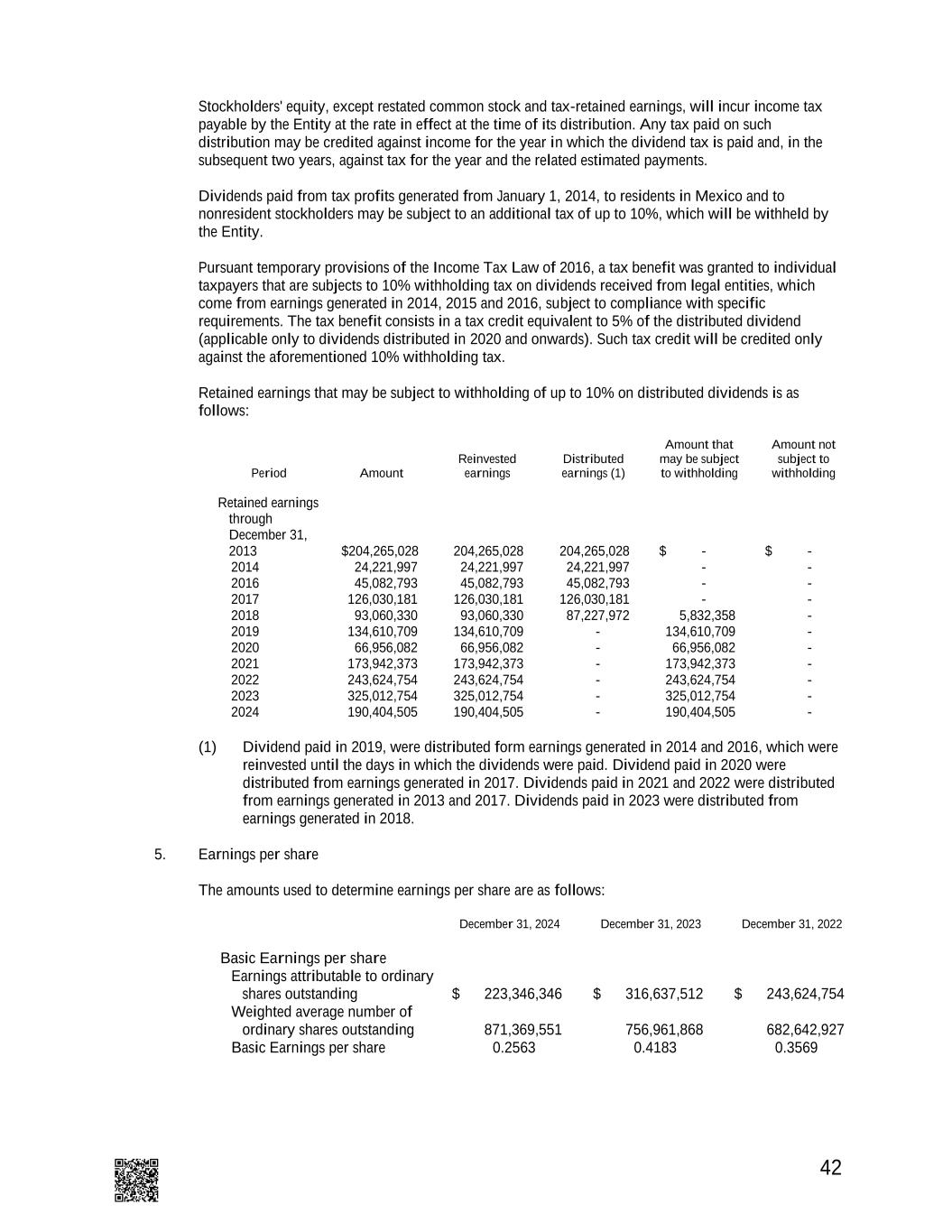

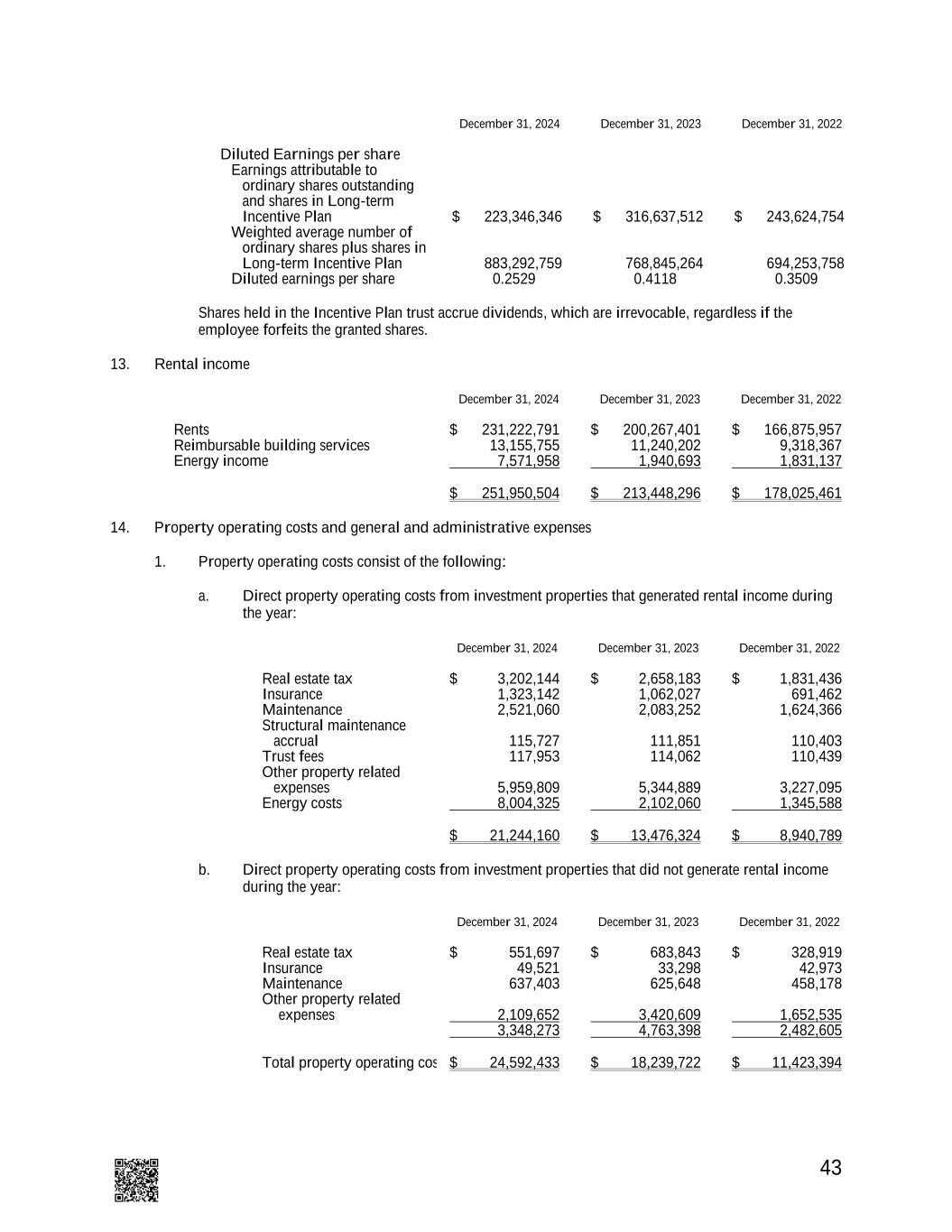

8 Corporación Inmobiliaria Vesta, S. A. B. de C. V. and Subsidiaries Consolidated Statements of Changes in Stockholders’ Equity For the years ended December 31, 2024, 2023 and 2022 (In US dollars) Capital Stock Additional Paid-in Capital Retained Earnings Share-Based Payments Reserve Foreign Currency Translation Reserve Total Stockholders’ Equity Balances as of January 1, 2022 $ 482,858,389 $ 466,230,183 $ 547,213,771 $ 7,149,453 $ (49,826,389) $ 1,453,625,407 Share-based payments - - - 6,650,487 - 6,650,487 Vested shares 2,014,895 5,800,994 - (7,815,889) - - Dividends declared - - (57,432,776) - - (57,432,776) Repurchase of shares (4,249,365) (11,353,943) - - - (15,603,308) Comprehensive income for the year - - 243,624,754 - 8,923,264 252,548,018 Balances as of December 31, 2022 480,623,919 460,677,234 733,405,749 5,984,051 (40,903,125) 1,639,787,828 Equity issuance 108,771,608 466,218,277 - - - 574,989,885 Share-based payments - - - 8,001,830 - 8,001,830 Vested shares 2,204,586 8,048,945 - (10,253,531) - - Dividends declared - - (60,307,043) - - (60,307,043) Comprehensive income for the year - - 316,637,512 - 7,858,413 324,495,925 Balances as of December 31, 2023 591,600,113 934,944,456 989,736,218 3,732,350 (33,044,712) 2,486,968,425 Share-based payments - - - 8,982,488 - 8,982,488 Vested shares 2,475,270 6,355,460 - (8,830,730) - - Dividends declared - - (64,686,487) - - (64,686,487) Repurchase of shares (8,588,126) (35,577,664) - - - (44,165,790) Comprehensive income for the year - - 223,346,346 - (13,160,799) 210,185,547 Balances as of December 31, 2024 $ 585,487,257 $ 905,722,252 $ 1,148,396,077 $ 3,884,108 $ (46,205,511) $ 2,597,284,183 See accompanying notes to consolidated financial statements.

