Exhibit 4.10 The redacted information (indicated with [***]) has been excluded because it is both (i) not material and (ii) of the type that the registrant customarily and actually treats as private or confidential Execution Version INVESTMENT NUMBER 50506 Loan Agreement between CORPORACIÓN INMOBILIARIA VESTA, S.A.B. DE C.V., as Borrower and INTERNATIONAL FINANCE CORPORATION as Lender Dated as of December 17, 2024

TABLE OF CONTENTS Article/ Section Item Page No. ARTICLE I .................................................................................................................................................. 1 Definitions and Interpretation ................................................................................................................... 1 Section 1.01. Definitions ......................................................................................................................... 1 Section 1.02. Accounting Terms .............................................................................................................. 8 Section 1.03. Interpretation ..................................................................................................................... 8 Section 1.04. Business Day Adjustment ................................................. ¡Error! Marcador no definido. ARTICLE II ................................................................................................................................................ 9 The Loan ...................................................................................................................................................... 9 Section 2.01. The Loan ............................................................................................................................ 9 Section 2.02. Disbursement Procedure ................................................................................................... 9 Section 2.03. Interest ............................................................................................................................. 10 Section 2.04. Default Rate Interest ........................................................................................................ 11 Section 2.05. Repayment ....................................................................................................................... 12 Section 2.06. Voluntary Prepayment ..................................................................................................... 12 Section 2.07. Mandatory Prepayment ................................................................................................... 13 Section 2.08. Fees .................................................................................................................................. 13 Section 2.09. Currency and Place of Payments .................................................................................... 14 Section 2.10. Allocation of Partial Payments ........................................................................................ 15 Section 2.11. Increased Costs ................................................................................................................ 15 Section 2.12. Unwinding Costs .............................................................................................................. 15 Section 2.13. Suspension or Cancellation by IFC ................................................................................. 15 Section 2.14. Cancellation by the Borrower ......................................................................................... 16 Section 2.15. Taxes ................................................................................................................................ 16 Section 2.16. Expenses .......................................................................................................................... 17 Section 2.17. Illegality of Participation ................................................................................................ 17 Section 2.18. Evidence of Debt .............................................................................................................. 18 ARTICLE III ............................................................................................................................................. 19 Representations and Warranties ............................................................................................................. 19 Section 3.01. Representations and Warranties ...................................................................................... 19 Section 3.02. IFC Reliance .................................................................................................................... 20 ARTICLE IV ............................................................................................................................................. 20 Conditions of Disbursement ..................................................................................................................... 20 Section 4.01. Conditions of First Disbursement .................................................................................... 20 Section 4.02. Conditions of All Disbursements ..................................................................................... 21 Section 4.03. Borrower's Certification .................................................................................................. 22 Section 4.04. Conditions for IFC Benefit .............................................................................................. 22 ARTICLE V .............................................................................................................................................. 22 Particular Covenants ................................................................................................................................ 22

- ii - Article/ Section Item Page No. Section 5.01. Affirmative Covenants ..................................................................................................... 22 Section 5.02. Negative Covenants ......................................................................................................... 25 Section 5.03. Most Favored Nation ....................................................................................................... 26 ARTICLE VI ............................................................................................................................................. 26 Events of Default ....................................................................................................................................... 26 Section 6.01. Acceleration after Default ............................................................................................... 26 Section 6.02. Events of Default ............................................................................................................. 26 Section 6.03. Bankruptcy ....................................................................................................................... 27 ARTICLE VII ........................................................................................................................................... 27 Miscellaneous............................................................................................................................................. 27 Section 7.01. Saving of Rights ............................................................................................................... 27 Section 7.02. Notices ............................................................................................................................. 28 Section 7.03. English Language ............................................................................................................ 28 Section 7.04. Term of Agreement .......................................................................................................... 29 Section 7.05. Applicable Law and Jurisdiction ..................................................................................... 29 Section 7.06. Disclosure of Information ................................................................................................ 30 Section 7.07. Indemnification; No Consequential Damage .................................................................. 31 Section 7.08. Successors and Assignees ................................................................................................ 32 Section 7.09. Amendments, Waivers and Consents ............................................................................... 32 Section 7.10. Counterparts .................................................................................................................... 33 Section 7.11. Third Party rights ............................................................................................................ 33 Section 7.12. Personal Data .................................................................................................................. 33 Section 7.13. Independence of the Borrower ......................................................................................... 34 Section 7.14. Role of IFC ...................................................................................................................... 34 Section 7.15. Acknowledgment of CAO ................................................................................................. 34

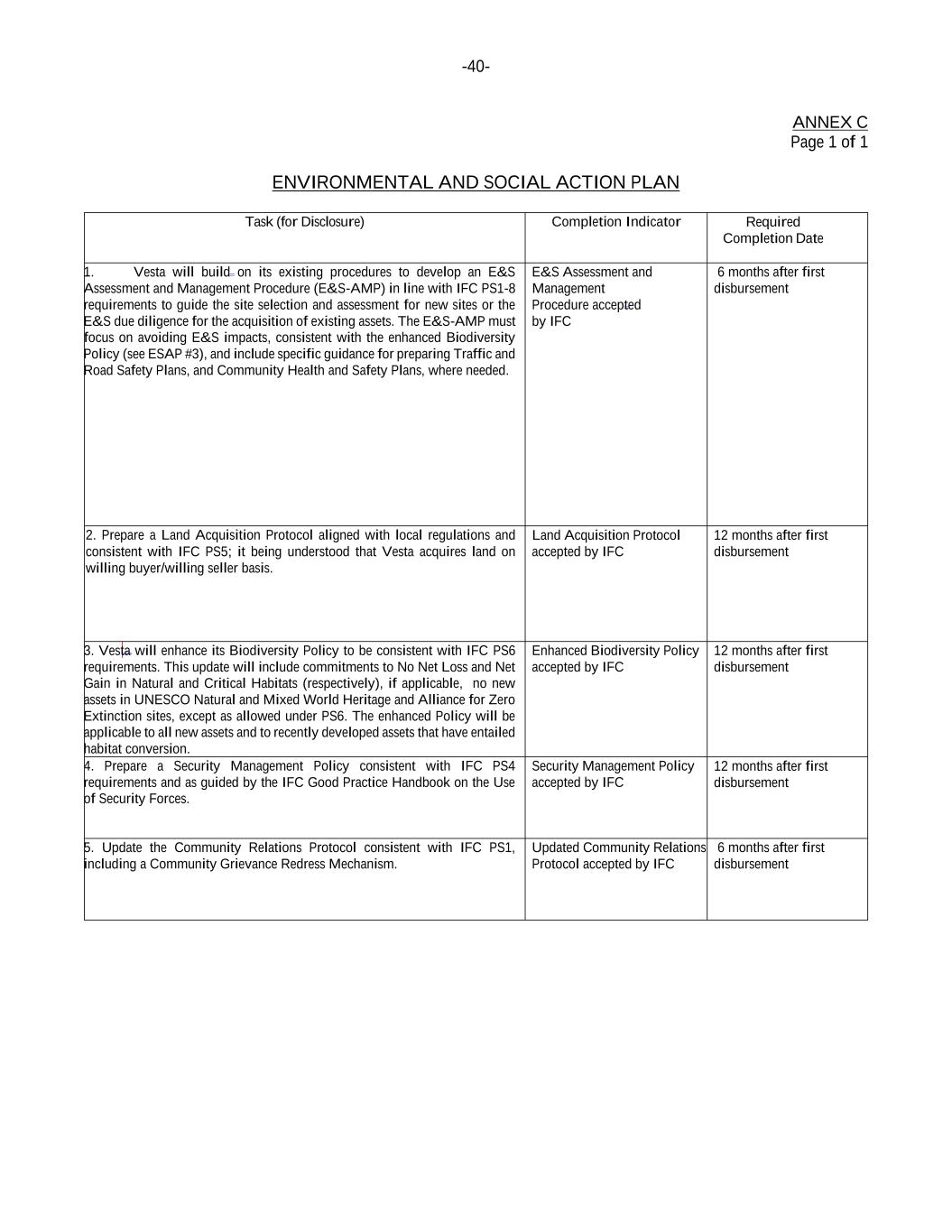

- iii - Article/ Section Item Page No. ANNEX A .................................................................................................................................................. 36 ANTI-CORRUPTION GUIDELINES FOR IFC TRANSACTIONS ........................................................ 36 ANNEX B ................................................................................................................................................... 39 PROHIBITED ACTIVITIES ...................................................................................................................... 39 ANNEX C .................................................................................................................................................. 40 ENVIRONMENTAL AND SOCIAL ACTION PLAN ............................................................................. 40 SCHEDULE 1............................................................................................................................................ 41 FORM OF ANNUAL MONITORING REPORT ...................................................................................... 41 SCHEDULE 2............................................................................................................................................ 18 FORM OF CERTIFICATE OF INCUMBENCY AND AUTHORITY ..................................................... 18 SCHEDULE 3............................................................................................................................................ 20 FORM OF LOAN NOTICE ....................................................................................................................... 20 SCHEDULE 4............................................................................................................................................ 22 FORM OF LOAN DISBURSEMENT RECEIPT ...................................................................................... 22 SCHEDULE 5............................................................................................................................................ 23 DEVELOPMENT IMPACT INDICATORS .............................................................................................. 23 SCHEDULE 6............................................................................................................................................ 24 APPLICABLE MARGIN ........................................................................................................................... 24 SCHEDULE 7............................................................................................................................................ 25 FORM OF SERVICE OF PROCESS LETTER ......................................................................................... 25 SCHEDULE 8............................................................................................................................................ 27 FORM OF IFC GUARANTEE AGREEMENT ......................................................................................... 27