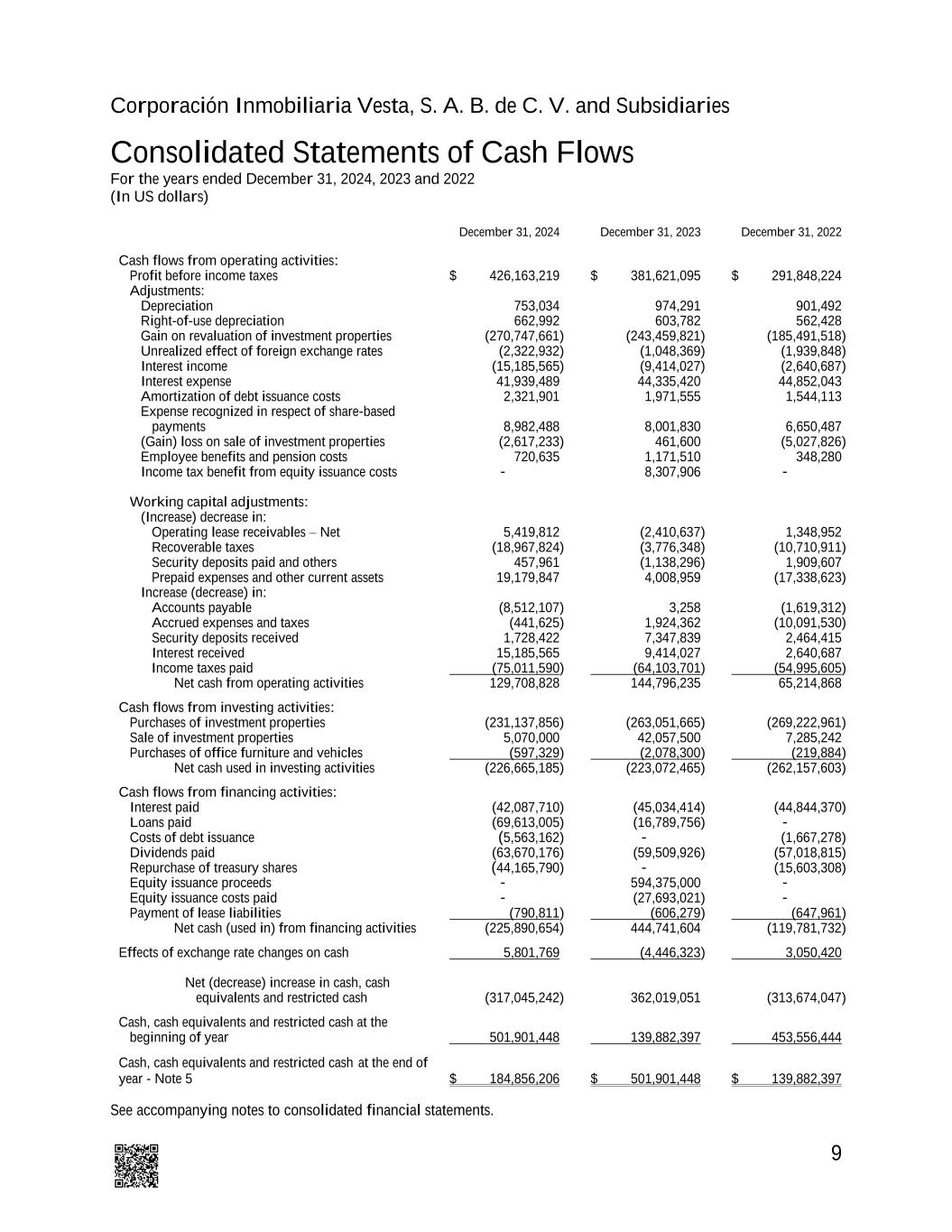

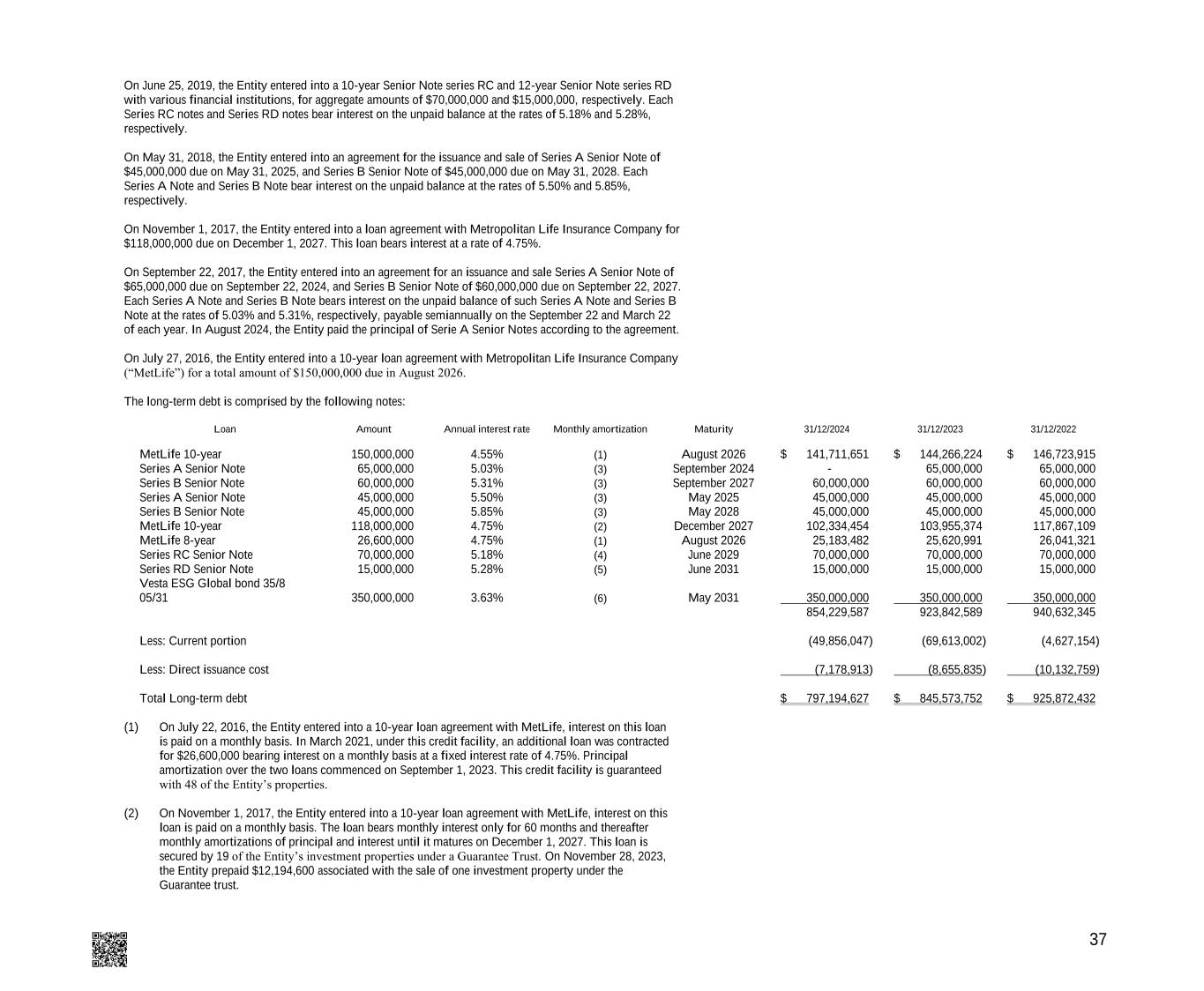

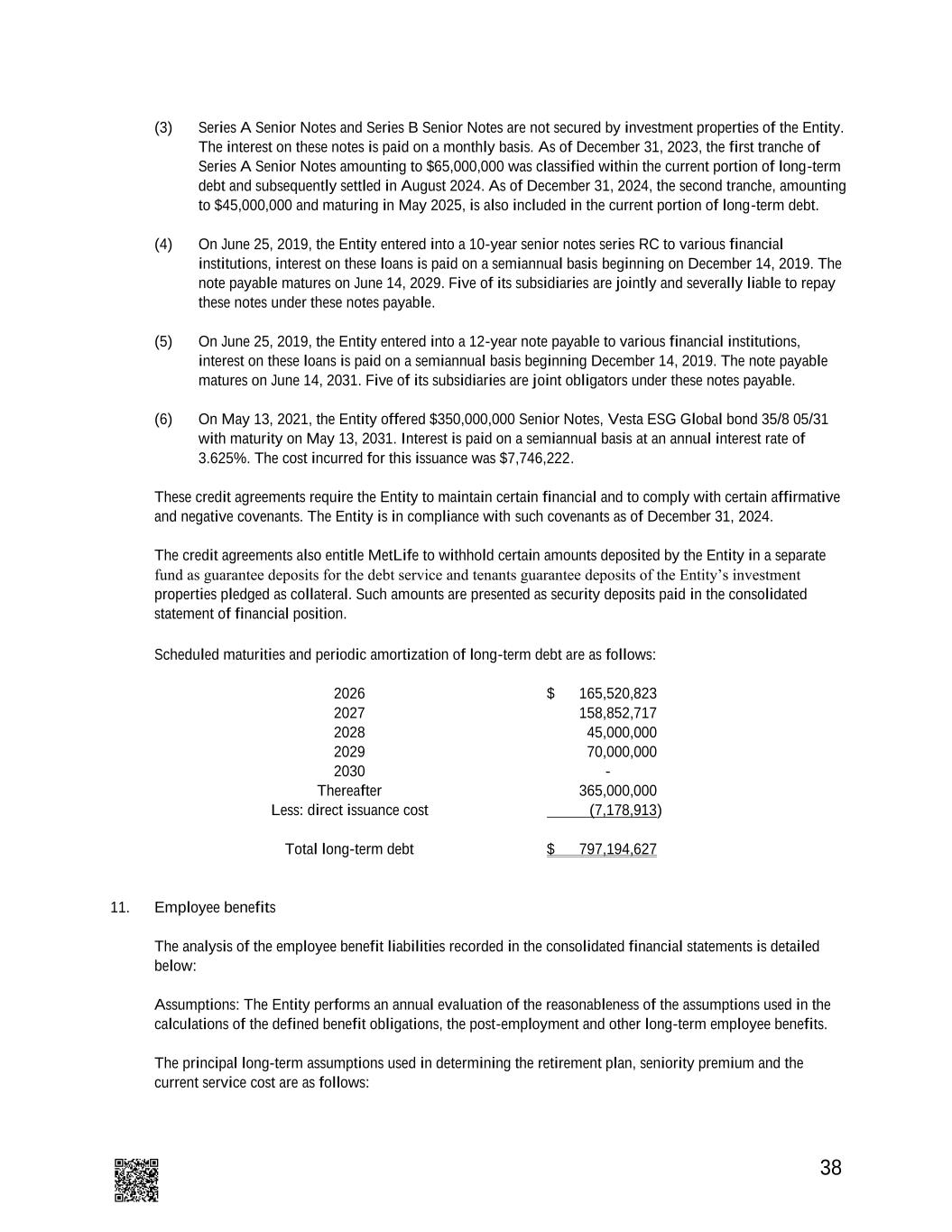

9 Corporación Inmobiliaria Vesta, S. A. B. de C. V. and Subsidiaries Consolidated Statements of Cash Flows For the years ended December 31, 2024, 2023 and 2022 (In US dollars) December 31, 2024 December 31, 2023 December 31, 2022 Cash flows from operating activities: Profit before income taxes $ 426,163,219 $ 381,621,095 $ 291,848,224 Adjustments: Depreciation 753,034 974,291 901,492 Right-of-use depreciation 662,992 603,782 562,428 Gain on revaluation of investment properties (270,747,661) (243,459,821) (185,491,518) Unrealized effect of foreign exchange rates (2,322,932) (1,048,369) (1,939,848) Interest income (15,185,565) (9,414,027) (2,640,687) Interest expense 41,939,489 44,335,420 44,852,043 Amortization of debt issuance costs 2,321,901 1,971,555 1,544,113 Expense recognized in respect of share-based payments 8,982,488 8,001,830 6,650,487 (Gain) loss on sale of investment properties (2,617,233) 461,600 (5,027,826) Employee benefits and pension costs 720,635 1,171,510 348,280 Income tax benefit from equity issuance costs - 8,307,906 - Working capital adjustments: (Increase) decrease in: Operating lease receivables – Net 5,419,812 (2,410,637) 1,348,952 Recoverable taxes (18,967,824) (3,776,348) (10,710,911) Security deposits paid and others 457,961 (1,138,296) 1,909,607 Prepaid expenses and other current assets 19,179,847 4,008,959 (17,338,623) Increase (decrease) in: Accounts payable (8,512,107) 3,258 (1,619,312) Accrued expenses and taxes (441,625) 1,924,362 (10,091,530) Security deposits received 1,728,422 7,347,839 2,464,415 Interest received 15,185,565 9,414,027 2,640,687 Income taxes paid (75,011,590) (64,103,701) (54,995,605) Net cash from operating activities 129,708,828 144,796,235 65,214,868 Cash flows from investing activities: Purchases of investment properties (231,137,856) (263,051,665) (269,222,961) Sale of investment properties 5,070,000 42,057,500 7,285,242 Purchases of office furniture and vehicles (597,329) (2,078,300) (219,884) Net cash used in investing activities (226,665,185) (223,072,465) (262,157,603) Cash flows from financing activities: Interest paid (42,087,710) (45,034,414) (44,844,370) Loans paid (69,613,005) (16,789,756) - Costs of debt issuance (5,563,162) - (1,667,278) Dividends paid (63,670,176) (59,509,926) (57,018,815) Repurchase of treasury shares (44,165,790) - (15,603,308) Equity issuance proceeds - 594,375,000 - Equity issuance costs paid - (27,693,021) - Payment of lease liabilities (790,811) (606,279) (647,961) Net cash (used in) from financing activities (225,890,654) 444,741,604 (119,781,732) Effects of exchange rate changes on cash 5,801,769 (4,446,323) 3,050,420 Net (decrease) increase in cash, cash equivalents and restricted cash (317,045,242) 362,019,051 (313,674,047) Cash, cash equivalents and restricted cash at the beginning of year 501,901,448 139,882,397 453,556,444 Cash, cash equivalents and restricted cash at the end of year - Note 5 $ 184,856,206 $ 501,901,448 $ 139,882,397 See accompanying notes to consolidated financial statements.