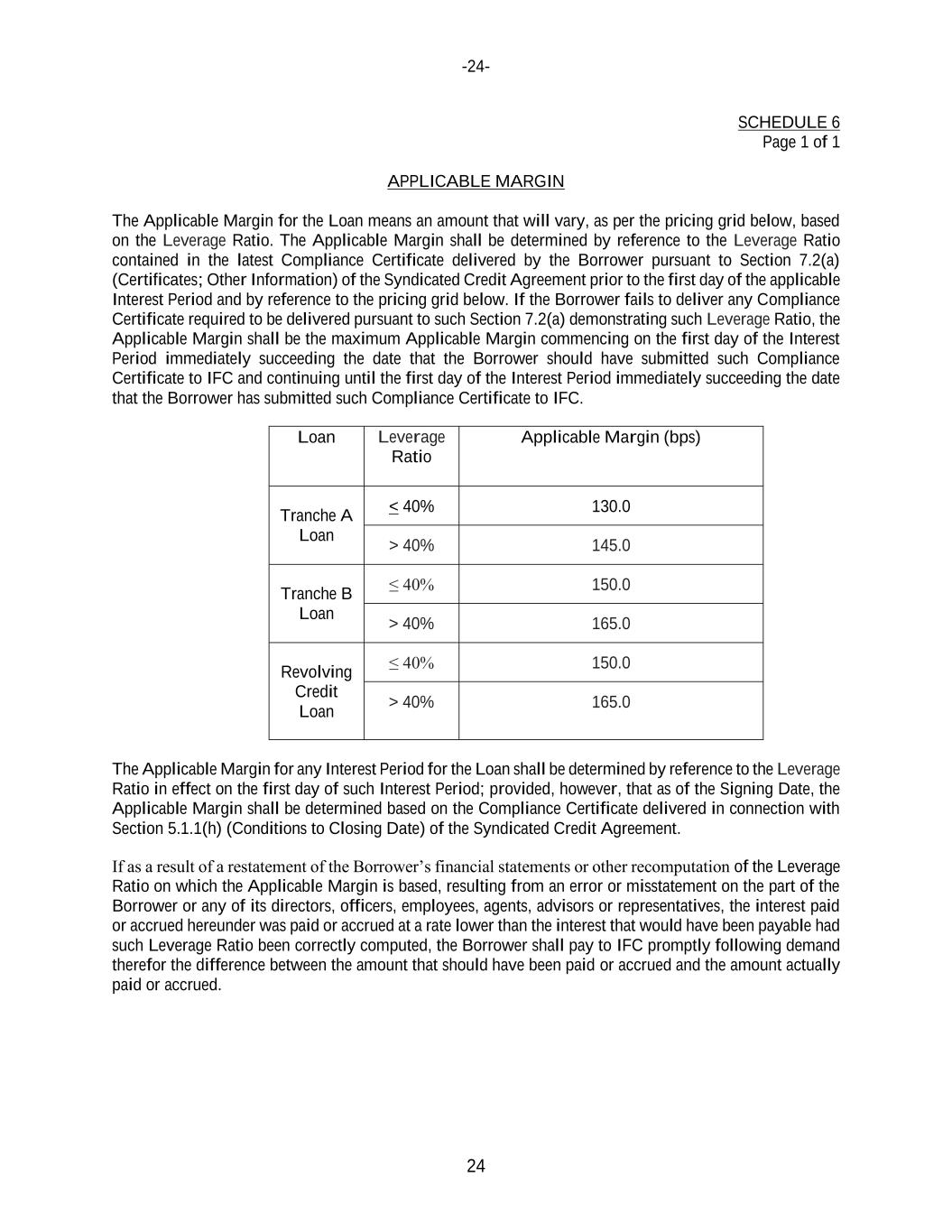

LOAN AGREEMENT LOAN AGREEMENT (the “Agreement”) dated as of December 17, 2024 (the “Signing Date”), between CORPORACIÓN INMOBILIARIA VESTA, S.A.B. DE C.V., a publicly traded corporation with variable capital (sociedad anónima bursátil de capital variable) organized and existing under the laws of Mexico (the “Borrower”) and INTERNATIONAL FINANCE CORPORATION, an international organization established by Articles of Agreement among its member countries including Mexico (“IFC”). RECITAL (A) On or about the date hereof, the Borrower is entering into the Syndicated Credit Agreement (as defined below) in order to procure loans for the purposes specified in Section 7.11 of such Syndicated Credit Agreement. (B) In parallel to the Syndicated Credit Agreement, the Borrower has requested that IFC provide a loan for the above-referenced purposes and IFC is willing to provide that loan. (C) Given certain specific policy and other requirements applicable to IFC and any financing provided by it, IFC and the Borrower are entering into this separate agreement, in parallel with the Syndicated Credit Agreement, in order to provide for the terms and conditions that shall govern the loan to provided by IFC to the Borrower. ARTICLE I Definitions and Interpretation Section 1.01. Definitions. Unless otherwise defined herein, capitalized terms defined in the Syndicated Credit Agreement shall have the same meanings as used herein. Otherwise, wherever used in this Agreement, the following terms have the following meanings: “Action Plan” means the Environmental and Social Action Plan set forth in Annex C (Environmental and Social Action Plan), as the same may be amended or supplemented from time to time in accordance with the terms hereof; “Annual Monitoring Report” means the annual monitoring report substantially in the form attached as Schedule 1 hereto setting out the specific environmental and social requirements of the Borrower in respect of its and its Subsidiaries’ Operations, as such may be amended or supplemented from time to time in accordance with the terms hereof; “Applicable E&S Law” means all applicable statutes, laws, ordinances, rules and regulations of the Country, including but not limited to any license, permit or other governmental Authorization, imposing liability or setting standards of conduct concerning any environmental, social, labor, health and safety or security risks of the type contemplated by the Performance Standards; “Applicable Margin” means a rate per annum determined in accordance with Schedule 6 (Applicable Margin), subject to any adjustment thereto pursuant to Section 2.03(e) (Interest). For the avoidance of doubt, (i) the rate determined for the Tranche A Loan under Schedule 6 (Applicable Margin) shall be the rate for the Tranche A Loan hereunder, (ii) the rate determined for the Tranche B Loan under Schedule 6 (Applicable Margin) shall be

-2- the rate for the Tranche B Loan hereunder and (iii) the rate determined for the Revolving Credit Loan under Schedule 6 (Applicable Margin) shall be the rate for the Revolving Credit Loan hereunder; “Availability Period” means (i) with respect to the Term Loans, the Term Loan Availability Period and (ii) with respect to the Revolving Credit Loan, the Revolving Credit Availability Period; “Authorization” means any consent, registration, filing, agreement, notarization, certificate, license, approval, permit, authority or exemption from, by or with any Governmental Authority, whether given by express action or deemed given by failure to act within any specified time period and all corporate, creditors’ and shareholders’ approvals or consents; “Authorized Representative” means any natural person who is duly authorized by the Borrower to act on its behalf for the purposes specified in, and whose name and a specimen of whose signature appear on, the Certificate of Incumbency and Authority most recently delivered by such Person to IFC; “Business Day” means (i) for the purpose of determining the Interest Rate, a SOFR Banking Day; and (ii) for all other purposes, a day that is a SOFR Banking Day and on which banks are open for business in New York, New York and Mexico City, in the Country; “CAO” means Compliance Advisor Ombudsman, the independent accountability mechanism for IFC for environmental and social concerns, which is governed by the CAO Policy; “CAO Policy” means the IFC/MIGA Independent Accountability Mechanism (CAO) Policy dated June 28, 2021 outlining CAO’s purpose, mandate and functions, core principles, governance, and operating procedures, as the same may be amended, updated or supplemented at any time and from time to time; “Certificate of Incumbency and Authority” means a certificate provided to IFC in the form of Schedule 2 (Form of Certificate of Incumbency and Authority); “Charter” means with respect to any Person, the memorandum and articles of association and/or such other constitutive document, howsoever called, of such Person; “Closing Date” means the date on which all the conditions precedent in Section 4.01 (Conditions of First Disbursement) are satisfied or waived by IFC; “Country” means Mexico; “Defaulting” as applicable to IFC, means if IFC (i) has failed to fund all or any portion of the Loan within two Business Days of the date such Loan or portion thereof was required to be funded hereunder unless IFC notifies the Borrower that such failure is the result of IFC’s determination that one or more conditions precedent to funding (each of which conditions precedent, together with any applicable default, shall be specifically identified in such writing) has not been satisfied, or, (ii) has notified the Borrower that it does not intend to comply with its funding obligations hereunder, or has made a public statement to that effect (unless such writing or public statement relates to IFC’s obligation to fund the Loan hereunder and states that such position is based on IFC’s determination that a condition precedent to funding (which condition precedent, together with any applicable default, shall be specifically identified in such writing or public statement) cannot be satisfied), or (iii) has failed, within three Business Days after request by the Borrower to confirm to the Borrower that it will comply with its prospective

-3- funding obligations hereunder; provided, that IFC shall cease to be Defaulting pursuant to this clause (iii) upon receipt of such confirmation by the Borrower; “Disbursement” means any disbursement of the Loan; “Dispute” has the meaning assigned to it under Section 7.05 (Applicable Law and Jurisdiction); “Dollars” and “$” means the lawful currency of the United States of America; “E&S Management System” means the Borrower’s environmental and social management system enabling it to identify, assess and manage Operations risks on an ongoing basis in a manner consistent with the Performance Standards; “Event of Default” means any one of the events included in Section 6.02 (Events of Default); “Financial Year”means with respect to the Borrower and each of its Subsidiaries, the accounting year commencing each year on January 1st and ending on the following December 31st, or such other period as such Person, with IFC’s consent, from time to time designates as its accounting year; “Floor” means a rate of interest equal to 0.00% per annum; “IFC Financing Documents” means, collectively, this Agreement, the Syndicated Credit Agreement, each Pagaré, the IFC Guarantee Agreement and any other document designated as such by the Borrower and IFC; “IFC Guarantee Agreement” means a Guaranty Agreement (or agreements) to be entered into among the Guarantors and IFC, substantially in the form attached as Schedule 8 (Form of IFC Guarantee Agreement); “Increased Costs” means the amount certified in an Increased Costs Certificate to be the net incremental costs of, or reduction in return to, IFC in connection with the making or maintaining of the Loan that result from: (i) any change in any applicable law or regulation or directive (whether or not having the force of law) or in its interpretation or application by any Governmental Authority charged with its administration; or (ii) compliance with any request from, or requirement of, any central bank or other monetary or other Governmental Authority; which, in either case, after the date of this Agreement: (A) imposes, modifies or makes applicable any reserve, special deposit or similar requirements against assets held by, or deposits with or for the account of, or loans made by, IFC; (B) imposes a cost on IFC as a result of IFC having made the Loan or reduces the rate of return on the overall capital of IFC that it would have achieved, had IFC not made the Loan; (C) changes the basis of taxation on payments received by IFC in respect of the Loan (otherwise than by a change in taxation of the overall net income of IFC imposed by the jurisdiction of its incorporation or in any political subdivision of any such jurisdiction); or (D) imposes on IFC any other condition regarding the making or maintaining of the Loan; “Increased Costs Certificate” means a certificate provided from time to time by IFC, certifying:

-4- (i) the circumstances giving rise to the Increased Costs; (ii) that the costs of IFC have increased or its rate of return has been reduced; (iii) that IFC has, in its opinion, exercised reasonable efforts to minimize or eliminate the relevant increase or reduction, as the case may be; and (iv) the amount of Increased Costs; “Interest Determination Date” means the second Business Day before the beginning of each Interest Period; provided, however, in the event any of the provisions of Section 2.03(d) (Interest) apply, such date shall be determined by IFC pursuant to the benchmark methodology provided by the relevant administrator for the relevant rate; “Interest Payment Date” means (i) the 25th day of each month in each year and (ii) in the case of each of the Revolving Credit Loan, the Tranche A Loan and the Tranche B Loan, its respective Maturity Date; “Interest Period” means each period of one month in each case beginning on an Interest Payment Date and ending on the day immediately before the next following Interest Payment Date, except in the case of the (i) first period applicable to each Disbursement when it means the period beginning on the date on which that Disbursement is made and ending on the day immediately before the next following Interest Payment Date and (ii) the last period applicable to each of the Revolving Credit Loan, the Tranche A Loan and the Tranche B Loan when it means the period beginning on the last Interest Payment Date preceding the relevant Maturity Date and ending on the day immediately preceding the relevant Maturity Date; “Interest Rate” means, (i) with respect to the Revolving Credit Loan, the Revolving Credit Loan Interest Rate, (ii) with respect to the Tranche A Loan, the Tranche A Loan Interest Rate, or (iii) with respect to the Tranche B Loan, the Tranche B Loan Interest Rate, as the context requires; “Loan” means, collectively, the Term Loans and the Revolving Credit Loan or, as the context requires, the principal amount thereof from time to time outstanding; “Loan Currency” means Dollars; “Loan Notice” a request for Disbursement hereunder in the form of Schedule 3 (Form of Loan Notice) hereto appropriately completed and signed by an Authorized Representative of the Borrower; “Loss” has the meaning assigned to it under Section 7.07 (Indemnification; No Consequential Damages); “Material Adverse Effect” means a material adverse effect on: (i) the business, condition (financial or otherwise), operations or properties of the Borrower and its Subsidiaries, taken as a whole; (ii) the ability of the Borrower and its Subsidiaries, taken as a whole, to perform their respective obligations under the IFC Financing Documents to which they are a party; or (iii) the ability of IFC to enforce any material provision of the IFC Financing Documents (or, in the case of the Syndicated Credit Agreement, the ability of any agent or lender to enforce any material provision thereof);

-5- “Maturity Date” means (i) with respect to the Revolving Credit Loan, the date occurring four years after the Signing Date, (ii) with respect to the Tranche A Loan, the date occurring three years after the Signing Date and (iii) with respect to the Tranche B Loan, the date occurring five years after the Signing Date; “Operations” means the operations, activities and facilities of any Person (including the design, construction, operation, maintenance, management and monitoring thereof, as applicable); “Pagaré” means each promissory note (pagaré) governed by the laws of Mexico, bearing a non-negotiable (no negociable) legend, executed and delivered by the Borrower, as issuer (suscriptor), signed by the Guarantors por aval, and payable to the order of IFC pursuant to its terms, in substantially the form of Exhibit C to the Syndicated Credit Agreement, evidencing the Loan or a portion thereof, as the same may be replaced as contemplated herein; “Participant” means any Person who acquires a Participation; “Participation” means the interest of any Participant in the Loan, or as the context requires, in any Disbursement; “Performance Standards” means IFC’s Performance Standards on Environmental & Social Sustainability, dated January 1, 2012, a copy of which has been delivered to and receipt of which has been acknowledged by the Borrower; “Person” means any natural person, corporation, company, partnership, firm, voluntary association, joint venture, trust, unincorporated organization, Governmental Authority or any other entity whether acting in an individual, fiduciary or other capacity; “Potential Event of Default” means any event or circumstance which would, with notice, lapse of time, the making of a determination or any combination thereof, become an Event of Default; “Proceeding” has the meaning assigned to it under Section 7.07 (Indemnification; No Consequential Damages); “Prohibited Activities” means the activities specified in Annex B; “Reference Rate” means, in relation to any Interest Period of any Loan: (i) Term SOFR on the Interest Determination Date for that Interest Period for 1 month, rounded up to five decimal places; or (ii) any fallback or replacement rate for Term SOFR determined pursuant to Section 2.03(d) (Interest); and if, in either case, that rate is less than the Floor, the Reference Rate shall be deemed to be the Floor; “Relevant Change” has the meaning assigned to it under Section 2.17 (Illegality of Participation); “Revolving Commitment Fee” has the meaning assigned to it under Section 2.08(a) (Fees); “Revolving Credit Availability Period” means the period from the Closing Date to the earliest of (i) the date that is 30 days prior to the Maturity Date with respect to the Revolving Credit Loan, (ii) the date of cancellation of all of the undisbursed portion of the Revolving Credit Loan pursuant to Section 2.14 (Cancellation by the