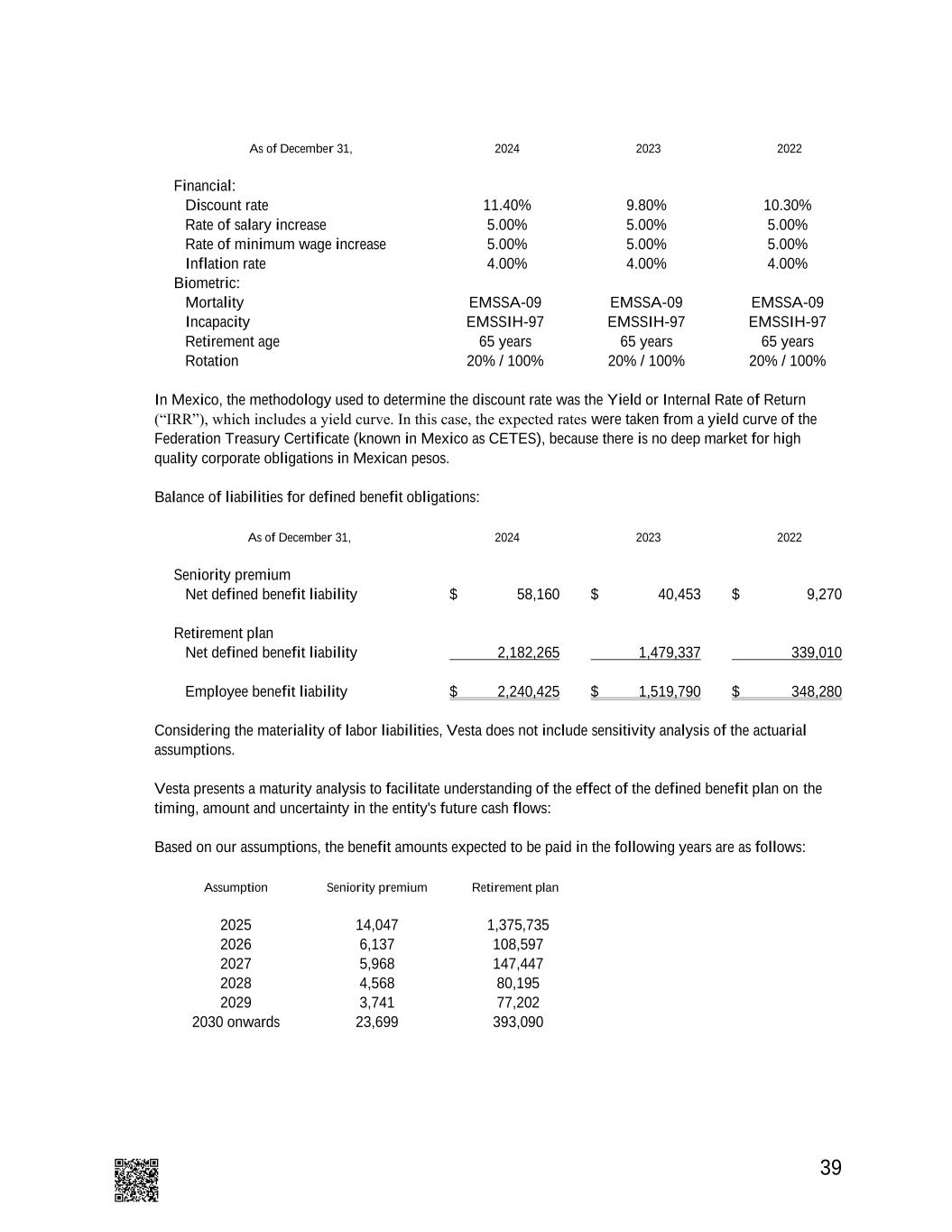

10 Corporación Inmobiliaria Vesta, S. A.B. de C. V. and Subsidiaries Notes to Consolidated Financial Statements For the years ended December 31, 2024, 2023 and 2022 (In US dollars) 1. General information Corporación Inmobiliaria Vesta, S. A. B. de C. V. (“Vesta” or the “Entity”) is a corporation incorporated in Mexico. The address of its registered office and principal place of business is Paseo de los Tamarindos 90, 28th floor, Mexico City. Vesta and subsidiaries (collectively, the “Entity”) are engaged in the development, acquisition and operation of industrial buildings and distribution facilities that are rented to corporations in eleven states throughout Mexico. 1.1 Significant events Global Syndicated Sustainable Credit Facility On December 18, 2024, Vesta closed a $545,000,000 Global Syndicated Sustainable Credit Facility (the "Facility") comprised of a $345,000,000 term loan available through two tranches, for three and five years, with an 18-month availability period and a $200,000,000 Revolving Credit Facility, substituting the Company’s prior $200,000,000 in-place un-drawn Revolving Credit Facility. The International Finance Corporation (IFC), BBVA, Citigroup, and Santander acted as Joint Lead Arrangers of the transaction The Credit Facility are subject to a sustainability pricing adjustment to the applicable margins. Vesta paid debt issuance costs in an amount of $5,563,162. As of December 31, 2024, no amount has been borrowed yet. The Follow-On Offering On December 7, 2023, Vesta entered into an underwriting agreement (the ‘‘Follow-On Underwriting Agreement’’) with Morgan Stanley & CO, LLC, BofA Securities, Inc. and Barclays Capital Inc., as representative of the underwriters, relating to Vesta’s sale of common shares (the ‘‘Follow-on Offering’’) of 42,500,000 Common Shares in the form of American Depositary Shares (“ADS”), each ADS representing 10 Common Shares of Vesta’s common stock, at a Follow-on Offering price of $35.00 US dollars per ADS. The closing of the Follow-on Offering for the American Depositary Shares (“ADS”) took place on December 13, 2023, raising gross proceeds of approximately $148,750,000. Issuance expenses were approximately $4,746,000. Vesta intends to use the net proceeds from the Follow-on Offering to fund growth strategy including the acquisition of land or properties and related infrastructure investments, and for the development of industrial buildings. The Offerings On June 29, 2023, Vesta entered into an underwriting agreement (the ‘‘Underwriting Agreement’’) with Citigroup Global Markets Inc., BofA Securities, Inc. and Barclays Capital Inc., as representative of the underwriters, relating to Vesta’s initial public offering (the ‘‘Offering’’) of 125,000,000 Common Shares in the form of the ADS, each ADS representing 10 Common Shares of Vesta’s common stock (‘‘common stock’’), which included the exercise by the underwriters in full of the over- allotment option to purchase an additional 18,750,000 shares of Vesta’s common stock, at an Offering price of $31.00 US dollars per ADS.

11 The closing of the Offering for the ADS’s took place on July 5, 2023, raising gross proceeds of approximately $445,625,000, which included 18,750,000 shares sold by Vesta upon the exercise by the underwriters of the over-allotment option in full. Issuance expenses were approximately $22,950,000. Vesta intends to use the net proceeds from the Offering to fund growth strategy including the acquisition of land or properties and related infrastructure investments, and for the development of industrial buildings. On April 27, 2021, Vesta announced the favorable results of its primary offering of common shares (equity issuance). The offering consisted in an equity offering of shares in Mexico through the Mexican Stock Exchange with an international distribution. Vesta received gross income of $200,000,000 from this equity issuance. The primary global offering considered 101,982,052 shares, and an over-allotment option of up to 15% calculated with respect to the number of shares subject to the primary offering, that was 15,297,306 additional shares, an option that could be exercised by the underwriters within the following 30 days to this date; such over-allotment was exercised by the underwriters on April 28, 2022 in a total of 14,797,307 shares for an amount of $29,215,419. The cost of such equity issuance was $6,019,970. Sustainability linked revolving credit facility On September 1, 2022, Vesta announced a $200,000,000 sustainability linked revolving credit facility with various financial institutions. As a part of such revolving credit, Vesta paid debt issuance costs in an amount of $1,339,606. The revolving credit facility was replaced on December 18, 2024, by the aforementioned Global Syndicated Sustainable Credit Facility. 2. Adoption of new and revised International Financial Reporting Standards Amendments to IAS 7 Statement of Cash Flows and IFRS 7 Financial Instruments: Disclosures titled Supplier Finance Arrangements The Entity has adopted the amendments to IAS 7 Statement of Cash Flows and IFRS 7 Financial Instruments: Disclosures titled Supplier Finance Arrangements for the first time in the current year. The amendments add a disclosure objective to IAS 7 stating that an entity is required to disclose information about its supplier finance arrangements that enables users of financial statements to assess the effects of those arrangements on the entity’s liabilities and cash flows. In addition, IFRS 7 is amended to add supplier finance arrangements as an example within the requirements to disclose information about an entity’s exposure to concentration of liquidity risk. The amendments contain specific transition provisions for the first annual reporting period in which the group applies the amendments. Under the transitional provisions an entity is not required to disclose: • comparative information for any reporting periods presented before the beginning of the annual reporting period in which the entity first applies those amendments. • the information otherwise required by IAS 7:44H(b)(ii)–(iii) as at the beginning of the annual reporting period in which the entity first applies those amendments. In the current year, the group has applied a number of amendments to IFRS Accounting Standards issued by the IASB that are mandatorily effective for an accounting period that begins on or after 1 January 2024. Their adoption has not had any material impact on the disclosures or on the amounts reported in these financial statements.

12 Amendments to IAS 1 Classification of Liabilities as Current or Non-current The Entity has adopted the amendments to IAS 1, published in January 2020, for the first time in the current year. The amendments affect only the presentation of liabilities as current or non- current in the statement of financial position and not the amount or timing of recognition of any asset, liability, income or expenses, or the information disclosed about those items. Vesta has adopted the amendments to IAS 1 for the first time as of January 1, 2024. The amendments to IAS 1 specify the requirements for classifying liabilities as current or non-current. The amendments clarify: The amendments clarify that the classification of liabilities as current or non- current is based on rights that are in existence at the end of the reporting period, specify that classification is unaffected by expectations about whether an entity will exercise its right to defer settlement of a liability, explain that rights are in existence if covenants are complied with at the end of the reporting period, and introduce a definition of ‘settlement’ to make clear that settlement refers to the transfer to the counterparty of cash, equity instruments, other assets or services. Amendments to IAS 1 Classification of Liabilities as Current or Non- current The Entity has adopted the amendments to IAS 1, published in November 2022, for the first time in the current year. The amendments specify that only covenants that an entity is required to comply with on or before the end of the reporting period affect the entity’s right to defer settlement of a liability for at least twelve months after the reporting date (and therefore must be considered in assessing the classification of the liability as current or non-current). Such covenants affect whether the right exists at the end of the reporting period, even if compliance with the covenant is assessed only after the reporting date (e.g. a covenant based on the entity’s financial position at the reporting date that is assessed for compliance only after the reporting date). The IASB also specifies that the right to defer settlement of a liability for at least twelve months after the reporting date is not affected if an entity only has to comply with a covenant after the reporting period. However, if the entity’s right to defer settlement of a liability is subject to the entity complying with covenants within twelve months after the reporting period, an entity discloses information that enables users of financial statements to understand the risk of the liabilities becoming repayable within twelve months after the reporting period. This would include information about the covenants (including the nature of the covenants and when the entity is required to comply with them), the carrying amount of related liabilities and facts and circumstances, if any, that indicate that the entity may have difficulties complying with the covenants. Amendments to IFRS 16 Leases—Lease Liability in a Sale and Leaseback The Entity has adopted the amendments to IFRS 16 for the first time in the current year. The amendments to IFRS 16 add subsequent measurement requirements for sale and leaseback transactions that satisfy the requirements in IFRS 15 Revenue from Contracts with Customers to be accounted for as a sale. The amendments require the seller-lessee to determine ‘lease payments’ or ‘revised lease payments’ such that the seller-lessee does not recognize a gain or loss that relates to the right of use retained by the seller-lessee, after the commencement date.