-6- Borrower) or (iii) the date of cancellation of all of the undisbursed portion of the Revolving Credit Loan pursuant to Section 2.13 (Suspension or Cancellation by IFC); “Revolving Credit Loan” means the loan defined as such under Section 2.01(c) (The Loan) or, as the context requires, the outstanding principal amount thereof; “Revolving Credit Loan Interest Rate” means for any Interest Period, the rate at which interest is payable on the Revolving Credit Loan during that Interest Period, determined in accordance with Section 2.03 (Interest); “Sanctionable Practice” means any Corrupt Practice, Fraudulent Practice, Coercive Practice, Collusive Practice, or Obstructive Practice, as those terms are defined in, and interpreted in accordance with, the Anti- Corruption Guidelines attached to this Agreement as Annex A (Anti-Corruption Guidelines for IFC Transactions); “SOFR” means the secured overnight financing rate administered by the Federal Reserve Bank of New York (or any other person which takes over the administration of that rate) published by the Federal Reserve Bank of New York (or any other person which takes over the publication of that rate); “SOFR Administrator” means the Federal Reserve Bank of New York (or a successor administrator of the secured overnight financing rate); “SOFR Banking Day” means any day other than: (i) a Saturday or Sunday; and (ii) a day on which the Securities Industry and Financial Markets Association (or any successor organization) recommends that the fixed income departments of its members be closed for the entire day for purposes of trading in US Government securities; “Syndicated Credit Agreement” means that certain Credit Agreement, dated as of the date of this Agreement, entered into among the Borrower and various financial institutions as lenders and agents, and IFC, as Sustainability Coordinator and Parallel Lender; “Syndicated Credit Agreement Event of Default” has the meaning assigned to it under Section 6.02 (Events of Default); “Term Loan” means each of the Tranche A Loan and the Tranche B Loan; “Term Loan Availability Period” means the period from the Closing Date to the earliest to occur of (i) the date that is 18 months from the Closing Date, (ii) the date of cancellation of the undisbursed portion of the Term Loans pursuant to Section 2.14 (Cancellation by the Borrower) and (iii) the date of cancellation of the undisbursed portion of the Term Loans pursuant to Section 2.13 (Suspension or Cancellation by IFC); “Term Loan Commitment Fee” has the meaning assigned to it under Section 2.08(a) (Fees); “Term SOFR” means for any day such rate may be required for purposes of this Agreement, the forward- looking term rate based on SOFR for the relevant maturity as provided by the Term SOFR Administrator to, and published by, authorized distributors of Term SOFR at 6:00 a.m., New York time (or any amended publication time for Term SOFR, as specified by the Term SOFR Administrator in the CME Term SOFR benchmark methodology; “Term SOFR Administrator” means the CME Group Benchmark Administration Limited (CBA) (or a successor administrator);

-7- “Term SOFR Index Cessation Effective Date” means, in respect of Term SOFR and a Term SOFR Index Cessation Event, the first date on which Term SOFR would ordinarily have been provided and is no longer provided; “Term SOFR Index Cessation Event” means in respect of Term SOFR: (i) a public statement or publication of information by or on behalf of the Term SOFR Administrator announcing that it has ceased or will cease to provide Term SOFR permanently or indefinitely; provided, that at the time of the statement or publication, there is no successor administrator that will continue to provide Term SOFR; or (ii) a public statement or publication of information by the regulatory supervisor for the Term SOFR Administrator, the Federal Reserve Bank of New York, an insolvency official with jurisdiction over the Term SOFR Administrator or a court or any entity with similar insolvency or resolution authority over the Term SOFR Administrator which states that the Term SOFR Administrator has ceased or will cease to provide Term SOFR permanently; provided, that at the time of the statement or publication, there is no successor administrator that will continue to provide Term SOFR; “Term SOFR Recommended Fallback Rate” means the rate (inclusive of any spreads or adjustments) recommended as the replacement for Term SOFR by: (i) the Term SOFR Administrator; or (ii) if the Term SOFR Administrator does not make a recommendation, a committee officially endorsed or convened by the Federal Reserve Board or the Federal Reserve Bank of New York or the supervisor for the Term SOFR Administrator for the purpose of recommending a replacement for Term SOFR (which rate may be produced by the Term SOFR Administrator or another administrator) and as provided by the administrator of that rate (or a successor administrator) or, if that rate is not provided by the administrator thereof (or a successor administrator), published by an authorized distributor; “Term SOFR Recommended Fallback Rate Index Cessation Effective Date” means, in respect of the Term SOFR Recommended Fallback Rate and a Term SOFR Recommended Fallback Rate Index Cessation Event, the first date on which the Term SOFR Recommended Fallback Rate would ordinarily have been provided and is no longer provided; “Term SOFR Recommended Fallback Rate Index Cessation Event” means in respect of Term SOFR Recommended Fallback Rate: (i) a public statement or publication of information by or on behalf of the administrator of the Term SOFR Recommended Fallback Rate announcing that it has ceased or will cease to provide the Term SOFR Recommended Fallback Rate permanently or indefinitely, provided, that at the time of the statement or publication, there is no successor administrator that will continue to provide Term SOFR Recommended Fallback Rate; or (ii) a public statement or publication of information by the regulatory supervisor for the administrator of the Term SOFR Recommended Fallback Rate, the Federal Reserve Bank of New York, an insolvency official with jurisdiction over the administrator of the Term SOFR Recommended Fallback Rate or a court or any entity with similar insolvency or resolution authority over the administrator of the Term SOFR Recommended Fallback Rate which states that the administrator of the Term SOFR Recommended Fallback Rate has ceased or will cease to provide Term SOFR Recommended Fallback Rate permanently; provided, that at the time of the statement or publication, there is no successor administrator that will continue to provide a Term SOFR Recommended Fallback Rate;

-8- “Tranche A Loan” means the loan defined as such under Section 2.01(a) (The Loan) or, as the context requires, the outstanding principal amount thereof; “Tranche A Loan Interest Rate” means for any Interest Period, the rate at which interest is payable on the Tranche A Loan during that Interest Period, determined in accordance with Section 2.03 (Interest); “Tranche B Loan” means the loan defined as such under Section 2.01(b) (The Loan) or, as the context requires, the outstanding principal amount thereof; “Tranche B Loan Interest Rate” means for any Interest Period, the rate at which interest is payable on the Tranche B Loan during that Interest Period, determined in accordance with Section 2.03 (Interest); “Transaction” means, collectively, the transaction described in Section 7.11 (Use of Proceeds) of the Syndicated Credit Agreement and contemplated by this Agreement; and “World Bank” means the International Bank for Reconstruction and Development, an international organization established by Articles of Agreement among its member countries. Section 1.02. Accounting Terms. The terms of Section 1.3 (Accounting Terms) of the Syndicated Credit Agreement are incorporated herein by reference, mutatis mutandis, as if set out in this Agreement in full. Section 1.03. Interpretation. In this Agreement, unless the context otherwise requires: (a) headings are for convenience only and do not affect the interpretation of this Agreement; (b) words importing the singular include the plural and vice versa; (c) a reference to an Annex, Article, party, Schedule or Section, unless expressly identified as that of a specific document (e.g., the Syndicated Credit Agreement), is a reference to that Article or Section of, or that Annex, party or Schedule to, this Agreement; (d) a reference to a document includes an amendment or supplement to, or replacement or novation of, that document but disregarding any amendment, supplement, replacement or novation made in breach of this Agreement; (e) a reference to a party to any document includes that party’s successors and permitted assigns; (f) any incorporation by reference herein of any obligation of the Borrower owed to any party under the Syndicated Credit Agreement shall mean such identical obligation, as applicable, owed by the Borrower to IFC hereunder, mutatis mutandis, as if set forth in full herein as between the Borrower and IFC; (g) a reference herein to a term of the Syndicated Credit Agreement shall mean such term as amended from time to time, but disregarding (i) any amendment thereto made in breach of any consent rights of IFC included in the Syndicated Credit Agreement and (ii) any amendment to the Syndicated Credit Agreement the effect of which is to be disregarded under Section 7.09(b) (Amendments, Waivers and Consents) hereof; and (h) references to sections of the Syndicated Credit Agreement made herein include the relevant section number and section heading; in the case where the section number corresponding to that section heading in the Syndicated Credit Agreement is incorrect (due to mistake, amendment or otherwise), the reference herein shall be

-9- deemed to refer to the relevant section of the Syndicated Credit Agreement corresponding to the specific section heading referenced herein. Section 1.04. Business Day Adjustment. (a) When an Interest Payment Date is not a Business Day, then such Interest Payment Date shall be automatically changed to the next Business Day in that calendar month (if there is one) or the preceding Business Day (if there is not). (b) When the day on or by which a payment (other than a payment of principal or interest) is due to be made is not a Business Day, that payment shall be made on or by the next Business Day in that calendar month (if there is one) or the preceding Business Day (if there is not). ARTICLE II The Loan Section 2.01. The Loan. Subject to the provisions of this Agreement, IFC agrees to lend, and the Borrower agrees to borrow, the Loan in an aggregate principal amount of up to $100,000,000, consisting of the following components: (a) a term loan with a maturity of approximately 5 years in a principal amount not to exceed $31,651,376.13 (the “Tranche A Loan”); (b) a term loan with a maturity of approximately 3 years in a principal amount not to exceed $31,651,376.16 (the “Tranche B Loan”); and (c) a revolving credit loan in an aggregate principal amount not to exceed, at any one time, $36,697,247.71 (the “Revolving Credit Loan”). If the Borrower delivers to the Administrative Agent a notice to request any Incremental Commitment under Section 3.13 (Uncommitted Incremental Loans) of the Syndicated Credit Agreement, the Borrower shall simultaneously deliver to IFC a copy of such notice and a same notice to IFC to request from IFC a pro rata increase of the principal amount(s) of the appliable component of the Loan. Upon the receipt of said notices, IFC may, but will not be obligated to amend this Agreement to accommodate such request. Section 2.02. Disbursement Procedure. (a) The Borrower may request Disbursements by delivering to IFC, at least 7 Business Days prior to the proposed date of disbursement, a Loan Notice. Without limiting the foregoing, it is the intention of the Borrower and IFC that the Loan provided hereunder be disbursed on a pro rata basis with the loans provided for under the Syndicated Credit Agreement. Consequently, the Borrower shall deliver a Loan Notice to IFC to request a pro rata Disbursement of the Loan hereunder (including, for the avoidance of doubt, by requesting a Disbursement under the relevant Term Loan and/or the Revolving Credit Loan, in order to match the type of loan which is being requested under the Syndicated Credit Agreement) each time that the Borrower delivers a corresponding notice to request the disbursement of a loan under the Syndicated Credit Agreement. (b) Each Loan Notice shall specify (i) the component of the Loan with respect to which such Disbursement relates, (ii) the requested date of the Disbursement (which shall be a Business Day during the Revolving Credit Availability Period, in the case of a Disbursement of the Revolving Credit Loan or during the Term Loan Availability Period, in the case of the Disbursement of the Term Loans) and (iii) the principal amount of the Loan to be borrowed. The Borrower may not request a Disbursement if, after giving effect to such

-10- Disbursement, there would be more than a combined total of 8 Disbursements outstanding hereunder and the Borrower may not request a combined total of more than 3 Disbursements hereunder in any calendar month. (c) Each Disbursement shall be made by IFC at a bank in New York, New York for further credit to the Borrower’s account at a bank in the Country, or any other place acceptable to IFC, all as specified by the Borrower in the relevant Loan Notice. (d) Each Disbursement (other than the last one) shall be made in an amount of not less than $5,000,000 or integral multiples of $1,000,000 in excess thereof. (e) The Borrower shall deliver to IFC a receipt, substantially in the form of Schedule 4 (Form of Loan Disbursement Receipt), within five Business Days following each Disbursement. Section 2.03. Interest. Subject to the provisions of Section 2.04 (Default Rate Interest), the Borrower shall pay interest on the Loan in accordance with this Section 2.03: (a) During each Interest Period, each of the Revolving Credit Loan, the Tranche A Loan and the Tranche B Loan (or, with respect to the first Interest Period for each Disbursement, the amount of that Disbursement) shall bear interest at the applicable Interest Rate for that Interest Period. (b) Interest on each of the Revolving Credit Loan, the Tranche A Loan and the Tranche B Loan shall accrue from day to day, be prorated on the basis of a 360-day year for the actual number of days in the relevant Interest Period and be payable in arrears on the Interest Payment Date immediately following the end of that Interest Period; provided, that with respect to any Disbursement made less than 15 days before an Interest Payment Date, interest on that Disbursement shall be payable commencing on the second Interest Payment Date following the date of that Disbursement. (c) The Tranche A Loan Interest Rate, the Tranche B Loan Interest Rate, and the Revolving Credit Loan Interest Rate for any Interest Period shall be the rate which is the sum of: (i) the Applicable Margin; and (ii) the Reference Rate. (d) (i) Temporary Non-Publication of Term SOFR. For purposes of determining the Reference Rate, if (A) Term SOFR for the duration of the relevant Interest Period is not published by the Term SOFR Administrator or an authorized distributor on an Interest Determination Date and is not otherwise provided by the Term SOFR Administrator on such date and (B) a Term SOFR Index Cessation Event shall not have occurred, then the rate for that Interest Determination Date will be the last provided or published Term SOFR for the duration of the relevant Interest Period. (ii) A Term SOFR Index Cessation Effective Date. If a Term SOFR Index Cessation Event has occurred, the rate in respect of an Interest Determination Date occurring on or after the Term SOFR Index Cessation Effective Date will be, subject to subsections (iii) and (iv) below, the Term SOFR Recommended Fallback Rate for the duration of the relevant Interest Period. (iii) Temporary Non-Publication of Term SOFR Recommended Fallback Rate. Subject to subsection (iv) below, if there is a Term SOFR Recommended Fallback Rate before the end of the first SOFR Banking Day following the Term SOFR Index Cessation Effective

-11- Date but neither the Term SOFR Administrator nor authorized distributors provide or publish the Term SOFR Recommended Fallback Rate for the duration of the relevant Interest Period, then, in respect of an Interest Determination Date for which the Term SOFR Recommended Fallback Rate is required, references to the Term SOFR Recommended Fallback Rate for the duration of the relevant Interest Period will be deemed to be references to the last provided or published Term SOFR Recommended Fallback Rate for the duration of the relevant Interest Period; provided, however, if there is no last provided or published Term SOFR Recommended Fallback Rate for the duration of the relevant Interest Period, then in respect of an Interest Determination Date for which the Term SOFR Recommended Fallback Rate is required, references to the Term SOFR Recommended Fallback Rate for the duration of the relevant Interest Period will be deemed to be references to the last provided or published Term SOFR for such period. (iv) No Term SOFR Recommended Fallback Rate or Term SOFR Recommended Fallback Rate Index Cessation Effective Date. If: (A) there is no Term SOFR Recommended Fallback Rate before the end of the first SOFR Banking Day following the Term SOFR Index Cessation Effective Date; or (B) there is a Term SOFR Recommended Fallback Rate and a Term SOFR Recommended Fallback Rate Index Cessation Effective Date subsequently occurs, then the rate for an Interest Determination Date occurring on or after the Term SOFR Index Cessation Effective Date or after the Term SOFR Recommended Fallback Rate Index Cessation Effective Date (as applicable) will be such rate as IFC may determine to be an appropriate successor or replacement for Term SOFR based on derivatives market practices then in effect or such other commercially reasonable alternative for Term SOFR as may be selected by IFC in its sole discretion as an appropriate benchmark for financing under this Agreement. (e) IFC acknowledges and agrees that in making any calculation of the relevant Interest Rate hereunder, it shall apply the provisions of Section 3.12 of the Syndicated Credit Agreement, and all other provisions of the Syndicated Credit Agreement relating to the Sustainability Spread Adjustment and all Sustainability Provisions, all of which are incorporated herein mutatis mutandis, in determining whether the Applicable Margin shall be subject to a Sustainability Discount or a Sustainability Premium during the relevant Interest Period. In connection therewith, and without prejudice to any other provisions set forth in this Agreement, the Borrower agrees that it shall deliver to IFC copies of all certificates, documents, reports and other information that the Borrower is obligated to deliver under the foregoing terms of the Syndicated Credit Agreement, at the same time as delivery thereof is made by the Borrower pursuant to the terms of the Syndicated Credit Agreement. (f) On each Interest Determination Date for any Interest Period, IFC shall determine the relevant Interest Rate applicable to each of the Revolving Credit Loan, the Tranche A Loan and the Tranche B Loan for that Interest Period and promptly notify the Borrower of the relevant rates. (g) The determination by IFC, from time to time, of the applicable Interest Rate shall be final and conclusive and bind the Borrower (unless the Borrower shows to IFC’s satisfaction that the determination involves manifest error). Section 2.04. Default Rate Interest. (a) Without limiting the remedies available to IFC under this Agreement or otherwise (and to the maximum extent permitted by applicable law), (i) if the Borrower fails to make any payment of principal or interest (including interest payable pursuant to this Section) when due as specified in this Agreement