13 The amendments do not affect the gain or loss recognized by the seller-lessee relating to the partial or full termination of a lease. Without these new requirements, a seller-lessee may have recognized a gain on the right of use it retains solely because of a remeasurement of the lease liability (for example, following a lease modification or change in the lease term) applying the general requirements in IFRS 16. This could have been particularly the case in a leaseback that includes variable lease payments that do not depend on an index or rate. As part of the amendments, the IASB amended an Illustrative Example in IFRS 16 and added a new example to illustrate the subsequent measurement of a right- of-use asset and lease liability in a sale and leaseback transaction with variable lease payments that do not depend on an index or rate. The illustrative examples also clarify that the liability that arises from a sale and leaseback transaction that qualifies as a sale applying IFRS 15 is a lease liability. A seller-lessee applies the amendments retrospectively in accordance with IAS 8 to sale and leaseback transactions entered into after the date of initial application, which is defined as the beginning of the annual reporting period in which the entity first applied IFRS 16. New and revised IFRS Accounting Standards in issue but not yet effective At the date of authorization of the consolidated financial statements, the Entity has not applied the following new and revised IFRS Accounting Standards that have been issued but are not yet effective: Amendments to IAS 21 Lack of Exchangeability IFRS 18 Presentation and Disclosures in Financial Statements IFRS 19 Subsidiaries without Public Accountability: Disclosures The directors do not expect that the adoption of the standards listed above will have a material impact on the financial statements of the group in future periods, except if indicated below. Amendments to IAS 21 The Effects of Changes in Foreign Exchange Rates titled Lack of Exchangeability The amendments specify how to assess whether a currency is exchangeable, and how to determine the exchange rate when it is not. The amendments state that a currency is exchangeable into another currency when an entity is able to obtain the other currency within a time frame that allows for a normal administrative delay and through a market or exchange mechanism in which an exchange transaction would create enforceable rights and obligations. An entity assesses whether a currency is exchangeable into another currency at a measurement date and for a specified purpose. If an entity is able to obtain no more than an insignificant amount of the other currency at the measurement date for the specified purpose, the currency is not exchangeable into the other currency. The assessment of whether a currency is exchangeable into another currency depends on an entity’s ability to obtain the other currency and not on its intention or decision to do so. When a currency is not exchangeable into another currency at a measurement date, an entity is required to estimate the spot exchange rate at that date. An entity’s objective in estimating the spot exchange rate is to reflect the rate at which an orderly exchange transaction would take place at the measurement date between market participants under prevailing economic conditions.

14 The amendments do not specify how an entity estimates the spot exchange rate to meet that objective. An entity can use an observable exchange rate without adjustment or another estimation technique. Examples of an observable exchange rate include: • a spot exchange rate for a purpose other than that for which an entity assesses exchangeability. • the first exchange rate at which an entity is able to obtain the other currency for the specified purpose after exchangeability of the currency is restored (first subsequent exchange rate). An entity using another estimation technique may use any observable exchange rate—including rates from exchange transactions in markets or exchange mechanisms that do not create enforceable rights and obligations—and adjust that rate, as necessary, to meet the objective as set out above. When an entity estimates a spot exchange rate because a currency is not exchangeable into another currency, the entity is required to disclose information that enables users of its financial statements to understand how the currency not being exchangeable into the other currency affects, or is expected to affect, the entity’s financial performance, financial position and cash flows. The amendments add a new appendix as an integral part of IAS 21. The appendix includes application guidance on the requirements introduced by the amendments. The amendments also add new Illustrative Examples accompanying IAS 21, which illustrate how an entity might apply some of the requirements in hypothetical situations based on the limited facts presented. In addition, the IASB made consequential amendments to IFRS 1 to align with and refer to the revised IAS 21 for assessing exchangeability. The amendments are effective for annual reporting periods beginning on or after 1 January 2025, with earlier application permitted. An entity is not permitted to apply the amendments retrospectively. Instead, an entity is required to apply the specific transition provisions included in the amendments. The directors of the Entity anticipate that the application of these amendments may not have an impact on the Entity´s consolidated financial statements in future periods. IFRS 18 Presentation and Disclosures in Financial Statements IFRS 18 replaces IAS 1, carrying forward many of the requirements in IAS 1 unchanged and complementing them with new requirements. In addition, some IAS 1 paragraphs have been moved to IAS 8 and IFRS 7. Furthermore, the IASB has made minor amendments to IAS 7 and IAS 33 Earnings per Share. IFRS 18 introduces new requirements to: • present specified categories and defined subtotals in the statement of profit or loss • provide disclosures on management-defined performance measures (MPMs) in the notes to the financial statements • improve aggregation and disaggregation. An entity is required to apply IFRS 18 for annual reporting periods beginning on or after 1 January 2027, with earlier application permitted. The amendments to IAS 7 and IAS 33, as well as the revised IAS 8 and IFRS 7, become effective when an entity applies IFRS 18. IFRS 18 requires retrospective application with specific transition provisions. The directors of the Entity anticipate that the application of these amendments may not have an impact on the Entity´s consolidated financial statements in future periods.

15 IFRS 19 Subsidiaries without Public Accountability: Disclosures IFRS 19 permits an eligible subsidiary to provide reduced disclosures when applying IFRS Accounting Standards in its financial statements. A subsidiary is eligible for the reduced disclosures if it does not have public accountability and its ultimate or any intermediate parent produces consolidated financial statements available for public use that comply with IFRS Accounting Standards. IFRS 19 is optional for subsidiaries that are eligible and sets out the disclosure requirements for subsidiaries that elect to apply it. An entity is only permitted to apply IFRS 19 if, at the end of the reporting period: • it is a subsidiary (this includes an intermediate parent) • it does not have public accountability, and • its ultimate or any intermediate parent produces consolidated financial statements available for public use that comply with IFRS Accounting Standards. A subsidiary has public accountability if: • its debt or equity instruments are traded in a public market or it is in the process of issuing such instruments for trading in a public market (a domestic or foreign stock exchange or an over-the-counter market, including local and regional markets), • it holds assets in a fiduciary capacity for a broad group of outsiders as one of its primary businesses (for example, banks, credit unions, insurance entities, securities brokers/dealers, mutual funds and investment banks often meet this second criterion). Eligible entities can apply IFRS 19 in their consolidated, separate or individual financial statements. An eligible intermediate parent that does not apply IFRS 19 in its consolidated financial statement may do so in its separate financial statements. The new standard is effective for reporting periods beginning on or after 1 January 2027 with earlier application permitted. If an entity elects to apply IFRS 19 for a reporting period earlier than the reporting period in which it first applies IFRS 18, it is required to apply a modified set of disclosure requirements set out in an appendix to IFRS 19. If an entity elects to apply IFRS 19 for an annual reporting period before it applied the amendments to IAS 21, it is not required to apply the disclosure requirements in IFRS 19 with regard to Lack of Exchangeability. The directors of the company do not anticipate that IFRS 19 will be applied for purposes of the consolidated financial statements of the Entity. 3. Material accounting policies a. Statement of compliance The consolidated financial statements have been prepared in accordance with International Financial Reporting Standards (IFRS) as issued by the International Accounting Standards Board (IASB).

16 b. Basis of preparation The consolidated financial statements have been prepared on the historical cost basis except for investment properties and financial instruments that are measured at fair value at the end of each reporting period, as explained in the accounting policies below. i. Historical cost Historical cost is generally based on the fair value of the consideration given in exchange for goods and services. ii. Fair value Fair value is the price that would be received to sell an asset or paid to transfer liability in an orderly transaction between market participants at the measurement date, regardless of whether that price is directly observable or estimated using another valuation technique. In estimating the fair value of an asset or a liability, the Entity takes into account the characteristics of the asset or liability if market participants would take those characteristics into account when pricing the asset or liability at the measurement date. Fair value for measurement and/or disclosure purposes in these consolidated financial statements is determined on such a basis, except for share-based payment transactions that are within the scope of IFRS 2, Share-based Payments. In addition, for financial reporting purposes, fair value measurements are categorized into Level 1, 2 or 3 based on the degree to which the inputs to the fair value measurements are observable and the significance of the inputs to the fair value measurement in its entirety, which are described as follows: • Level 1 fair value measurements are those derived from quoted prices (unadjusted) in active markets for identical assets or liabilities that the entity can access at the measurement date; • Level 2 fair value measurements are those derived from inputs, other than quoted prices included within Level 1, that are observable for the asset or liability, either directly or indirectly; and • Level 3 fair value measurements are those derived from valuation techniques that include inputs for the asset or liability that are not based on observable market data. iii. Going concern The consolidated financial statements have been prepared by Management assuming that the Entity will continue to operate as a going concern. c. Basis of consolidation The consolidated financial statements incorporate the financial statements of Vesta and entities (including structured entities) controlled by Vesta and its subsidiaries. Control is achieved when the Entity: • Has power over the investee; • Is exposed, or has rights, to variable returns from its involvement with the investee; and • Has the ability to use its power to affect its returns. The Entity reassesses whether or not it controls an investee if facts and circumstances indicate that there are changes to one or more of the three elements of control listed above.