-12- (whether at stated maturity or upon acceleration), the Borrower shall pay interest on the amount of that payment due and unpaid at the rate which shall be the sum of 2% per annum and the Revolving Credit Loan Interest Rate (with respect to amounts relating to the Revolving Credit Loan), 2% per annum and the Tranche A Loan Loan Interest Rate (with respect to amounts relating to the Tranche A Loan) and 2% per annum and the Tranche B Loan Interest Rate (with respect to amounts relating to the Tranche B Loan) in effect from time to time and (ii) in the case of any default with respect to amounts provided for in Section 2.08 (Fees), the Borrower shall pay interest on any such amount that is due and unpaid at the rate which shall be the sum of (A) the Applicable Margin (in the case of any such amounts that do not specifically relate to the Revolving Credit Loan, the Tranche A Loan or the Tranche B Loan, the Applicable Margin for the Tranche A Loan shall apply), (B) 2% per annum and (C) Term SOFR for the date that is two SOFR Banking Days prior to the commencement of the Interest Period in which such default occurs and reset on the second SOFR Banking Day preceding each succeeding Interest Period during which such amount remains unpaid; provided, that if default in the payment of any such amount occurs prior to the first Interest Payment Date under this Agreement (whether or not a disbursement has occurred), the applicable Term SOFR rate used to calculate default interest during the period in which such amount remains unpaid extending up to but excluding such first Interest Payment Date shall be Term SOFR for the date that is two SOFR Banking Days prior to the date of this Agreement. (b) Interest at the rate referred to in Section 2.04(a) shall accrue from the date on which payment of the relevant overdue amount became due until the date of actual payment of that amount (as well after as before judgment), and shall be payable on demand or, if not demanded, on each Interest Payment Date falling after any such overdue amount became due. Section 2.05. Repayment. (a) Subject to Section 1.04 (Business Day Adjustment), the Borrower shall repay the principal amount of: (i) the Tranche A Loan, on the relevant Maturity Date therefor; (ii) the Tranche B Loan, on the relevant Maturity Date therefor; and (iii) the Revolving Credit Loan, on the relevant Maturity Date therefor. (b) Any principal amount of a Term Loan repaid under this Agreement may not be re-borrowed. (c) The Borrower may repay principal amounts outstanding under the Revolving Credit Loan and reborrow such amounts during the Revolving Credit Availability Period from time to time, subject to the terms and conditions of this Agreement and subject always to the limitation that the principal amount outstanding under the Revolving Credit Loan at any one time may not exceed $60,000,000. Section 2.06. Voluntary Prepayment. Without prejudice to Sections 2.03 (Interest), 2.06(c), Section 2.11 (Increased Costs), Section 2.15 (Taxes) and Section 2.17 (Illegality of Participation): (a) the Borrower may prepay on any Interest Payment Date all or any part of the Loan by delivering a notice to IFC on or before 12:00 pm of the date that is ten Business Days prior to the requested date of prepayment, but only if: (i) the Borrower simultaneously pays all accrued interest and Increased Costs (if any) on the amount of the Loan to be prepaid, together with all other amounts then due and payable under this Agreement, including the amount payable under Section 2.12 (Unwinding Costs), if the prepayment is not made on an Interest Payment Date; (ii) for a partial prepayment, that prepayment (together with the amount of simultaneous prepayments under the Syndicated Credit Agreement required to be made in connection therewith pursuant to clause (iv) below) is in an aggregate amount not less than $5,000,000 or integral multiples of $1,000,000 in excess thereof (or, if less, the aggregate amount of the applicable Loan then outstanding);

-13- (iii) if requested by IFC, the Borrower delivers to IFC, prior to the date of prepayment, evidence satisfactory to IFC that all necessary Authorizations with respect to the prepayment have been obtained; and (iv) the Borrower simultaneously makes a prepayment under the Syndicated Credit Agreement pro rata to the amount prepaid to IFC under this Section 2.06 (for the avoidance of doubt, pro rata shall mean that the prepayment hereunder and under the Syndicated Credit Agreement is made in respect of the Term Loan with the same maturity as the corresponding term loan being prepaid under the Syndicated Credit Agreement and/or the Revolving Credit Loan if the revolving credit facility is being prepaid under the Syndicated Credit Agreement, as applicable, and the same proportional amount thereof is being prepaid), in each case following the procedures set out in the Syndicated Credit Agreement, including Section 2.3 (Voluntary Prepayments) thereof. (b) Upon delivery of a notice in accordance with Section 2.06(a), the Borrower shall make the prepayment in accordance with the terms of that notice. (c) Other than the principal amount of the Revolving Credit Loan, which may be re-borrowed by the Borrower following prepayment hereunder to the extent permitted under Section 2.05(c) (Repayment), any principal amount of the Loan prepaid under this Agreement may not be re-borrowed. Section 2.07. Mandatory Prepayment. The Borrower shall be required to prepay the Loan in accordance with the terms of this Section 2.07. (a) If the Borrower prepays any loan under the Syndicated Credit Agreement, the Borrower shall prepay the Loan on a pro rata basis so that the same percentage amount of the principal amount outstanding under the Loan hereunder is prepaid to IFC (for the avoidance of doubt, pro rata shall mean that the prepayment hereunder and under the Syndicated Credit Agreement is made in respect of the Term Loan with the same maturity as the corresponding term loan being prepaid under the Syndicated Credit Agreement and/or the Revolving Credit Loan if the revolving credit facility is being prepaid under the Syndicated Credit Agreement, as applicable, and the same proportional amount thereof is being prepaid). Any prepayment pursuant to this Section 2.07(a) shall be made, together with all other amounts then due and payable under this Agreement, including the amount payable under Section 2.12 (Unwinding Costs) if the prepayment is not made on an Interest Payment Date. (b) Other than the principal amount of the Revolving Credit Loan, which may be re-borrowed by the Borrower following prepayment hereunder to the extent permitted under Section 2.05(c) (Repayment) hereof, any principal amount of the Loan prepaid under this Agreement may not be re-borrowed. Section 2.08. Fees. (a) The Borrower shall pay to IFC: (i) an unused commitment fee (the “Revolving Commitment Fee”) (together with any applicable value added Taxes) in Loan Currency in an amount equal to 30% of the Applicable Margin times the average daily amount by which the maximum committed principal amount of the Revolving Credit Loan exceeds the aggregate outstanding principal amount of the Revolving Credit Loan. The Revolving Commitment Fee shall accrue, at all times from the Signing Date to and including the last day of the Revolving Credit Availability Period, and shall be due and payable in arrears on each Quarterly Date, commencing with the first such date to occur after the Signing Date and ending, on the last day of the Revolving Credit Availability Period. Any decrease or increase to the Applicable Margin, including any Sustainability Discount or Sustainability Premium in effect from time to time pursuant to Section 2.03(e) (Interest), shall apply to the calculation of the