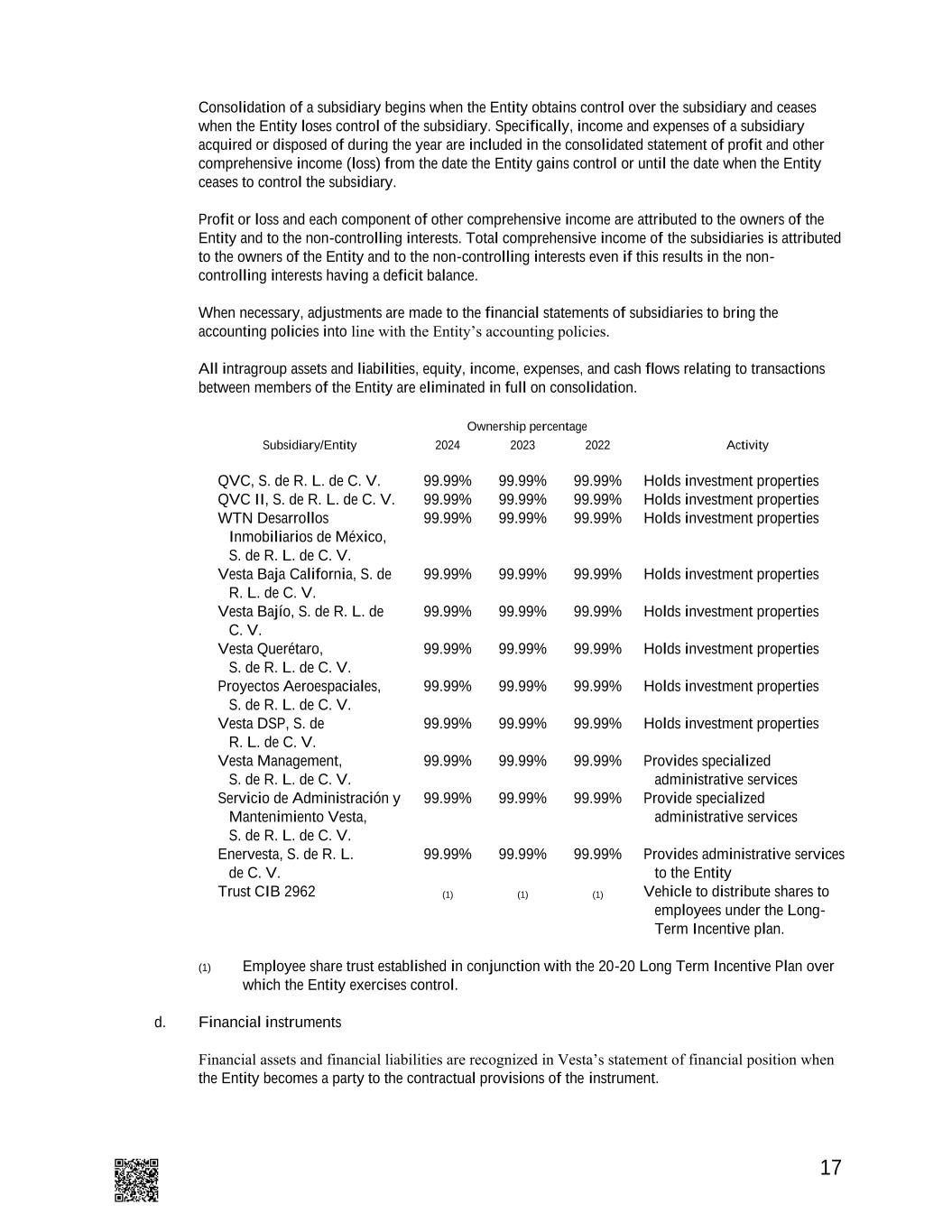

17 Consolidation of a subsidiary begins when the Entity obtains control over the subsidiary and ceases when the Entity loses control of the subsidiary. Specifically, income and expenses of a subsidiary acquired or disposed of during the year are included in the consolidated statement of profit and other comprehensive income (loss) from the date the Entity gains control or until the date when the Entity ceases to control the subsidiary. Profit or loss and each component of other comprehensive income are attributed to the owners of the Entity and to the non-controlling interests. Total comprehensive income of the subsidiaries is attributed to the owners of the Entity and to the non-controlling interests even if this results in the non- controlling interests having a deficit balance. When necessary, adjustments are made to the financial statements of subsidiaries to bring the accounting policies into line with the Entity’s accounting policies. All intragroup assets and liabilities, equity, income, expenses, and cash flows relating to transactions between members of the Entity are eliminated in full on consolidation. Ownership percentage Subsidiary/Entity 2024 2023 2022 Activity QVC, S. de R. L. de C. V. 99.99% 99.99% 99.99% Holds investment properties QVC II, S. de R. L. de C. V. 99.99% 99.99% 99.99% Holds investment properties WTN Desarrollos Inmobiliarios de México, S. de R. L. de C. V. 99.99% 99.99% 99.99% Holds investment properties Vesta Baja California, S. de R. L. de C. V. 99.99% 99.99% 99.99% Holds investment properties Vesta Bajío, S. de R. L. de C. V. 99.99% 99.99% 99.99% Holds investment properties Vesta Querétaro, S. de R. L. de C. V. 99.99% 99.99% 99.99% Holds investment properties Proyectos Aeroespaciales, S. de R. L. de C. V. 99.99% 99.99% 99.99% Holds investment properties Vesta DSP, S. de R. L. de C. V. 99.99% 99.99% 99.99% Holds investment properties Vesta Management, S. de R. L. de C. V. 99.99% 99.99% 99.99% Provides specialized administrative services Servicio de Administración y Mantenimiento Vesta, S. de R. L. de C. V. 99.99% 99.99% 99.99% Provide specialized administrative services Enervesta, S. de R. L. de C. V. 99.99% 99.99% 99.99% Provides administrative services to the Entity Trust CIB 2962 (1) (1) (1) Vehicle to distribute shares to employees under the Long- Term Incentive plan. (1) Employee share trust established in conjunction with the 20-20 Long Term Incentive Plan over which the Entity exercises control. d. Financial instruments Financial assets and financial liabilities are recognized in Vesta’s statement of financial position when the Entity becomes a party to the contractual provisions of the instrument.

18 Financial assets and financial liabilities are initially measured at fair value. Transaction costs that are directly attributable to the acquisition or issue of financial assets and financial liabilities (other than financial assets and financial liabilities at fair value through profit or loss) are added to or deducted from the fair value of the financial assets or financial liabilities, as appropriate, on initial recognition. Transaction costs directly attributable to the acquisition of financial assets or financial liabilities at fair value through profit or loss are recognized immediately in profit or loss. e. Financial assets All regular way purchases or sales of financial assets are recognized and derecognized on a trade date basis. Regular way purchases or sales are purchases or sales of financial assets that require delivery of assets within the time frame established by regulation or convention in the marketplace. All recognized financial assets are measured subsequently in their entirety at either amortized cost or fair value, depending on the classification of the financial assets. Classification of financial assets Debt instruments that meet the following conditions are measured subsequently at amortized cost: • The financial asset is held within a business model whose objective is to hold financial assets in order to collect contractual cash flows; and • The contractual terms of the financial asset give rise on specified dates to cash flows that are solely payments of principal and interest on the principal amount outstanding. Debt instruments that meet the following conditions are measured subsequently at fair value through other comprehensive income (FVTOCI): • The financial asset is held within a business model whose objective is achieved by both collecting contractual cash flows and selling the financial assets; and • The contractual terms of the financial asset give rise on specified dates to cash flows that are solely payments of principal and interest on the principal amount outstanding. By default, all other financial assets are measured subsequently at fair value through profit or loss (FVTPL). Despite the foregoing, the Entity may make the following irrevocable election / designation at initial recognition of a financial asset: • The Entity may irrevocably elect to present subsequent changes in fair value of an equity investment in other comprehensive income if certain criteria are met and • The Entity may irrevocably designate a debt investment that meets the amortized cost or FVTOCI criteria as measured at FVTPL if doing so eliminates or significantly reduces an accounting mismatch. (i) Amortized cost and effective interest method The effective interest method is a method for calculating the amortized cost of a debt instrument and for allocating interest income during the relevant period.

19 For financial assets that were not purchased or originated by credit-impaired financial assets (for example, assets that are credit-impaired on initial recognition), the effective interest rate is the rate that exactly discounts future cash inflows (including all commissions and points paid or received that form an integral part of the effective interest rate, transaction costs, and other premiums or discounts), excluding expected credit losses, over the expected life of the debt instrument or , if applicable, a shorter period, to the gross carrying amount of the debt instrument on initial recognition. For purchased or originated credit-impaired financial assets, a credit-adjusted effective interest rate is calculated by discounting estimated future cash flows, including expected credit losses, at the amortized cost of the debt instrument on initial recognition. The amortized cost of a financial asset is the amount at which the financial asset is measured on initial recognition minus repayments of principal, plus the accumulated amortization using the effective interest method of any difference between that initial amount and the maturity amount, adjusted for any loss allowance. The gross carrying amount of a financial asset is the amortized cost of a financial asset before adjusting any provision for loss allowance. Interest income is recognized using the effective interest method for debt instruments subsequently measured at amortized cost and at FVTCOI. For financial assets other than purchased or originated credit-impaired financial assets, interest income is calculated by applying the effective interest rate to the gross carrying amount of a financial asset, except for financial assets that have subsequently suffered impairment of credit (see below). For financial assets that have subsequently credit-impaired, interest income is recognized by applying the effective interest rate to the amortized cost of the financial asset. If, in subsequent reporting periods the credit risk in the credit-impaired financial instrument improves, so that the financial asset is no longer credit-impaired, interest income is recognized by applying the effective interest rate to the gross carrying amount of the financial asset. Interest income is recognized as realized in the consolidated statements of profit and other comprehensive income (loss) and is included in the interest income line item. Foreign exchange gains and losses The carrying amount of financial assets denominated in a foreign currency is determined in that foreign currency and translated at the exchange rate at the end of each reporting period. For financial assets measured at amortized cost that are not part of a designated hedging relationship, exchange differences are recognized in exchange gain (loss) -net in the statement of profit and other comprehensive income (loss). Impairment of financial assets The Entity recognizes lifetime expected credit losses (“ECL”) for operating lease receivables. The expected credit losses on these financial assets are estimated using a provision matrix based on the Entity’s historical credit loss experience, adjusted for factors that are specific to the debtors, general economic conditions and an assessment of both the current as well as the forecast direction of conditions at the reporting date, including time value of money where appropriate. (i) Measurement and recognition of expected credit losses The measurement of expected credit losses is a function of the probability of default, the loss given the default (that is, the magnitude of the loss if there is a default), and the exposure at default.

20 The evaluation of the probability of default and the default loss is based on historical data adjusted for forward-looking information as described above. Regarding exposure to default, for financial assets, this is represented by the gross book value of the assets on the reporting date; for financial guarantee contracts, the exposure includes the amount established on the reporting date, along with any additional amount expected to be obtained in the future by default date determined based on the historical trend, the Entity's understanding of the specific financial needs of the debtors, and other relevant information for the future. For financial assets, the expected credit loss is estimated as the difference between all the contractual cash flows that are due to the Entity in accordance with the contract and all the cash flows that the Entity expects to receive, discounted at the original effective interest rate. For a lease receivable, the cash flows used to determine the expected credit losses are consistent with the cash flows used in the measurement of the lease receivable in accordance with IFRS 16 Leases. The Entity recognizes an impairment loss or loss in the result of all financial instruments with a corresponding adjustment to their book value through a provision for losses account, except investments in debt instruments that are measured at fair value at through other comprehensive income, for which the provision for losses is recognized in other comprehensive and accumulated results in the investment revaluation reserve, and does not reduce the book value of the financial asset in the statement of financial position. Derecognition of financial assets The Entity derecognizes a financial asset only when the contractual rights to the cash flows expire, or when it transfers the financial asset and substantially all the risks and rewards of ownership of the asset to another entity. If the Entity does not transfer or retain substantially all the risks and benefits of ownership and continues to control the transferred asset, the Entity recognizes its retained interest in the asset and an associated liability for the amounts due. If the Entity retains substantially all the risks and benefits of ownership of a transferred financial asset, the Entity continues to recognize the financial asset and also recognizes a collateralized borrowing for the proceeds received. Upon derecognition of a financial asset measured at amortized cost, the difference between the asset's carrying amount and the sum of the consideration received and receivable is recognized in profit or loss. In addition, when an investment in a debt instrument classified as at FVTOCI is written off, the accumulated gain or loss previously accumulated in the investment revaluation reserve is reclassified to profit or loss. In contrast, in the derecognition of an investment in a capital instrument that the Entity chose in the initial recognition to measure at FVTOCI, the accumulated gain or loss previously accumulated in the investment revaluation reserve is not reclassified to profit or loss but is transferred to retained earnings. f. Financial liabilities All financial liabilities are measured subsequently at amortized cost using the effective interest method. Financial liabilities measured subsequently at amortized cost Financial liabilities (including borrowings) that are not (i) contingent consideration of an acquirer in a business combination, (ii) held-for-trading, or (iii) designated as at FVTPL, are measured subsequently at amortized cost using the effective interest method. The effective interest method is a method of calculating the amortized cost of a financial liability and of allocating interest expense over the relevant period. The effective interest rate is the rate that exactly discounts estimated future cash payments (including all fees and expenses paid or received that form an integral part of the effective interest rate, transaction costs and other premiums or discounts) through the expected life of the financial liability, or (where appropriate) a shorter period, to the amortized cost of a financial liability.

21 Foreign exchange gains and losses For financial liabilities that are denominated in a foreign currency and are measured at amortized cost at the end of each reporting period, the foreign exchange gains and losses are determined based on the amortized cost of the instruments. These foreign exchange gains and losses are recognized in the ‘exchange (loss) gain - net’ line item in profit or loss for financial liabilities. Modification of contractual cash flows When the contractual cash flows of a financial instrument are modified and does not result in derecognition, differences between the recalculated gross carrying amount and the carrying amount before modification is recognized in profit or loss as modification gain or loss, at the date of modification. Financial liabilities linked to a sustainability factor For sustainability-linked bonds or credit facilities, where compliance with a sustainability factor results in a decrease in the contractual interest rate, the Entity assesses whether the contractual linkage of the interest amount to such sustainability factor meets the definition of an embedded derivative that needs to be bifurcated from the host contract and accounted for separately. To make this assessment, the Entity analyzes whether the sustainability factor is a financial or non-financial variable, which is determined by the impact of such variable on the Entity’s own credit risk. For instruments where the sustainability factor is a financial variable, the Entity has determined that the definition of an embedded derivative is met. However, the economic characteristics and risks of the embedded derivative are deemed to be closely related to the host contract, and therefore, it is not bifurcated. When there are changes in cash flows resulting from changes in interest rates caused by the sustainability factor, the Entity revises the future cash flows and adjusts the effective interest rate accordingly, having no impact on profit or loss. For instruments where the sustainability factor is a non-financial variable, the Entity has determined that the definition of an embedded derivative is not met. When there are changes in cash flows resulting from changes in interest rates caused by the sustainability factor, the Entity revises the future cash flows and discounts them using the original effective interest rate. The difference between the carrying amount before the change and the remeasured carrying amount is recognized immediately in profit or loss. Derecognition of financial liabilities The Entity derecognizes financial liabilities when, and only when, the Entity’s obligations are discharged, cancelled or have expired. The difference between the carrying amount of the financial liability derecognized and the consideration paid and payable is recognized in profit or loss. When the Entity exchanges with the existing lender a debt instrument in another with substantially different terms, that exchange is accounted for as an extinction of the original financial liability and the recognition of a new financial liability. Similarly, the Entity considers the substantial modification of the terms of an existing liability or part of it as an extinction of the original financial liability and the recognition of a new liability. The terms are assumed to be substantially different if the discounted present value of the cash flows under the new terms, including any fees paid net of any fees received and discounted using the original effective rate, is at least 10% different from the current discounted rate. Value of the remaining cash flows of the original financial liability. If the modification is not material, the difference between: (1) the carrying amount of the liability before the modification; and (2) the present value of the cash flows after the modification should be recognized in profit or loss as the gain or loss from the modification within other gains and losses.

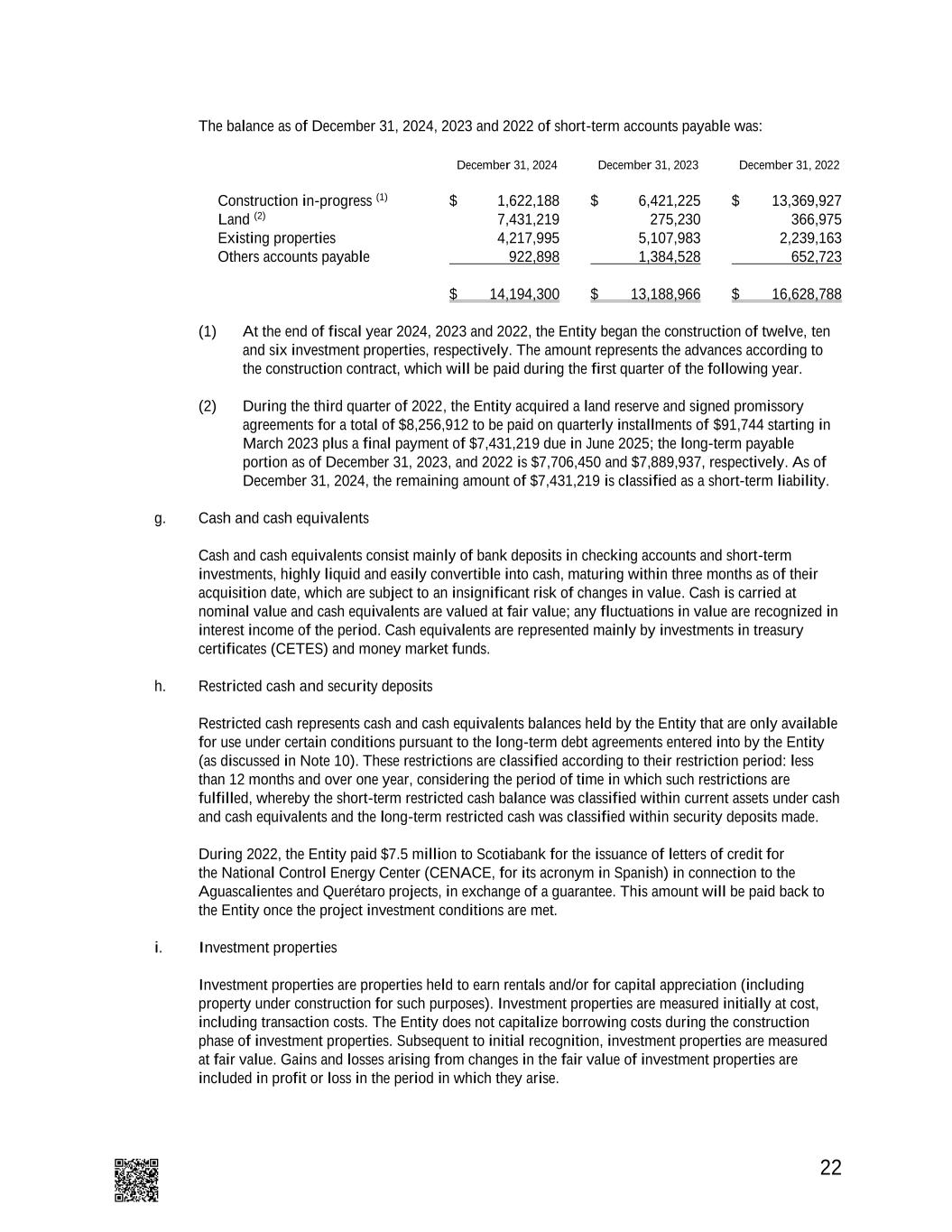

22 The balance as of December 31, 2024, 2023 and 2022 of short-term accounts payable was: December 31, 2024 December 31, 2023 December 31, 2022 Construction in-progress (1) $ 1,622,188 $ 6,421,225 $ 13,369,927 Land (2) 7,431,219 275,230 366,975 Existing properties 4,217,995 5,107,983 2,239,163 Others accounts payable 922,898 1,384,528 652,723 $ 14,194,300 $ 13,188,966 $ 16,628,788 (1) At the end of fiscal year 2024, 2023 and 2022, the Entity began the construction of twelve, ten and six investment properties, respectively. The amount represents the advances according to the construction contract, which will be paid during the first quarter of the following year. (2) During the third quarter of 2022, the Entity acquired a land reserve and signed promissory agreements for a total of $8,256,912 to be paid on quarterly installments of $91,744 starting in March 2023 plus a final payment of $7,431,219 due in June 2025; the long-term payable portion as of December 31, 2023, and 2022 is $7,706,450 and $7,889,937, respectively. As of December 31, 2024, the remaining amount of $7,431,219 is classified as a short-term liability. g. Cash and cash equivalents Cash and cash equivalents consist mainly of bank deposits in checking accounts and short-term investments, highly liquid and easily convertible into cash, maturing within three months as of their acquisition date, which are subject to an insignificant risk of changes in value. Cash is carried at nominal value and cash equivalents are valued at fair value; any fluctuations in value are recognized in interest income of the period. Cash equivalents are represented mainly by investments in treasury certificates (CETES) and money market funds. h. Restricted cash and security deposits Restricted cash represents cash and cash equivalents balances held by the Entity that are only available for use under certain conditions pursuant to the long-term debt agreements entered into by the Entity (as discussed in Note 10). These restrictions are classified according to their restriction period: less than 12 months and over one year, considering the period of time in which such restrictions are fulfilled, whereby the short-term restricted cash balance was classified within current assets under cash and cash equivalents and the long-term restricted cash was classified within security deposits made. During 2022, the Entity paid $7.5 million to Scotiabank for the issuance of letters of credit for the National Control Energy Center (CENACE, for its acronym in Spanish) in connection to the Aguascalientes and Querétaro projects, in exchange of a guarantee. This amount will be paid back to the Entity once the project investment conditions are met. i. Investment properties Investment properties are properties held to earn rentals and/or for capital appreciation (including property under construction for such purposes). Investment properties are measured initially at cost, including transaction costs. The Entity does not capitalize borrowing costs during the construction phase of investment properties. Subsequent to initial recognition, investment properties are measured at fair value. Gains and losses arising from changes in the fair value of investment properties are included in profit or loss in the period in which they arise.

23 An investment property is derecognized upon sale or when the investment property is permanently withdrawn from use and no future economic benefits are expected to be received from such investment property. Any gain or loss arising on derecognition of the property (calculated as the difference between the net sale proceeds and the carrying amount of the asset) is included in gain or loss on sale of investment properties in the period in which the property is derecognized. j. Leases 1) The Entity as lessor Vesta, as a lessor, retains substantially all of the risks and benefits of ownership of the investment properties and account for its leases as operating leases. Rental income from operating leases is recognized on a straight-line basis over the term of the relevant lease. Initial direct costs incurred in negotiating and arranging an operating lease are added to the carrying amount of the leased asset and recognized on a straight-line basis over the lease term. 2) The Entity as lessee The Entity assesses whether a contract is or contains a lease, at inception of the contract. The Entity recognizes a right-of-use asset and a corresponding lease liability with respect to all lease arrangements in which it is the lessee, except for short-term leases (defined as leases with a lease term of 12 months or less) and leases of low value assets. For these leases, the Entity recognizes the lease payments as an operating expense on a straight-line basis over the term of the lease unless another systematic basis is more representative of the time pattern in which economic benefits from the leased assets are consumed. The lease liability is initially measured at the present value of the lease payments that are not paid at the commencement date, discounted by using the rate implicit in the lease. If this rate cannot be readily determined, the Entity uses its incremental borrowing rate. Lease payments included in the measurement of the lease liability comprise: • Fixed lease payments (including in-substance fixed payments), less any lease incentives; • Variable lease payments that depend on an index or rate, initially measured using the index or rate at the commencement date; • The amount expected to be payable by the lessee under residual value guarantees; • The exercise price of purchase options, if the lessee is reasonably certain to exercise the options; and • Payments of penalties for terminating the lease, if the lease term reflects the exercise of an option to terminate the lease. The lease liability is presented as a separate line in the consolidated statement of financial position. The lease liability is subsequently measured by increasing the carrying amount to reflect interest on the lease liability (using the effective interest method) and by reducing the carrying amount to reflect the lease payments made. Rights-of-use assets consist of the initial measurement of the corresponding lease liability, the lease payments made at or before the commencement date, less any lease incentives received and any initial direct costs. Subsequent valuation is cost less accumulated depreciation and impairment losses.

24 If the Entity incurs an obligation arising from the costs of dismantling and removing a leased asset, restoring the place in which it is located, or restoring the underlying asset to the condition required by the terms and conditions of the lease, a provision measured in accordance with IAS 37 should be recognized. To the extent that the costs are related to a rights of use asset, the costs are included in the related rights of use asset. Right-of-use assets are depreciated over the shorter period between the lease term and the useful life of the underlying asset. If a lease transfers ownership of the underlying asset or the cost of the right-of-use reflects that the Entity expects to exercise a purchase option, the related right-of-use asset is depreciated over its useful life of the underlying asset. The depreciation starts at commencement date of the lease. Right-of-use assets are presented as a separate concept in the consolidated statement of financial position. The Entity applies IAS 36 to determine whether a right-of-use asset is impaired and accounts for any identified impairment loss. Leases with variable income that do not depend on an index or rate are not included in the measurement of the lease liability and the right-of-use asset. The related payments are recognized as an expense in the period in which the event or condition that triggers the payments occurs and are included in the concept of “Other expenses” in the consolidated statement of profits and other comprehensive income (loss). As a practical expedient, IFRS 16 permits a lessee not to separate non-lease components, and instead account for any lease and associated non-lease components as a single arrangement. The Entity has not used this practical expedient. For contracts that contain lease components and one or more additional lease or non-lease components, the Entity assigns the consideration of the contract to each lease component on the basis of the relative selling price method independent of the lease component and aggregate stand-alone relative stand-alone price of the lease component and the aggregate stand-alone price of the non-lease components. k. Foreign currencies The U.S. dollar is the functional currency of Vesta and all of its subsidiaries except for WTN Desarrollos Inmobiliarios de México, S. de R. L. de C. V. (“WTN”), which considers the Mexican peso as its functional currency and is considered as a “foreign operation” under IFRS. However, Vesta and its subsidiaries keep their accounting records in Mexican pesos. In preparing the financial statements of each individual entity, transactions in currencies other than the entity's functional currency (foreign currencies) are recognized at the exchange rates in effect on the dates of each transaction. At the end of each reporting period, monetary items denominated in foreign currencies are retranslated at the exchange rates in effect at that date. Non-monetary items carried at fair value that are denominated in foreign currencies are retranslated at the exchange rates in effect on the date when the fair value was determined. Non-monetary items that are measured in terms of historical cost in a foreign currency are not retranslated. Exchange differences on monetary items are recognized in profit or loss in the period in which they arise. For the purposes of presenting consolidated financial statements, the assets and liabilities of WTN are translated into U.S. dollars using the exchange rates in prevailing on the reporting date. Income and expense items are translated at the average exchange rates for the period, unless exchange rates fluctuate significantly during that period, in which case the exchange rates at the dates of the transactions are used. Exchange differences arising, if any, are recorded in other comprehensive income.