-14- Revolving Commitment Fee for so long as in effect. Notwithstanding the foregoing or any other provision of this Agreement, the Borrower shall not be required to pay a Revolving Commitment Fee to IFC for any day on which IFC is Defaulting; (ii) an unused commitment fee (the “Term Loan Commitment Fee”) (together with any applicable value added Taxes) in Loan Currency in an amount equal to 30% of the Applicable Margin times the average daily amount by which the maximum committed principal of the Term Loans exceeds the aggregate principal amount outstanding under the Term Loans. The Term Loan Commitment Fee shall accrue, at all times from the Term Loan Commitment Fee Date to and including the last day of the Term Loan Availability Period, and shall be due and payable in arrears on each Quarterly Date, commencing with the first such date to occur after the Term Loan Commitment Fee Date and ending, on the last day of the Term Loan Availability Period. Any decrease or increase to the Applicable Margin, including any Sustainability Discount or Sustainability Premium in effect from time to time pursuant to Section 2.03(e) (Interest), shall apply to the calculation of the Term Loan Commitment Fee for so long as in effect. Notwithstanding the foregoing or any other provision of this Agreement, the Borrower shall not be required to pay a Term Loan Commitment Fee to IFC for any day on which IFC is Defaulting. (b) The Borrower shall also pay to IFC: (i) a one-time coordination fee equal to $136,250, to be paid on the date of this Agreement; (ii) a one-time structuring fee equal to $948,750, to be paid on the date of this Agreement; and (iii) a sustainability fee equal to (A) an initial sustainability fee of $75,000 to be paid on the date of this Agreement, plus (B) an annual sustainability supervision fee of $15,000 per annum, in consideration for the activities performed by IFC as Sustainability Coordinator hereunder and in respect of the Syndicated Credit Agreement, with such initial annual fee to be paid on the date of this Agreement. (c) All computations of fees shall be made on the basis of a 360-day year and actual days elapsed. Each determination by IFC of a fee hereunder shall be conclusive and binding for all purposes, absent demonstrable error. Section 2.09. Currency and Place of Payments. (a) The Borrower shall make all payments of principal, interest, fees, and any other amount due to IFC under this Agreement in the Loan Currency, in same day funds, to the account of IFC at Citibank, N.A., New York, New York, U.S.A., ABA#021000089, for credit to IFC’s account number 36085579, with reference to Investment No. 50506 or at such other bank or account in New York as IFC from time to time designates in writing to the Borrower. Payments must be received in IFC’s designated account no later than 1:00 p.m. New York time. (b) The tender or payment of any amount payable under this Agreement (whether or not by recovery under a judgment) in any currency other than the Loan Currency shall not novate, discharge or satisfy the obligation of the Borrower to pay in the Loan Currency all amounts payable under this Agreement except to the extent that (and as of the date when) IFC actually receives funds in the Loan Currency in the account specified in, or pursuant to, Section 2.09(a). (c) The Borrower shall indemnify IFC against any losses resulting from a payment being received or an order or judgment being given under this Agreement in any currency other than the Loan Currency or any place other than the account specified in, or pursuant to, Section 2.09(a). The Borrower shall, as a separate obligation, pay such additional amount as is necessary to enable IFC to receive, after conversion to the Loan Currency at a

-15- market rate and transfer to that account, the full amount due to IFC under this Agreement in the Loan Currency and in the account specified in, or pursuant to, Section 2.09(a). (d) Notwithstanding the provisions of Section 2.09(a) and Section 2.09(b), IFC may require the Borrower to pay (or reimburse IFC) for any Taxes, fees, costs, expenses and other amounts payable under Section 2.15 (a) (Taxes) and Section 2.16 (Expenses) in the currency in which they are payable, if other than the Loan Currency. Section 2.10. Allocation of Partial Payments. If at any time IFC receives less than the full amount then due and payable to it under this Agreement, IFC may allocate and apply the amount received in any way or manner and for such purpose or purposes under this Agreement as IFC in its sole discretion determines, notwithstanding any instruction that the Borrower may give to the contrary. Section 2.11. Increased Costs. On each Interest Payment Date, the Borrower shall pay, in addition to interest, the amount which IFC from time to time notifies to the Borrower in an Increased Costs Certificate as being the aggregate Increased Costs of IFC accrued and unpaid prior to that Interest Payment Date. Section 2.12. Unwinding Costs. (a) If IFC incurs any cost, expense or loss as a result of the Borrower: (i) failing to borrow in accordance with a request for Disbursement made pursuant to Section 2.02 (Disbursement Procedure); (ii) failing to prepay in accordance with a notice of prepayment; (iii) prepaying all or any portion of the Loan on a date other than an Interest Payment Date; or (iv) after acceleration of the Loan, paying all or a portion of the Loan on a date other than an Interest Payment Date; then the Borrower shall immediately pay to IFC the amount that IFC from time to time notifies to the Borrower as being the amount of those costs, expenses and losses incurred. (b) For the purposes of this Section, “costs, expenses or losses” include any premium, penalty or expense incurred to liquidate or obtain third party deposits, borrowings, hedges or swaps in order to make, maintain, fund or hedge all or any part of any Disbursement or prepayment of the Loan, or any payment of all or part of the Loan upon acceleration. (c) To request compensation under this Section 2.12 or Section 2.09 (Currency and Place of Payments), IFC shall deliver to the Borrower a certificate setting forth in reasonable detail a calculation of the amount demanded, and any such certificate shall be conclusive absent demonstrable error. The Borrower shall pay to IFC he amount shown as due on any such certificate within 15 days after receipt thereof. Section 2.13. Suspension or Cancellation by IFC. (a) IFC may, by notice to the Borrower, suspend the right of the Borrower to Disbursements or cancel the undisbursed portion of the Loan in whole or in part: (i) if any Event of Default has occurred and is continuing; or (ii) any undisbursed portion of a loan provided for under the Syndicated Credit Agreement is cancelled, or the right of the Borrower to request a disbursement of a loan under the Syndicated Credit Agreement is suspended.

-16- Notwithstanding the foregoing, IFC and the Borrower acknowledge and agree that any undisbursed portion of (A) the Tranche A Loan and the Tranche B Loan shall be automatically cancelled, without any requirement of notice, at the expiry of the Term Loan Availability Period and (B) the Revolving Credit Loan shall be automatically cancelled, without any requirement of notice, at the expiry of the Revolving Credit Availability Period. (b) Upon the giving of any such notice (or upon automatic cancellation under subclause (A) or (B) above), the right of the Borrower to any further Disbursement shall be suspended or cancelled, as the case may be. The exercise by IFC of its right of suspension shall not preclude IFC from exercising its right of cancellation, either for the same or any other reason specified in Section 2.13(a) and shall not limit any other provision of this Agreement. Upon any cancellation the Borrower shall, subject to paragraph (c) of this Section 2.13, pay to IFC all fees and other amounts accrued (whether or not then due and payable) under this Agreement up to the date of that cancellation. A suspension shall not limit any other provision of this Agreement. (c) In the case of partial cancellation of the Loan pursuant to paragraph (a) of this Section 2.13, or Section 2.13(a), interest on the amount then outstanding of the Loan remains payable as provided in Section 2.03 (Interest). Section 2.14. Cancellation by the Borrower. (a) The Borrower may, by notice to IFC, irrevocably request IFC to cancel the undisbursed portion of the Loan, in whole or in part on the date specified in that notice (which shall be a date not earlier than 11:00 a.m. ten (10) Business Days after the date of that notice), subject to the satisfaction of the following conditions (i) if a partial cancellation, the notice shall specify whether the cancellation applies to the Tranche A Loan, the Tranche B Loan or the Revolving Credit Loan, (ii) any requested partial reduction shall be in an aggregate amount of $5,000,000 or integral multiples of $1,000,000 in excess thereof and (iii) the Borrower shall have simultaneously requested a pro rata cancellation of the undisbursed loans under the Syndicated Credit Agreement (for the avoidance of doubt, pro rata shall mean that the cancellation hereunder and under the Syndicated Credit Agreement is made in respect of the Term Loan with the same maturity as the corresponding term loan being cancelled under the Syndicated Credit Agreement and/or the Revolving Credit Loan if the revolving credit facility is being cancelled under the Syndicated Credit Agreement, as applicable, and in the same proportional amount). (b) IFC shall, by notice to the Borrower, cancel the undisbursed portion of the Loan effective as of that specified date if the conditions set forth in Section 2.14(a) are satisfied, and subject to Section 2.13(c) (Suspension or Cancellation by IFC), IFC has received all fees and other amounts accrued (whether or not then due and payable) under this Agreement up to such specified date. (c) Any portion of the Loan that is cancelled under this Section 2.14 may not be reinstated or disbursed. Section 2.15. Taxes. (a) The Borrower shall pay or cause to be paid all Taxes (other than taxes, if any, payable on the overall income of IFC) on or in connection with the payment of any and all amounts due under this Agreement that are now or in the future levied or imposed by any Governmental Authority of the Country or any jurisdiction through or out of which a payment is made. (b) All payments of principal, interest, fees and other amounts due under this Agreement shall be made without deduction for or on account of any Taxes. (c) If the Borrower is required by operation of law or otherwise to make or cause to make those payments with deduction for any Tax, the principal or (as the case may be) interest, fees or other amounts due under this Agreement shall be increased to such amount as may be necessary so that IFC receives the full amount it would have received (taking into account any Taxes payable on amounts payable by the Borrower under this subsection) had those payments been made without that deduction.