25 l. Employee benefits Employee benefits for termination Employee benefits for termination are recorded in the results of the year in which they are incurred. Short-term and other long-term employee benefits A liability is recognized for benefits accruing to employees in respect of wages and salaries, annual leave, and sick leave in the period the related service is rendered at the undiscounted amount of the benefits expected to be paid in exchange for that service. Liabilities recognized in respect of short-term employee benefits are measured at the undiscounted amount of the benefits expected to be paid in exchange for the related service. Liabilities recognized in respect of other long-term employee benefits are measured at the present value of the estimated future cash outflows expected to be made by the Entity in respect of services provided by employees up to the reporting date. Post-employment and other long-term employee benefits Post-employment and other long-term employee benefits, which are considered to be monetary items, include obligations for pension and retirement plans and seniority premiums. In Mexico, the economic benefits from employee benefits and retirement pensions are granted to employees with 10 years of service and minimum age of 60. In accordance with Mexican Labor Law, the Entity provides seniority premium benefits to its employees under certain circumstances. These benefits consist of a one-time payment equivalent to 12 days wages for each year of service (at the employee’s most recent salary, but not to exceed twice the legal minimum wage), payable to all employees with 15 or more years of service, as well as to certain employees terminated involuntarily before the vesting of their seniority premium benefit. For defined benefit retirement plans and other long-term employee benefits, such as the Entity’s sponsored pension and retirement plans and seniority premiums, the cost of providing benefits is determined using the projected unit credit method, with actuarial valuations being carried out at the end of each reporting period. All remeasurement effects of the Entity’s defined benefit obligation such as actuarial gains and losses are recognized directly in Other comprehensive gain – Net of tax. The Entity presents service costs within general and administrative expenses in the consolidated statement of profit and other comprehensive income (Loss). The Entity presents net interest cost within finance costs in the consolidated statement of profit and other comprehensive income (Loss). The projected benefit obligation recognized in the consolidated statement of financial position represents the present value of the defined benefit obligation as of the end of each reporting period. Statutory employee profit sharing (“PTU”) PTU is recorded in the results of the year in which it is incurred and is presented in the general and administrative expenses line item in the consolidated statement of profit and other comprehensive income (loss). As result of the recent changes to the Income Tax Law and the Labor Law, as of December 31, 2024, 2023 and 2022, PTU is determined based on taxable income, according to Section I of Article 9 of the that Law and the Article 127 of the Labor Law.