-17- (d) If Section 2.15(c) applies and IFC so requests, the Borrower shall deliver to IFC official tax receipts evidencing payment (or certified copies of them) within 30 days of the date of that request. (e) Section 2.15(a), Section 2.15(b) and Section 2.15(c) do not apply to Taxes (i) which directly result from (A) an assignee or a Participant being organized under the laws of, or a resident in, the Country, or (B) having its principal office in the Country or having or maintaining a permanent office or establishment in the Country, if and to the extent that, in respect of this sub-paragraph (B), such permanent office or establishment acquires the relevant assignment or Participation, and (ii) in excess of Indemnified Taxes. Section 2.16. Expenses. (a) The Borrower shall pay or, as the case may be, reimburse IFC or its assignees any amount paid by them on account of, all taxes (including stamp taxes), duties, fees or other charges payable on or in connection with the execution, issue, delivery, registration or notarization of the IFC Financing Documents and any other documents related to this Agreement or any other IFC Financing Document. (b) The Borrower shall pay to IFC or as IFC may direct (subject to any separate fee arrangements agreed by the Borrower, IFC and such counsel): (i) the reasonable fees and expenses of IFC’s counsel in the Country and in New York incurred in connection with: (A) the preparation of the investment by IFC provided for under this Agreement and any other IFC Financing Document; (B) the preparation and/or review, execution and, where appropriate, translation and registration of the IFC Financing Documents and any other documents related to them; (C) the giving of any legal opinions required by IFC under this Agreement and any other IFC Financing Document; (D) the administration by IFC of the investment provided for in this Agreement or otherwise in connection with any amendment, supplement or modification to, or waiver under, any of the IFC Financing Documents; and (E) the registration (where appropriate) and the delivery of the evidences of indebtedness relating to the Loan and its disbursement; and (ii) the costs and expenses incurred by IFC in relation to (A) the occurrence of any Event of Default or Potential Event of Default and (B) efforts to enforce or protect its rights under any IFC Financing Document, or the exercise of its rights or powers consequent upon or arising out of the occurrence of any such Event of Default or Potential Event of Default, including legal and other professional consultants’ fees and expenses. Section 2.17. Illegality of Participation. If IFC has sold a Participation in the Loans and after the date of such sale, any change made in any applicable law or regulation or official directive (or its interpretation or application by any Governmental Authority charged with its administration) (herein the “Relevant Change”) makes it unlawful for the Participant acquiring that Participation to continue to maintain or to fund that Participation: (a) the Borrower shall, upon request by IFC (but subject to any applicable Authorization having been obtained), on the earlier of (x) the next Interest Payment Date and (y) the date that IFC advises the Borrower is the

-18- latest day permitted by the Relevant Change, prepay in full that part of the Loan that IFC advises corresponds to that Participation; (b) concurrently with the prepayment of the part of the Loans corresponding to the Participation affected by the Relevant Change, the Borrower shall pay all accrued interest on that part of the Loan; and (c) the Borrower agrees to take all reasonable steps to obtain, as quickly as possible after receipt of IFC’s request for prepayment, the Authorization referred to in Section 2.17(a) if any such Authorization is then required. Section 2.18. Evidence of Debt. (a) The Loan shall be evidenced by one or more accounts or records maintained by IFC in the ordinary course of business. The accounts or records maintained by IFC shall be prima facie evidence of the amount of the Loan made and the interest and payments thereon. Any failure to so record or any error in doing so shall not, however, limit or otherwise affect the obligations of the Borrower hereunder to pay any amount owing with respect to the Borrower’s obligations hereunder. (b) The Borrower agrees that upon notice by IFC to the Borrower to the effect that a Pagaré is required or appropriate in order for IFC to evidence the Loan or any portion thereof owing to, or to be made by IFC, the Borrower shall promptly execute as issuer (suscriptor) and deliver, and cause the Guarantors to execute por aval, to IFC (through its physical delivery to IFC’s designated representative in connection with this Agreement) a Pagaré or Pagarés payable to IFC in a principal amount equal to the Loan or any portion thereof (if applicable, simultaneously with the return of previously executed and delivered Pagarés held by IFC, that would result in IFC maintaining Pagarés in an aggregate principal amount exceeding the aggregate principal amount payable to IFC). All references to Pagarés in the IFC Financing Documents shall mean Pagarés, if any, to the extent issued hereunder. In the event of a conflict between the terms of this Agreement and any Pagaré, the terms of this Agreement shall prevail. (c) Promptly upon and concurrently with (i) the accession or release of an additional Guarantor pursuant to this Agreement and the IFC Guarantee Agreement, (ii) any assignment of the Loan or a portion thereof pursuant to Section 7.08 (Successors and Assignees), and (iii) any Disbursement, IFC shall be entitled to request from the Borrower, and the Borrower shall promptly execute as issuer (suscriptor) and deliver, and cause the Guarantors to execute por aval, to IFC (through its physical delivery to IFC’s designated representative in connection with this Agreement) in exchange for any Pagaré evidencing the Loan or portion thereof previously delivered to IFC (which Pagaré shall be delivered to the Borrower duly cancelled simultaneously with the delivery by the Borrower of any new Pagaré), payable to IFC dated as of the date of such Pagaré being exchanged, in a principal amount equal to the Loan or portion thereof evidenced by such Pagaré being exchanged; provided, that if such previously delivered Pagaré has been lost, stolen or mutilated, IFC may deliver in its place an affidavit of lost note and a written indemnity in customary form and reasonably acceptable to the Borrower and, at the discretion of the Borrower and at IFC’s cost, shall assist the Borrower in pursuing any legal proceedings in the Country necessary to obtain the cancellation and issuance of a new Pagaré. (d) The payment of any part of the principal of any Pagaré shall discharge the obligation of the Borrower under this Agreement to pay principal of the Loan or portion thereof evidenced by such Pagaré pro tanto, and the payment of any principal of the Loan or portion thereof in accordance with the terms hereof shall discharge the obligations of the Borrower under the Pagaré evidencing the Loan or portion thereof pro tanto.

-19- ARTICLE III Representations and Warranties Section 3.01. Representations and Warranties. The representations and warranties set out in Article VI (Representations and Warranties) of the Syndicated Credit Agreement shall be made and are deemed to be made herein, mutatis mutandis, for the benefit of IFC as if set out in this Agreement in full. Without limiting the foregoing, the Borrower represents and warrants that: (a) No Immunity. Neither the Borrower nor any of its Subsidiaries nor any of their respective property enjoys any right of immunity from set-off, suit or execution with respect to their respective assets or their respective obligations under any IFC Financing Document; (b) Disclosure. All information disclosed to IFC by the Borrower or any of the Borrower’s Subsidiaries relating to the Borrower, its Subsidiaries, and the Transaction was true and accurate as of the date of such disclosure (other than for projections and other forward-looking statements which the Borrower believes to be reasonable) and does not contain any information which is misleading in any material respect nor does it omit any information the omission of which makes the information contained in it misleading in any material respect; (c) Employee Benefit Plans. Each of the Borrower and its Subsidiaries is in compliance in all material respects with its respective obligations relating to all employee benefit plans established, maintained or contributed to by it and does not have outstanding any liabilities with respect to any such employee benefit plans; (d) Litigation. Neither the Borrower nor any of its Subsidiaries is engaged in nor, to the best of its knowledge, after due inquiry, threatened by, any litigation, arbitration or administrative proceedings, the outcome of which, if adversely determined, could or would reasonably be expected to have a Material Adverse Effect or which involves any Sanctionable Practice; (e) Compliance with Law. (i) To the best of its knowledge and belief, after due inquiry, neither the Borrower nor any of its Subsidiaries is in violation of any statute or regulation of any Governmental Authority in connection with the conduct of its respective business or ownership of its respective property, except for any such violations for which the failure to comply therewith, either individually or in the aggregate, are minor and non-material and do not materially interfere with the conduct of the business and operations of the Borrower or any of its Subsidiaries; and (ii) No judgment or order has been issued which has or may reasonably be expected to have a Material Adverse Effect; (f) Environmental Matters. (i) To the best of its knowledge and belief, after due inquiry, there are no material environmental or social risks or issues in respect of its or any of its Subsidiaries’ Operations other than those disclosed to IFC; and (ii) Neither it nor any of its Subsidiaries has received nor is it or any of its Subsidiaries aware of (A) any existing or threatened complaint, order, directive, claim, citation or notice from any Governmental Authority or (B) any material written communication from any Person,