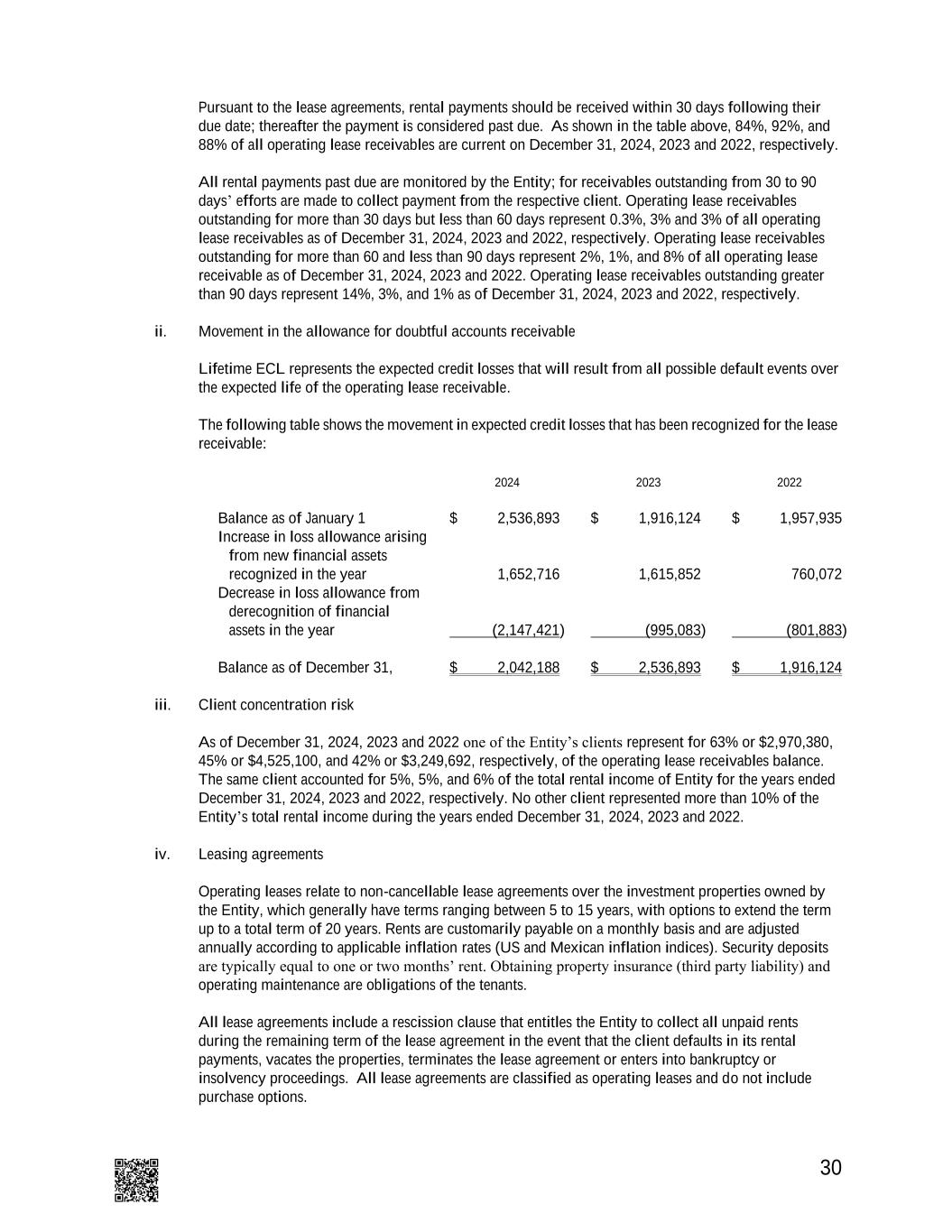

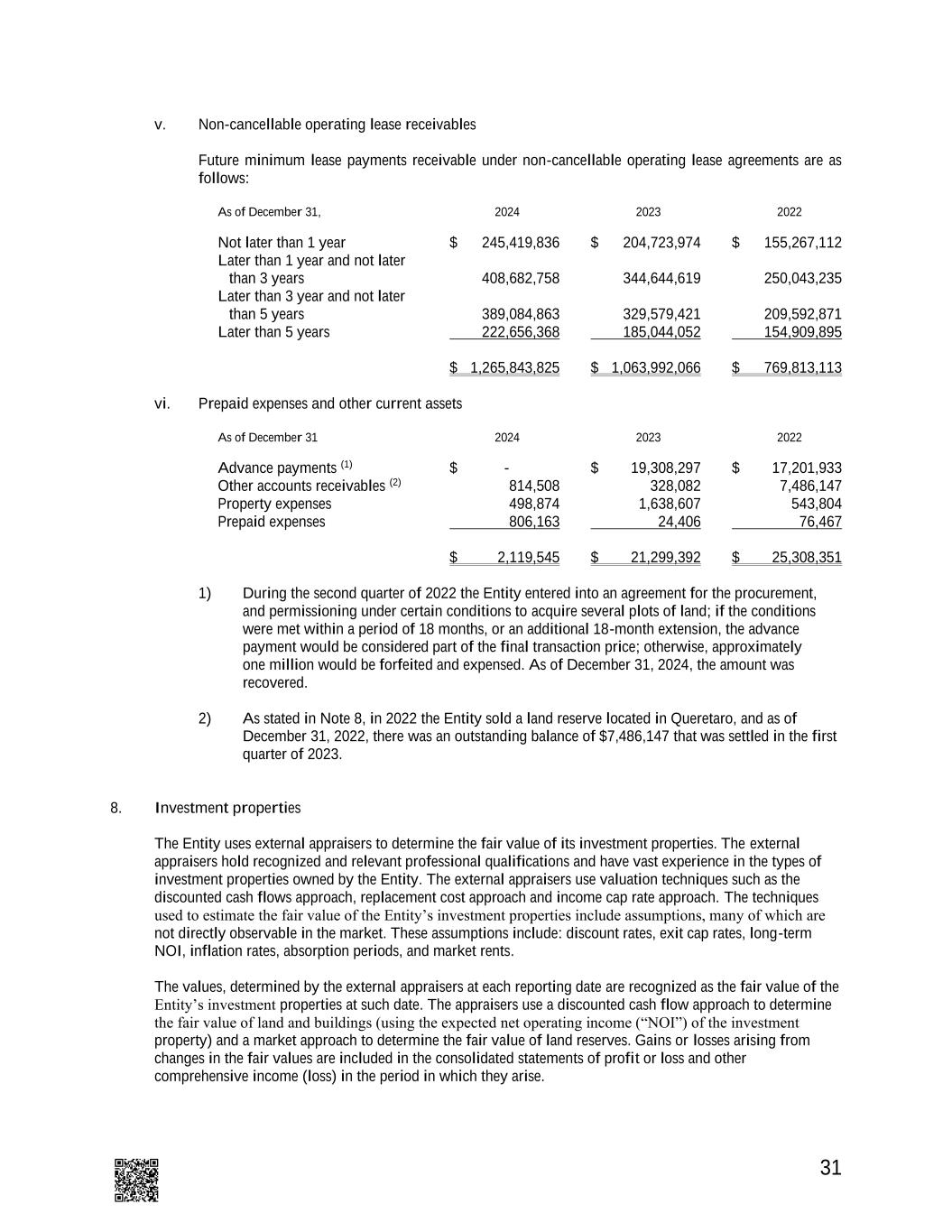

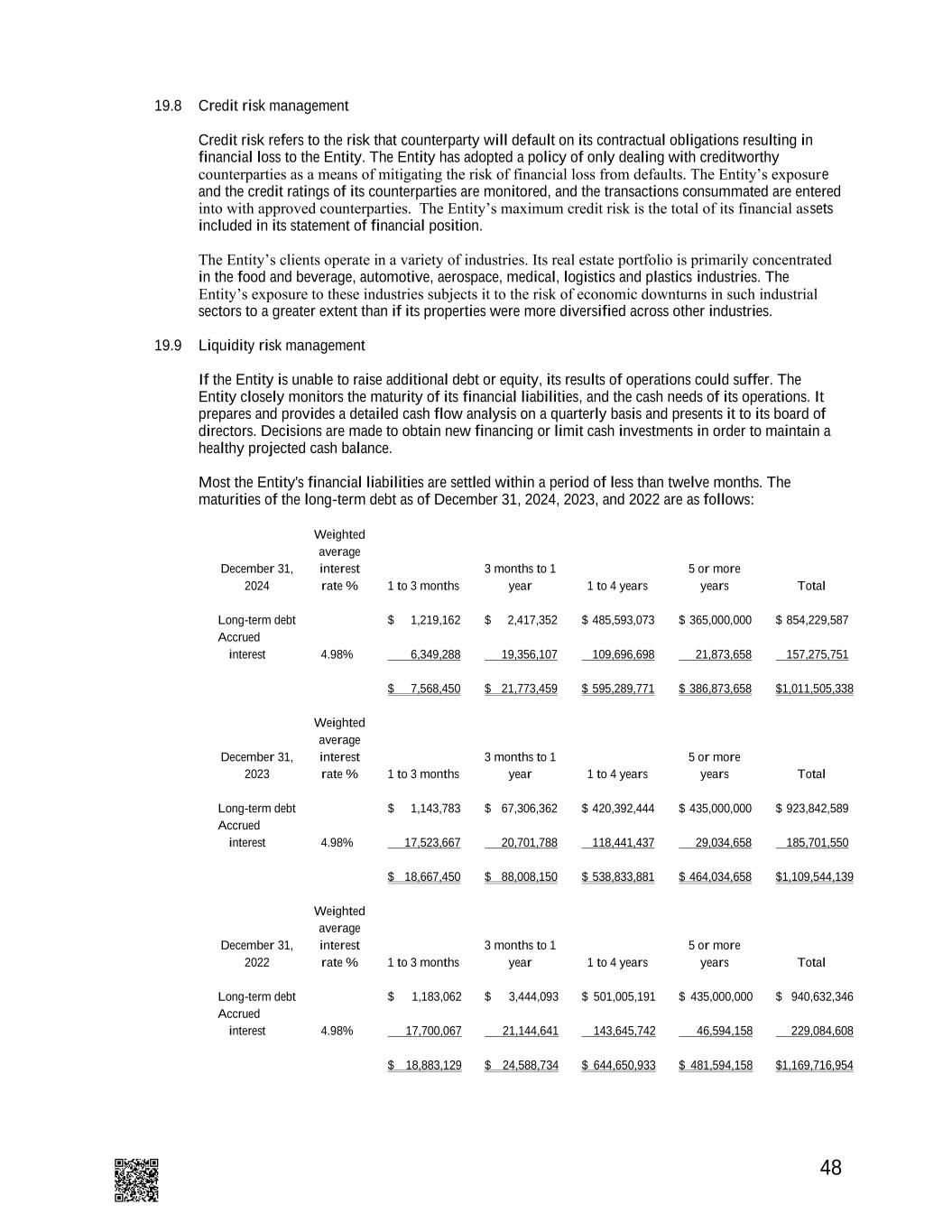

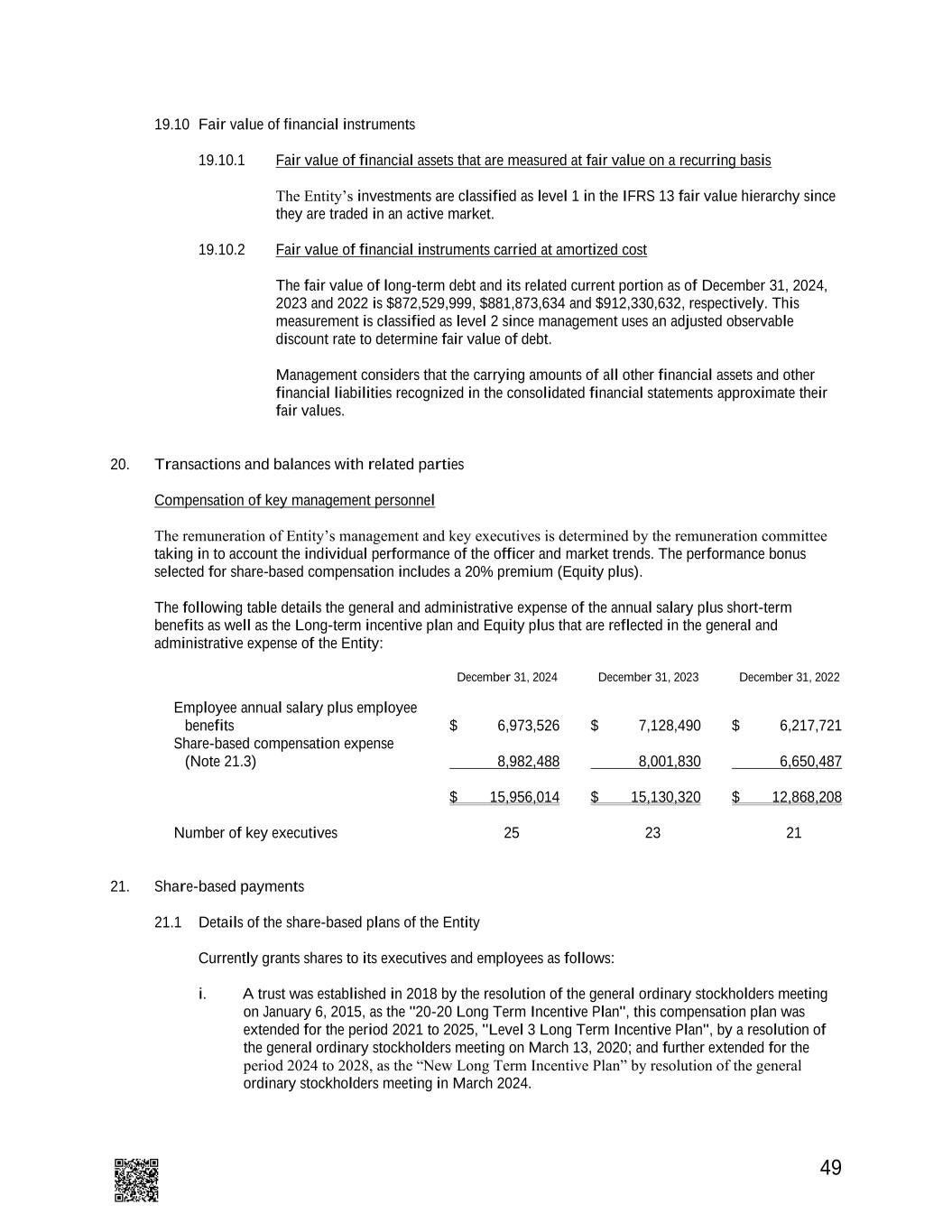

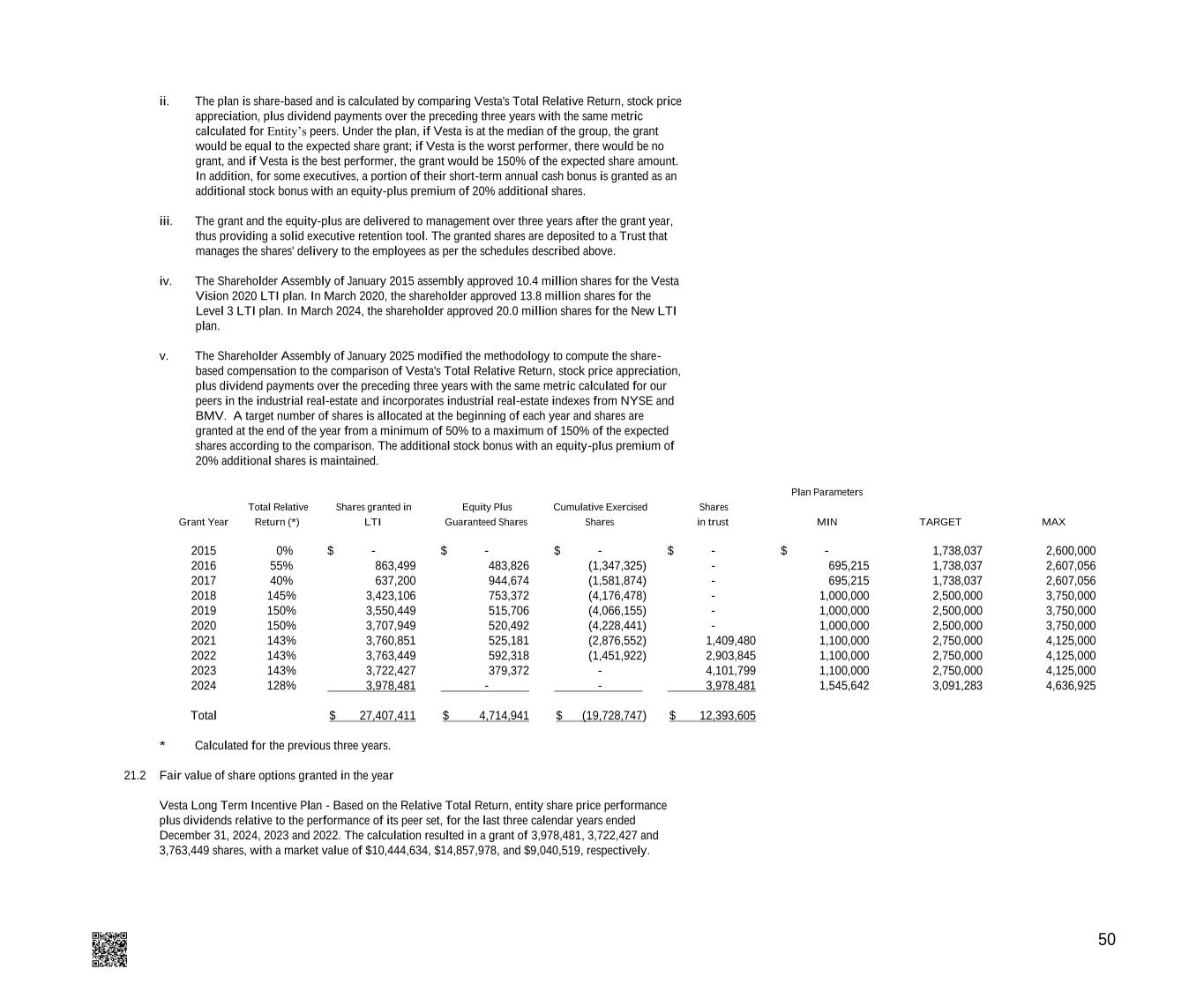

26 Compensated absences The Entity creates a provision for the costs of compensated absences, such as paid annual leave, which is recognized using the accrual method. m. Share-based payment arrangements Share-based payment transactions of the Entity Equity-settled share-based payments to employees are measured at the fair value of the equity instruments at the grant date. Details regarding the determination of the fair value of equity-settled share-based transactions are set out in Note 21. The fair value determined at the grant date of the equity-settled share-based payments is expensed on a straight-line basis over the vesting period, based on the Entity’s estimate of equity instruments that will eventually vest, with a corresponding increase in equity. At the end of each reporting period, the Entity revises its estimate of the number of equity instruments expected to vest. The impact of the revision of the original estimates, if any, is recognized in profit or loss such that the cumulative expense reflects the revised estimate, with a corresponding adjustment to the equity settled employee benefits reserve. n. Income taxes Income tax expense represents the sum of current and deferred income tax expense. 1. Current tax Current income tax (“ISR”) is recognized in the results of the year in which is incurred. The tax currently payable is based on taxable profit for the year. Taxable profit differs from net profit as reported in profit or loss because it excludes items of income or expense that are taxable or deductible in other years and it further excludes items that are never taxable or deductible. The Entity’s liability for current tax is calculated using tax rates that have been enacted or substantively enacted by the end of the reporting period. A provision is recognized for those matters for which the tax determination is uncertain but it is considered probable that there will be a future outflow of funds to a tax authority. The provisions are measured at the best estimate of the amount expected to become payable. The assessment is based on the judgement of tax professionals within the Entity supported by previous experience in respect of such activities and in certain cases based on specialist independent tax advice. 2. Deferred income tax Deferred tax is recognized on temporary differences between the carrying amounts of assets and liabilities in the consolidated financial statements and the corresponding tax bases used in the computation of taxable profit. Deferred tax liabilities are generally recognized for all taxable temporary differences and deferred tax assets are generally recognized for all deductible temporary differences to the extent that it is probable that taxable profits will be available against which those deductible temporary differences can be utilized. Such deferred tax assets and liabilities are not recognized if the temporary difference arises from the initial recognition (other than in a business combination) of other assets and liabilities in a transaction that affects neither the taxable profit nor the accounting profit. In addition, deferred tax liabilities are not recognized if the temporary difference arises from the initial recognition of goodwill.